The Capital Structure Puzzle

... their optimal ratios. But there is nothing in the usual static tradeoff stories suggesting that adjustment costs are a first-order concern-in fact, they are rarelymentioned. Invoking them without modelling them is a cop-out. Any cross-sectional test of financing behavior should specify whether firms ...

... their optimal ratios. But there is nothing in the usual static tradeoff stories suggesting that adjustment costs are a first-order concern-in fact, they are rarelymentioned. Invoking them without modelling them is a cop-out. Any cross-sectional test of financing behavior should specify whether firms ...

Opportunities for Individual Investors Green Century Funds: First

... The performance data quoted represents past performance, and past performance is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performan ...

... The performance data quoted represents past performance, and past performance is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performan ...

Recuperation and repair

... boosting the nation’s investment profile and tourism industry, and political and economic outlooks. In Mexico, an improved growth outlook can be tied to outside factors, including the US economy. Meanwhile, China, India and Brazil are among emerging powerhouses with increasing financial resources. I ...

... boosting the nation’s investment profile and tourism industry, and political and economic outlooks. In Mexico, an improved growth outlook can be tied to outside factors, including the US economy. Meanwhile, China, India and Brazil are among emerging powerhouses with increasing financial resources. I ...

bonds plus 400 fund - Insight Investment

... long in breakevens. Our credit exposure was the largest positive contributor. We held a modest long in credit combined with some single name credit default swap positions. Our long in assetbacked securities also continued to perform positively. Sub-investment grade and emerging market exposure was n ...

... long in breakevens. Our credit exposure was the largest positive contributor. We held a modest long in credit combined with some single name credit default swap positions. Our long in assetbacked securities also continued to perform positively. Sub-investment grade and emerging market exposure was n ...

The equity premium

... value of cc required to generate the observed equity premium results in an unacceptably high riskfree rate. The late Fischer Black proposed that ax = 55 would solve the puzzle.10 Indeed, it can be shown that the U.S. experience from 1889 through 1978 reported here can be reconciled with alpha = 48 a ...

... value of cc required to generate the observed equity premium results in an unacceptably high riskfree rate. The late Fischer Black proposed that ax = 55 would solve the puzzle.10 Indeed, it can be shown that the U.S. experience from 1889 through 1978 reported here can be reconciled with alpha = 48 a ...

Moore lcr08 7952932 en

... To acquire general output as input for the production of new capital, investing entrepreneurs sell equity claims to the future returns from the newly produced capital. The crucial feature of the model is that, because the investing entrepreneur is still needed to run the project to produce output an ...

... To acquire general output as input for the production of new capital, investing entrepreneurs sell equity claims to the future returns from the newly produced capital. The crucial feature of the model is that, because the investing entrepreneur is still needed to run the project to produce output an ...

Templeton Developing Markets Trust Fact Sheet

... All MSCI data is provided “as is.” The Fund described herein is not sponsored or endorsed by MSCI. In no event shall MSCI, its affiliates or any MSCI data provider have any liability of any kind in connection with the MSCI data or the Fund described herein. Copying or redistributing the MSCI data is ...

... All MSCI data is provided “as is.” The Fund described herein is not sponsored or endorsed by MSCI. In no event shall MSCI, its affiliates or any MSCI data provider have any liability of any kind in connection with the MSCI data or the Fund described herein. Copying or redistributing the MSCI data is ...

CI LifeCycle Portfolios

... their investment mandates over time. The team favours portfolio managers who excel at security selection and are not afraid to differentiate their portfolios from the benchmark index. ...

... their investment mandates over time. The team favours portfolio managers who excel at security selection and are not afraid to differentiate their portfolios from the benchmark index. ...

Guaranteed Accumulation funds

... The funds are designed to offer smoothed, relatively stable growth and a guaranteed medium-term return, backed by investments in high quality corporate and government bonds. The funds are available in sterling, US dollars and euros and offer capital growth through investments in the global bond mark ...

