Impact on Rising Interest Rates

... beneficial to the domestic country for lowering down value of Imports and might help in bring down Inflation due to that. However the Exports will see major hit as it will be more expensive than earlier, the EOUs will have tough time during this. ...

... beneficial to the domestic country for lowering down value of Imports and might help in bring down Inflation due to that. However the Exports will see major hit as it will be more expensive than earlier, the EOUs will have tough time during this. ...

Mortgage-Related Securities

... What are adjustable rate mortgage (ARM) pass-throughs? ARMs are mortgages with coupons that adjust periodically based on the terms of the mortgage and the applicable value of a specified index. They first originated in the 1970s. The typically lower initial rates (called teaser rates) of ARMs compa ...

... What are adjustable rate mortgage (ARM) pass-throughs? ARMs are mortgages with coupons that adjust periodically based on the terms of the mortgage and the applicable value of a specified index. They first originated in the 1970s. The typically lower initial rates (called teaser rates) of ARMs compa ...

Housing Finance

... House Leasings are today an alternative that allow financing up to 95% of the property value. This alternative has been used primarily in houses priced below US$ 35.000 However, costs in house leasings are higher than what banks or mortgage loan corporations (MLC) usually charge, since the main fina ...

... House Leasings are today an alternative that allow financing up to 95% of the property value. This alternative has been used primarily in houses priced below US$ 35.000 However, costs in house leasings are higher than what banks or mortgage loan corporations (MLC) usually charge, since the main fina ...

practice final

... (a) If the bank is offering simple interest, what must be the annual interest rate for this investment? (b) If the bank is offering compound interest, compounded quarterly, what must be the annual interest rate for this investment? (c) If the bank is offering compound interest, compounded continuous ...

... (a) If the bank is offering simple interest, what must be the annual interest rate for this investment? (b) If the bank is offering compound interest, compounded quarterly, what must be the annual interest rate for this investment? (c) If the bank is offering compound interest, compounded continuous ...

practice final

... (a) If the bank is offering simple interest, what must be the annual interest rate for this investment? (b) If the bank is offering compound interest, compounded quarterly, what must be the annual interest rate for this investment? (c) If the bank is offering compound interest, compounded continuous ...

... (a) If the bank is offering simple interest, what must be the annual interest rate for this investment? (b) If the bank is offering compound interest, compounded quarterly, what must be the annual interest rate for this investment? (c) If the bank is offering compound interest, compounded continuous ...

Project Finance Overview

... In these circumstances, a project borrower with a reputable sponsor standing behind it might be able to secure loan financing from a bank at the bank’s prime rate plus a credit spread of 2 per cent per annum. Assuming the prime rate is currently 3 per cent per annum, the all-in interest rate payable ...

... In these circumstances, a project borrower with a reputable sponsor standing behind it might be able to secure loan financing from a bank at the bank’s prime rate plus a credit spread of 2 per cent per annum. Assuming the prime rate is currently 3 per cent per annum, the all-in interest rate payable ...

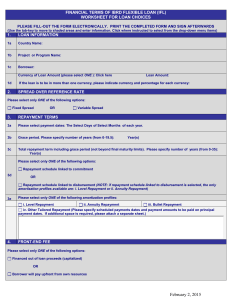

English - World Bank Treasury

... The Borrower represents that it has made its own independent decisions to obtain the Loan on the terms contained in this Worksheet and as to whether the Loan is appropriate for it based upon its own judgment. The Borrower is not relying on any communication (written or oral) of the Bank as a recomme ...

... The Borrower represents that it has made its own independent decisions to obtain the Loan on the terms contained in this Worksheet and as to whether the Loan is appropriate for it based upon its own judgment. The Borrower is not relying on any communication (written or oral) of the Bank as a recomme ...

CH. 4 KEY - Allen ISD

... 4.3 FLOW OF DEPOSITS INTERBANK TRANSACTIONS- Banks loan money to each other (at Fed Funds Rate) to cover the reserve requirement Deposits and the FEDS: If reserve requirements are low then-more money can be used for loans instead of reserves HELPS EXPAND THE MONEY SUPPLY If reserve requirements are ...

... 4.3 FLOW OF DEPOSITS INTERBANK TRANSACTIONS- Banks loan money to each other (at Fed Funds Rate) to cover the reserve requirement Deposits and the FEDS: If reserve requirements are low then-more money can be used for loans instead of reserves HELPS EXPAND THE MONEY SUPPLY If reserve requirements are ...

MCQ4 - uob.edu.bh

... a. shift the demand for loanable funds downward. b. shift the supply of loanable funds downward. c. shift the demand and supply for loanable funds upward decreasing interest rates. d. shift the demand and supply for loanable funds upward increasing interest rates. 9. If the actual rate of inflation ...

... a. shift the demand for loanable funds downward. b. shift the supply of loanable funds downward. c. shift the demand and supply for loanable funds upward decreasing interest rates. d. shift the demand and supply for loanable funds upward increasing interest rates. 9. If the actual rate of inflation ...

AUSTIN COLLEGE GRANT/LOAN PROGRAM

... 50% of the grant-loan will be forgiven for students maintaining continuous full-time enrollment and graduating within five years of admission. Students withdrawing before graduation will be obligated to repay the full amount. Interest will not be charged while the student is enrolled full-time at Au ...

... 50% of the grant-loan will be forgiven for students maintaining continuous full-time enrollment and graduating within five years of admission. Students withdrawing before graduation will be obligated to repay the full amount. Interest will not be charged while the student is enrolled full-time at Au ...

Rate Hike Probability

... A key input into deciding how to position a portfolio is, of course, the future direction of interest rates. Given the recent low interest rate environment, market participants have been anticipating an increase in rates. However, the precise timing of such increase is much debated. The following ar ...

... A key input into deciding how to position a portfolio is, of course, the future direction of interest rates. Given the recent low interest rate environment, market participants have been anticipating an increase in rates. However, the precise timing of such increase is much debated. The following ar ...

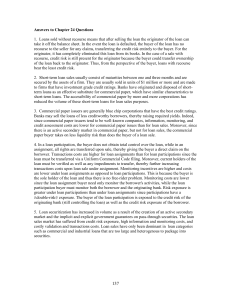

Answers to Chapter 24 Questions

... 1. Loans sold without recourse means that after selling the loan the originator of the loan can take it off the balance sheet. In the event the loan is defaulted, the buyer of the loan has no recourse to the seller for any claims, transferring the credit risk entirely to the buyer. For the originato ...

... 1. Loans sold without recourse means that after selling the loan the originator of the loan can take it off the balance sheet. In the event the loan is defaulted, the buyer of the loan has no recourse to the seller for any claims, transferring the credit risk entirely to the buyer. For the originato ...