Problem 1: An individual estimates that the maintenance cost of a

... today’s dollars to continue its operations. Assuming that the marginal tax rate is 30%, the market interest rate is 20% and the inflation rate is 10%, Fill in the following table and construct the net cash flow structure. (Assume that all values in the question are given in today’s dollars but you n ...

... today’s dollars to continue its operations. Assuming that the marginal tax rate is 30%, the market interest rate is 20% and the inflation rate is 10%, Fill in the following table and construct the net cash flow structure. (Assume that all values in the question are given in today’s dollars but you n ...

Chapter 19 Residential Real Estate Finance: Mortgage

... way home purchases are financed today is the emergence of a dominant secondary market for home mortgage loans and the securitization of these loans “Real Estate Principles for the New Economy”: Norman G. Miller and David M. Geltner ...

... way home purchases are financed today is the emergence of a dominant secondary market for home mortgage loans and the securitization of these loans “Real Estate Principles for the New Economy”: Norman G. Miller and David M. Geltner ...

Direct Subsidized Loans are federal student loans offered to eligible

... who have financial need. Typically, interest does not accrue on subsidized loans until you are no longer enrolled part-time in an academic program. Direct Unsubsidized Loans are federal student loans offered to eligible students in which financial need is not required. Interest begins to accrue on u ...

... who have financial need. Typically, interest does not accrue on subsidized loans until you are no longer enrolled part-time in an academic program. Direct Unsubsidized Loans are federal student loans offered to eligible students in which financial need is not required. Interest begins to accrue on u ...

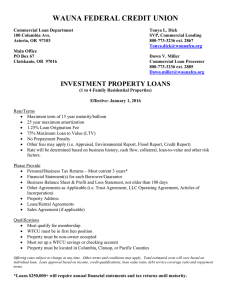

Investment - Wauna Federal Credit Union

... • Business Balance Sheet & Profit and Loss Statement, not older than 180 days • Other Agreements as Applicable (i.e. Trust Agreement, LLC Operating Agreement, Articles of Incorporation) • Property Address • Lease/Rental Agreements • Sales Agreement (if applicable) Qualifications • Must qualify for m ...

... • Business Balance Sheet & Profit and Loss Statement, not older than 180 days • Other Agreements as Applicable (i.e. Trust Agreement, LLC Operating Agreement, Articles of Incorporation) • Property Address • Lease/Rental Agreements • Sales Agreement (if applicable) Qualifications • Must qualify for m ...

Interest rates on mortgages 2. Fixed Rate Mortgage

... decline in numbers of first time buyers is the rise in the value of deposits paid to secure a mortgage. For first time buyers, the average deposit as a percentage of purchase price increased by almost 10% between 1988 and 2013, standing at 22% of the price of the house. ...

... decline in numbers of first time buyers is the rise in the value of deposits paid to secure a mortgage. For first time buyers, the average deposit as a percentage of purchase price increased by almost 10% between 1988 and 2013, standing at 22% of the price of the house. ...

How Housing Policy Hurts the Middle Class

... subsidizing loans that borrowers couldn't otherwise afford. This encouraged housing speculation supported by financial leverage. Ultimately, taxpayers got the bill. Housing's 2008 collapse led to the U.S. Treasury takeover of Fannie's and Freddie's obligations even as the Federal Housing Administra ...

... subsidizing loans that borrowers couldn't otherwise afford. This encouraged housing speculation supported by financial leverage. Ultimately, taxpayers got the bill. Housing's 2008 collapse led to the U.S. Treasury takeover of Fannie's and Freddie's obligations even as the Federal Housing Administra ...

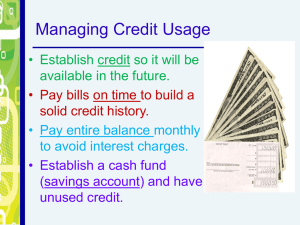

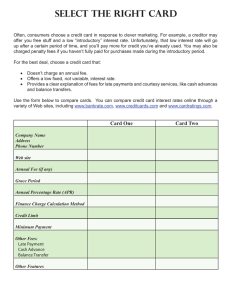

Select the Right Card

... offer you free stuff and a low “introductory” interest rate. Unfortunately, that low interest rate will go up after a certain period of time, and you’ll pay more for credit you’ve already used. You may also be charged penalty fees if you haven’t fully paid for purchases made during the introductory ...

... offer you free stuff and a low “introductory” interest rate. Unfortunately, that low interest rate will go up after a certain period of time, and you’ll pay more for credit you’ve already used. You may also be charged penalty fees if you haven’t fully paid for purchases made during the introductory ...

questions in real estate finance

... Loan must be recast to fully amortizing every five or ten years Negative amortization maximum of 125% of original loan balance Loan payment increases to fully amortizing level ...

... Loan must be recast to fully amortizing every five or ten years Negative amortization maximum of 125% of original loan balance Loan payment increases to fully amortizing level ...

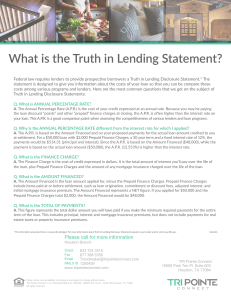

What is the Truth in Lending Statement?

... statement is designed to give you information about the costs of your loan so that you can be compare these costs among various programs and lenders. Here are the most common questions that we get on the subject of Truth in Lending Disclosure Statements: Q. What is ANNUAL PERCENTAGE RATE? ...

... statement is designed to give you information about the costs of your loan so that you can be compare these costs among various programs and lenders. Here are the most common questions that we get on the subject of Truth in Lending Disclosure Statements: Q. What is ANNUAL PERCENTAGE RATE? ...