Using Risk Analysis to Classify Junk Bonds as Equity for Federal

... Another way to view the deductibility issue is to say that section 163(a) allows deduction for interest payments but prohibits deductions for dividend ...

... Another way to view the deductibility issue is to say that section 163(a) allows deduction for interest payments but prohibits deductions for dividend ...

Slide 1 - Saracen Fund Managers

... This document contains information relating to Saracen Fund Managers Ltd and Saracen Investment Funds ICVC (‘the Company’). Saracen Fund Managers Ltd is authorised and regulated by the Financial Services Authority (‘FSA’). This document is issued and approved by Saracen Fund Managers Ltd (‘SFM’) for ...

... This document contains information relating to Saracen Fund Managers Ltd and Saracen Investment Funds ICVC (‘the Company’). Saracen Fund Managers Ltd is authorised and regulated by the Financial Services Authority (‘FSA’). This document is issued and approved by Saracen Fund Managers Ltd (‘SFM’) for ...

The Myth of Diversification: Risk Factors vs. Asset Classes

... individually or collectively, not develop over time. The analysis reflected in this information is based upon data at time of analysis. Forecasts, estimates, and certain information contained herein are based upon proprietary research and should not be considered as investment advice or a recommenda ...

... individually or collectively, not develop over time. The analysis reflected in this information is based upon data at time of analysis. Forecasts, estimates, and certain information contained herein are based upon proprietary research and should not be considered as investment advice or a recommenda ...

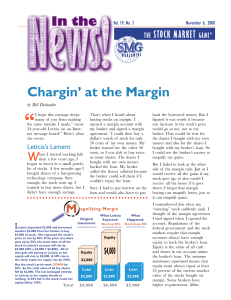

Chargin` at the Margin

... margin as the edge or border of something, such as the edge or border of this page. In margin buying, the margin is the amount an investor must deposit up front (on the front “edge” of a stock purchase) when borrowing from a broker to buy stock. For example, Leticia wanted to buy $4,000 worth of sto ...

... margin as the edge or border of something, such as the edge or border of this page. In margin buying, the margin is the amount an investor must deposit up front (on the front “edge” of a stock purchase) when borrowing from a broker to buy stock. For example, Leticia wanted to buy $4,000 worth of sto ...

EDHEC and EuroPerformance release the Alpha League Table 2007 for the UK

... EDHEC is one of the leading French and European business schools. It ranked 7th in the Financial Times “Masters in Management” Rankings in 2006. With 35 professors, engineers and associate researchers, the EDHEC Risk and Asset Management Research Centre is the leading European research centre in ass ...

... EDHEC is one of the leading French and European business schools. It ranked 7th in the Financial Times “Masters in Management” Rankings in 2006. With 35 professors, engineers and associate researchers, the EDHEC Risk and Asset Management Research Centre is the leading European research centre in ass ...

Key Investor Information

... Currency risk: The fund can be exposed to different currencies. Changes in foreign exchange rates could create losses. Derivatives risk: A derivative may not perform as expected, and may create losses greater than the cost of the derivative. Equity risk: Equity prices fluctuate daily, based on many ...

... Currency risk: The fund can be exposed to different currencies. Changes in foreign exchange rates could create losses. Derivatives risk: A derivative may not perform as expected, and may create losses greater than the cost of the derivative. Equity risk: Equity prices fluctuate daily, based on many ...

Working Life

... This presentation contains some forward thinking statements which should not be taken as fact. Information given is based on our current understanding, as at May 2014, of current taxation, legislation and HMRC practice, all of which are liable to change. No reproduction, copy, transmission or amendm ...

... This presentation contains some forward thinking statements which should not be taken as fact. Information given is based on our current understanding, as at May 2014, of current taxation, legislation and HMRC practice, all of which are liable to change. No reproduction, copy, transmission or amendm ...

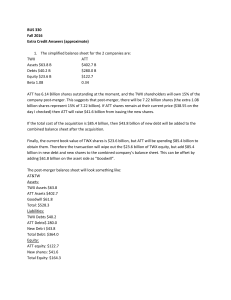

Bonus Assignment solution

... “if”) – then this would be a $2.4 billion cost savings per year, or an additional $2.4 billion of pretax income. Income tax is currently about 30% of its income, so that would leave $1.7 billion of additional net income. This amount would increase TWX earnings per share by 44%. Therefore cost saving ...

