Commercial Mortgage_Private RE Debt Strategies_Global.indd

... level of interest rates. To gauge the excess value provided by commercial mortgage investments over bond investments, primary focus should be placed on spread differentials and credit loss expectations. However, it’s interesting to note that the total returns of those two fixed income asset classes ...

... level of interest rates. To gauge the excess value provided by commercial mortgage investments over bond investments, primary focus should be placed on spread differentials and credit loss expectations. However, it’s interesting to note that the total returns of those two fixed income asset classes ...

The UK equity gap

... skills gaps and the need for a more integrated European marketplace. One theory is that development and growth are held back by an ‘equity gap’ at various stages in the firm lifecycle. The UK equity gap can be defined in different ways. While some approach it at a macrolevel, looking at the differen ...

... skills gaps and the need for a more integrated European marketplace. One theory is that development and growth are held back by an ‘equity gap’ at various stages in the firm lifecycle. The UK equity gap can be defined in different ways. While some approach it at a macrolevel, looking at the differen ...

The EBRD

... Structure – we can consider investments as Senior, Subordinated / Mezzanine, - Long-term, and short term Working Capital Finance. We can work alongside domestic and international banks ; Term / Maturity – typically up to 5-8 years for Long-Term Senior Debt to companies – potentially longer for proje ...

... Structure – we can consider investments as Senior, Subordinated / Mezzanine, - Long-term, and short term Working Capital Finance. We can work alongside domestic and international banks ; Term / Maturity – typically up to 5-8 years for Long-Term Senior Debt to companies – potentially longer for proje ...

Shane Oliver - AMP Capital: Liquidity and investment markets

... Shares – potential for multiple expansion …stage three of a bull market ...

... Shares – potential for multiple expansion …stage three of a bull market ...

Corporate financing in Austria in the run-up to capital

... thirds (United Kingdom) or some 60% (Belgium) of companies opted for these legal forms. The legal form of corporation makes a difference when it comes to issuing equity securities, because access to organized capital markets is usually limited to corporations. Even in cases where companies do not n ...

... thirds (United Kingdom) or some 60% (Belgium) of companies opted for these legal forms. The legal form of corporation makes a difference when it comes to issuing equity securities, because access to organized capital markets is usually limited to corporations. Even in cases where companies do not n ...

II. Private Debt - University of Sussex

... It is important to note that here we assume a fixed proportion of the original investment can be recovered from the original investment in the event of default. An alternative assumption could be to assume a recovery of the investment value from the previous period i.e. Si,T-1 in this case. ...

... It is important to note that here we assume a fixed proportion of the original investment can be recovered from the original investment in the event of default. An alternative assumption could be to assume a recovery of the investment value from the previous period i.e. Si,T-1 in this case. ...

Regulation af Debt and Equity

... underlying investments, not only among the parties to those transactions but also among others. The design of these arrangements also may either diminish or increase the total risk posed by uncertain investments to the economy. Because of agency costs, externalities, and competitive pressures, finan ...

... underlying investments, not only among the parties to those transactions but also among others. The design of these arrangements also may either diminish or increase the total risk posed by uncertain investments to the economy. Because of agency costs, externalities, and competitive pressures, finan ...

The Case for Funds of Hedge Funds

... allowing them to take advantage of more diverse opportunity sets than provided by allocations to a small number of single-manager hedge funds. Additionally, they also remove the due diligence burden an investor would otherwise have and help investors to navigate foreign markets more efficiently and ...

... allowing them to take advantage of more diverse opportunity sets than provided by allocations to a small number of single-manager hedge funds. Additionally, they also remove the due diligence burden an investor would otherwise have and help investors to navigate foreign markets more efficiently and ...

Professional Letter

... This fund adds to the Non-U.S. equity offering from Lincoln. The fund focuses mainly on small to mid cap international cap stocks. The other Non-U.S. equity fund, The American Funds EuroPacific Growth Fund, focuses primarily on large international stocks. Adds a socially responsible fund to Lincoln’ ...

... This fund adds to the Non-U.S. equity offering from Lincoln. The fund focuses mainly on small to mid cap international cap stocks. The other Non-U.S. equity fund, The American Funds EuroPacific Growth Fund, focuses primarily on large international stocks. Adds a socially responsible fund to Lincoln’ ...

From Start-up to Scale-up - Centre for Economic Policy Research

... The third question is normative: What is the possible role of government and public policies in supporting the financing of scale-ups? To answer these questions, we divide our analysis into three parts. In the first part, we develop some simple conceptual frameworks for analysing the financing choic ...