... The funds are designed to offer smoothed, relatively stable growth and a guaranteed medium-term return, backed by investments in high quality corporate and government bonds. The funds are available in sterling, US dollars and euros and offer capital growth through investments in the global bond mark ...

Monthly Investment Commentary

... hedge-fund strategies was triggered by our concern that stocks and bonds were priced to deliver belowaverage returns and expose investors to above-average risk. In theory, hedge funds could offer an alternative place to hang out, capturing decent returns with less volatility, while waiting for bette ...

... hedge-fund strategies was triggered by our concern that stocks and bonds were priced to deliver belowaverage returns and expose investors to above-average risk. In theory, hedge funds could offer an alternative place to hang out, capturing decent returns with less volatility, while waiting for bette ...

Chapter 15: Intercorporate Investments

... • Similarly, because the single line item on the balance sheet item (investment in joint venture) under the equity method reflects the investors’ share of the net assets of the joint venture, the total net assets of the investor is identical under both methods. • But there can be significant differe ...

... • Similarly, because the single line item on the balance sheet item (investment in joint venture) under the equity method reflects the investors’ share of the net assets of the joint venture, the total net assets of the investor is identical under both methods. • But there can be significant differe ...

Fundamental Analysis Module

... •Capital reserves - gains resulting from an increase in the value of assets and are not freely distributable to the shareholders. ...

... •Capital reserves - gains resulting from an increase in the value of assets and are not freely distributable to the shareholders. ...

A Portfolio Built on Divident Growth - Presentation by Scott Malatesta

... 1. Total return is based on NAV. Returns include reinvestment of dividends and capital gains. Other classes of shares with differing fees and expenses are available. Index performance is for illustrative purposes only. You cannot invest directly in an index.. 2. Source: Lipper Database; Bloomberg. ...

... 1. Total return is based on NAV. Returns include reinvestment of dividends and capital gains. Other classes of shares with differing fees and expenses are available. Index performance is for illustrative purposes only. You cannot invest directly in an index.. 2. Source: Lipper Database; Bloomberg. ...

catalytic first-loss capital - Global Impact Investing Network

... around both the benefits of CFLC and the structuring mechanisms that drive benefits and prevent potential downsides. CFLC can be a powerful tool to catalyze much greater impact investment and, in doing so, create benefits not only for the Recipient but also for the Provider. In particular the Provid ...

... around both the benefits of CFLC and the structuring mechanisms that drive benefits and prevent potential downsides. CFLC can be a powerful tool to catalyze much greater impact investment and, in doing so, create benefits not only for the Recipient but also for the Provider. In particular the Provid ...

socially responsible investing - Sustainable World Financial Advisors

... today. Social research organizations are able to provide much higher quality information than ever before. The better informed investors are, the more responsible their actions tend to be. Availability. Some 201 mutual funds are designed for socially conscious investors.* Socially screened options a ...

... today. Social research organizations are able to provide much higher quality information than ever before. The better informed investors are, the more responsible their actions tend to be. Availability. Some 201 mutual funds are designed for socially conscious investors.* Socially screened options a ...

Investment Style and Process - Qualified Financial Services

... – Primary risk objective: To ensure that the absolute return objective is achieved – Secondary risk objective: To maintain less return volatility than the benchmark ...

... – Primary risk objective: To ensure that the absolute return objective is achieved – Secondary risk objective: To maintain less return volatility than the benchmark ...

Policy Prescription to the Regional Disparities in the Supply

... times higher than their regional counterparts. Commercial funds managed their investee portfolio more intensely. Accordingly, the operating costs of commercial funds were 20% higher than their regional counterparts. However, when expressed as a percentage of funds under management, these costs were ...

... times higher than their regional counterparts. Commercial funds managed their investee portfolio more intensely. Accordingly, the operating costs of commercial funds were 20% higher than their regional counterparts. However, when expressed as a percentage of funds under management, these costs were ...

1 - Member and Committee Information

... slowing economic growth rate and currency devaluation in China, and the “will they, won’t they increase” story of US interest rates. ...

