MS Word - Securities Commission Malaysia

... Does the applicant have similar funds in its stable of funds? Yes ...

... Does the applicant have similar funds in its stable of funds? Yes ...

Strategy Overview Schroder International Equity Alpha Summary

... Important information: Schroders is a global asset management company with $462.1 billion under management as of December 31, 2015. Our clients are major financial institutions including banks and insurance companies, public and private pension funds, endowments and foundations, high net worth indiv ...

... Important information: Schroders is a global asset management company with $462.1 billion under management as of December 31, 2015. Our clients are major financial institutions including banks and insurance companies, public and private pension funds, endowments and foundations, high net worth indiv ...

Technical Prep

... Through Proprietary Trading which is done by a special set of traders who do not interface with clients and through Principal Risk. This risk is undertaken by a trader after he buys or sells a product to a client and does not hedge his total exposure. ...

... Through Proprietary Trading which is done by a special set of traders who do not interface with clients and through Principal Risk. This risk is undertaken by a trader after he buys or sells a product to a client and does not hedge his total exposure. ...

Corporate Finance

... upon the assumption that operating income will grow 3% a year forever, but there are no net cap ex or working capital investments being made after the terminal year. When you confront the analyst, he contends that this is still feasible because the company is becoming more efficient with its existin ...

... upon the assumption that operating income will grow 3% a year forever, but there are no net cap ex or working capital investments being made after the terminal year. When you confront the analyst, he contends that this is still feasible because the company is becoming more efficient with its existin ...

FM11 Ch 09 Instructors Manual

... of capital to make many capital investments. Recently, though, capital costs have been declining, and the company has decided to look seriously at a major expansion program that had been proposed by the marketing department. Assume that you are an assistant to Leigh Jones, the financial vice-preside ...

... of capital to make many capital investments. Recently, though, capital costs have been declining, and the company has decided to look seriously at a major expansion program that had been proposed by the marketing department. Assume that you are an assistant to Leigh Jones, the financial vice-preside ...

Myth 4: Funding reduces public spending on pensions.

... regulation is ineffective, financial markets will fail to channel savings into efficient and productive investment, thus squandering the gains private pensions were intended to engender. Effective government is essential for any type of pension scheme. It is sometimes argued that funded schemes ar ...

... regulation is ineffective, financial markets will fail to channel savings into efficient and productive investment, thus squandering the gains private pensions were intended to engender. Effective government is essential for any type of pension scheme. It is sometimes argued that funded schemes ar ...

Key Investor Information

... the name of which is at the top of this document. The prospectus and periodic reports are prepared for the entire umbrella fund. To protect investors, the assets and liabilities of each compartment are segregated by law from those of other compartments. Switches: Subject to conditions, you may apply ...

... the name of which is at the top of this document. The prospectus and periodic reports are prepared for the entire umbrella fund. To protect investors, the assets and liabilities of each compartment are segregated by law from those of other compartments. Switches: Subject to conditions, you may apply ...

CIMA submission to the HM Treasury and Department of Work and

... manager’s assessment of a company. More explicit activism is usually reserved to encourage desired corporate change when a company is under performing and in crisis. If private influence fails, fund managers can fall back on public mechanisms. Low attendance at AGMs by institutional investors does n ...

... manager’s assessment of a company. More explicit activism is usually reserved to encourage desired corporate change when a company is under performing and in crisis. If private influence fails, fund managers can fall back on public mechanisms. Low attendance at AGMs by institutional investors does n ...

Securities Markets

... Household and institutional investor participation increased through growing confidence in the transparency and robustness of the market design which was put in place over the period 1993-2001. Such participation was also assisted by stock market index returns of 11 per cent in 2004 followed by 36 p ...

... Household and institutional investor participation increased through growing confidence in the transparency and robustness of the market design which was put in place over the period 1993-2001. Such participation was also assisted by stock market index returns of 11 per cent in 2004 followed by 36 p ...

Investment Bond Option B

... Investment Bond is a unit-linked product that allows you to invest a single contribution into a range of different funds. It is intended as a medium to long-term investment, offering the potential to benefit from growth in the stock, bond, property markets and other asset classes and strategies. ...

... Investment Bond is a unit-linked product that allows you to invest a single contribution into a range of different funds. It is intended as a medium to long-term investment, offering the potential to benefit from growth in the stock, bond, property markets and other asset classes and strategies. ...

