Fidelity Convertible Securities Investment Trust

... that are predictive in nature, that depend upon or refer to future events or conditions, or that include words such as “expects”, “anticipates”, “intends”, “plans”, “believes”, “estimates” and similar forward-looking expressions or negative versions thereof. In addition, any statement that may be ma ...

... that are predictive in nature, that depend upon or refer to future events or conditions, or that include words such as “expects”, “anticipates”, “intends”, “plans”, “believes”, “estimates” and similar forward-looking expressions or negative versions thereof. In addition, any statement that may be ma ...

3354:1-20-07 Investment policy

... FTSE, NIKKEI, DAX) and readily marketable with market capitalization generally exceeding $1 billion. Non-marketable securities may not be purchased or held without prior approval from the Committee. As used herein, “generally exceeding $1 billion” means that greater than 50% of the value of the port ...

... FTSE, NIKKEI, DAX) and readily marketable with market capitalization generally exceeding $1 billion. Non-marketable securities may not be purchased or held without prior approval from the Committee. As used herein, “generally exceeding $1 billion” means that greater than 50% of the value of the port ...

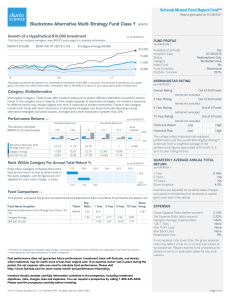

Blackstone Alternative Multi-Strategy Fund Class Y BXMYX

... the funds will fluctuate up to and after the target dates. There is no guarantee the funds will provide adequate income at or through retirement. Fixed income securities are subject to increased loss of principal during periods of rising interest rates. Lower rated securities are subject to greater ...

... the funds will fluctuate up to and after the target dates. There is no guarantee the funds will provide adequate income at or through retirement. Fixed income securities are subject to increased loss of principal during periods of rising interest rates. Lower rated securities are subject to greater ...

Private Equity Fund Fees

... Break-up fees are paid to a fund when a target company of a buyout fund wishes to terminate the purchase agreement with the buyout fund because it desires to accept a higher purchase price from another party. Directors Fees Directors fees are paid by portfolio companies to their directors, including ...

... Break-up fees are paid to a fund when a target company of a buyout fund wishes to terminate the purchase agreement with the buyout fund because it desires to accept a higher purchase price from another party. Directors Fees Directors fees are paid by portfolio companies to their directors, including ...

q. are you the same charles e. olson whose direct testimony

... provide so wide a range as to be entitled to little weight, as is the case in this proceeding, but we are persuaded that to the extent it may be based upon circular reasoning, it should be tested in its end result by the application of other evidence of comparable earnings. In determining just and r ...

... provide so wide a range as to be entitled to little weight, as is the case in this proceeding, but we are persuaded that to the extent it may be based upon circular reasoning, it should be tested in its end result by the application of other evidence of comparable earnings. In determining just and r ...

Investment Fund Sample Portfolios

... peers and benchmarks; competitive expense ratios; clearly articulated investment strategy and buy-sell discipline; style adherence; and organizational depth and stability. ADP selects investment options solely on determining whether or not to make such investment options available to its clients, no ...

... peers and benchmarks; competitive expense ratios; clearly articulated investment strategy and buy-sell discipline; style adherence; and organizational depth and stability. ADP selects investment options solely on determining whether or not to make such investment options available to its clients, no ...

What a Mutual Fund is

... fund, in turn, uses investors' cash to purchase securities, such as stocks and bonds. As mentioned above, the primary assets of a fund are the securities it invests in. When you buy a mutual fund, you're actually buying shares of the fund. The price of a share at any time is called the fund's net as ...

... fund, in turn, uses investors' cash to purchase securities, such as stocks and bonds. As mentioned above, the primary assets of a fund are the securities it invests in. When you buy a mutual fund, you're actually buying shares of the fund. The price of a share at any time is called the fund's net as ...

Financial Statement Analysis Tools

... meets its current obligations. 2. Efficiency ratios: describe how well the firm is using its investment in assets to produce sales. 3. Leverage ratios: reveal the degree to which debt has been used to finance the firm's asset purchases. 4. Coverage ratios: are similar to liquidity ratios in that the ...

... meets its current obligations. 2. Efficiency ratios: describe how well the firm is using its investment in assets to produce sales. 3. Leverage ratios: reveal the degree to which debt has been used to finance the firm's asset purchases. 4. Coverage ratios: are similar to liquidity ratios in that the ...

III.11 Guidelines on Spread Requirements

... having values ascertainable by reference to more than one security (such as index-tracking collective investment schemes, approved pooled investment funds, authorized unit trusts, financial futures and option contracts for indices, and any of the investments included in the Annex with more than one ...

