Flyer re x - AMP Capital

... which a prospective investor would consider material, and has been prepared without taking account of any particular person’s objectives, financial situation or needs. Accordingly, the information in this document should not form the basis of any investment decision. A person should, before making a ...

... which a prospective investor would consider material, and has been prepared without taking account of any particular person’s objectives, financial situation or needs. Accordingly, the information in this document should not form the basis of any investment decision. A person should, before making a ...

Long-Term Asset Class Forecasts

... fees. Before fees, we believe that an average private equity fund can outperform large-cap listed equities by perhaps 0.5% over the long run. All else equal, this makes our long-term forecast for private equities reasonably comparable to our projections for small capitalization stocks, but we also c ...

... fees. Before fees, we believe that an average private equity fund can outperform large-cap listed equities by perhaps 0.5% over the long run. All else equal, this makes our long-term forecast for private equities reasonably comparable to our projections for small capitalization stocks, but we also c ...

Cos, HNIs Set to Bypass MF Distributors, Invest Directly from January 1

... These investors will subscribe to ‘direct plans’ which will be cheaper by 50-75 basis points as customers have the flexibility to invest directly without incurring any incidental costs. According to a Sebi decision taken earlier this year, every fund and scheme must have a direct plan for investors ...

... These investors will subscribe to ‘direct plans’ which will be cheaper by 50-75 basis points as customers have the flexibility to invest directly without incurring any incidental costs. According to a Sebi decision taken earlier this year, every fund and scheme must have a direct plan for investors ...

Hedge Fund Directive clashes with Irish regulations If the European

... Directive proposes, therefore, to affect the operations of managers of all nonUCITS funds, irrespective of the legal structure of the fund, its investment strategy, whether it is domiciled inside or outside of the EU or whether it is an open or closed-ended fund. The Explanatory Memorandum concedes ...

... Directive proposes, therefore, to affect the operations of managers of all nonUCITS funds, irrespective of the legal structure of the fund, its investment strategy, whether it is domiciled inside or outside of the EU or whether it is an open or closed-ended fund. The Explanatory Memorandum concedes ...

Investment-Guidelines-First-Draft-Sep-08-2015

... The Board Members of the CAC have delegated the authorization to make day-to-day investment decisions to the President and/or Controller (“Authorized Persons”), subject to the direction from the Board and/or Finance and Investment Committee. Detailed reports of the corporation’s investments will be ...

... The Board Members of the CAC have delegated the authorization to make day-to-day investment decisions to the President and/or Controller (“Authorized Persons”), subject to the direction from the Board and/or Finance and Investment Committee. Detailed reports of the corporation’s investments will be ...

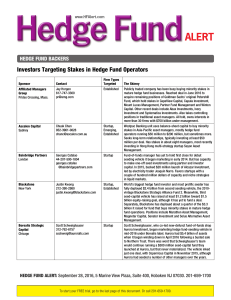

Hedge Fund Backers

... After buying Jefferies in 2013, formed asset-management division that seeks to acquire stakes in new and emerging alternativeinvestment businesses including hedge fund managers and commodity-trading advisors. In 2014, reached deal with former SAC Capital executive Sol Kumin to seed his Folger Hill A ...

... After buying Jefferies in 2013, formed asset-management division that seeks to acquire stakes in new and emerging alternativeinvestment businesses including hedge fund managers and commodity-trading advisors. In 2014, reached deal with former SAC Capital executive Sol Kumin to seed his Folger Hill A ...

New Frontier - listing - Business Plan (00142711

... The Company intends to list 600,000 non-voting, non-redeemable preference shares denominated in ZAR, with a fixed dividend yield of 7%, with an equivalent value in USD of $600,000, on the SEM and 313,000,000 of the same class of preference shares, with a USD value of $313,000,000, to be dual listed ...

... The Company intends to list 600,000 non-voting, non-redeemable preference shares denominated in ZAR, with a fixed dividend yield of 7%, with an equivalent value in USD of $600,000, on the SEM and 313,000,000 of the same class of preference shares, with a USD value of $313,000,000, to be dual listed ...

Mutual Fund Scheme Analysis

... contain strong growth perspective, investors can continue their holdings in the midcap scheme and can stay further at least for a year or so. Investors with high risk appetite and intending to stay for longer can consider accumulating the units of ICICI Pru Discovery scheme. Considering present mark ...

