Chap 19-20

... changes in equity, increases equity ratio or pushing for acquisition by larger bank Risk weights increase attractiveness of Government securities. (also subjects them to interest rate risk) Shifting from riskier assets within each category Take on more interest- and exchange-rate risk Take o ...

... changes in equity, increases equity ratio or pushing for acquisition by larger bank Risk weights increase attractiveness of Government securities. (also subjects them to interest rate risk) Shifting from riskier assets within each category Take on more interest- and exchange-rate risk Take o ...

Federal Funds Rate

... Since the Fed Funds rate is the interest rate that banks charge each other, the lowest interest rate around As the “base” interest rate, the FF rate will dictate or at least heavily influence the cost of borrowing of businesses and consumers Why is the FF rate the lowest rate around? ...

... Since the Fed Funds rate is the interest rate that banks charge each other, the lowest interest rate around As the “base” interest rate, the FF rate will dictate or at least heavily influence the cost of borrowing of businesses and consumers Why is the FF rate the lowest rate around? ...

Falling US Mortgage Rates

... began to drop, Menatian started calling borrowers who missed out on last summer's low rates to let them know they had one more opportunity to cut their borrowing costs. David Lys, a health-club trainer and fitness manager, had been looking for a home for about a year. Last week, he agreed to pay $52 ...

... began to drop, Menatian started calling borrowers who missed out on last summer's low rates to let them know they had one more opportunity to cut their borrowing costs. David Lys, a health-club trainer and fitness manager, had been looking for a home for about a year. Last week, he agreed to pay $52 ...

Show Me the Money! - Fuse Financial Partners

... 1. Be the Shark, Not the Mark Rules of the Funding Game 2. Solids or Stripes The Colors of Money 3. What’s the Wager How Use Determines Source 4. Tricky Combo Shots Non-Bank Options ...

... 1. Be the Shark, Not the Mark Rules of the Funding Game 2. Solids or Stripes The Colors of Money 3. What’s the Wager How Use Determines Source 4. Tricky Combo Shots Non-Bank Options ...

GLOSSARY • Risk Assets Acceptance Criteria (RAAC)

... It prescribes risk parameters like age, income, property value, local area where finance will be extended, the maximum loan amount the bank will lend to any borrower etc. ...

... It prescribes risk parameters like age, income, property value, local area where finance will be extended, the maximum loan amount the bank will lend to any borrower etc. ...

Chapter 7

... • MARGIN: The distance between actual and index rate. • ADJUSTMENT PERIODS: How often rate changes. Typically every 6 or 12 months. • CAP: Maximum rate over initial rate. • TEASER: Very low initial rate for short period before increase to normal ARM rate. • CONVERTIBLE: During “window period” (2-5 y ...

... • MARGIN: The distance between actual and index rate. • ADJUSTMENT PERIODS: How often rate changes. Typically every 6 or 12 months. • CAP: Maximum rate over initial rate. • TEASER: Very low initial rate for short period before increase to normal ARM rate. • CONVERTIBLE: During “window period” (2-5 y ...

PowerPoint - Invest Ed

... Real Estate • Our home is usually the first major asset we own. • Most Americans’ wealth is in their houses. • In spite of three very bad years (2007-2009) in real estate, housing prices have moved upwards with inflation over the last 100 years. • Real estate is a fixed, secure asset. • If you own ...

... Real Estate • Our home is usually the first major asset we own. • Most Americans’ wealth is in their houses. • In spite of three very bad years (2007-2009) in real estate, housing prices have moved upwards with inflation over the last 100 years. • Real estate is a fixed, secure asset. • If you own ...

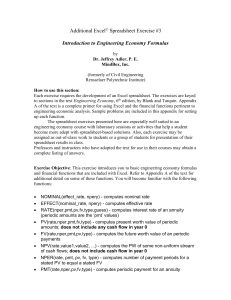

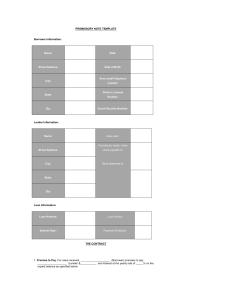

MBS Note

... – CPR grows 0.2% per month before the loan/pool reaches 30 month / 6% – Then CPR will stay flat at 6% for the remaining life of the loan/pool – CPR = 6% * min (t / 30, 1) ...

... – CPR grows 0.2% per month before the loan/pool reaches 30 month / 6% – Then CPR will stay flat at 6% for the remaining life of the loan/pool – CPR = 6% * min (t / 30, 1) ...