... having values ascertainable by reference to more than one security (such as index-tracking collective investment schemes, approved pooled investment funds, authorized unit trusts, financial futures and option contracts for indices, and any of the investments included in the Annex with more than one ...

Richmond ETF update

... The Central Bank of Ireland has granted authorisation for the Vanguard USD Treasury Bond UCITS ETF to invest up to 100% of net assets in different Transferable Securities and Money Market Instruments issued or guaranteed by any EU Member State, its local authorities, non-EU Member States or public i ...

... The Central Bank of Ireland has granted authorisation for the Vanguard USD Treasury Bond UCITS ETF to invest up to 100% of net assets in different Transferable Securities and Money Market Instruments issued or guaranteed by any EU Member State, its local authorities, non-EU Member States or public i ...

St Andrew`s Retirement Plan

... To advise members that UBS Global Asset Management (Australia) Ltd was making changes to the UBS Property Securities Fund. The changes being made include change of benchmark and investment strategy. To advise members that the responsible entity changed to Equity Trustees replacing Ventura Investment ...

... To advise members that UBS Global Asset Management (Australia) Ltd was making changes to the UBS Property Securities Fund. The changes being made include change of benchmark and investment strategy. To advise members that the responsible entity changed to Equity Trustees replacing Ventura Investment ...

LO 3 Explain the accounting for stock investments.

... An unrealized loss on available-for-sale securities is: a. reported under Other Expenses and Losses in the income statement. b. closed-out at the end of the accounting period. c. reported as a separate component of stockholders' equity. d. deducted from the cost of the investment. ...

... An unrealized loss on available-for-sale securities is: a. reported under Other Expenses and Losses in the income statement. b. closed-out at the end of the accounting period. c. reported as a separate component of stockholders' equity. d. deducted from the cost of the investment. ...

BEPS Action 6 – Discussion Draft on non-CIV examples

... We strongly recommend that a fourth example be included to illustrate how the PPT should be applied to a pooled fund which is managed by a Fund Manager. The example below seeks to illustrate the aforementioned points. We have sought to frame the additional example of a colocated Fund Manager and poo ...

... We strongly recommend that a fourth example be included to illustrate how the PPT should be applied to a pooled fund which is managed by a Fund Manager. The example below seeks to illustrate the aforementioned points. We have sought to frame the additional example of a colocated Fund Manager and poo ...

Small Business Management

... • Investment activities consist of – The purchase or sale of fixed assets (change in gross fixed assets) – The purchase or sale of other long-term assets (changes in goodwill, patents, etc.) ...

... • Investment activities consist of – The purchase or sale of fixed assets (change in gross fixed assets) – The purchase or sale of other long-term assets (changes in goodwill, patents, etc.) ...

The Role of Public Policy in Promoting Investment

... banks and discouraging stock market listings) • However, institutions are a function of history, accident and legal framework Evidence of lack of external financing not sufficient to validate risky and costly major institutional reform of UK corporate finance ...

... banks and discouraging stock market listings) • However, institutions are a function of history, accident and legal framework Evidence of lack of external financing not sufficient to validate risky and costly major institutional reform of UK corporate finance ...

Endowment Investment Policy

... of return on total Endowment Fund assets, with a concern for stability and preservation of principal. 3. When selecting securities, the investment manager(s) or investment advisor(s) without discretion (brokers) are expected to prudently diversify the investments of the Endowment fund consistent wit ...

... of return on total Endowment Fund assets, with a concern for stability and preservation of principal. 3. When selecting securities, the investment manager(s) or investment advisor(s) without discretion (brokers) are expected to prudently diversify the investments of the Endowment fund consistent wit ...

IFSL Brunsdon Investment Funds brochure

... The IFSL BRUNSDON CAUTIOUS GROWTH FUND The Cautious mandate is looking to target a LIBOR + 2.5% return per annum on a rolling three year time horizon, while looking to achieve a positive return on any 12 month basis by seeking to find the optimum balance between risk and return using traditional ass ...

... The IFSL BRUNSDON CAUTIOUS GROWTH FUND The Cautious mandate is looking to target a LIBOR + 2.5% return per annum on a rolling three year time horizon, while looking to achieve a positive return on any 12 month basis by seeking to find the optimum balance between risk and return using traditional ass ...

Optimum Bank Equity Capital and Value at Risk

... financial market (For an excellent discussion of bank management see Greenbaum/Thakor 1995, and for modelling a banking firm see, e.g., Broll/Wahl 2000.). The return on the bank’s portfolio of assets is uncertain. Hence, the banking firm is exposed to market risk and may not be able to meet its debt ...