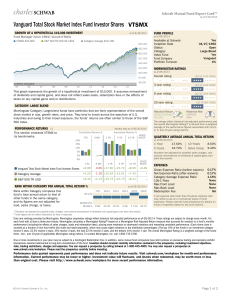

Vanguard Total Stock Market Index Fund Investor Shares

... International Inc. and Standard & Poor's. GICS is a service mark of MSCI and S&P and has been licensed for use by Charles Schwab & Co., Inc. Government bond fund shares are not guaranteed. Their price and investment return will fluctuate with market conditions and interest rates. Investment income f ...

... International Inc. and Standard & Poor's. GICS is a service mark of MSCI and S&P and has been licensed for use by Charles Schwab & Co., Inc. Government bond fund shares are not guaranteed. Their price and investment return will fluctuate with market conditions and interest rates. Investment income f ...

The European Capital Markets Union

... Attract more investors into the markets For capital markets to play the long-term role that policymakers envisage in supporting the European economy, they will need to grow considerably. A fundamental challenge, therefore, in creating a Capital Markets Union, will be increasing the pool of European ...

... Attract more investors into the markets For capital markets to play the long-term role that policymakers envisage in supporting the European economy, they will need to grow considerably. A fundamental challenge, therefore, in creating a Capital Markets Union, will be increasing the pool of European ...

VENTURE CAPITAL, 2002, VOL. 4, No.4, 275-287

... particular geographical region were financed (see below for references). These early studies found that private investors were a significant source of early stage equity financing. Once the existence of such individuals had been established, other approaches were developed, notably by seeking to dis ...

... particular geographical region were financed (see below for references). These early studies found that private investors were a significant source of early stage equity financing. Once the existence of such individuals had been established, other approaches were developed, notably by seeking to dis ...

MANAGING VOLATILITY: A STRATEGIC FRAMEWORK

... Investors need to consider a variety of factors in their risk management plans, based on their type of plan and on other considerations such as their governance model. The governance of a pool of assets is a key factor in the way risk management decisions are made and implemented. If we take a corpo ...

... Investors need to consider a variety of factors in their risk management plans, based on their type of plan and on other considerations such as their governance model. The governance of a pool of assets is a key factor in the way risk management decisions are made and implemented. If we take a corpo ...

PSG Global Equity Feeder Fund Class A

... significantly. Continued threats of disruption (both perceived and real) by online retailers and lower-cost competitors have also driven the prices of US retailers down by 7% at an index level. In addition, while most emerging markets have seen their currencies and stock markets appreciate considera ...

... significantly. Continued threats of disruption (both perceived and real) by online retailers and lower-cost competitors have also driven the prices of US retailers down by 7% at an index level. In addition, while most emerging markets have seen their currencies and stock markets appreciate considera ...

Asian Total Return Bond Fund

... FIL Investment Management (Singapore) Limited [FIMSL] (Co. Reg. No.: 199006300E) is a responsible entity for the fund in Singapore. Prospectus of the fund is available from FIMSL or its distributors upon request. Potential investors should read the prospectus before investing. All views expressed an ...

... FIL Investment Management (Singapore) Limited [FIMSL] (Co. Reg. No.: 199006300E) is a responsible entity for the fund in Singapore. Prospectus of the fund is available from FIMSL or its distributors upon request. Potential investors should read the prospectus before investing. All views expressed an ...

L09 Dividend Policy

... Stock split • Brings about a big decrease in price of the stock to put it in a more favorable trading range – could have a psychological effect on price • Recently Lucent had negative split to raise its price over a $1.00 to avoid being NYSE delisted • Par value is split proportionally but ownership ...

... Stock split • Brings about a big decrease in price of the stock to put it in a more favorable trading range – could have a psychological effect on price • Recently Lucent had negative split to raise its price over a $1.00 to avoid being NYSE delisted • Par value is split proportionally but ownership ...

Session 4 Discussion Session - Agricultural and Food Marketing

... Maputo Development Corridor: Championship and balancing the roles of the public and private sectors Mozambique has been the focus of several spatial development initiatives. The Maputo Development Corridor (MDC) was the original development, starting in 1995. Soderbaum (2001) observes that the MDC’ ...

... Maputo Development Corridor: Championship and balancing the roles of the public and private sectors Mozambique has been the focus of several spatial development initiatives. The Maputo Development Corridor (MDC) was the original development, starting in 1995. Soderbaum (2001) observes that the MDC’ ...

