this instrument and any securities issuable pursuant hereto have not

... law or otherwise, by either party without the prior written consent of the other; provided, however, that this instrument and/or the rights contained herein may be assigned without the Company’s consent by the Investor to any other entity who directly or indirectly, controls, is controlled by or is ...

... law or otherwise, by either party without the prior written consent of the other; provided, however, that this instrument and/or the rights contained herein may be assigned without the Company’s consent by the Investor to any other entity who directly or indirectly, controls, is controlled by or is ...

Determinants of Financial Leverage in Indian Pharmaceutical Industry

... This industry caters to the needs of Indian as well as world citizens for healthy living and promotes economic development of the nation. 2. Review of previous studies Modigliani Miller (1958) found that the market value of a firm is affected by the structure of its debts. l MM ...

... This industry caters to the needs of Indian as well as world citizens for healthy living and promotes economic development of the nation. 2. Review of previous studies Modigliani Miller (1958) found that the market value of a firm is affected by the structure of its debts. l MM ...

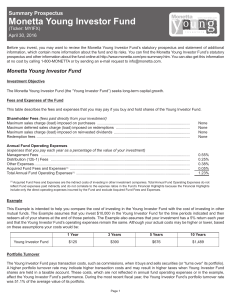

Monetta Young Investor Fund

... 50% of its assets in exchange-traded funds (“ETFs”) and other funds that seek to track the S&P 500 Index (the “Index”) or other broad-based market indices that primarily include stocks of large capitalization U.S. companies. The balance of the Fund is directly invested in common stocks of companies ...

... 50% of its assets in exchange-traded funds (“ETFs”) and other funds that seek to track the S&P 500 Index (the “Index”) or other broad-based market indices that primarily include stocks of large capitalization U.S. companies. The balance of the Fund is directly invested in common stocks of companies ...

Portable Document Format

... **The freestanding investment of $12.5M is the annualized investment for the period March 1, 2009 thru November 30, 2009 which was the initial expected implementation date of APGs. This resulted in an investment of $9.375M to be added for this 9 month period. As APGs were not implemented until Septe ...

... **The freestanding investment of $12.5M is the annualized investment for the period March 1, 2009 thru November 30, 2009 which was the initial expected implementation date of APGs. This resulted in an investment of $9.375M to be added for this 9 month period. As APGs were not implemented until Septe ...

The Public Market Equivalent and Private Equity Performance

... This analysis considers the practical problem of evaluating the performance of private equity (“PE”) funds, such as buyout (“BO”) or venture capital (“VC”) funds. These funds hold privately-held companies, without quoted market valuations, and hence they have no regularly quoted month-to-month or q ...

... This analysis considers the practical problem of evaluating the performance of private equity (“PE”) funds, such as buyout (“BO”) or venture capital (“VC”) funds. These funds hold privately-held companies, without quoted market valuations, and hence they have no regularly quoted month-to-month or q ...

What kinds of firms diversify?

... What are hedge funds? • Private investment vehicles for “sophisticated” (e.g., wealthy) investors • Similar to mutual funds in that they invest in a portfolio of securities • Differ from mutual funds: often take extensive short positions typically highly leveraged non-linear compensation schem ...

... What are hedge funds? • Private investment vehicles for “sophisticated” (e.g., wealthy) investors • Similar to mutual funds in that they invest in a portfolio of securities • Differ from mutual funds: often take extensive short positions typically highly leveraged non-linear compensation schem ...

Analyzing Debt Ratios Defining the Ratios

... earned (the interest coverage ratio). Again, Starbucks has a much healthier and improving ratio (from 9.6 in 2008 to 15.3 in 2009 and 25.2 in the trailing 12-month period). The McDonald’s ratio is lower (12.5 in 2008, 14.4 in 2009 and 14.7 in the trailing 12 months) but is still much higher than the ...

... earned (the interest coverage ratio). Again, Starbucks has a much healthier and improving ratio (from 9.6 in 2008 to 15.3 in 2009 and 25.2 in the trailing 12-month period). The McDonald’s ratio is lower (12.5 in 2008, 14.4 in 2009 and 14.7 in the trailing 12 months) but is still much higher than the ...