... The third question is normative: What is the possible role of government and public policies in supporting the financing of scale-ups? To answer these questions, we divide our analysis into three parts. In the first part, we develop some simple conceptual frameworks for analysing the financing choic ...

MFS MERIDIAN ® FUNDS ― GLOBAL - fund

... The prospectus for Switzerland, the Key Investor Information Documents, the articles of incorporation the annual and semi-annual report, in French, and further information can be obtained free of charge from the representative in Switzerland: Carnegie Fund Services S.A., 11, rue du Général-Dufour, C ...

... The prospectus for Switzerland, the Key Investor Information Documents, the articles of incorporation the annual and semi-annual report, in French, and further information can be obtained free of charge from the representative in Switzerland: Carnegie Fund Services S.A., 11, rue du Général-Dufour, C ...

Dividends, Instructor`s Manual

... true in the real world. The “bird-in-the-hand” theory assumes that investors value a dollar of dividends more highly than a dollar of expected capital gains because the dividend yield component, D1/P0, is less risky than the g component in the total expected return equation rS = D1/P0 + g. The tax p ...

... true in the real world. The “bird-in-the-hand” theory assumes that investors value a dollar of dividends more highly than a dollar of expected capital gains because the dividend yield component, D1/P0, is less risky than the g component in the total expected return equation rS = D1/P0 + g. The tax p ...

Segregated Funds or Other Insurance Investment Products

... recommendations for the resolution of investor complaints arising from the provision of investment products and services to retail investors by its participating investment firms and their licensed representatives; and, Whereas securities regulators, with the exception of the Authorité des marchés f ...

... recommendations for the resolution of investor complaints arising from the provision of investment products and services to retail investors by its participating investment firms and their licensed representatives; and, Whereas securities regulators, with the exception of the Authorité des marchés f ...

CMU Briefing Paper - For Print

... As table 1 shows, 62% of EU households’ financial savings are typically long term: pension funds, life insurance, shares, funds and bonds. In addition, in the EU, financial savings are often not the biggest part of households’ savings: when one takes property assets into account as well, the long te ...

... As table 1 shows, 62% of EU households’ financial savings are typically long term: pension funds, life insurance, shares, funds and bonds. In addition, in the EU, financial savings are often not the biggest part of households’ savings: when one takes property assets into account as well, the long te ...

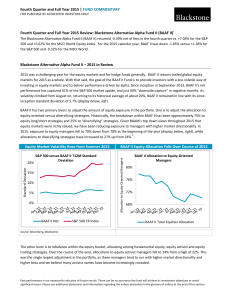

Fourth Quarter and Full Year 2015

... Management L.P., the investment manager of the Fund. Please note that the contents herein are intended for informational purposes only. They are not intended as legal or investment advice nor do they express any legal or industry views of The Blackstone Group L.P. or any of its businesses, includin ...

... Management L.P., the investment manager of the Fund. Please note that the contents herein are intended for informational purposes only. They are not intended as legal or investment advice nor do they express any legal or industry views of The Blackstone Group L.P. or any of its businesses, includin ...

“Direct” and “Indirect” Real Estate Investing

... expertise and skill-set to match what is required for a particular transaction or investment strategy. At the same time as large institutional investors’ use of local partners is eroding the distinction between “direct” and “indirect” investment, these local partners, as a group, are raising real es ...

... expertise and skill-set to match what is required for a particular transaction or investment strategy. At the same time as large institutional investors’ use of local partners is eroding the distinction between “direct” and “indirect” investment, these local partners, as a group, are raising real es ...

Financially distressed firms are more likely to issue equity

... states that in a world with no bankruptcy costs, taxes, agency costs or asymmetric information the firms value is unaffected by the capital structure it possesses. This idea is also called proposition I of Modigliani and Miller. From this point on the studies in the field of corporate finance has cr ...

... states that in a world with no bankruptcy costs, taxes, agency costs or asymmetric information the firms value is unaffected by the capital structure it possesses. This idea is also called proposition I of Modigliani and Miller. From this point on the studies in the field of corporate finance has cr ...

PDF

... returned a total of 21.9 percent over the year ending June 30, 2013. As investors continued to favor quality or high-yielding stocks, three sectors led the gains: Financials, Telecommunications and Health Care. The market was also boosted by three separate cuts to official interest rates, totaling 0 ...

... returned a total of 21.9 percent over the year ending June 30, 2013. As investors continued to favor quality or high-yielding stocks, three sectors led the gains: Financials, Telecommunications and Health Care. The market was also boosted by three separate cuts to official interest rates, totaling 0 ...

