* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Active Vs. Passive - Jentner Wealth Management

Financial economics wikipedia , lookup

Land banking wikipedia , lookup

Beta (finance) wikipedia , lookup

Private equity wikipedia , lookup

Private equity in the 2000s wikipedia , lookup

Stock trader wikipedia , lookup

Interbank lending market wikipedia , lookup

Syndicated loan wikipedia , lookup

Private equity secondary market wikipedia , lookup

Proactive investing with a global focus

The

ACTIVE

VS. PASSIVE

Investing

Debate

1-866-JENTNER • www.jentner.com

3677 Embassy Parkway, Akron, Ohio 44333

Executive Summary

Those in search of the best investment strategy want to

know if active or passive investing yields greater returns.

Though it is a commonly debated topic among investment

professionals and investors alike, the data show that passive

management yields better results over the long term.

Active managers underperform their

benchmarks:

• Of all actively managed U.S. funds, 81% of

equity funds and 92% of fixed-income funds failed

to outperform their benchmarks over the fifteen

years ending December 31, 2014.

• Of all of the equity mutual funds that existed

from 1965 to 1984, not a single fund generated

a statistically significant positive return compared

to its benchmark.

•Of the domestic equity funds that were in the

top quartile for performance as of March 2011,

only 0.28% managed to stay in that top quartile

after four years.

•After five years ending in 2014, nearly one

quarter of all domestic equity funds and global

and international equity funds could not even

manage to survive.

Past performance is not an indication of

future performance:

• Of the top 20 domestic equity mutual funds from

1996 to 2005, during the five subsequent years,

two ranked in the zero and second percentiles,

with the average ranking in the 66th percentile.

• Of all Canadian equity funds, only 45%

survived after five years, ending in 2009.

Positive returns are based on luck not skill:

• Each participant in the market has a 25%

chance of being in the top quartile and a

25% chance of being in the bottom

quartile.

• While a particular manager may have been in the

top quartile in the past, they have the same

chance as every other participant of being in the

top quartile in the future.

• If beating the market was due to skill and not

luck, more managers would be beating the

market.

Market predictions are ineffective:

• It is improbable that there is one person

who will systematically and consistently have

more information than the seven billion others to

correctly make market predictions.

• Missing the 25 best trading days since 1970

would leave an investor with 76% less than

if they had remained invested in the market.

Short-term investing can miss major gains:

• Since 1926, the bull markets in the S&P 500

Index have lasted nearly twice as long as bear

markets and have delivered price gains that are

disproportionately greater than the bear market

losses. Those gains have been nearly three times

greater than the losses.

• Reactions to short-term market movements can

compromise long-term performance. Despite

large average intra-year drops of 14.2%, annual

returns were positive in 27 of 35 years.

Active management is costly:

• Active managers typically have higher

management fees to cover the cost of research

and higher transaction costs because of the high

turnover of securities.

• The majority of the earnings from actively

managed mutual funds were made by the same

securities as those held by the passive benchmark

index. The remaining actively managed funds

earned limited returns while generating significant

costs.

• Actively managed domestic funds were more than

five times more expensive than passive mutual

funds, according to a study from 2012.

The evidence is clear that active management is a risky

investment option that often fails investors. Instead,

passive management involves no forecasting, stock

picking, or market timing. Passive managers seek to

capture the returns of the market either by using index

funds to represent an asset class or institutional assetclass funds to hold essentially all of the securities that

comprise an asset class. By developing an intelligent plan

with a long-range strategy and rebalancing the portfolio

to align with the original target allocation, passive

managers strive to keep the portfolio on track to pursue

long-term goals.

1

Which Yields Better Results — Active Or Passive Investing?

The investing public is consistently bombarded with

conflicting messages on how to best manage its money.

The media and many investment advisors constantly make

market predictions and name the hottest stocks. But is this

the best way? The debate remains: Does implementing an

active or a passive approach yield more lucrative

long-term returns?

Today, societal pressure calls us to act now, do not

just stand by, make things happen. These catch phrases

penetrate our everyday decision-making process, which

is precisely why it can be so hard for investors to resist

interacting with their money on a daily basis. We can feel

handicapped when we are not making changes and may

believe we are missing out on today’s hot stocks. However,

an investor who knows the advantages of a passively

engineered portfolio and can ignore societal pressures

is more likely to succeed over the long term.

Generally, active or tactical management is defined as the

art of selecting specific securities and attempting to time

the market. Active managers strive to recognize and invest

in companies they believe will post above-average returns.

They may look for companies with notable sales and

profits or innovative new products or one that is poised

to make a comeback after a time of poor performance.

All active managers, no matter what they look for in an

investment, purchase securities based on a forecast of

future events. Active management essentially relies on

predicting the future.

