Sphere FTSE Emerging Markets Sustainable Yield Index ETF

... London Stock Exchange Group companies includes FTSE International Limited (“FTSE”), Frank Russell Company ("Russell"), MTS Next Limited (“MTS”), and FTSE TMX Global Debt Capital Markets Inc (“FTSE TMX”). All rights reserved. “FTSE®”, “Russell®”, “MTS®”, “FTSE TMX®” and “FTSE Russell” and other servi ...

... London Stock Exchange Group companies includes FTSE International Limited (“FTSE”), Frank Russell Company ("Russell"), MTS Next Limited (“MTS”), and FTSE TMX Global Debt Capital Markets Inc (“FTSE TMX”). All rights reserved. “FTSE®”, “Russell®”, “MTS®”, “FTSE TMX®” and “FTSE Russell” and other servi ...

The Power of a Low Volatility Investing Approach

... Source: AQR, Bank of America Merrill Lynch, JP Morgan, Consensus Economics and Bloomberg. For illustrative purposes only and not representative of an actual portfolio AQR manages. The risk-free rate used to calculate the Sharpe ratios is the 3-month T-bill. For government bonds: Portfolios formed by ...

... Source: AQR, Bank of America Merrill Lynch, JP Morgan, Consensus Economics and Bloomberg. For illustrative purposes only and not representative of an actual portfolio AQR manages. The risk-free rate used to calculate the Sharpe ratios is the 3-month T-bill. For government bonds: Portfolios formed by ...

The Diversified Portfolio Index

... trades until reaching the point where having done nothing would have been better. Even hindsight could not provide me with a particular style that would have provided better than average performance for a standard portfolio. While equities were favored for the long run up to 2000, an investor would ...

... trades until reaching the point where having done nothing would have been better. Even hindsight could not provide me with a particular style that would have provided better than average performance for a standard portfolio. While equities were favored for the long run up to 2000, an investor would ...

ACCA F9 S16 Notes

... If a company is trying to decide whether or not to invest in a new project, they will need to know the cost of the money being used. If the project is being financed by shareholders (either by way of a new issue of shares, or by the use of retained earnings), then we need to be able to calculate the ...

... If a company is trying to decide whether or not to invest in a new project, they will need to know the cost of the money being used. If the project is being financed by shareholders (either by way of a new issue of shares, or by the use of retained earnings), then we need to be able to calculate the ...

Al Rifai raises USD $15000000 in a private placement

... equities, fixed income, currency and commodity markets. MedSecurities has been involved in several private placements over the course of the past several years across different industries and geographies and has raised in excess of USD 300 Mln in private deals. ...

... equities, fixed income, currency and commodity markets. MedSecurities has been involved in several private placements over the course of the past several years across different industries and geographies and has raised in excess of USD 300 Mln in private deals. ...

Presentation

... Philanthropy is the easy way out (only one measurable, but no data available) Corporate Responsibility is more effective, but not the panacea Fair wages, good working conditions, responsible products, concern for the environment, support for the community, local supply chain (microenterprises), ...

... Philanthropy is the easy way out (only one measurable, but no data available) Corporate Responsibility is more effective, but not the panacea Fair wages, good working conditions, responsible products, concern for the environment, support for the community, local supply chain (microenterprises), ...

of Power (Continued) The Abuse

... Cablevision have used limited voting stock in purchases of independent telephone companies. ...

... Cablevision have used limited voting stock in purchases of independent telephone companies. ...

Stocks and Investment - The Independent School

... Why Stocks Fluctuate in Value (continued) • Supply and demand – Stock prices may rise or fall based on supply and demand for their shares • If a large shareholder needs to sell shares of a stock to meet cash needs, supply increases and the price is likely to decline • Likewise, if a large investor ...

... Why Stocks Fluctuate in Value (continued) • Supply and demand – Stock prices may rise or fall based on supply and demand for their shares • If a large shareholder needs to sell shares of a stock to meet cash needs, supply increases and the price is likely to decline • Likewise, if a large investor ...

What have the Capital Markets ever done for us?

... The purpose of capital markets is to match the supply of funds from investors with the demand for funding from companies and governments. They play an important role in complementing lending by banks, and allocate capital to where it can be most effectively deployed. The capital markets industry is ...

