chapter 5

... Once the credit account is established with a supplier, no additional work is required to obtain credit; it just happens spontaneously when the firm makes a purchase ...

... Once the credit account is established with a supplier, no additional work is required to obtain credit; it just happens spontaneously when the firm makes a purchase ...

Alternative Assets: The Next Frontier for Defined Contribution

... Over the past few decades, an increasing number of investors have been effectively using alternative assets to improve their portfolios. These alternative assets—such as hedge funds, private real estate, private equity, and commodities—often have different properties than traditional stocks and bond ...

... Over the past few decades, an increasing number of investors have been effectively using alternative assets to improve their portfolios. These alternative assets—such as hedge funds, private real estate, private equity, and commodities—often have different properties than traditional stocks and bond ...

Employing Finders and Solicitors

... effects securities transactions through U.S. jurisdictional means to register with the SEC as a brokerdealer, unless, in the case of an individual, such person is an associated person of a registered brokerdealer. In very limited circumstances, finders who are not registered broker-dealers may be us ...

... effects securities transactions through U.S. jurisdictional means to register with the SEC as a brokerdealer, unless, in the case of an individual, such person is an associated person of a registered brokerdealer. In very limited circumstances, finders who are not registered broker-dealers may be us ...

Investor Relations Communications Plan

... In Nasdaq Online, there are 13 possible styles, defined below, by which institutional investors are classified by the source of the data, the Carson Group. The Carson Group employs quantitative techniques based on key financial fundamentals of an investor's portfolio: primarily, the portions of the ...

... In Nasdaq Online, there are 13 possible styles, defined below, by which institutional investors are classified by the source of the data, the Carson Group. The Carson Group employs quantitative techniques based on key financial fundamentals of an investor's portfolio: primarily, the portions of the ...

Boom and Bust of Equity Portfolio Flows to Emerging Markets A

... different to those that encourage portfolio flows. For this reason, as well as the fact that South Africa’s capital inflows are predominantly in the form of portfolio inflows, this paper focuses on portfolio inflows, and more specifically portfolio equity inflows. While bond inflows are also importa ...

... different to those that encourage portfolio flows. For this reason, as well as the fact that South Africa’s capital inflows are predominantly in the form of portfolio inflows, this paper focuses on portfolio inflows, and more specifically portfolio equity inflows. While bond inflows are also importa ...

Angel Investing: Changing Strategies During Volatile Times Jeffrey

... In an earlier study of UK angels, yield rates were determined to be 6% (Mason and Harrison (1994)), although this estimate was based on a sample of only 35 investments by a small group of angels. The only study to date on US angel yield rates focused on referral efficiency and determined acceptance ...

... In an earlier study of UK angels, yield rates were determined to be 6% (Mason and Harrison (1994)), although this estimate was based on a sample of only 35 investments by a small group of angels. The only study to date on US angel yield rates focused on referral efficiency and determined acceptance ...

Chapter 4

... in theory creates a “fund” which will be used later to replace the worn-out asset. b. In actuality: it is a “tax shelter”. It reduces our ...

... in theory creates a “fund” which will be used later to replace the worn-out asset. b. In actuality: it is a “tax shelter”. It reduces our ...

Fund Change Notice

... Total returns are historical and include change in share value and reinvestment of dividends and capital gains, if any. Cumulative total returns are reported as of the period indicated. Life of Fund figures are reported as of the inception date to the period indicated. These figures do not include t ...

... Total returns are historical and include change in share value and reinvestment of dividends and capital gains, if any. Cumulative total returns are reported as of the period indicated. Life of Fund figures are reported as of the inception date to the period indicated. These figures do not include t ...

download

... employed or capable of being employed in the production of more wealth. A subset of Assets. Thus business capital. Define Capital Structure The post investment financial structure must fit the particular capital requirements of the company that will provide sufficient long-term capital growth. Defin ...

... employed or capable of being employed in the production of more wealth. A subset of Assets. Thus business capital. Define Capital Structure The post investment financial structure must fit the particular capital requirements of the company that will provide sufficient long-term capital growth. Defin ...

Download attachment

... their own fund, and because the Islamic market is fast moving and complex, long-term focus and in-depth understanding are necessary. Outsourcing provides these banks with the fund management expertise that they lack, and at the same time, outsourcing is cheaper to implement. Conversely, many fund ma ...

... their own fund, and because the Islamic market is fast moving and complex, long-term focus and in-depth understanding are necessary. Outsourcing provides these banks with the fund management expertise that they lack, and at the same time, outsourcing is cheaper to implement. Conversely, many fund ma ...

