* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Are Businesses Ready To Deal With A Rise In Interest

Monetary policy wikipedia , lookup

Quantitative easing wikipedia , lookup

Interbank lending market wikipedia , lookup

Global saving glut wikipedia , lookup

Present value wikipedia , lookup

History of pawnbroking wikipedia , lookup

Adjustable-rate mortgage wikipedia , lookup

Financialization wikipedia , lookup

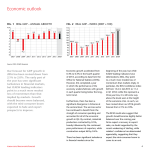

Pensions crisis wikipedia , lookup

POLICY BRIEFING ARE BUSINESSES READY TO DEAL WITH A RISE IN INTEREST RATES? Half of businesses fearing rise are not planning response Drop in consumer demand will jeopardise growth Higher rates good for finance, bad for construction Rate hike to drive demand for higher wages, especially for skilled staff In advance of a potential rise in the Bank of England’s interest rate in 2015 from its current historically low level of 0.5%, ICAEW surveyed 500 businesses on how it may or may not impact them. The responses arrived at four main conclusions on how a rate rise will affect businesses: 1. Concerns over business preparations in advance of higher rates ICAEW research finds that more than half of those who think an interest rate rise will have a negative impact on their bottom-line are not considering any pre-cautionary measures to hedge against it. There are a large number of new businesses (1.6 million) which have been established while interest rates have been kept at 0.5%; therefore this suggests that they would be unprepared to operate in a higher rate environment. Hence, a faster than expected rise in the cost of borrowing could place cost constraints, prevent business growth and may even lead to a rise in insolvencies. Are you considering any measures to deal with a rise in interest rates if you expect to be impacted negatively? The number of new businesses has risen by more than a third since interest rates went down to 0.5% + 1.6 million 54% 46% Yes No 2009 N.B. The percentage is of those who said an interest rate rise will negatively impact them 2010 2011 2012 N.B. The cumulative number of new businesses registering with Companies House since 2009 is more than 1.6 million Policy recommendation: A significant hike in the Bank of England’s interest rate would place an added burden on those new small and medium sized businesses that have no experience in operating within a higher rate environment. Therefore a future rate rise should be gradual and accommodate the continued growth of these new businesses. 1 2. Drop in consumer demand will jeopardise growth Consumer spending accounted for the majority of the growth seen last year – 86% of growth according to the OBR. ICAEW research finds that if there is to be a rise in interest rates, 30% of businesses expect to be negatively impacted by a drop in customer demand. The diagram below shows that personal and consumer debt levels have recently reached a record high of £1.43 trillion. Therefore an earlier than expected interest rate rise will push a lot of households into an unsustainable debt cycle and will dent consumer confidence, one of the key drivers of the UK economy over the last year. Personal debt levels have reached a record high of £1.43 trillion £1.43 trillion £1.42 trillion £1.41 trillion £1.42 trillion £1.41 trillion £1.40 trillion Interest rates 2009 2010 2011 2012 2013 2014 2015 Policy recommendation: The Bank of England should wait until other economic drivers pick up such as business investment and exports. Jeopardising consumer spending at a time when it has been the main driver of the recent recovery will cast a doubt over the economy’s ability to maintain growth. 3. Higher rates good for some; bad for others A future rise in interest rates will have an uneven impact across the different sectors of the economy, hurting consumer-reliant businesses more than those who have more diversified revenue sources. ICAEW research finds that while 30% of construction companies believe their bottom-line will take a hit, more than a third of financial services firms expect to benefit from a rate rise. This will add further strains on efforts to rebalance the UK economy and to support those industries, such as construction, which most suffered from the financial crisis. The ICAEW/Grant Thornton Business Confidence Monitor shows that confidence in the construction sector is booming, and therefore a premature rate rise will dampen this before it is allowed to translate into greater business investment and economic activity. Policy recommendation: Policy makers should be wary of the unintended consequences a faster than expected rate rise will have on key sectors of the economy. Although higher rates may be good for some, it may prevent investment growth and more hiring in industries which the government has identified as target sectors for growth. 4. Demand for higher wages will hurt employers More than a quarter of businesses believe that a rise in the interest rate from its current level of 0.5% will affect their staff pay levels. The findings in the most recent ICAEW/Grant Thornton Business Confidence Monitor indicate that businesses expect total salaries to rise by 2.2% over the next 12 months, thereby overtaking inflation. A rate rise in 2015 will put more pressure on wage demand and leave businesses in a dilemma over whether to retain skilled staff at a higher cost or cut-back on hiring. Policy recommendation: Decisions over when and how to raise interest rates should take into consideration the impact on employers and the retention and recruitment of skilled staff which would support their further growth. 2