... financial market (For an excellent discussion of bank management see Greenbaum/Thakor 1995, and for modelling a banking firm see, e.g., Broll/Wahl 2000.). The return on the bank’s portfolio of assets is uncertain. Hence, the banking firm is exposed to market risk and may not be able to meet its debt ...

Main Findings from FOL Review and Foreign Investor

... Definition of the “Deemed Foreign Investors” under the Investment Law (2014) should be revised: The Investment Law, Article 23.1 stipulates that if 51% or more of charter capital of a company is held by foreign investors, such company must satisfy the conditions and carry out investment procedures i ...

... Definition of the “Deemed Foreign Investors” under the Investment Law (2014) should be revised: The Investment Law, Article 23.1 stipulates that if 51% or more of charter capital of a company is held by foreign investors, such company must satisfy the conditions and carry out investment procedures i ...

Quarterly Investment Chartbook

... Sense Where Appropriate If a significant duration mismatch exists between investments and liabilities, LDI may make the most sense. LDI is one of the very few scenarios where we see the need to purchase long-duration bonds based on the current low yield environment. ...

... Sense Where Appropriate If a significant duration mismatch exists between investments and liabilities, LDI may make the most sense. LDI is one of the very few scenarios where we see the need to purchase long-duration bonds based on the current low yield environment. ...

Factsheet - Venture Capital Trusts

... Venture Capital Trusts (VCTs) are investment companies which typically invest in unquoted shares including new shares of privately owned companies, and new shares of companies that are traded on the Alternative Investment Market (AIM) and PLUS Market. VCTs were launched in 1995 as vehicles to encour ...

... Venture Capital Trusts (VCTs) are investment companies which typically invest in unquoted shares including new shares of privately owned companies, and new shares of companies that are traded on the Alternative Investment Market (AIM) and PLUS Market. VCTs were launched in 1995 as vehicles to encour ...

$doc.title

... celebrate but they also pose an opportunity to stop and reflect on the past year and set goals for the future. As American University’s Student Managed Investment Fund celebrates its second birthday it is fitting that we pause to look back on our progress. This year has been an exciting one and has ...

... celebrate but they also pose an opportunity to stop and reflect on the past year and set goals for the future. As American University’s Student Managed Investment Fund celebrates its second birthday it is fitting that we pause to look back on our progress. This year has been an exciting one and has ...

Private Placements - Canadian Structured Finance Law

... > Benefits of public ABS in terms of pricing and market depth appear to be far less compelling in Canada > If Canadian regulations follow the same model, may spur further increase in rated private placements > Recent trends indicate that even in the U.S. there has been a recent movement from public ...

... > Benefits of public ABS in terms of pricing and market depth appear to be far less compelling in Canada > If Canadian regulations follow the same model, may spur further increase in rated private placements > Recent trends indicate that even in the U.S. there has been a recent movement from public ...

PBE Paper II Management Accounting and Finance

... sustainable profit increase for at least 10 years. The company just also sold a major asset and realised $100M in cash which the Directors are planning to return to shareholders. The relevant information is not made known to the market. The recent global financial crisis has caused a significant dro ...

... sustainable profit increase for at least 10 years. The company just also sold a major asset and realised $100M in cash which the Directors are planning to return to shareholders. The relevant information is not made known to the market. The recent global financial crisis has caused a significant dro ...

MainStay Epoch Global Equity Yield SMA

... entails greater risks than those normally associated with domestic markets such as foreign political, currency, economic and market risks. Equity securities' prices may fluctuate in response to specific situations for each company, industry, market conditions and general economic environment. Compan ...

... entails greater risks than those normally associated with domestic markets such as foreign political, currency, economic and market risks. Equity securities' prices may fluctuate in response to specific situations for each company, industry, market conditions and general economic environment. Compan ...

Private equity

In finance, private equity is an asset class consisting of equity securities and debt in operating companies that are not publicly traded on a stock exchange.A private equity investment will generally be made by a private equity firm, a venture capital firm or an angel investor. Each of these categories of investor has its own set of goals, preferences and investment strategies; however, all provide working capital to a target company to nurture expansion, new-product development, or restructuring of the company’s operations, management, or ownership.Bloomberg Businessweek has called private equity a rebranding of leveraged-buyout firms after the 1980s. Common investment strategies in private equity include: leveraged buyouts, venture capital, growth capital, distressed investments and mezzanine capital. In a typical leveraged-buyout transaction, a private-equity firm buys majority control of an existing or mature firm. This is distinct from a venture-capital or growth-capital investment, in which the investors (typically venture-capital firms or angel investors) invest in young, growing or emerging companies, and rarely obtain majority control.Private equity is also often grouped into a broader category called private capital, generally used to describe capital supporting any long-term, illiquid investment strategy.