... “if”) – then this would be a $2.4 billion cost savings per year, or an additional $2.4 billion of pretax income. Income tax is currently about 30% of its income, so that would leave $1.7 billion of additional net income. This amount would increase TWX earnings per share by 44%. Therefore cost saving ...

IEF 213 - Portfolio Management

... Portfolio management is both an art and a science. It is a dynamic decision making process, one that is continuous and systematic but also requires a great deal of judgment. The objective of this class is to blend theory and practice to achieve a consistent portfolio management process. This dynamic ...

... Portfolio management is both an art and a science. It is a dynamic decision making process, one that is continuous and systematic but also requires a great deal of judgment. The objective of this class is to blend theory and practice to achieve a consistent portfolio management process. This dynamic ...

EQUITY INVESTING FOR REGULAR, HIGH INCOME WITH LOW

... maturity. Investors can hold on for a 0% return several years into the future or exit their positions at a loss, as these instruments are typically trading at sharp discounts to their issue price. ...

... maturity. Investors can hold on for a 0% return several years into the future or exit their positions at a loss, as these instruments are typically trading at sharp discounts to their issue price. ...

Strategic Value Dividend (MA) Select UMA

... in investment thesis arises, an alternate investment with superior upside potential is identified or the weighting exceeds 5% of the portfolio ...

... in investment thesis arises, an alternate investment with superior upside potential is identified or the weighting exceeds 5% of the portfolio ...

Investment Policy - Hindu Temple Society of Augusta

... 1. Preservation of Capital – Consistent with their respective investment styles and philosophies, investment managers should make reasonable efforts to preserve capital, understanding that losses may occur in individual securities. 2. Risk Aversion – Understanding that risk is present in all types o ...

... 1. Preservation of Capital – Consistent with their respective investment styles and philosophies, investment managers should make reasonable efforts to preserve capital, understanding that losses may occur in individual securities. 2. Risk Aversion – Understanding that risk is present in all types o ...

Nationwide® Investor Destinations Conservative Fund

... variety of asset classes, primarily by investing in underlying funds. Therefore, in addition to the expenses of the Nationwide Investor Destinations Funds, each investor is indirectly paying a proportionate share of the applicable fees and expenses of the underlying funds. Each Fund is subject to di ...

... variety of asset classes, primarily by investing in underlying funds. Therefore, in addition to the expenses of the Nationwide Investor Destinations Funds, each investor is indirectly paying a proportionate share of the applicable fees and expenses of the underlying funds. Each Fund is subject to di ...

Fund Categories and Basis of Accounting

... future year. Debt service fund resources come most often from transfer from the General Fund (or other fund), income from the investment of resources held by the funds, and tax assessed specially to serve the debt. The assets of this fund consist of cash, investment, and sometimes receivables. ...

... future year. Debt service fund resources come most often from transfer from the General Fund (or other fund), income from the investment of resources held by the funds, and tax assessed specially to serve the debt. The assets of this fund consist of cash, investment, and sometimes receivables. ...

Topic 4: Asymmetric information models of capital structure

... has enough money to finance the investment, he invest in the project and thereby increase his wealth by R-I without taking any risk. Now suppose that the entrepreneur does not have the required funds and he needs to raise I dollars from outsiders. One thing he can do is to issue debt with face value ...

... has enough money to finance the investment, he invest in the project and thereby increase his wealth by R-I without taking any risk. Now suppose that the entrepreneur does not have the required funds and he needs to raise I dollars from outsiders. One thing he can do is to issue debt with face value ...

Impact Investing: Trading Up, Not Trading Off

... customer. Indeed, the environmental business sector (also known as the resource management sector) is so massively inefficient in the United States that investors should be able to earn extranormal market returns—in effect, to “trade up” without needing to “tradeoff.” The clean economy market is wai ...

... customer. Indeed, the environmental business sector (also known as the resource management sector) is so massively inefficient in the United States that investors should be able to earn extranormal market returns—in effect, to “trade up” without needing to “tradeoff.” The clean economy market is wai ...

