* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Investment - Wauna Federal Credit Union

Negative gearing wikipedia , lookup

Present value wikipedia , lookup

Financialization wikipedia , lookup

Payday loan wikipedia , lookup

Peer-to-peer lending wikipedia , lookup

Credit card interest wikipedia , lookup

Annual percentage rate wikipedia , lookup

Public finance wikipedia , lookup

Adjustable-rate mortgage wikipedia , lookup

Securitization wikipedia , lookup

Yield spread premium wikipedia , lookup

Credit rationing wikipedia , lookup

History of pawnbroking wikipedia , lookup

Interest rate ceiling wikipedia , lookup

Continuous-repayment mortgage wikipedia , lookup

Student loan wikipedia , lookup

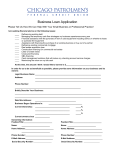

WAUNA FEDERAL CREDIT UNION Commercial Loan Department 100 Columbia Ave. Astoria, OR 97103 Tonya L. Dick SVP, Commercial Lending 800-773-3236 ext. 2867 [email protected] Main Office PO Box 67 Clatskanie, OR 97016 Dawn V. Miller Commercial Loan Processor 800-773-3236 ext. 2885 [email protected] INVESTMENT PROPERTY LOANS (1 to 4 Family Residential Properties) Effective: January 1, 2016 Rate/Terms • Maximum term of 15 year maturity/balloon • 25 year maximum amortization • 1.25% Loan Origination Fee • 75% Maximum Loan to Value (LTV) • No Prepayment Penalty • Other fees may apply (i.e. Appraisal, Environmental Report, Flood Report, Credit Report) • Rate will be determined based on business history, cash flow, collateral, loan-to-value and other risk factors. Please Provide • Personal/Business Tax Returns – Most current 3 years* • Financial Statement(s) for each Borrower/Guarantor • Business Balance Sheet & Profit and Loss Statement, not older than 180 days • Other Agreements as Applicable (i.e. Trust Agreement, LLC Operating Agreement, Articles of Incorporation) • Property Address • Lease/Rental Agreements • Sales Agreement (if applicable) Qualifications • Must qualify for membership • WFCU must be in first lien position • Property must be non-owner occupied • Must set up a WFCU savings or checking account • Property must be located in Columbia, Clatsop, or Pacific Counties Offering rates subject to change at any time. Other terms and conditions may apply. Total estimated costs will vary based on individual loan. Loan approval based on income, credit qualifications, loan value ratio, debt service coverage ratio and repayment terms. *Loans $250,000+ will require annual financial statements and tax returns until maturity.