Extended Stay America (ESA) – A Case Study

... ESA develops, owns and operates extended stay lodging facilities, which provide an affordable and attractive lodging alternative at a variety of price points for value-conscious guests. The Company’s facilities are designed to offer a superior product at lower rates than most other lodging providers ...

... ESA develops, owns and operates extended stay lodging facilities, which provide an affordable and attractive lodging alternative at a variety of price points for value-conscious guests. The Company’s facilities are designed to offer a superior product at lower rates than most other lodging providers ...

Key Investor Information db x-trackers Equity Value Factor UCITS ETF

... without MSCI’s consent. The Fund is not sponsored, endorsed, or promoted by MSCI, and MSCI bears no liability with respect to the Fund or any index on which such Fund is based. The MSCI indexes are provided without any warranties of any kind. The Index is calculated and published by Solactive AG. So ...

... without MSCI’s consent. The Fund is not sponsored, endorsed, or promoted by MSCI, and MSCI bears no liability with respect to the Fund or any index on which such Fund is based. The MSCI indexes are provided without any warranties of any kind. The Index is calculated and published by Solactive AG. So ...

The case for investing in smaller companies

... change within a company that have not yet been identified by the wider market. With a focus on finding high quality, profitable businesses with significant growth potential, the smaller companies team seek to identify tomorrow’s larger companies today. What do the team look for in a smaller company? ...

... change within a company that have not yet been identified by the wider market. With a focus on finding high quality, profitable businesses with significant growth potential, the smaller companies team seek to identify tomorrow’s larger companies today. What do the team look for in a smaller company? ...

DEBT – Equity Mix - Scholars Middle East Publishers

... tax savings by using debt finance in capital structure. This theory grouped the disadvantages of debt finance under financial distress. It arises when the firm is unable to meet its financial obligations to debt holders, which situation may lead a firm to insolvency. The degree of business risk depe ...

... tax savings by using debt finance in capital structure. This theory grouped the disadvantages of debt finance under financial distress. It arises when the firm is unable to meet its financial obligations to debt holders, which situation may lead a firm to insolvency. The degree of business risk depe ...

cipperman & company - Cipperman Compliance Services

... Disclosure cures many problems but not all conflicts Need more valuation guidance Proxy voting and Privacy remain hot topics Adviser due diligence obligations Money market funds New regulatory regime in 2010 ...

... Disclosure cures many problems but not all conflicts Need more valuation guidance Proxy voting and Privacy remain hot topics Adviser due diligence obligations Money market funds New regulatory regime in 2010 ...

CI Money Market Fund - Mutual Fund Search

... Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. The indicated rates of return are the historical annual compounded total including changes in unit value and reinvestment of all distributi ...

... Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. The indicated rates of return are the historical annual compounded total including changes in unit value and reinvestment of all distributi ...

Available-for-Sale Securities

... from changes in their market prices. Trading securities are often held by banks, mutual funds, insurance companies, and other financial institutions. Because trading securities are held as a short-term investment, they are reported as a current asset on the balance sheet. ...

... from changes in their market prices. Trading securities are often held by banks, mutual funds, insurance companies, and other financial institutions. Because trading securities are held as a short-term investment, they are reported as a current asset on the balance sheet. ...

EURO HIGH YIELD BOND FUND

... The investment objective of the Henderson Horizon Fund Euro High Yield Bond Fund is to provide a high overall yield and potential for capital growth. The Fund will invest at least 70% of its net assets in sub investment grade corporate debt securities with a credit rating equivalent to BB+ or lower ...

... The investment objective of the Henderson Horizon Fund Euro High Yield Bond Fund is to provide a high overall yield and potential for capital growth. The Fund will invest at least 70% of its net assets in sub investment grade corporate debt securities with a credit rating equivalent to BB+ or lower ...

Handbook on Climate-Related Investing across Asset Classes

... Cash plays an essential role in economic development that must occur in order to accomplish sustainability initiatives. For instance, physical improvements such as retrofitting buildings and upgrading the efficiency of equipment benefit the environment, but require upfront capital. For this reason, ...