AMENDMENT NO. 1 DATED JULY 21, 2016 TO

... survive the hard times and are likely to lead the rebound of their industries when supply/demand conditions improve. The Bankable Deal strategy takes an in-depth look at the current assets and cash flow of a company to reveal value that is not reflected in the stock’s price. ...

... survive the hard times and are likely to lead the rebound of their industries when supply/demand conditions improve. The Bankable Deal strategy takes an in-depth look at the current assets and cash flow of a company to reveal value that is not reflected in the stock’s price. ...

TIB Powerpoint - CP11/11

... > Some ‘clever stuff’ may be going on : removing market risk and pre-defining returns is challenging ...

... > Some ‘clever stuff’ may be going on : removing market risk and pre-defining returns is challenging ...

Financial Intermediary Leverage and Value-at-Risk

... decides on the total size of its balance sheet - its total assets A - by taking on debt as necessary. The debt financing decision involves both the face value of debt D̄, as well as the market value of debt D. The repurchase price D̄ in the repo contract can be interpreted as the face value of the d ...

... decides on the total size of its balance sheet - its total assets A - by taking on debt as necessary. The debt financing decision involves both the face value of debt D̄, as well as the market value of debt D. The repurchase price D̄ in the repo contract can be interpreted as the face value of the d ...

Download817 KB - Long

... In order to meet this challenge, the Caisse des Dépôts has taken the initiative of launching a major national study by all those involved in the French economy and concerned about the long term – banks, insurance companies, businesses, trade federations, etc. – at a National Conference on LongTerm F ...

... In order to meet this challenge, the Caisse des Dépôts has taken the initiative of launching a major national study by all those involved in the French economy and concerned about the long term – banks, insurance companies, businesses, trade federations, etc. – at a National Conference on LongTerm F ...

Taxes and Bankruptcy Costs

... information about optimal capital structure. The problem is that there are important variables that are not included in the model. As we examine firms in the real world, there seems to be important determinants of capital structure that are not captured by this model. ...

... information about optimal capital structure. The problem is that there are important variables that are not included in the model. As we examine firms in the real world, there seems to be important determinants of capital structure that are not captured by this model. ...

CHAPTER 3 Financial Statement Analysis

... Asset management: is the firm generating good revenue from assets? (Sales is important, at least from your marketing class:) Profitability: Is the firm sufficiently profitable as reflected in PM, ROE, and ROA? Debt management: is the firm using the right mix of debt and equity? Market value: Do inve ...

... Asset management: is the firm generating good revenue from assets? (Sales is important, at least from your marketing class:) Profitability: Is the firm sufficiently profitable as reflected in PM, ROE, and ROA? Debt management: is the firm using the right mix of debt and equity? Market value: Do inve ...

How to Establish an Alternative Investment Fund in

... the AIFM passport under Article 33 of AIFMD to manage the Irish AIF either on a cross-border basis or by establishing a branch in Ireland. 4.3 Non-EU AIFM If it is determined that an entity located outside of the EU will be the AIFM, it will not, at least in the short term, be able to be authorised ...

... the AIFM passport under Article 33 of AIFMD to manage the Irish AIF either on a cross-border basis or by establishing a branch in Ireland. 4.3 Non-EU AIFM If it is determined that an entity located outside of the EU will be the AIFM, it will not, at least in the short term, be able to be authorised ...

Private equity

In finance, private equity is an asset class consisting of equity securities and debt in operating companies that are not publicly traded on a stock exchange.A private equity investment will generally be made by a private equity firm, a venture capital firm or an angel investor. Each of these categories of investor has its own set of goals, preferences and investment strategies; however, all provide working capital to a target company to nurture expansion, new-product development, or restructuring of the company’s operations, management, or ownership.Bloomberg Businessweek has called private equity a rebranding of leveraged-buyout firms after the 1980s. Common investment strategies in private equity include: leveraged buyouts, venture capital, growth capital, distressed investments and mezzanine capital. In a typical leveraged-buyout transaction, a private-equity firm buys majority control of an existing or mature firm. This is distinct from a venture-capital or growth-capital investment, in which the investors (typically venture-capital firms or angel investors) invest in young, growing or emerging companies, and rarely obtain majority control.Private equity is also often grouped into a broader category called private capital, generally used to describe capital supporting any long-term, illiquid investment strategy.