Five Ways to Ramp Up Fee Income

... So it’s time to look at opportunities for outside income – while offering seamless service to your clients. This is especially true if you can actually add profitable products and services without adding any credit exposure, or expanding staff, or taxing scarce risk based capital. You’ll get some gr ...

... So it’s time to look at opportunities for outside income – while offering seamless service to your clients. This is especially true if you can actually add profitable products and services without adding any credit exposure, or expanding staff, or taxing scarce risk based capital. You’ll get some gr ...

chap5

... not vary too much over time, changes in the nominal interest rate will simply track changes in the inflation rate. However, this assumes that the inflation rate is easy to predict. Changes in the money supply are the primary determinant of the inflation rate and unfortunately, changes in the money ...

... not vary too much over time, changes in the nominal interest rate will simply track changes in the inflation rate. However, this assumes that the inflation rate is easy to predict. Changes in the money supply are the primary determinant of the inflation rate and unfortunately, changes in the money ...

preparing for rising interest rates

... bonds are more volatile than investment grade securities, and they involve greater risks of loss (including loss of principal) from missed payments, defaults or downgrades because of their speculative nature. Short positions in a security lose value as that security's price increases. Narrowly focus ...

... bonds are more volatile than investment grade securities, and they involve greater risks of loss (including loss of principal) from missed payments, defaults or downgrades because of their speculative nature. Short positions in a security lose value as that security's price increases. Narrowly focus ...

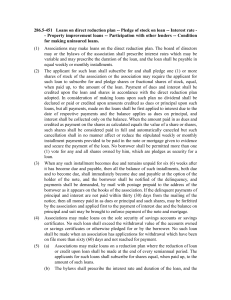

Covered Bonds in the European Union Reflections on the

... Realkredit Danmark’s fixed rate callable mortgage covered bonds will normally reach a volume that fulfills the minimum requirements of the LCR. In bonds open for issuance the activity has been high which is counteracted by the frequent changes in interest rates leading to issuance in several ISIN’s. ...

... Realkredit Danmark’s fixed rate callable mortgage covered bonds will normally reach a volume that fulfills the minimum requirements of the LCR. In bonds open for issuance the activity has been high which is counteracted by the frequent changes in interest rates leading to issuance in several ISIN’s. ...

- Seckman High School

... Types of Loans • House Loan—a mortgage is a loan that is used to secure financing for the purchase of a house. • Ten to thirty years of payments • Fixed or adjustable rate (ARM) • Balloon payments, large amount at the end, can reduce the monthly payments • Closing costs—expenses the buyer pays in o ...

... Types of Loans • House Loan—a mortgage is a loan that is used to secure financing for the purchase of a house. • Ten to thirty years of payments • Fixed or adjustable rate (ARM) • Balloon payments, large amount at the end, can reduce the monthly payments • Closing costs—expenses the buyer pays in o ...

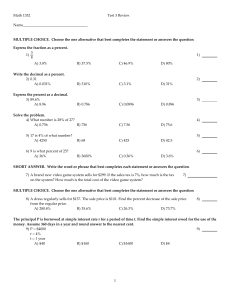

File

... You just bought a quality used car from your Aunt for $3,000. She agreed to let you make payments for 3 years with simple interest at 6 percent. After you have paid her back fully and on time, how much did the car actually cost? Do you think this is a good deal? ...

... You just bought a quality used car from your Aunt for $3,000. She agreed to let you make payments for 3 years with simple interest at 6 percent. After you have paid her back fully and on time, how much did the car actually cost? Do you think this is a good deal? ...

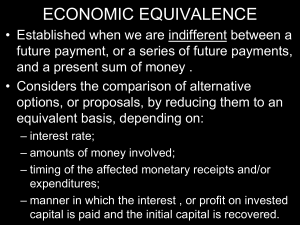

chapter 3 - UniMAP Portal

... • Considers the comparison of alternative options, or proposals, by reducing them to an equivalent basis, depending on: – interest rate; – amounts of money involved; – timing of the affected monetary receipts and/or expenditures; – manner in which the interest , or profit on invested capital is paid ...

... • Considers the comparison of alternative options, or proposals, by reducing them to an equivalent basis, depending on: – interest rate; – amounts of money involved; – timing of the affected monetary receipts and/or expenditures; – manner in which the interest , or profit on invested capital is paid ...

PowerPoint-presentasjon

... • Borrowers are personally liable for their debt, also for outstanding debt post foreclosure and forced sale • Swift foreclosure regime upon non-payment • Individual borrowers have tight relationship with their lenders • Transparent information about borrowers ...

... • Borrowers are personally liable for their debt, also for outstanding debt post foreclosure and forced sale • Swift foreclosure regime upon non-payment • Individual borrowers have tight relationship with their lenders • Transparent information about borrowers ...

The Thinking of Subprime Lending Crisis

... one side, this makes the distance between the original risk and the last holder of the risk even longer. In another side, this can also make the functions of the different financial leverage be interweaved, bring about the risks even bigger in economy. Thus, the fragile of financial market represent ...

... one side, this makes the distance between the original risk and the last holder of the risk even longer. In another side, this can also make the functions of the different financial leverage be interweaved, bring about the risks even bigger in economy. Thus, the fragile of financial market represent ...

A Closer Look at Housing Loan Arrears Box C

... in prices. With prices no longer rising, borrowers from these periods cannot sell their property as easily if they get into payment difficulty, particularly if they are already in negative equity. This may help explain the recent increase in the longer-duration (180+ days) securitised mortgage arrea ...

... in prices. With prices no longer rising, borrowers from these periods cannot sell their property as easily if they get into payment difficulty, particularly if they are already in negative equity. This may help explain the recent increase in the longer-duration (180+ days) securitised mortgage arrea ...

PRACTICE ONLY

... 12. Suppose you analyze a particular deal and it appears that for an investment of $1,000,000 your client can obtain a positive NPV of over $500,000. Your client is typical of the type of high tax bracket individual investors who commonly purchase and sell this type of property, and indeed typically ...

... 12. Suppose you analyze a particular deal and it appears that for an investment of $1,000,000 your client can obtain a positive NPV of over $500,000. Your client is typical of the type of high tax bracket individual investors who commonly purchase and sell this type of property, and indeed typically ...

BANK INTEREST RATE MARGINS

... convertible notes, or preference shares) and will generally be prepared to pay only a small premium to an intermediary for finance. For smaller borrowers, customer margins are wider reflecting the fact that, on average, the risks are greater. Generally, the range is up to 4 percentage points, with a ...

... convertible notes, or preference shares) and will generally be prepared to pay only a small premium to an intermediary for finance. For smaller borrowers, customer margins are wider reflecting the fact that, on average, the risks are greater. Generally, the range is up to 4 percentage points, with a ...

New consumer needs require new, innovative financial products.

... customers on a nationwide basis. A nonbank federal charter will allow lenders to provide many more credit alternatives than are currently available under the patchwork of state laws, and to do so much more efficiently, thus lowering costs to consumers. States like New York, Pennsylvania, Massachuset ...

... customers on a nationwide basis. A nonbank federal charter will allow lenders to provide many more credit alternatives than are currently available under the patchwork of state laws, and to do so much more efficiently, thus lowering costs to consumers. States like New York, Pennsylvania, Massachuset ...