... contain strong growth perspective, investors can continue their holdings in the midcap scheme and can stay further at least for a year or so. Investors with high risk appetite and intending to stay for longer can consider accumulating the units of ICICI Pru Discovery scheme. Considering present mark ...

(Fiduciary) Fund

... financial statements of business enterprises because internal service funds do not issue revenue bonds or receive contributions or deposits from customers, as do enterprise funds ...

... financial statements of business enterprises because internal service funds do not issue revenue bonds or receive contributions or deposits from customers, as do enterprise funds ...

Bendigo Socially Responsible Growth Fund

... Financial performance meets positive social change. As well as access to socially responsible investments across a wide range of asset classes, the Bendigo Socially Responsible Growth Fund: • is certified by the Responsible Investment Association of Australasia • engages Sustainanalytics, a respon ...

... Financial performance meets positive social change. As well as access to socially responsible investments across a wide range of asset classes, the Bendigo Socially Responsible Growth Fund: • is certified by the Responsible Investment Association of Australasia • engages Sustainanalytics, a respon ...

Slide 1

... “…Americans created the phrase ‘to make money.’ No other language or nation had ever used these words before... Americans were the first to understand that wealth has to be created.” Ayn Rand (1905-1982) Russian-American philosopher ...

... “…Americans created the phrase ‘to make money.’ No other language or nation had ever used these words before... Americans were the first to understand that wealth has to be created.” Ayn Rand (1905-1982) Russian-American philosopher ...

The place for listing Alternative Investment Funds

... Hedge Funds Luxembourg is an established European centre for Hedge Funds. Luxembourg Hedge Funds benefit from the know-how of service providers and the flexibility of the Luxembourg regulator. As at 31 December 2010, EUR 71,417 billion of Hedge Funds assets were under administration in Luxembourg an ...

... Hedge Funds Luxembourg is an established European centre for Hedge Funds. Luxembourg Hedge Funds benefit from the know-how of service providers and the flexibility of the Luxembourg regulator. As at 31 December 2010, EUR 71,417 billion of Hedge Funds assets were under administration in Luxembourg an ...

Vilar Gave Select Access to IPOs

... that the offshore account didn't collect extra performance fees common among hedge funds that could give investment managers an incentive to put the most lucrative investments in such accounts. Full Text (959 words) Copyright (c) 2005, Dow Jones & Company Inc. Reproduced with permission of copyright ...

... that the offshore account didn't collect extra performance fees common among hedge funds that could give investment managers an incentive to put the most lucrative investments in such accounts. Full Text (959 words) Copyright (c) 2005, Dow Jones & Company Inc. Reproduced with permission of copyright ...

Download attachment

... severe financial distress, i.e. there is hardly any cash flow from the underlying assets of the Sukuk (the asset-based type). Therefore, extending the maturity of the Sukuk is not an option. To give an example from the conventional financial system, Argentina offered last month 66 per cent haircut o ...

... severe financial distress, i.e. there is hardly any cash flow from the underlying assets of the Sukuk (the asset-based type). Therefore, extending the maturity of the Sukuk is not an option. To give an example from the conventional financial system, Argentina offered last month 66 per cent haircut o ...

The role of hedge funds (II)

... manage to accumulate highly concentrated positions in the energy futures markets without the market knowing it suggests that counterparty-risk management may not be working as well as most regulators would have expected. The incident also shows how the opaqueness of hedge funds can prevent early det ...

... manage to accumulate highly concentrated positions in the energy futures markets without the market knowing it suggests that counterparty-risk management may not be working as well as most regulators would have expected. The incident also shows how the opaqueness of hedge funds can prevent early det ...

12 - Cengage

... statements do not know what the financial statements represent and how to analyze them. Your intermediate accounting textbook, to this point, has focused primarily on various accounting treatments and how they flow into and affect the creation of financial statements. Financial statement analysis ha ...

... statements do not know what the financial statements represent and how to analyze them. Your intermediate accounting textbook, to this point, has focused primarily on various accounting treatments and how they flow into and affect the creation of financial statements. Financial statement analysis ha ...

PCA Faces Suit Linked to CalPERS Bribery Scandal

... Instead, the lawsuit claims former CalPERS CIO Joe Dear, who began his tenure in 2009, allegedly “harbored a deep-seated animus towards Baez.” Baez further claimed the pension was discriminating against him for being Latino. Dear “wanted [Baez] out of Centinela, or at the very least wanted to be see ...