Passive management, however, involves constructing a

well-diversified portfolio that represents broad-based

financial markets without attempting to identify specific

securities that one hopes will be superior performers.

This approach can be applied to any asset class, including

large-cap, small-cap, value, growth, foreign, or domestic

stocks. Unlike active managers, passive managers do not

attempt to distinguish superior performing investments.

For instance, a passive manager would not decide if Apple

is preferable to Microsoft but instead would construct

a portfolio that represents a variety of asset classes,

using either index funds to represent an asset class or

institutional asset-class funds to acquire essentially all of

the securities that comprise an asset class. In either case,

the resulting passively constructed portfolio would hold

hundreds or even thousands of stocks. Furthermore, a

passive manager who uses institutional asset-class funds

would actually construct a portfolio that holds nearly

every publicly traded company. Whether index or assetclass funds are used, the goal is to create a portfolio that

closely resembles the performance and, in turn, captures

the returns of the global markets. Well-recognized market

benchmarks are used to compare returns for each

particular asset class, such as the Standard & Poor’s 500

Composite Index for large U.S. companies or the Morgan

Stanley EAFE Index for large foreign companies.

2

Playing The Game Of Active Management — The Evidence

Many successful wealth managers and market experts

agree that using an active management strategy is a lot

like a game of Monopoly, winning and losing money each

time you play. At the end of the game, you put the surviving

pieces of your investment portfolio back in the box, having

risked too much, wishing for a different outcome. Here, we

will explore the evidence that defends those who prefer

investors do anything with their money but play games.

Active Managers Underperform Their Benchmarks

There is a plethora of data that show active management

underperforming the market over the long term. Active

managers’ attempts to time the market often leave

investors disappointed. Their claims are riddled with

marketing spin and often only show good returns

over a relatively short period of time.

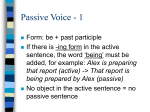

When active managers are put to the test, the data show

that most active managers typically fail to add value.

And over longer periods of time, they are more likely to

underperform their respective benchmark. Figures 1 and 2

offers recent evidence of this, showing the percentage of

U.S. equity and fixed-income funds that survived and were

able to outperform their benchmark after periods of three,

five, ten, and fifteen years, ending December 31, 2014.

The size and complexity of the mutual-fund landscape

masks the fact that many funds disappear each year, often

as a result of poor investment performance. After three

Figure 1: Percent of U.S. Equity Funds That

Survived and Outperformed Their Benchmarks

after 3, 5, 10, and 15 Years, as of Dec. 31, 2014

Data provided by Dimensional Fund Advisors

years, 85% of equity funds and 88% of fixed-income funds

survived. Over time, fund survival rates dropped sharply.

After fifteen years, only 42% of equity funds and 41% of

fixed-income funds managed to survive.

Investors likely have a more ambitious goal than to

just pick a fund that survives. Most people are on a

hunt for funds that will provide superior performance.

Unfortunately for many investors, after three years, 69% of

equity and fixed-income funds failed to outperform their

benchmarks. Fund performance results are even worse

over longer horizons. After fifteen years, 81% of equity

funds and 92% of fixed-income funds failed to outperform

their benchmarks. Over both short and long time horizons

and for both equities and bonds, the deck is stacked against

the investor seeking outperformance.

One of the most comprehensive studies of actively

managed funds was conducted by Elton, Gruber, Hlavka,

and Das. In this study, they examined all equity mutual

funds that existed from 1965 to 1984. These funds were

compared to the set of index funds that most closely

reflected the actual funds’ investment choices, including

large stocks, small stocks, and fixed income. Over the

20-year period, the equity funds underperformed the

index funds by 159 basis points on average each year.

Furthermore, not a single fund generated a statistically

significant positive earning.

Figure 2: Percent of Fixed-Income Funds That

Survived and Outperformed Their Benchmarks

after 3, 5, 10, and 15 Years, as of Dec. 31, 2014

Data provided by Dimensional Fund Advisors

3

In another study, Mark Carhart reviewed the performance

of 1,892 funds that existed from 1961 to 1993. His

extensive analysis showed that the actively managed funds

underperformed their benchmark by an average

of 1.8% per year.

Looking at more recent data, Standard & Poor’s publishes

a quarterly analysis called Standard & Poor’s Index Versus

Active that shows the performance of active funds versus

their benchmarks. The analysis consistently suggests

that while active managers may achieve short periods

of outperformance, over longer periods of three to five

years, they rarely outperform their benchmarks. Whether

Standard & Poor’s analyzed funds in broad categories,

such as all large-cap U.S. stock funds, or looked at smaller

segments, such as New York municipal-bond funds, it found

that the vast majority of funds consistently lagged behind

their asset-class’s benchmark index, the very index they

were attempting to beat.