Immigrant Investor Programme - Guidelines for Funds

... managers should provide details of their fund valuation methods and the target return to investors. While the Immigrant Investor Programme does not attach any conditions to return on investment, the Evaluation Committee will require details of the target return on investment in order to satisfy them ...

... managers should provide details of their fund valuation methods and the target return to investors. While the Immigrant Investor Programme does not attach any conditions to return on investment, the Evaluation Committee will require details of the target return on investment in order to satisfy them ...

glossary

... Response A: This is one of three forms of business organization discussed in the chapter. Response B: Correct! Response C: This is one of three forms of business organization discussed in the chapter. Response D: This is one of three forms of business organization discussed in the chapter. ...

... Response A: This is one of three forms of business organization discussed in the chapter. Response B: Correct! Response C: This is one of three forms of business organization discussed in the chapter. Response D: This is one of three forms of business organization discussed in the chapter. ...

Good First--and Maybe Only--Funds

... Index funds are also advantageous because they are fairly predictable. First, they tend to return what the index does, minus their expenses. Second, they always own what the index owns, which means they tend to be style specific. For example, if a fund indexes the S&P 500, that means it owns large-b ...

... Index funds are also advantageous because they are fairly predictable. First, they tend to return what the index does, minus their expenses. Second, they always own what the index owns, which means they tend to be style specific. For example, if a fund indexes the S&P 500, that means it owns large-b ...

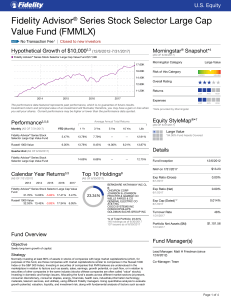

Fidelity Advisor® Series Stock Selector Large Cap Value Fund

... Expenses: This Morningstar data point compares the fund's net expense ratio to the net expense ratio of all the other funds within its Morningstar Category grouping. 5. Total returns are historical and include change in share value and reinvestment of dividends and capital gains, if any. Cumulative ...

... Expenses: This Morningstar data point compares the fund's net expense ratio to the net expense ratio of all the other funds within its Morningstar Category grouping. 5. Total returns are historical and include change in share value and reinvestment of dividends and capital gains, if any. Cumulative ...

Chapter 6 - Fund Accounting

... introduced as part of the governmental financial reporting model established by GASB Statement No. 34, Basic Financial Statements -- and Management’s Discussion and Analysis for State and Local Governments (GASBS 34). Permanent funds should be used to report resources that are legally restricted to ...

... introduced as part of the governmental financial reporting model established by GASB Statement No. 34, Basic Financial Statements -- and Management’s Discussion and Analysis for State and Local Governments (GASBS 34). Permanent funds should be used to report resources that are legally restricted to ...

MN20211A-2009 - people.bath.ac.uk

... Value of the Firm and Capital Structure Value of the Firm = Value of Debt + Value of Equity = discounted value of future cashflows available to the providers of capital. (where values refer to market values). Capital Structure is the amount of debt and equity: It is the way a firm ...

... Value of the Firm and Capital Structure Value of the Firm = Value of Debt + Value of Equity = discounted value of future cashflows available to the providers of capital. (where values refer to market values). Capital Structure is the amount of debt and equity: It is the way a firm ...

Joint Press Release CCG CFI

... Investments Limited to Calamatta Cuschieri Group plc. This agreement is subject to all regulatory approvals, amongst which that by the MFSA, and a normal due diligence. This proposed acquisition will further strengthen Calamatta Cuschieri Group plc’s position as one of the largest investment service ...

... Investments Limited to Calamatta Cuschieri Group plc. This agreement is subject to all regulatory approvals, amongst which that by the MFSA, and a normal due diligence. This proposed acquisition will further strengthen Calamatta Cuschieri Group plc’s position as one of the largest investment service ...

Valuation: Part I Discounted Cash Flow Valuation

... Critical ingredient in discounted cashflow valuation. Errors in estimating the discount rate or mismatching cashflows and discount rates can lead to serious errors in valuation. " At an intuitive level, the discount rate used should be consistent with both the riskiness and the type of cashflow bein ...

... Critical ingredient in discounted cashflow valuation. Errors in estimating the discount rate or mismatching cashflows and discount rates can lead to serious errors in valuation. " At an intuitive level, the discount rate used should be consistent with both the riskiness and the type of cashflow bein ...

HERMES GLOBAL HIGH YIELD BOND FUND

... The investment objective of the Fund is to generate a high level of income. The Fund will seek to achieve its objective by investing primarily in a diversified portfolio of high yield bonds. The Fund may also use credit default Swaps extensively. The Investment Manager intends to use an active appro ...