... slowing economic growth rate and currency devaluation in China, and the “will they, won’t they increase” story of US interest rates. ...

Outsourced investment management: what it offers the long

... investors have encountered in the capital markets of recent years. The steep declines of 2008 and early 2009 left many institutional investors with losses of more than 20 percent in their asset pools — a drop that may require many years to recover. As a result, risk management has moved to the foref ...

... investors have encountered in the capital markets of recent years. The steep declines of 2008 and early 2009 left many institutional investors with losses of more than 20 percent in their asset pools — a drop that may require many years to recover. As a result, risk management has moved to the foref ...

Al Beit Al Mali Fund Al-Beit Al Mali Fund

... IMPORTANT NOTE: This document, prepared by Amwal LLC, does not constitute a solicitation, recommendation or offer in relation to any investment product or service. The information and opinions contained herein are based upon sources believed to be reliable and are believed to be fair and not mislead ...

... IMPORTANT NOTE: This document, prepared by Amwal LLC, does not constitute a solicitation, recommendation or offer in relation to any investment product or service. The information and opinions contained herein are based upon sources believed to be reliable and are believed to be fair and not mislead ...

Chapter 5 The Time Value of Money

... produced and sold, costs $200 per year; therefore, the fixed operating costs are $200 per year. The variable cost of producing a gasket is $0.40, and Gearing sells each gasket for $1. For now, let us hold the number of units produced and sold to 1,000 units. What does Gearing’s income statement look ...

... produced and sold, costs $200 per year; therefore, the fixed operating costs are $200 per year. The variable cost of producing a gasket is $0.40, and Gearing sells each gasket for $1. For now, let us hold the number of units produced and sold to 1,000 units. What does Gearing’s income statement look ...

CI RI Policy FINAL

... CI Investments’ portfolio managers and analysts meet with the entities in which they invest on an ongoing basis and often discuss risks and opportunities relating to ESG factors. We engage more specifically with companies on ESG-related issues when those issues have been ...

... CI Investments’ portfolio managers and analysts meet with the entities in which they invest on an ongoing basis and often discuss risks and opportunities relating to ESG factors. We engage more specifically with companies on ESG-related issues when those issues have been ...

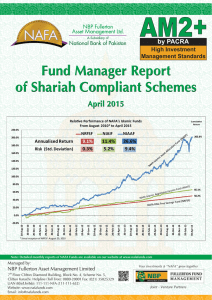

Islamic FMR- April 2015_(Complete)

... Banking, Construction and Materials, and Electricity sectors performed better than the market, while Oil and Gas, General Industrials, and Forestry & Paper sectors lagged behind. Healthy corporate earnings announcements and payouts and sanguine valuations resulted in the strong performance of bankin ...

... Banking, Construction and Materials, and Electricity sectors performed better than the market, while Oil and Gas, General Industrials, and Forestry & Paper sectors lagged behind. Healthy corporate earnings announcements and payouts and sanguine valuations resulted in the strong performance of bankin ...

Private equity

In finance, private equity is an asset class consisting of equity securities and debt in operating companies that are not publicly traded on a stock exchange.A private equity investment will generally be made by a private equity firm, a venture capital firm or an angel investor. Each of these categories of investor has its own set of goals, preferences and investment strategies; however, all provide working capital to a target company to nurture expansion, new-product development, or restructuring of the company’s operations, management, or ownership.Bloomberg Businessweek has called private equity a rebranding of leveraged-buyout firms after the 1980s. Common investment strategies in private equity include: leveraged buyouts, venture capital, growth capital, distressed investments and mezzanine capital. In a typical leveraged-buyout transaction, a private-equity firm buys majority control of an existing or mature firm. This is distinct from a venture-capital or growth-capital investment, in which the investors (typically venture-capital firms or angel investors) invest in young, growing or emerging companies, and rarely obtain majority control.Private equity is also often grouped into a broader category called private capital, generally used to describe capital supporting any long-term, illiquid investment strategy.