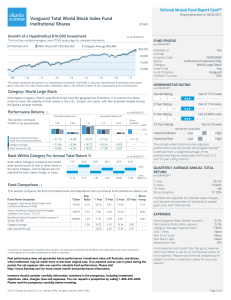

Vanguard Total World Stock Index Fund Institutional Shares

... the funds will fluctuate up to and after the target dates. There is no guarantee the funds will provide adequate income at or through retirement. Fixed income securities are subject to increased loss of principal during periods of rising interest rates. Lower rated securities are subject to greater ...

... the funds will fluctuate up to and after the target dates. There is no guarantee the funds will provide adequate income at or through retirement. Fixed income securities are subject to increased loss of principal during periods of rising interest rates. Lower rated securities are subject to greater ...

Performance of Equity Managers: Style versus "Neural Network

... – Institutional managers are larger than mutual funds and their customers typically have more money than the managers: • The average minimum investment in 2003 for our sample is $8.9M. • While the average account size for a mutual fund is about $28,000 in 2003 according to the Mutual Fund Factbook, ...

... – Institutional managers are larger than mutual funds and their customers typically have more money than the managers: • The average minimum investment in 2003 for our sample is $8.9M. • While the average account size for a mutual fund is about $28,000 in 2003 according to the Mutual Fund Factbook, ...

What is a Security?

... o Business stays private and makes enough profits to pay returns to investors o Management buy-out of the early stage investors, or o IPO. Crowdfunding recently adopted by the JOBS Act in 2012, though enabling Rules and Regulations not yet adopted by the SEC making Crowdfunding active. No such thi ...

... o Business stays private and makes enough profits to pay returns to investors o Management buy-out of the early stage investors, or o IPO. Crowdfunding recently adopted by the JOBS Act in 2012, though enabling Rules and Regulations not yet adopted by the SEC making Crowdfunding active. No such thi ...

Key Investor Information

... Currency risk: The fund can be exposed to different currencies. Changes in foreign exchange rates could create losses. Derivatives risk: A derivative may not perform as expected, and may create losses greater than the cost of the derivative. Equity risk: Equity prices fluctuate daily, based on many ...

... Currency risk: The fund can be exposed to different currencies. Changes in foreign exchange rates could create losses. Derivatives risk: A derivative may not perform as expected, and may create losses greater than the cost of the derivative. Equity risk: Equity prices fluctuate daily, based on many ...

The Equity Premium: Why Is It a Puzzle? Rajnish Mehra

... The feature that makes Equation 2 the “preference function of choice” in much of the literature on growth and in Real Business Cycle theory is that it is scale invariant. Although the levels of aggregate variables, such as capital stock, have increased over time, the equilibrium return process is st ...

... The feature that makes Equation 2 the “preference function of choice” in much of the literature on growth and in Real Business Cycle theory is that it is scale invariant. Although the levels of aggregate variables, such as capital stock, have increased over time, the equilibrium return process is st ...

Key Investor Information

... At least 80% of the fund will be invested in shares of UK companies. The fund aims to provide an income in excess of 110% of the FTSE All Share index yield. The fund invests in 'value' stocks – those whose share prices appear low relative to their long-term profit potential, and which are typically ...

... At least 80% of the fund will be invested in shares of UK companies. The fund aims to provide an income in excess of 110% of the FTSE All Share index yield. The fund invests in 'value' stocks – those whose share prices appear low relative to their long-term profit potential, and which are typically ...

JBWere SMA Listed Fixed Income Portfolio

... securities including government and corporate bonds, hybrids, convertible notes and exchange traded funds recommended by JBWere. While the Portfolio aims to be fully invested at all times, short-term allocations to cash may occur. ...

... securities including government and corporate bonds, hybrids, convertible notes and exchange traded funds recommended by JBWere. While the Portfolio aims to be fully invested at all times, short-term allocations to cash may occur. ...

MARKET REVIEW U.S. equity markets closed out 2016 with a post

... The Small Cap strategy’s outperformance in the fourth quarter was driven by stock selection while sector allocations detracted from returns. Companies in the Health Care and Consumer Discretionary sectors provided the strongest stock selection effects. A significant underweight to the Financial Serv ...

... The Small Cap strategy’s outperformance in the fourth quarter was driven by stock selection while sector allocations detracted from returns. Companies in the Health Care and Consumer Discretionary sectors provided the strongest stock selection effects. A significant underweight to the Financial Serv ...

