Products, services, customers, geography

... high interest rate on their loan, plus fees. The fees are what you really need to be aware of when looking at very tempting offers to refinance your mortgage. And most companies will say, don’t worry about paying any of the fees up front – we’ll just add it onto your mortgage balance. This means if ...

... high interest rate on their loan, plus fees. The fees are what you really need to be aware of when looking at very tempting offers to refinance your mortgage. And most companies will say, don’t worry about paying any of the fees up front – we’ll just add it onto your mortgage balance. This means if ...

FREE Sample Here

... © 2010 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as perm itted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. ...

... © 2010 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as perm itted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. ...

International Macro

... purchase more imports and reduce exports. A rise in the price of domestic goods increases the value of those goods in trade. ...

... purchase more imports and reduce exports. A rise in the price of domestic goods increases the value of those goods in trade. ...

Market Synopsis â April 2015

... loss of output commensurate with the Great Depression. In that case, the authors concluded that the optimal Fed Funds rate would need to be a modest 30 to 75 basis points higher. It does thus seem prudent to aggressively raise rates only at times when there is clear evidence of large-scale macro imb ...

... loss of output commensurate with the Great Depression. In that case, the authors concluded that the optimal Fed Funds rate would need to be a modest 30 to 75 basis points higher. It does thus seem prudent to aggressively raise rates only at times when there is clear evidence of large-scale macro imb ...

Group LTD Pricing Issues

... • Easy to understand and explain • More likely to be used by underwriters • Convenient to periodically review • Approximates equity to the satisfaction of ...

... • Easy to understand and explain • More likely to be used by underwriters • Convenient to periodically review • Approximates equity to the satisfaction of ...

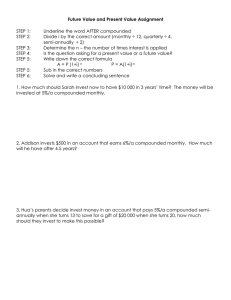

Future Value and Present Value Assignment

... 3. Hua’s parents decide invest money in an account that pays 5%/a compounded semiannually when she turns 13 to save for a gift of $20 000 when she turns 20, how much should they invest to make this possible? ...

... 3. Hua’s parents decide invest money in an account that pays 5%/a compounded semiannually when she turns 13 to save for a gift of $20 000 when she turns 20, how much should they invest to make this possible? ...

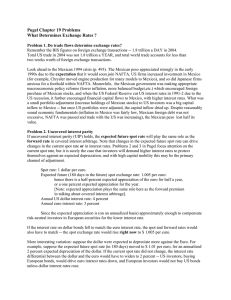

Pugel Chapter 19 Problems What Determines Exchange Rates ?

... a. Since there is no interest differential between US and Japanese bonds, there should be no difference between the current spot rate and the expected forward rate. b. Expected dollar appreciation (it will cost less to buy one yen -- not one cent but 0.95 cents) is more considerable than the fourth ...

... a. Since there is no interest differential between US and Japanese bonds, there should be no difference between the current spot rate and the expected forward rate. b. Expected dollar appreciation (it will cost less to buy one yen -- not one cent but 0.95 cents) is more considerable than the fourth ...

Document

... • Since the future is uncertain, and the further into the future a loan is to be repaid, the more uncertain that repayment becomes lenders require a higher interest rate • Term structure of interest rates is the relationship between the duration of the loan and the interest rate charge ...

... • Since the future is uncertain, and the further into the future a loan is to be repaid, the more uncertain that repayment becomes lenders require a higher interest rate • Term structure of interest rates is the relationship between the duration of the loan and the interest rate charge ...

doc

... if monetary expansion occurs abroad and leads to world inflation while the domestic money supply remains stable, then the prices of internationally-traded goods rise; thus, imports become more expensive and exports become cheaper to foreigners; thus, imports decrease, but exports increase the balanc ...

... if monetary expansion occurs abroad and leads to world inflation while the domestic money supply remains stable, then the prices of internationally-traded goods rise; thus, imports become more expensive and exports become cheaper to foreigners; thus, imports decrease, but exports increase the balanc ...

Microsoft Office 2003 Deployment Plan

... VA loan programs enabled a whole generation of young households to become successful homeowners with only a limited down payment. • Today, state housing finance agencies continue to successfully manage high LTV lending programs with loan performance records that regularly exceed those of the convent ...

... VA loan programs enabled a whole generation of young households to become successful homeowners with only a limited down payment. • Today, state housing finance agencies continue to successfully manage high LTV lending programs with loan performance records that regularly exceed those of the convent ...