Royal London Sterling Extra Yield Bond Fund

... The fund is ranked in risk category 4 because its share price has shown a medium level of volatility historically. As an investment, bonds are more volatile than money market instruments but are less volatile than shares. Bonds issued by corporations are more volatile than bonds issued by government ...

... The fund is ranked in risk category 4 because its share price has shown a medium level of volatility historically. As an investment, bonds are more volatile than money market instruments but are less volatile than shares. Bonds issued by corporations are more volatile than bonds issued by government ...

International Developed Markets Fund

... Russell Investments dynamically allocates between Numeric’s core international equity strategy and an international active low volatility strategy. In the international equities strategy, Numeric employs a quantitative cross sectional model to evaluate stocks that Russell Investments believes result ...

... Russell Investments dynamically allocates between Numeric’s core international equity strategy and an international active low volatility strategy. In the international equities strategy, Numeric employs a quantitative cross sectional model to evaluate stocks that Russell Investments believes result ...

Document

... the net sales as the base. Step 2. Round each answer to the nearest tenth percent. Step 3. List the percent of each income statement item in a column to the right of the monetary amount. ...

... the net sales as the base. Step 2. Round each answer to the nearest tenth percent. Step 3. List the percent of each income statement item in a column to the right of the monetary amount. ...

Franklin Growth Fund Fact Sheet - Franklin Templeton Investments

... Performance: The fund offers other share classes subject to different fees and expenses, which will affect their performance. Class A: Prior to 8/3/98, fund shares were offered at a lower initial sales charge; thus, actual returns may differ. Effective 5/1/94, the fund implemented a Rule 12b-1 plan, ...

... Performance: The fund offers other share classes subject to different fees and expenses, which will affect their performance. Class A: Prior to 8/3/98, fund shares were offered at a lower initial sales charge; thus, actual returns may differ. Effective 5/1/94, the fund implemented a Rule 12b-1 plan, ...

Venture Capital and Private Equity in India:

... the Planning Commission to examine issues related to technology innovation and policies for growth in venture capital activity in India. This is a very important report as it differentiated between 'Venture Capital' & 'Private Equity' and also summarizes the factors under which risk capital would fl ...

... the Planning Commission to examine issues related to technology innovation and policies for growth in venture capital activity in India. This is a very important report as it differentiated between 'Venture Capital' & 'Private Equity' and also summarizes the factors under which risk capital would fl ...

3.56 MB - Financial System Inquiry

... property funds. The mFunds platform provides investors with the ability to apply for and redeem units in managed funds through their stockbroker or adviser through electronic means without the need for paper based applications. Trades are effected through the ASX settlement system and in accordance ...

... property funds. The mFunds platform provides investors with the ability to apply for and redeem units in managed funds through their stockbroker or adviser through electronic means without the need for paper based applications. Trades are effected through the ASX settlement system and in accordance ...

MOST Missouri`s 529 Plan (Advisor)

... The plan features a broad range of asset classes and investment strategies. There is no age-based option, but advisors can choose among 20+ static-allocation and individualfund options spanning most major asset classes. Many of these options are well-regarded by Morningstar analysts, including Ameri ...

... The plan features a broad range of asset classes and investment strategies. There is no age-based option, but advisors can choose among 20+ static-allocation and individualfund options spanning most major asset classes. Many of these options are well-regarded by Morningstar analysts, including Ameri ...

Private equity

In finance, private equity is an asset class consisting of equity securities and debt in operating companies that are not publicly traded on a stock exchange.A private equity investment will generally be made by a private equity firm, a venture capital firm or an angel investor. Each of these categories of investor has its own set of goals, preferences and investment strategies; however, all provide working capital to a target company to nurture expansion, new-product development, or restructuring of the company’s operations, management, or ownership.Bloomberg Businessweek has called private equity a rebranding of leveraged-buyout firms after the 1980s. Common investment strategies in private equity include: leveraged buyouts, venture capital, growth capital, distressed investments and mezzanine capital. In a typical leveraged-buyout transaction, a private-equity firm buys majority control of an existing or mature firm. This is distinct from a venture-capital or growth-capital investment, in which the investors (typically venture-capital firms or angel investors) invest in young, growing or emerging companies, and rarely obtain majority control.Private equity is also often grouped into a broader category called private capital, generally used to describe capital supporting any long-term, illiquid investment strategy.