A2 PRIVATE INVESTMENTS IN NEW INFRASTRUCTURES

... The market failure of external effects occurs in many if not all infrastructures. External effects occur when not all welfare effects of the production and consumption of a product or service have a price. External effects can be either negative – i.e. incurring costs and reducing welfare – or posit ...

... The market failure of external effects occurs in many if not all infrastructures. External effects occur when not all welfare effects of the production and consumption of a product or service have a price. External effects can be either negative – i.e. incurring costs and reducing welfare – or posit ...

What drives Financial Distress Risk and Default

... deals are usually financed with a relatively small portion of equity and a relatively large portion of outside debt financing (60-90%), hence the name “leveraged buyout” (Kaplan and Strömberg, 2008). In a typical LBO transaction, the private equity firm buys majority control of the acquired firm. T ...

... deals are usually financed with a relatively small portion of equity and a relatively large portion of outside debt financing (60-90%), hence the name “leveraged buyout” (Kaplan and Strömberg, 2008). In a typical LBO transaction, the private equity firm buys majority control of the acquired firm. T ...

Toews

... Consider the investment objectives, risks, charges, and expenses carefully before investing. The investment return and principal value of an investment will fluctuate. The investor’s account may be worth less than the original investment when liquidated. Toews Corporation (Toews/TC) is an SEC regist ...

... Consider the investment objectives, risks, charges, and expenses carefully before investing. The investment return and principal value of an investment will fluctuate. The investor’s account may be worth less than the original investment when liquidated. Toews Corporation (Toews/TC) is an SEC regist ...

QUALIFIED PLAN STATEMENT OF INVESTMENT DIRECTION FOR DOLLAR COST AVERAGING Account Number: _________________________

... and amounts indicated by parenthesis $ (0.00) and buy the funds and amounts indicated without parenthesis $ 0.00. These monthly investments shall: (Choose one) Continue for the next _________ months at which time this direction will expire. Continue until another Investment Direction For Dollar Cost ...

... and amounts indicated by parenthesis $ (0.00) and buy the funds and amounts indicated without parenthesis $ 0.00. These monthly investments shall: (Choose one) Continue for the next _________ months at which time this direction will expire. Continue until another Investment Direction For Dollar Cost ...

factsheet Neuberger Berman Emerging Market Debt Blend

... be invested in directly. Index returns assume reinvestment of dividends and capital gains and unlike fund returns do not reflect fees or expenses. Adverse movements in currency exchange rates can result in a decrease in return and a loss of capital. The investments of each portfolio may be fully hed ...

... be invested in directly. Index returns assume reinvestment of dividends and capital gains and unlike fund returns do not reflect fees or expenses. Adverse movements in currency exchange rates can result in a decrease in return and a loss of capital. The investments of each portfolio may be fully hed ...

5 key facts to consider- Ideall Absolute Return Strategies Fund (7652)

... Most conventional investment funds only reward investors when markets go up. Absolute return funds seek to deliver positive absolute returns over the medium to long term whether markets are rising or falling. ...

... Most conventional investment funds only reward investors when markets go up. Absolute return funds seek to deliver positive absolute returns over the medium to long term whether markets are rising or falling. ...

Investors` Interest In Dermatology Is More Than Skin-Deep

... practice definition. Failing to meet even one of the required elements can create risk in the transaction for both the dermatology practice and the private equity investor. Note that since July 15, 2013, when the U.S. Government Accountability Office published a report stating that dermatology prac ...

... practice definition. Failing to meet even one of the required elements can create risk in the transaction for both the dermatology practice and the private equity investor. Note that since July 15, 2013, when the U.S. Government Accountability Office published a report stating that dermatology prac ...

Key Investor Information Document

... Currency risk: The fund can be exposed to different currencies. Changes in foreign exchange rates could create losses. Derivatives risk: A derivative may not perform as expected, and may create losses greater than the cost of the derivative. Equity risk: Equity prices fluctuate daily, based on many ...

... Currency risk: The fund can be exposed to different currencies. Changes in foreign exchange rates could create losses. Derivatives risk: A derivative may not perform as expected, and may create losses greater than the cost of the derivative. Equity risk: Equity prices fluctuate daily, based on many ...

Sample

... (4) individual investors vs. institutional investors The most important factor is uncertainty, the ever-present issue with which all investors must deal. Uncertainty dominates investments, and always will. 1-15. Institutional investors include bank trust departments, pension funds, mutual funds (inv ...

