Oct 2013 Micro Cap WP.indd

... All of the above-mentioned factors should favor active managers who have gained an intimate knowledge of the small and micro cap sectors by conducting primary research and developing longstanding relationships with companies, including frequent visits and discussions with management. ...

... All of the above-mentioned factors should favor active managers who have gained an intimate knowledge of the small and micro cap sectors by conducting primary research and developing longstanding relationships with companies, including frequent visits and discussions with management. ...

Financial Crises, Bank Risk Exposure and Government Financial

... preferences over hours: The latter, of course, eliminates wealth effects from labor supply. As will become clear, these features improve the ability for the model to capture business cycle dynamics despite the absence of labor market frictions. At the same time, they permit introducing reasonable deg ...

... preferences over hours: The latter, of course, eliminates wealth effects from labor supply. As will become clear, these features improve the ability for the model to capture business cycle dynamics despite the absence of labor market frictions. At the same time, they permit introducing reasonable deg ...

Wednesday, July 26, 2006

... Standard mutual funds would require buy or sell orders to be in by 2 p.m. Eastern time, in order for the trades to take effect the same day, and the day-end net asset value is not knowable until much later. But this creates the risk of a mismatch between the amount being sold and the amount to be re ...

... Standard mutual funds would require buy or sell orders to be in by 2 p.m. Eastern time, in order for the trades to take effect the same day, and the day-end net asset value is not knowable until much later. But this creates the risk of a mismatch between the amount being sold and the amount to be re ...

Investing - Madeira City Schools

... Are you willing to sacrifice some purchases to provide financing for your investments? What do you value? Participate in elective savings programs Payroll deduction or electronic transfer Make extra effort to save one or two months each year Take advantage of gifts, inheritances, and win ...

... Are you willing to sacrifice some purchases to provide financing for your investments? What do you value? Participate in elective savings programs Payroll deduction or electronic transfer Make extra effort to save one or two months each year Take advantage of gifts, inheritances, and win ...

High-growth robot company MiR receives growth capital from a

... Torben Frigaard Rasmussen, who was recently hand-picked as the new chairman of MiR's board of directors, is one of the two new investors mentioned by Mr Jul Jakobsen. Mr Frigaard Rasmussen has previously been involved in companies such as E-soft, Worldticket, Umbraco and E-conomics. "I think that Mi ...

... Torben Frigaard Rasmussen, who was recently hand-picked as the new chairman of MiR's board of directors, is one of the two new investors mentioned by Mr Jul Jakobsen. Mr Frigaard Rasmussen has previously been involved in companies such as E-soft, Worldticket, Umbraco and E-conomics. "I think that Mi ...

March 2017 Dear All, Please find below a rundown of recent

... https://www.bloomberg.com/news/articles/2017-03-13/valeant-falls-as-bill-ackman-sells-out-departscompany-s-board. “Bill Ackman has finally conceded defeat on Valeant Pharmaceuticals International Inc. After waging a costly and outspoken public defense of the controversial drugmaker, its once-biggest ...

... https://www.bloomberg.com/news/articles/2017-03-13/valeant-falls-as-bill-ackman-sells-out-departscompany-s-board. “Bill Ackman has finally conceded defeat on Valeant Pharmaceuticals International Inc. After waging a costly and outspoken public defense of the controversial drugmaker, its once-biggest ...

Chapter 14

... Market Liquidity is the ability to buy or sell an asset quickly with little price change from a prior transaction assuming no new information External market liquidity is a source of risk to investors ...

... Market Liquidity is the ability to buy or sell an asset quickly with little price change from a prior transaction assuming no new information External market liquidity is a source of risk to investors ...

Capital Budgeting for Small Businesses

... the same firm will pay significantly more, 20.5% (16% ^ (1-0.22)), for an issue of only $1 million. Because of these costs, small businesses with smaller capital requirements typically rely upon owners' equity and com mercial banks as their main sources of capital instead of primary capital markets ...

... the same firm will pay significantly more, 20.5% (16% ^ (1-0.22)), for an issue of only $1 million. Because of these costs, small businesses with smaller capital requirements typically rely upon owners' equity and com mercial banks as their main sources of capital instead of primary capital markets ...

print - MFS Investment Management

... Elements of market history and mean reversion are incorporated into our model in both stages. Reversion speed and target levels are calibrated based on our analysis of historical data and forward-looking expectations. The first stage of our model examines current conditions and then assumes a health ...