... The purpose of capital markets is to match the supply of funds from investors with the demand for funding from companies and governments. They play an important role in complementing lending by banks, and allocate capital to where it can be most effectively deployed. The capital markets industry is ...

fund facts - CI Investments

... In general, you'll have to pay income tax on any money you make on a fund. How much you pay depends on the tax laws of where you live and whether you hold the fund in a registered plan, such as a Registered Retirement Savings Plan or a Tax-Free Savings ...

... In general, you'll have to pay income tax on any money you make on a fund. How much you pay depends on the tax laws of where you live and whether you hold the fund in a registered plan, such as a Registered Retirement Savings Plan or a Tax-Free Savings ...

(Attachment: 3)PI 2005 - Council

... The general policy objective contained in the guidance is that local authorities should invest prudently the short-term cash surpluses held on behalf of their communities. The guidance emphasises that priority should be given to security and liquidity rather than yield. Within that framework the aut ...

... The general policy objective contained in the guidance is that local authorities should invest prudently the short-term cash surpluses held on behalf of their communities. The guidance emphasises that priority should be given to security and liquidity rather than yield. Within that framework the aut ...

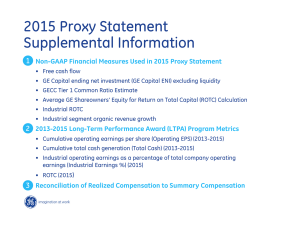

GE 2015 Proxy - Supplemental Information

... (a) Earnings-per-share amounts are computed independently. As a result, the sum of per share amounts may not equal the total. Operating earnings excludes non-service-related pension costs of our principal pension plans comprising interest cost, expected return on plan assets and amortization of actu ...

... (a) Earnings-per-share amounts are computed independently. As a result, the sum of per share amounts may not equal the total. Operating earnings excludes non-service-related pension costs of our principal pension plans comprising interest cost, expected return on plan assets and amortization of actu ...

EN EN Foreword The Commission`s priority – Europe`s priority – is

... - from investors to European investment projects, improving allocation of risk and capital across the EU and, ultimately, making Europe more resilient to future shocks. The Commission has therefore committed to put in place the building blocks of a wellregulated and integrated Capital Markets Union, ...

... - from investors to European investment projects, improving allocation of risk and capital across the EU and, ultimately, making Europe more resilient to future shocks. The Commission has therefore committed to put in place the building blocks of a wellregulated and integrated Capital Markets Union, ...

Exemptions to Private Companies

... managing director, whole-time director or manager and the terms and conditions of such appointment and remuneration payable does not require the approval at the General meeting and subsequently the approval of Central Government is also not required, even if the conditions for appointment are not as ...

... managing director, whole-time director or manager and the terms and conditions of such appointment and remuneration payable does not require the approval at the General meeting and subsequently the approval of Central Government is also not required, even if the conditions for appointment are not as ...

Utility Cost of Capital

... Capital invested in rate base …the company will be allowed as large a return on the capital invested in its enterprise (which will be net to the company)… • Capital invested by customers would not be part of the company’s net capital investment • The utility is not entitled to any return on custome ...

... Capital invested in rate base …the company will be allowed as large a return on the capital invested in its enterprise (which will be net to the company)… • Capital invested by customers would not be part of the company’s net capital investment • The utility is not entitled to any return on custome ...

The past five years have seen market behaviour dominated by

... ‗market‘ index can be passive, i.e. held by all investors simultaneously. Allocating assets to smart beta strategies is an active decision that provides exposure to one or more factor risk premia. The fact that some smart beta products are exchange traded and low cost should not distract from this i ...

... ‗market‘ index can be passive, i.e. held by all investors simultaneously. Allocating assets to smart beta strategies is an active decision that provides exposure to one or more factor risk premia. The fact that some smart beta products are exchange traded and low cost should not distract from this i ...

Foord Conservative Fund (Class B2)

... affected by changes in the market or economic conditions and legal, regulatory and tax requirements. Foord Unit Trusts does not provide any guarantee either with respect to the capital or the performance return of the investment. Unit trusts are traded at ruling prices and can engage in borrowing. F ...

