* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download simple interest - percents review

Survey

Document related concepts

Transcript

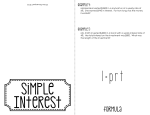

Simple Interest (Percents Review) Objectives: …to solve rate problems involving simple interest ...to solve basic problems involving percents Assessment Anchor: 8.A.2.2 – Represent or solve problems using rates, ratios, proportions and/or percents. 8.A.3.2 – Use estimation strategies in problem-solving situations. Vocabulary alert!! INTEREST – a fee (extra amount of money) paid by the person or entity who is borrowing money My dad once told me that “interest” is what allows people to get things that they otherwise wouldn’t be able to get. When I asked him one day why he was paying so much extra money for something, he said, “Because I want it…and that’s the only way I can have it.” People agree to pay “interest” on many things. Car loans, home mortgages, credit cards…they all have “interest” attached to them. Think about all the commercials and billboards you see that mention “interest”… Banks provide things like checking accounts, savings accounts, certificates of deposits, etc…almost all of those things allow you to earn “interest” (the banks pay YOU the extra money!) while they keep your money for you. Most of the time, interest is compounded in some way…but it’s very important to first discuss SIMPLE INTEREST so we have a good foundation to build on. Simple Interest Formula: I = Prt I = interest, P = principal amount, r = interest rate, and t = time (in years) Simple Interest (Percents Review) EXAMPLES 1) Michelle invests $5,000 in a mutual fund with an annual interest rate of 4.8%. How much interest would she earn after 2 years? 2) James puts $2,300 in a savings account earning simple interest at 3.25% annually. How much interest would he earn after 5 years? % to decimal I = Prt I = (5,000)(0.048)(2) I = 480 $480 3) (Formula) (Substitute) (Answer) (Label) Larry borrows $3,000 at an annual simple interest rate of 9%. He is going to pay off the loan in 18 months. How much total interest will he have to pay? 4) Brooke invests $800 in a CD that pays 8.5% simple interest annually. How much interest will she earn after 6 months? % to decimal I = Prt I = (3,000)(0.09)(1.5) I = 405 time in years $405 5) (Formula) (Substitute) (Answer) (Label) Helen invested in a savings bond that pays simple interest annually at 3.9%. After 5 years she earned $300 in interest. What was her initial investment? % to decimal I = Prt 300 = P(0.039)(5) 300 = P(0.195) 0.195 0.195 1,538.46 = P solve for “P” $1,538.46 6) Gene paid $62,700 just in interest on his student loan he took out 20 years earlier. The interest rate on his loan was 8.25%. What was the amount of Gene’s initial loan? Simple Interest (Percents Review) 7) Paul invested $8,500 in a simple interest savings account. After just 3 years, he had earned $1,912.50 in interest. What is the interest rate on Paul’s account? 8) Linda borrowed $1,500 for a vacation trip. The loan is for 20 months, and will cost Linda an extra $125 in interest. What interest rate did Linda’s loan carry? 10) Luis deposits $12,000 in an account that earns 2.5% simple interest annually. How many months until his account has reached a total of $12,450? I = Prt 1,912.50 = (8,500)r(3) 1,912.50 = r(25,500) 25,500 25,500 0.075 = r 9) solve for “r” 7.5% Ken puts $2,000 in an account. The account was earning 6% simple interest annually. Years later, he sees that the account is now at $2,840. How many years have passed? I = Prt 840 = (2,000)(0.06)t 840 = 120t 120 120 7=t solve for “t” 7 years “Now would probably be a good time to review other things involving money and percents…like discounts, tax, etc. Do you remember some of the generic equations that helped us?”