... Instead, the lawsuit claims former CalPERS CIO Joe Dear, who began his tenure in 2009, allegedly “harbored a deep-seated animus towards Baez.” Baez further claimed the pension was discriminating against him for being Latino. Dear “wanted [Baez] out of Centinela, or at the very least wanted to be see ...

THE DETERMINANTS OF CORPORATE CAPITAL STRUCTURE

... is also known as capital structure irrelevance principle. Following on from the pioneering work of Modigliani and Miller (1958), capital structure has aroused intense debate in the financial management arena for the last fifty years. Even though there are other theories that tried to explain the det ...

... is also known as capital structure irrelevance principle. Following on from the pioneering work of Modigliani and Miller (1958), capital structure has aroused intense debate in the financial management arena for the last fifty years. Even though there are other theories that tried to explain the det ...

money market fund

... Invests in investment grade domestic debt securities, taxable and tax-exempt, all US$ denominated; using yield curve, sector selection and security selection ...

... Invests in investment grade domestic debt securities, taxable and tax-exempt, all US$ denominated; using yield curve, sector selection and security selection ...

2017 Q1 Industry Investment Report - Private Equity Growth Capital

... SM Energy (Non-Operated Eagle Ford Assets ...

... SM Energy (Non-Operated Eagle Ford Assets ...

Long-term investment in Europe The origin of the

... On 9 May 2010 the so-called ‘Monti Report’5 was delivered to President Barroso in which the subject of long-term investment and the need for a regulatory framework capable of attracting private capital to finance these investments became central to the debate on the strengthening of the single marke ...

... On 9 May 2010 the so-called ‘Monti Report’5 was delivered to President Barroso in which the subject of long-term investment and the need for a regulatory framework capable of attracting private capital to finance these investments became central to the debate on the strengthening of the single marke ...

BPI Philippine Infrastructure Equity Index Fund

... 1. What is the BPI Philippine Infrastructure Equity Index Fund? The BPI Philippine Infrastructure Equity Index Fund is an index tracker UITF that tracks the performance of the BPI Philippine Infrastructure Equity Index. It buys all the stocks that comprise the BPI Philippine Infrastructure Equity In ...

... 1. What is the BPI Philippine Infrastructure Equity Index Fund? The BPI Philippine Infrastructure Equity Index Fund is an index tracker UITF that tracks the performance of the BPI Philippine Infrastructure Equity Index. It buys all the stocks that comprise the BPI Philippine Infrastructure Equity In ...

direct investment enterprise

... A foreign direct investor is an entity (an institutional unit) that has acquired at least 10% of the voting power of a corporation, or equivalent for an unincorporated enterprise, resident in an economy other than its own. A direct investor could be from any sector of the economy and could be any of ...

... A foreign direct investor is an entity (an institutional unit) that has acquired at least 10% of the voting power of a corporation, or equivalent for an unincorporated enterprise, resident in an economy other than its own. A direct investor could be from any sector of the economy and could be any of ...

The Impact of Post- Financial Crisis Regulations

... positive in order to secure capital inflow in future funds and keep investors satisfied. The fund’s general partner(s), which usually is a legal entity, has full liability for the debts and obligations of the fund, which is usually organized as a LLC or LP. The fund will be managed and controlled by ...

... positive in order to secure capital inflow in future funds and keep investors satisfied. The fund’s general partner(s), which usually is a legal entity, has full liability for the debts and obligations of the fund, which is usually organized as a LLC or LP. The fund will be managed and controlled by ...

Private equity

In finance, private equity is an asset class consisting of equity securities and debt in operating companies that are not publicly traded on a stock exchange.A private equity investment will generally be made by a private equity firm, a venture capital firm or an angel investor. Each of these categories of investor has its own set of goals, preferences and investment strategies; however, all provide working capital to a target company to nurture expansion, new-product development, or restructuring of the company’s operations, management, or ownership.Bloomberg Businessweek has called private equity a rebranding of leveraged-buyout firms after the 1980s. Common investment strategies in private equity include: leveraged buyouts, venture capital, growth capital, distressed investments and mezzanine capital. In a typical leveraged-buyout transaction, a private-equity firm buys majority control of an existing or mature firm. This is distinct from a venture-capital or growth-capital investment, in which the investors (typically venture-capital firms or angel investors) invest in young, growing or emerging companies, and rarely obtain majority control.Private equity is also often grouped into a broader category called private capital, generally used to describe capital supporting any long-term, illiquid investment strategy.