... Cash plays an essential role in economic development that must occur in order to accomplish sustainability initiatives. For instance, physical improvements such as retrofitting buildings and upgrading the efficiency of equipment benefit the environment, but require upfront capital. For this reason, ...

real estate players must understand that the introduction of

... a closed end real estate investment fund focused on urban investments. The Fund’s investment strategy is to identify and capitalise on the development, acquisition, repositioning, and adaptive reuse of urban real estate. SREF has been approached with an investment memorandum titled ‘The Rosebery’. T ...

... a closed end real estate investment fund focused on urban investments. The Fund’s investment strategy is to identify and capitalise on the development, acquisition, repositioning, and adaptive reuse of urban real estate. SREF has been approached with an investment memorandum titled ‘The Rosebery’. T ...

Investment Policy Statement

... selection of investments, the selection of service providers and administration of the assets of the Program. The Board will maintain written records of all decisions, decision making process, and general Program information. The Board may rely on one or more contract professionals to assist in the ...

... selection of investments, the selection of service providers and administration of the assets of the Program. The Board will maintain written records of all decisions, decision making process, and general Program information. The Board may rely on one or more contract professionals to assist in the ...

going further to go farther

... with these investments. Please read the prospectus before investing. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all distributions and do not take into account sales, redemptions, distributions or optional charg ...

... with these investments. Please read the prospectus before investing. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all distributions and do not take into account sales, redemptions, distributions or optional charg ...

Chapter 11: Reporting and Analyzing Stockholders` Equity

... A company may choose one of several ways to raise needed capital for growth and expansion. A popular alternative for raising capital is to sell stock to the public. Research your school library and/or the Internet to find an initial public offering (IPO) of common stock within the last three years. ...

... A company may choose one of several ways to raise needed capital for growth and expansion. A popular alternative for raising capital is to sell stock to the public. Research your school library and/or the Internet to find an initial public offering (IPO) of common stock within the last three years. ...

FRONT STREET TACTICAL BOND FUND Interim Management

... In December of 2015, the U.S. Federal Reserve raised interest rates 25 basis points, with an outlook of three to four more hikes in 2016. As the new year began, market sentiment deteriorated on concerns that China’s economy was slowing faster than anticipated, and amid rumours of large portfolio rea ...

... In December of 2015, the U.S. Federal Reserve raised interest rates 25 basis points, with an outlook of three to four more hikes in 2016. As the new year began, market sentiment deteriorated on concerns that China’s economy was slowing faster than anticipated, and amid rumours of large portfolio rea ...

PIPEs Transaction and Regulation D

... Who issues structured products? Generally, large financial institutions that are WKSIs issue structured products, usually on an SEC-registered basis Foreign banks may issue structured products to US investors in reliance on the Section 3(a)(2) exemption or in a private placement Usually, the ...

... Who issues structured products? Generally, large financial institutions that are WKSIs issue structured products, usually on an SEC-registered basis Foreign banks may issue structured products to US investors in reliance on the Section 3(a)(2) exemption or in a private placement Usually, the ...

(PPT, 130KB)

... Investment management firms (who typically manage large accounts on behalf of customers such as pension funds and endowments) use the foreign exchange market to facilitate transactions in foreign securities. For example, an investment manager bearing an international equity portfolio needs to purcha ...

... Investment management firms (who typically manage large accounts on behalf of customers such as pension funds and endowments) use the foreign exchange market to facilitate transactions in foreign securities. For example, an investment manager bearing an international equity portfolio needs to purcha ...

Private equity

In finance, private equity is an asset class consisting of equity securities and debt in operating companies that are not publicly traded on a stock exchange.A private equity investment will generally be made by a private equity firm, a venture capital firm or an angel investor. Each of these categories of investor has its own set of goals, preferences and investment strategies; however, all provide working capital to a target company to nurture expansion, new-product development, or restructuring of the company’s operations, management, or ownership.Bloomberg Businessweek has called private equity a rebranding of leveraged-buyout firms after the 1980s. Common investment strategies in private equity include: leveraged buyouts, venture capital, growth capital, distressed investments and mezzanine capital. In a typical leveraged-buyout transaction, a private-equity firm buys majority control of an existing or mature firm. This is distinct from a venture-capital or growth-capital investment, in which the investors (typically venture-capital firms or angel investors) invest in young, growing or emerging companies, and rarely obtain majority control.Private equity is also often grouped into a broader category called private capital, generally used to describe capital supporting any long-term, illiquid investment strategy.