* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Financial Ratios

Survey

Document related concepts

Transcript

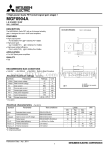

Comparative Analysis between Dodge and Mitsubishi Founding of the Dodge motor car company The Dodge brothers John and Horace started the company in Detroit, Michigan in November 1914. History of Dodge motor car company 1914: John and Horace Dodge brothers create the company Dodge. 1916: Budd all steel bodywork established and used frequently. 1920: Dodge climbed to second place in overall sales in US. 1925: in US. Dodge drop's to fifth place in overall sales 1927: Breakthrough with an all new 3.7 liter six cylinder car exploding into the industry, but low sales dropping the company to seventh place in US car sales. 1928: Dodge company sold to Walter Chrysler for $175,000,000. 1933: Dodge takes fourth place in car sales of that year. 1942: Due to Japan's attack on Pearl Harbor, Dodge passenger car assembly is shut down in favor of war equipment production. 1992: Dodge moved forward with the high performance Viper. 2006: 2007: Dodge Charger launched. DaimlerChrysler agreed with Cerberus Capital Management to sell off its Chrysler Group. Founding of the Mitsubishi motor car company The Mitsubishi group of companies is a Japanese corporate group. Mitsubishi was founded by Iwasaki Yataro. Mitsubishi Motors Corporation found in April 1970. History of Mitsubishi motor car company The Mitsubishi auto division wasn't officially formed until 1970. 1917 Mitsubishi produced Japan's first series production car, the Model A. 1951 The production of Mitsubishi Jeeps began with the Jeep CJ-3B. The company built jeeps until 1998. 1960 The Mitsubishi 500 was introduced. 1962-1963 The Minica Kei Car and the first family Colt car known as the Colt 1000 was produced. 1971 Mitsubishi sold part of their company to the Chrysler Corporation. 1977 Mitsubishi cars were becoming well established throughout Europe. 1980 1,000,000 Mitsubishi cars had been produced in total. 1982 The American market was introduced to the Mitsubishi brand. 1988 Mitsubishi Motor Corporation went public. 1990 Mitsubishi was assigned a new president by the name of Hirokazu Nakamura. Financial Ratios Financial ratios are useful indicators of a firm's performance and financial position, ratios can be used to analyze trends and to compare the firm's financials to those of other firms, ratios must be used with other elements of financial analysis because they do not provide answers by themselves. There are four categories of key financial ratios: Liquidity Ratios. Activity Ratios. Leverage Ratios. Profitability Ratios. 1) Liquidity Ratios Measures a firm ability to meet cash needs as they arise in the future. From the liquidity ratios we will be using current ratio, quick or acid-test ratio, and the average collection ratio. Current Ratio Acid test ratio Average Collection Period 2) Activity Ratio Activity ratios are used to measure the relative efficiency of a firm based on its use of its assets, they are important in determining whether a company's management is doing a good enough job of generating revenues, cash, etc. Fixed Asset Turnover Total Asset Turnover 3) Leverage Ratio Measure the extent of a firm’s financing with debt relative to equity and its ability to cover interest and other fixed charges. From the leverage ratios we will be using debt ratio, debt to equity, and time interest ratio. Debt Ratio Debt to Equity Times Interest Ratio 4) Profitability Ratio Measures the overall performance of a firm and its efficiency in managing assets, liabilities and equity. From the profitability ratios we will be using the operating profit margin, net profit margin, and return on equity. Operating Profit Margin Net Profit Margin Return on Equity Conclusion: 1. From what we have calculated we have found out that: Liquidity rates of both Dodge and Mitsubishi have been improving, yet Mitsubishi is doing slightly better than Dodge 2. acid test ratio for both firms has increased slightly, yet Mitsubishi’s acid test ratio has increased a bit further than what Dodge’s ratio resulting in it becoming less risky. 3. Dodge has shown more improvement over the year, Mitsubishi has a higher rate of total assets, resulting in better-generated results Both companies aren’t doing so well in operating profit yet dodge has got the upper hand in its ratio rate. The return on equity indicates that Dodge has a higher return in equity than Mitsubishi meaning that they have used their equity to generate more profit. Therefore, this analysis of ratios indicates that Mitsubishi is better to invest in since it is performing better than Dodge.