Chapter 13 The Cost of Capital

... quality to junk status. Junk bonds are aptly named: they are the debt of companies in some sort of financial difficulty. Because they are so risky they have to offer much higher yields than other debt. This brings up an important point: not all bonds are inherently safer than shares. 1.4.5 The minim ...

... quality to junk status. Junk bonds are aptly named: they are the debt of companies in some sort of financial difficulty. Because they are so risky they have to offer much higher yields than other debt. This brings up an important point: not all bonds are inherently safer than shares. 1.4.5 The minim ...

Global Real Assets Launches Direct Real Asset Investment Platform

... to help further meet client demand for direct and co-investment real asset opportunities across the risk/return spectrum and around the world. ...

... to help further meet client demand for direct and co-investment real asset opportunities across the risk/return spectrum and around the world. ...

Understanding Your Choices - FieldNet

... Analysts Journal, May/June 1991. The study analyzed data from 82 large corporate pension plans with assets of at least $100 million over a 10-year period beginning in 1977 and concluded that asset allocation policy explained, on average, 91.5% of variation in total plan return over time. This is the ...

... Analysts Journal, May/June 1991. The study analyzed data from 82 large corporate pension plans with assets of at least $100 million over a 10-year period beginning in 1977 and concluded that asset allocation policy explained, on average, 91.5% of variation in total plan return over time. This is the ...

Paulson Confronts Goldman Fallout

... clients that they might withdraw money from his firm after a lawsuit brought by the government against Goldman Sachs Group Inc. related to an investment created at his firm's request. Investors have indicated they are concerned that scrutiny over the firm's deals may spread, including to overseas re ...

... clients that they might withdraw money from his firm after a lawsuit brought by the government against Goldman Sachs Group Inc. related to an investment created at his firm's request. Investors have indicated they are concerned that scrutiny over the firm's deals may spread, including to overseas re ...

Insurance-related investments strategy

... bonds and direct reinsurance contracts, but is biased to the latter where pricing on a like-for-like basis remains more attractive. In our recent discussions with AlphaCat, they advised they have begun the planning process for mid-year reinsurance policy renewals in June, where they are optimistic i ...

... bonds and direct reinsurance contracts, but is biased to the latter where pricing on a like-for-like basis remains more attractive. In our recent discussions with AlphaCat, they advised they have begun the planning process for mid-year reinsurance policy renewals in June, where they are optimistic i ...

measuring risk-adjusted returns in alternative investments

... • The Favre-Galeano article shows that most hedge fund categories have concave payoffs on the downside. • Diversification benefits disappear at extreme levels of traditional asset returns with several exceptions. ...

... • The Favre-Galeano article shows that most hedge fund categories have concave payoffs on the downside. • Diversification benefits disappear at extreme levels of traditional asset returns with several exceptions. ...

speech - Europa.eu

... turning, in growing numbers, to equity-based investments. Over the longer-term, these investments provide for higher returns (often with lower volatility) than government bonds. The switch to equity investment is long-established in the UK, but it is novel to the rest of the Community. In France, fo ...

... turning, in growing numbers, to equity-based investments. Over the longer-term, these investments provide for higher returns (often with lower volatility) than government bonds. The switch to equity investment is long-established in the UK, but it is novel to the rest of the Community. In France, fo ...

Heading 1: 24pt Arial regular

... offering a full range of retail financial products and services to its members. This includes deposit, investment and loan products and transactional services provided directly to its members, and insurance products, salary sacrifice, investment planning and motor vehicle broking services provided a ...

... offering a full range of retail financial products and services to its members. This includes deposit, investment and loan products and transactional services provided directly to its members, and insurance products, salary sacrifice, investment planning and motor vehicle broking services provided a ...

Small Business Management 12e - Longenecker, Moore

... Fact: The industry has plenty of money, but limited appetite for new investment Fact: Investor attitudes toward risk have changed ...

... Fact: The industry has plenty of money, but limited appetite for new investment Fact: Investor attitudes toward risk have changed ...

Financial Ratios

... acid test ratio for both firms has increased slightly, yet Mitsubishi’s acid test ratio has increased a bit further than what Dodge’s ratio resulting in it becoming less risky. ...