US Securities Law Issues in Tender Offers for Foreign Companies

... Tier II exemption would have allowed for payment to be made in accordance with German law and practice and would have made available certain other limited technical relief from Rule 14e-1. However, given that the majority of ProSiebenSat’s voting stock was bene>cially owned by US private equity inve ...

... Tier II exemption would have allowed for payment to be made in accordance with German law and practice and would have made available certain other limited technical relief from Rule 14e-1. However, given that the majority of ProSiebenSat’s voting stock was bene>cially owned by US private equity inve ...

Active Vs. Passive - Jentner Wealth Management

... that are predicted to post above-average returns. Much of what active managers do is attempt to gain insight into the future performance of a company. They may look for a company posting significant sales and profits or one that is touting the launch of a new product. However, while a manager is gat ...

... that are predicted to post above-average returns. Much of what active managers do is attempt to gain insight into the future performance of a company. They may look for a company posting significant sales and profits or one that is touting the launch of a new product. However, while a manager is gat ...

Fund Manager Sector Minimum Investment Fund Size

... The Total Expense Ra�o (TER) is the annualised percentage of the Fund’s average assets under management that has been used to pay the Fund’s actual expenses over the past three years. This percentage of the average Net Asset Value of the por�olio was incurred as charges, levies and fees related to t ...

... The Total Expense Ra�o (TER) is the annualised percentage of the Fund’s average assets under management that has been used to pay the Fund’s actual expenses over the past three years. This percentage of the average Net Asset Value of the por�olio was incurred as charges, levies and fees related to t ...

Weighted Average Cost of Capital (WACC)

... FESCO Distributes and supplies electricity to about 2.81 million customers within its territory with a population over 26.5 million under a Distribution License granted by National Electric Power Regulatory Authority (NEPRA) pursuant to the Regulation of Generation, Transmission and Distribution of ...

... FESCO Distributes and supplies electricity to about 2.81 million customers within its territory with a population over 26.5 million under a Distribution License granted by National Electric Power Regulatory Authority (NEPRA) pursuant to the Regulation of Generation, Transmission and Distribution of ...

Why yield matters for investors – particularly now

... in the US and elsewhere all leading to concerns house prices might fall sharply going forward. This has all seen the investor obsession with speculation and growth fade substantially in relation to both shares and property. Secondly, a high starting point yield for an investment provides some securi ...

... in the US and elsewhere all leading to concerns house prices might fall sharply going forward. This has all seen the investor obsession with speculation and growth fade substantially in relation to both shares and property. Secondly, a high starting point yield for an investment provides some securi ...

Capital Structure of Listed Company in China: Based on Real... Industry

... chances are different in between equity financing and debt financing for the listed companies. For a long time, there exists a seller’s market and profit effect that matter in China’s stock market. Debt financing is resisted after the disordered capital collecting and financing environment in the ea ...

... chances are different in between equity financing and debt financing for the listed companies. For a long time, there exists a seller’s market and profit effect that matter in China’s stock market. Debt financing is resisted after the disordered capital collecting and financing environment in the ea ...

Illiquid assets - Select Investment Partners

... and redemptions (and switches), the valuation of illiquid assets is crucial, especially if they are a large component of the portfolio. After all, at any point, you may have investors that are taking a very short-term view (redeeming or switching within days) versus those that intend to hold for man ...

... and redemptions (and switches), the valuation of illiquid assets is crucial, especially if they are a large component of the portfolio. After all, at any point, you may have investors that are taking a very short-term view (redeeming or switching within days) versus those that intend to hold for man ...

Private equity

In finance, private equity is an asset class consisting of equity securities and debt in operating companies that are not publicly traded on a stock exchange.A private equity investment will generally be made by a private equity firm, a venture capital firm or an angel investor. Each of these categories of investor has its own set of goals, preferences and investment strategies; however, all provide working capital to a target company to nurture expansion, new-product development, or restructuring of the company’s operations, management, or ownership.Bloomberg Businessweek has called private equity a rebranding of leveraged-buyout firms after the 1980s. Common investment strategies in private equity include: leveraged buyouts, venture capital, growth capital, distressed investments and mezzanine capital. In a typical leveraged-buyout transaction, a private-equity firm buys majority control of an existing or mature firm. This is distinct from a venture-capital or growth-capital investment, in which the investors (typically venture-capital firms or angel investors) invest in young, growing or emerging companies, and rarely obtain majority control.Private equity is also often grouped into a broader category called private capital, generally used to describe capital supporting any long-term, illiquid investment strategy.