... The investment objective of the Fund is to generate a high level of income. The Fund will seek to achieve its objective by investing primarily in a diversified portfolio of high yield bonds. The Fund may also use credit default Swaps extensively. The Investment Manager intends to use an active appro ...

Finance Notes 2008 Size: 351.5kb Last modified

... Portfolio Theory - Portfolio risk is not the weighted average of individual variances. Covariances give rise to risk reduction through diversification. (Impacts denominator but not numerator; θ Ε(v) discounted at lower rate is still zero) - Remember, in a crisis, all correlations go to one (Hurrican ...

... Portfolio Theory - Portfolio risk is not the weighted average of individual variances. Covariances give rise to risk reduction through diversification. (Impacts denominator but not numerator; θ Ε(v) discounted at lower rate is still zero) - Remember, in a crisis, all correlations go to one (Hurrican ...

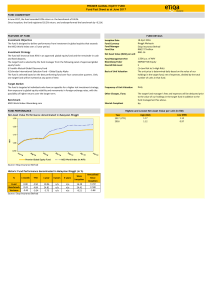

Etiqa Insurance Berhad Overall Risk Level Basis of Unit Valuation

... • At any time, we reserve the right to close any fund, or to transfer the investments to a new fund, subject to prior approval by the regulator. In such an event, we will provide 90 days prior written notification. RISK DISCLOSURE The policyholders should consider the following potential risks when ...

... • At any time, we reserve the right to close any fund, or to transfer the investments to a new fund, subject to prior approval by the regulator. In such an event, we will provide 90 days prior written notification. RISK DISCLOSURE The policyholders should consider the following potential risks when ...

Market Value of the Firm, Market Value of Equity

... The objective of this paper is to answer these questions by a mathematic model based on optimal control theory and derived from comparison study about maximization. I am going to accomplish four arguments. (1) We measure the performance of the firm by return rate on capital (i.e., maximum return rat ...

... The objective of this paper is to answer these questions by a mathematic model based on optimal control theory and derived from comparison study about maximization. I am going to accomplish four arguments. (1) We measure the performance of the firm by return rate on capital (i.e., maximum return rat ...

Why expenses matter - Charles Schwab Investment Management

... There is a $10 million minimum investment for Institutional Shares not purchased in an employer-sponsored plan. Operating Expense Ratios as reflected in each fund’s prospectus as of 3/1/17 and are subject to change. Investment returns will fluctuate and are subject to market volatility, so that an ...

... There is a $10 million minimum investment for Institutional Shares not purchased in an employer-sponsored plan. Operating Expense Ratios as reflected in each fund’s prospectus as of 3/1/17 and are subject to change. Investment returns will fluctuate and are subject to market volatility, so that an ...

Why understanding asset allocation could improve

... was that spooked investors, including many SMSF investors, reallocated to safer investments such as cash. Of course you would have missed out on the massive gains in shares over the past 18 months if the majority of your holdings were in cash. It is almost impossible to pick the exact bottom, or exa ...

... was that spooked investors, including many SMSF investors, reallocated to safer investments such as cash. Of course you would have missed out on the massive gains in shares over the past 18 months if the majority of your holdings were in cash. It is almost impossible to pick the exact bottom, or exa ...

Pricing Insurance Policies: The Internal Rate of Return Model

... Traditional ratemaking procedures don’t focus much on expense costs. A target loss ratio is set as the complement of the expense ratio. We should analyze expenses as closely as we do premiums and losses. The reasons we can’t: 1) Data: Few companies monitor expense payment patterns, as most keep expe ...

... Traditional ratemaking procedures don’t focus much on expense costs. A target loss ratio is set as the complement of the expense ratio. We should analyze expenses as closely as we do premiums and losses. The reasons we can’t: 1) Data: Few companies monitor expense payment patterns, as most keep expe ...

Private equity

In finance, private equity is an asset class consisting of equity securities and debt in operating companies that are not publicly traded on a stock exchange.A private equity investment will generally be made by a private equity firm, a venture capital firm or an angel investor. Each of these categories of investor has its own set of goals, preferences and investment strategies; however, all provide working capital to a target company to nurture expansion, new-product development, or restructuring of the company’s operations, management, or ownership.Bloomberg Businessweek has called private equity a rebranding of leveraged-buyout firms after the 1980s. Common investment strategies in private equity include: leveraged buyouts, venture capital, growth capital, distressed investments and mezzanine capital. In a typical leveraged-buyout transaction, a private-equity firm buys majority control of an existing or mature firm. This is distinct from a venture-capital or growth-capital investment, in which the investors (typically venture-capital firms or angel investors) invest in young, growing or emerging companies, and rarely obtain majority control.Private equity is also often grouped into a broader category called private capital, generally used to describe capital supporting any long-term, illiquid investment strategy.