... acid test ratio for both firms has increased slightly, yet Mitsubishi’s acid test ratio has increased a bit further than what Dodge’s ratio resulting in it becoming less risky. ...

Templeton Foreign Fund Fact Sheet

... time, and can reduce returns. Because the Fund may invest its assets in companies in a specific region, including Europe, it is subject to greater risks of adverse developments in that region and/or the surrounding regions than a fund that is more broadly diversified geographically. Current politica ...

... time, and can reduce returns. Because the Fund may invest its assets in companies in a specific region, including Europe, it is subject to greater risks of adverse developments in that region and/or the surrounding regions than a fund that is more broadly diversified geographically. Current politica ...

KIID LU1335425580 en LU

... 5 Operational risks: The Fund may become the target of fraud or other criminal acts. It may also suffer losses as a result of system failures as well as of processing mistakes or misconduct of company employees or an external third party. External events such as political, legal and economical chang ...

... 5 Operational risks: The Fund may become the target of fraud or other criminal acts. It may also suffer losses as a result of system failures as well as of processing mistakes or misconduct of company employees or an external third party. External events such as political, legal and economical chang ...

Using Coke-Cola and Pepsico to demonstrate optimal capital

... Modigliani and Miller (1958) show that with a simple set of assumptions the value of a firm is independent of the capital structure. M&M (1958) assume that capital markets are certain and that there are no taxes or trading cost. Investors are able to borrow and lend at the same rate. The value of th ...

... Modigliani and Miller (1958) show that with a simple set of assumptions the value of a firm is independent of the capital structure. M&M (1958) assume that capital markets are certain and that there are no taxes or trading cost. Investors are able to borrow and lend at the same rate. The value of th ...

Lesson 4 A cost ofcapital

... The cost of debt to the firm is the effective yield to maturity (or interest rate) paid to its bondholders Since interest is tax deductible to the firm, the actual cost of debt is less than the yield to maturity: After-tax cost of debt = yield x (1 - tax rate) ...

... The cost of debt to the firm is the effective yield to maturity (or interest rate) paid to its bondholders Since interest is tax deductible to the firm, the actual cost of debt is less than the yield to maturity: After-tax cost of debt = yield x (1 - tax rate) ...

Materials

... Mathematics and Physics, to purchase equipment for these departments as suggested by the heads of the departments and approved by the President and the Board of Visitors, and to provide for scholarships in these departments for outstanding students." Mr. Pratt’s will provides further that these fund ...

... Mathematics and Physics, to purchase equipment for these departments as suggested by the heads of the departments and approved by the President and the Board of Visitors, and to provide for scholarships in these departments for outstanding students." Mr. Pratt’s will provides further that these fund ...

Low Volatility Equity Strategies: New And Improved?

... costs, identical asset predicted returns and variances, and covariances across investors), a capitalization-weighted portfolio of all investable securities should provide the highest expected return per unit of risk, thus delivering maximum market efficiency. Furthermore, within that cap-weighted ma ...

... costs, identical asset predicted returns and variances, and covariances across investors), a capitalization-weighted portfolio of all investable securities should provide the highest expected return per unit of risk, thus delivering maximum market efficiency. Furthermore, within that cap-weighted ma ...

Public and Private Capital Markets are Not Substitutes

... investors in smaller public companies actually have received greater returns to compensate for additional. As the leading valuation expert Shannon Pratt further indicates, the total risk, or standard deviation of annual returns, also increases with decreasing size.3 This implies the market does not ...

... investors in smaller public companies actually have received greater returns to compensate for additional. As the leading valuation expert Shannon Pratt further indicates, the total risk, or standard deviation of annual returns, also increases with decreasing size.3 This implies the market does not ...

From big to great: The world`s leading institutional investors forge

... investors? How will they stay on their strong trajectory? What do the changes in the macro environment mean for them? How will they manage the increasingly complex internal structures they have set up? To answer these questions, we have surveyed 27 large pensions and sovereign wealth funds that coll ...