... Elements of market history and mean reversion are incorporated into our model in both stages. Reversion speed and target levels are calibrated based on our analysis of historical data and forward-looking expectations. The first stage of our model examines current conditions and then assumes a health ...

RTF - Review of Business Taxation

... offset first against capital gains actually realised by the entity before the change in ownership. Any remaining deemed capital loss would then be allowed to be offset against the gains from the entity’s assets treated, at the entity’s option, as having been disposed of on change of ownership. Any d ...

... offset first against capital gains actually realised by the entity before the change in ownership. Any remaining deemed capital loss would then be allowed to be offset against the gains from the entity’s assets treated, at the entity’s option, as having been disposed of on change of ownership. Any d ...

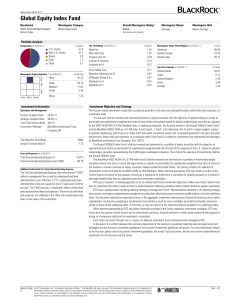

Global Equity Index Fund

... investment objective. An investment in the Fund is not a bank deposit, is not guaranteed by BlackRock, Inc. or any of its affiliates, and is not insured by the Federal Deposit Insurance Corporation or any other agency of the U.S. government. Equity Investment Risk: The price of an equity security fl ...

... investment objective. An investment in the Fund is not a bank deposit, is not guaranteed by BlackRock, Inc. or any of its affiliates, and is not insured by the Federal Deposit Insurance Corporation or any other agency of the U.S. government. Equity Investment Risk: The price of an equity security fl ...

Alternative Investments as Modern Financial Innovations

... precisely and comprehensively characterize the term alternative investments. Alternative investments offer an extremely broad and diverse group of financial products and services. Therefore, it is difficult to state unambiguously whether they are a separate category of assets or whether they constit ...

... precisely and comprehensively characterize the term alternative investments. Alternative investments offer an extremely broad and diverse group of financial products and services. Therefore, it is difficult to state unambiguously whether they are a separate category of assets or whether they constit ...

British Investment Overseas 1870-1913

... capital from overseas to home purposes would have added 25—50 per cent to the British national income. Crafts, on more restrictive assumptions, made it 25 per cent.5 If this indeed was the case, then Britain would have enjoyed a higher standard of living had Victorian investors allocated a larger p ...

... capital from overseas to home purposes would have added 25—50 per cent to the British national income. Crafts, on more restrictive assumptions, made it 25 per cent.5 If this indeed was the case, then Britain would have enjoyed a higher standard of living had Victorian investors allocated a larger p ...

Unconventional Wisdom

... Focused Funds White Paper Research provides evidentiary support While it makes intuitive sense that having better information may produce benefits for investors, academic research supports the idea, as well. It suggests that focused fund managers are more confident and have longer-term outlooks. In ...

... Focused Funds White Paper Research provides evidentiary support While it makes intuitive sense that having better information may produce benefits for investors, academic research supports the idea, as well. It suggests that focused fund managers are more confident and have longer-term outlooks. In ...

Superannuation funds and alternative asset investment

... investments in listed equities. A further characteristic of many alternative assets, such as direct investments in private equity and infrastructure, is their relative illiquidity. While this is not in itself a concern, the relationship between the liquidity of a fund’s assets and the likelihood of ...

... investments in listed equities. A further characteristic of many alternative assets, such as direct investments in private equity and infrastructure, is their relative illiquidity. While this is not in itself a concern, the relationship between the liquidity of a fund’s assets and the likelihood of ...

Study on Impediments to Growth of CISs in Kenya

... It is of utmost importance for the CMA to continually undertake assessments of the changing environment within the local capital market as well as globally, particularly as it strives to achieve its mission and objectives, recognising that capital markets are dynamic. As a result, the CMA, its staff ...

... It is of utmost importance for the CMA to continually undertake assessments of the changing environment within the local capital market as well as globally, particularly as it strives to achieve its mission and objectives, recognising that capital markets are dynamic. As a result, the CMA, its staff ...

Effect of Leverage on Performance of Non

... when the firm relies on too much debt. This leads to a trade-off between the tax benefit and the disadvantage of higher risk of financial distress. But there are more cost and benefits involved with the use of debt and equity. One other major cost factor consists of agency costs. Jensen (1986) argue ...