... affected by changes in the market or economic conditions and legal, regulatory and tax requirements. Foord Unit Trusts does not provide any guarantee either with respect to the capital or the performance return of the investment. Unit trusts are traded at ruling prices and can engage in borrowing. F ...

INVESTMENT BANKING BOUTIQUE FIRMS

... William Blair is a Chicago-based investment firm offering investment banking, asset management, equity research, institutional and private brokerage, and private capital to individual, institutional, and issuing clients. William Blair is based in Chicago, and has office locations in 10 cities, inclu ...

... William Blair is a Chicago-based investment firm offering investment banking, asset management, equity research, institutional and private brokerage, and private capital to individual, institutional, and issuing clients. William Blair is based in Chicago, and has office locations in 10 cities, inclu ...

Royce Total Return Fund

... stocks, which may involve considerably more risk than investing in larger-cap stocks. (Please see "Primary Risks for Fund Investors" in the prospectus.) The Fund’s broadly diversified portfolio does not ensure a profit or guarantee against loss. The Fund may invest up to 25% of its net assets in for ...

... stocks, which may involve considerably more risk than investing in larger-cap stocks. (Please see "Primary Risks for Fund Investors" in the prospectus.) The Fund’s broadly diversified portfolio does not ensure a profit or guarantee against loss. The Fund may invest up to 25% of its net assets in for ...

Surdna Foundation Launches $100 Million Impact Investing Drive

... A recent commitment to a fund managed by venture firm DBL Partners gave Surdna confidence that funds aligned with its values did exist. The board carved out the $100 million to impact investing in 2015. Surdna’s new pool will be a test case for the value proposition of socially responsible investing ...

... A recent commitment to a fund managed by venture firm DBL Partners gave Surdna confidence that funds aligned with its values did exist. The board carved out the $100 million to impact investing in 2015. Surdna’s new pool will be a test case for the value proposition of socially responsible investing ...

IFI_Ch14

... MRR, which is a negative-slope curve because it is wellknown that for larger capital budget levels, the marginal rate of return on capital should decrease – If the firm is limited to raising funds in its domestic (illiquid) market, even the capital structure being the same and the thus financial ris ...

... MRR, which is a negative-slope curve because it is wellknown that for larger capital budget levels, the marginal rate of return on capital should decrease – If the firm is limited to raising funds in its domestic (illiquid) market, even the capital structure being the same and the thus financial ris ...

INVESTMENT POLICY The Kitsap Community Foundation (“the

... diversification, and a predictable and dependable source of cash flow. It is expected that fixed income investments will not be totally dedicated to the long-term bond market, but will be flexibly allocated among maturities of different lengths. Fixed income instruments should reduce the overall vol ...

... diversification, and a predictable and dependable source of cash flow. It is expected that fixed income investments will not be totally dedicated to the long-term bond market, but will be flexibly allocated among maturities of different lengths. Fixed income instruments should reduce the overall vol ...

MS Word - Securities Commission Malaysia

... Does the applicant have similar funds in its stable of funds? Yes ...

... Does the applicant have similar funds in its stable of funds? Yes ...

Private equity

In finance, private equity is an asset class consisting of equity securities and debt in operating companies that are not publicly traded on a stock exchange.A private equity investment will generally be made by a private equity firm, a venture capital firm or an angel investor. Each of these categories of investor has its own set of goals, preferences and investment strategies; however, all provide working capital to a target company to nurture expansion, new-product development, or restructuring of the company’s operations, management, or ownership.Bloomberg Businessweek has called private equity a rebranding of leveraged-buyout firms after the 1980s. Common investment strategies in private equity include: leveraged buyouts, venture capital, growth capital, distressed investments and mezzanine capital. In a typical leveraged-buyout transaction, a private-equity firm buys majority control of an existing or mature firm. This is distinct from a venture-capital or growth-capital investment, in which the investors (typically venture-capital firms or angel investors) invest in young, growing or emerging companies, and rarely obtain majority control.Private equity is also often grouped into a broader category called private capital, generally used to describe capital supporting any long-term, illiquid investment strategy.