... investors? How will they stay on their strong trajectory? What do the changes in the macro environment mean for them? How will they manage the increasingly complex internal structures they have set up? To answer these questions, we have surveyed 27 large pensions and sovereign wealth funds that coll ...

mmi13 Zimmermann 19075478 en

... argue that Basel II exacerbates business cycle fluctuations by requiring banks to hold more capital during downturns. Higher costs of raising capital in downturns force banks to further contract lending, a credit crunch. However, such demand-side arguments ignores the negative impact of declining ca ...

... argue that Basel II exacerbates business cycle fluctuations by requiring banks to hold more capital during downturns. Higher costs of raising capital in downturns force banks to further contract lending, a credit crunch. However, such demand-side arguments ignores the negative impact of declining ca ...

Now - CT Corporation

... attention as well as newer sources of capital, such as small and mid-cap equity funds, new mutual funds, ETFs and institutional investors that have yet to invest in listed real estate. New tax incentives for U.S. REITs also may generate increased demand among foreign investors. Nevertheless, REITs f ...

... attention as well as newer sources of capital, such as small and mid-cap equity funds, new mutual funds, ETFs and institutional investors that have yet to invest in listed real estate. New tax incentives for U.S. REITs also may generate increased demand among foreign investors. Nevertheless, REITs f ...

Chapter 1

... Foreign subsidiary capital structure, continued – Political risk management • The use of financing to reduce political risks typically involves mechanisms to avoid or reduce the impact of certain risks, such as those related to exchange controls or expropriation. – By raising funds locally, if a sub ...

... Foreign subsidiary capital structure, continued – Political risk management • The use of financing to reduce political risks typically involves mechanisms to avoid or reduce the impact of certain risks, such as those related to exchange controls or expropriation. – By raising funds locally, if a sub ...

Differences in target-firm characteristics and premiums paid by

... The significant participation of private firms in general and private equity (hence “private” or “PE”) firms in particular in mergers and acquisitions activities over recent years has drawn much attention in the press. In 2014, 22% of the total deal value of U.S. mergers and acquisitions came from p ...

... The significant participation of private firms in general and private equity (hence “private” or “PE”) firms in particular in mergers and acquisitions activities over recent years has drawn much attention in the press. In 2014, 22% of the total deal value of U.S. mergers and acquisitions came from p ...

ppt - AAII

... The return objective is based on achieving personal financial goals such as retirement, education of children, philanthropy, leaving an inheritance, or whatever else the investor might choose ...

... The return objective is based on achieving personal financial goals such as retirement, education of children, philanthropy, leaving an inheritance, or whatever else the investor might choose ...

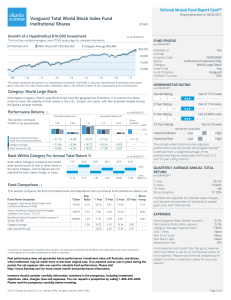

Vanguard Total World Stock Index Fund Institutional Shares

... the funds will fluctuate up to and after the target dates. There is no guarantee the funds will provide adequate income at or through retirement. Fixed income securities are subject to increased loss of principal during periods of rising interest rates. Lower rated securities are subject to greater ...

... the funds will fluctuate up to and after the target dates. There is no guarantee the funds will provide adequate income at or through retirement. Fixed income securities are subject to increased loss of principal during periods of rising interest rates. Lower rated securities are subject to greater ...

Private equity

In finance, private equity is an asset class consisting of equity securities and debt in operating companies that are not publicly traded on a stock exchange.A private equity investment will generally be made by a private equity firm, a venture capital firm or an angel investor. Each of these categories of investor has its own set of goals, preferences and investment strategies; however, all provide working capital to a target company to nurture expansion, new-product development, or restructuring of the company’s operations, management, or ownership.Bloomberg Businessweek has called private equity a rebranding of leveraged-buyout firms after the 1980s. Common investment strategies in private equity include: leveraged buyouts, venture capital, growth capital, distressed investments and mezzanine capital. In a typical leveraged-buyout transaction, a private-equity firm buys majority control of an existing or mature firm. This is distinct from a venture-capital or growth-capital investment, in which the investors (typically venture-capital firms or angel investors) invest in young, growing or emerging companies, and rarely obtain majority control.Private equity is also often grouped into a broader category called private capital, generally used to describe capital supporting any long-term, illiquid investment strategy.