... when the firm relies on too much debt. This leads to a trade-off between the tax benefit and the disadvantage of higher risk of financial distress. But there are more cost and benefits involved with the use of debt and equity. One other major cost factor consists of agency costs. Jensen (1986) argue ...

Enrollment Form - Accurecord Direct

... 1.) Select funds based on your projected retirement date. These are packages of funds that are actively managed and automatically adjusted during your employment years as your projected retirement date approaches. Your investment is on autopilot. 2.) Select funds based on your Risk Category. These a ...

... 1.) Select funds based on your projected retirement date. These are packages of funds that are actively managed and automatically adjusted during your employment years as your projected retirement date approaches. Your investment is on autopilot. 2.) Select funds based on your Risk Category. These a ...

CIRE Magazine :: The Private Investment Pool

... and putting the capital into self directed companies and investing in real estate. This will be a great source of business for the real estate broker,” he says. ...

... and putting the capital into self directed companies and investing in real estate. This will be a great source of business for the real estate broker,” he says. ...

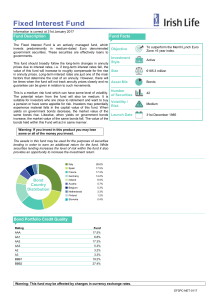

Fixed Interest Fund - Irish Life Corporate Business

... factors that determine the cost of an annuity. However, there will be times when the fund will not track annuity prices closely and no Asset Mix guarantee can be given in relation to such movements. This is a medium risk fund which can have some level of volatility. The potential return from the fun ...

... factors that determine the cost of an annuity. However, there will be times when the fund will not track annuity prices closely and no Asset Mix guarantee can be given in relation to such movements. This is a medium risk fund which can have some level of volatility. The potential return from the fun ...

File ch21 Type: Multiple Choice 1. Which of the following is NOT one

... Ans: False Response: Although the investment policies of institutions are set up by people, the text details how individuals define risk as “losing money,” but institutions use more sophisticated definitions. Section: Formulate an Appropriate Investment Strategy. ...

... Ans: False Response: Although the investment policies of institutions are set up by people, the text details how individuals define risk as “losing money,” but institutions use more sophisticated definitions. Section: Formulate an Appropriate Investment Strategy. ...

Cash Flow Statement for the year ended 31st March, 2016

... OF ARRANGEMENT CLOSING CASH AND CASH EQUIVALENTS ...

... OF ARRANGEMENT CLOSING CASH AND CASH EQUIVALENTS ...

Risk Management Investment case

... A substitute to owning alternatives, providing absolute returns in a broad range of market environments by investing in the most favorable asset classes including equities, real estate, fixed income and alternative securities. ...

... A substitute to owning alternatives, providing absolute returns in a broad range of market environments by investing in the most favorable asset classes including equities, real estate, fixed income and alternative securities. ...

pdf

... capture only a small fraction of the market return over time. For some reason, very few investors are prepared to put their money in equities, and with the fund managers they back, for the long haul. Why would that be? a) A large part of it is due to momentum investing. Many believe they ‘can ride ...

... capture only a small fraction of the market return over time. For some reason, very few investors are prepared to put their money in equities, and with the fund managers they back, for the long haul. Why would that be? a) A large part of it is due to momentum investing. Many believe they ‘can ride ...

chapter 5

... Once the credit account is established with a supplier, no additional work is required to obtain credit; it just happens spontaneously when the firm makes a purchase ...

... Once the credit account is established with a supplier, no additional work is required to obtain credit; it just happens spontaneously when the firm makes a purchase ...

Private equity

In finance, private equity is an asset class consisting of equity securities and debt in operating companies that are not publicly traded on a stock exchange.A private equity investment will generally be made by a private equity firm, a venture capital firm or an angel investor. Each of these categories of investor has its own set of goals, preferences and investment strategies; however, all provide working capital to a target company to nurture expansion, new-product development, or restructuring of the company’s operations, management, or ownership.Bloomberg Businessweek has called private equity a rebranding of leveraged-buyout firms after the 1980s. Common investment strategies in private equity include: leveraged buyouts, venture capital, growth capital, distressed investments and mezzanine capital. In a typical leveraged-buyout transaction, a private-equity firm buys majority control of an existing or mature firm. This is distinct from a venture-capital or growth-capital investment, in which the investors (typically venture-capital firms or angel investors) invest in young, growing or emerging companies, and rarely obtain majority control.Private equity is also often grouped into a broader category called private capital, generally used to describe capital supporting any long-term, illiquid investment strategy.