... (4) individual investors vs. institutional investors The most important factor is uncertainty, the ever-present issue with which all investors must deal. Uncertainty dominates investments, and always will. 1-15. Institutional investors include bank trust departments, pension funds, mutual funds (inv ...

The Morningstar® Diversified Alternatives IndexSM

... There was a time when investing involved mostly stocks, bonds, and cash. Today, hedge funds and other alternative strategies have found their way into registered mutual funds and exchange-traded funds available to average investors. While a powerful option for improving portfolio-wide risk adjusted ...

... There was a time when investing involved mostly stocks, bonds, and cash. Today, hedge funds and other alternative strategies have found their way into registered mutual funds and exchange-traded funds available to average investors. While a powerful option for improving portfolio-wide risk adjusted ...

Mutual fund distributions - Sun Life Global Investments

... When a traditional distribution is issued, it’s used to purchase additional securities of the fund. The total number of securities held increases according to the distribution amount, while the net asset value per security is reduced according to the distribution amount. There is no change in the ma ...

... When a traditional distribution is issued, it’s used to purchase additional securities of the fund. The total number of securities held increases according to the distribution amount, while the net asset value per security is reduced according to the distribution amount. There is no change in the ma ...

Financial Report 2014--15

... at June 30, 2015; an increase of $57 million over the prior year. The long-term investment horizon allows for a largely equity-oriented investing strategy where the potential for longterm capital appreciation exists. Other asset management strategies—including but not limited to hedging, derivative ...

... at June 30, 2015; an increase of $57 million over the prior year. The long-term investment horizon allows for a largely equity-oriented investing strategy where the potential for longterm capital appreciation exists. Other asset management strategies—including but not limited to hedging, derivative ...

Timothy Plan High Yield Bond Fund Class I

... the funds will fluctuate up to and after the target dates. There is no guarantee the funds will provide adequate income at or through retirement. Fixed income securities are subject to increased loss of principal during periods of rising interest rates. Lower rated securities are subject to greater ...

... the funds will fluctuate up to and after the target dates. There is no guarantee the funds will provide adequate income at or through retirement. Fixed income securities are subject to increased loss of principal during periods of rising interest rates. Lower rated securities are subject to greater ...

US Equities: Light at the End of the Tunnel

... unprecedented unconventional monetary policy, leading to a form of financial repression that anchors bond yields lower. However, when we analyze the last major period of financial repression, from 1942 to 1951—when the Fed pegged Treasury bond yields to help finance World War II—there exists a simil ...

... unprecedented unconventional monetary policy, leading to a form of financial repression that anchors bond yields lower. However, when we analyze the last major period of financial repression, from 1942 to 1951—when the Fed pegged Treasury bond yields to help finance World War II—there exists a simil ...

Training - NYU Stern

... Activist investors: Some investors have been willing to challenge management practices at companies by offering proposals for change at annual meetings. While they have been for the most part unsuccessful at getting these proposals adopted, they have shaken up incumbent managers. Proxy contests: In ...

... Activist investors: Some investors have been willing to challenge management practices at companies by offering proposals for change at annual meetings. While they have been for the most part unsuccessful at getting these proposals adopted, they have shaken up incumbent managers. Proxy contests: In ...

Using Risk Analysis to Classify Junk Bonds as Equity for Federal

... Another way to view the deductibility issue is to say that section 163(a) allows deduction for interest payments but prohibits deductions for dividend ...

... Another way to view the deductibility issue is to say that section 163(a) allows deduction for interest payments but prohibits deductions for dividend ...

Private equity

In finance, private equity is an asset class consisting of equity securities and debt in operating companies that are not publicly traded on a stock exchange.A private equity investment will generally be made by a private equity firm, a venture capital firm or an angel investor. Each of these categories of investor has its own set of goals, preferences and investment strategies; however, all provide working capital to a target company to nurture expansion, new-product development, or restructuring of the company’s operations, management, or ownership.Bloomberg Businessweek has called private equity a rebranding of leveraged-buyout firms after the 1980s. Common investment strategies in private equity include: leveraged buyouts, venture capital, growth capital, distressed investments and mezzanine capital. In a typical leveraged-buyout transaction, a private-equity firm buys majority control of an existing or mature firm. This is distinct from a venture-capital or growth-capital investment, in which the investors (typically venture-capital firms or angel investors) invest in young, growing or emerging companies, and rarely obtain majority control.Private equity is also often grouped into a broader category called private capital, generally used to describe capital supporting any long-term, illiquid investment strategy.