Furthermore, Figures 3 and 4 show the failure of actively

managed equity and fixed-income funds over the last

five years, as of June 30, 2015. During this time, the vast

majority of funds failed to outperform their respective

market benchmark. In most equity asset classes, more than

70% of active managers failed, as seen in Figure 3.

Additionally, Figure 4 presents the number of fixed-income

funds that failed during the same five years. Seven out of

ten fixed-income funds failed to beat their benchmark over

the last five years in the majority of fixed-income asset

classes.

Figure 3: Percentage of Equity Funds That Failed to Beat the Index During Prior Five Years, as

of June 30, 2015

Data provided by S&P Dow Jones Indices, LLC

Figure 4: Percentage of Fixed-Income Funds That Failed to Beat the Index During Prior Five

Years, as of June 30, 2015

Data provided by S&P Dow Jones Indices, LLC

4

Additionally, The Wall Street Journal asked Morningstar to

evaluate the performance of active managers during the

economic slowdown of 2008. During this time, active

funds fell behind their benchmarks in six of the nine

major categories. Morningstar also discovered that active

managers performed worse during this recession than

in previous recessions. While many active managers claim

they have the knowledge and foresight to time the market

to curb losses for their clients, this study suggests that

active managers often fail to avoid a market downturn.

Relying on their claims and assurances can lead to

false hopes.

Over and over again, these facts and figures show that

active investment managers are failing to beat the market

and are being outperformed by the benchmarks they are

striving to beat. While there are sporadic periods of aboveaverage results, 50 years of historical data convey that the

efforts of active managers to beat the market result in

underperformance, and the only consistent performer in

any asset class is the market itself. While active managers

continually assert that they can outperform, in reality, they

are not beating the market, but, rather, the market is beating

them. Instead of attempting to beat the market

and most likely failing, investors should strive to capture the

returns of the market by employing a passively engineered

strategy.

Past Performance Is Not an Indication of

Future Performance

Furthermore, a recent Standard & Poor’s Index Versus

Active U.S. Scorecard looked at the performance of equity

funds over the five-year period ending in 2014. During

this time, 24% of both domestic equity funds and global

and international equity funds did not survive. If nearly a

quarter of equity funds did not survive these five years,

how many are likely to survive 10, 20 or even 50 years?

Many investment managers boast of their past results

in an effort to gain future clients, showing great returns

from a previous time period. While a manager may have

performed well in the past, it is unlikely that he or she will

continue to earn those great returns in the future. History

shows that past performance is not an indication of future

performance, and this year’s winners may be next year’s

biggest losers. Figure 5 shows the performance of the

top 25% of domestic equity funds over five consecutive

twelve-month periods. Out of the 703 domestic equity

funds that were in the top quartile for performance as

of March 2011, only 4.69% managed to stay in that top

quartile after two years. And after four years, only 0.28%

were still in the top quartile. It is important to note that

none of the large-, mid-, or small-cap funds managed to

stay in the top quartile after four years. While managers

may flaunt their past performance, it is no indication of

future performance, and history shows their futures will

not likely be nearly as bright.

Often times, when managers boast of their performance,

they remove those dead funds from calculations, skewing

the results in their favor. Brad Steiman, director and head

of Canadian Financial Advisor Services, said that making

claims based on only the small sample of surviving funds

“would be like attending a World War II fighter pilot

convention and concluding that being a World War II

fighter pilot results in longevity because everyone at the

convention was over 80 years old.” Those funds that did

not survive must also be accounted for, just like the fighter

pilots. Data are often twisted in the manager’s favor, and

the whole picture is rarely presented. Legendary investor

Bernard Baruch said, “Only liars manage to always be out

during bad times and in during good times.”

Figure 5: Performance Persistence of Domestic Equity Funds Over Five Consecutive

Twelve-Month Periods

Mutual Fund Category

Fund Count

at Start

(March 2011)

March 2012

March 2013

March 2014

March 2015

All Domestic Funds

703

30.87

4.69

1

0.28

Large-Cap Funds

269

30.86

3.72

0

0

Mid-Cap Funds

101

28.71

0

0

0

Small-Cap Funds

148

30.41

6.08

1.35

0

Multi-Cap Funds

185

32.43

7.57

2.7

1.08

Percentage Remaining in Top Quartile

Data provided by S&P Dow Jones Indices, LLC

5

Positive Returns Are Based on

Luck Not Skill

While there is a plethora of investment research, there

is not one major published study that effectively proves

that managers beat the markets more than one would

expect by chance. For the millions of participants in the

market, each has a 25% chance of being in the top quartile,

as well as a 25% chance of being in the bottom quartile.

While a particular manager may have been in the top

quartile in the past, that manager has the same chance as

every other participant of being in the top quartile in the

future, regardless of his or her past performance. Future

performance is independent of prior experience.

If beating the market was due to skill and not luck, more

managers would be outperforming the market. But the

data show that the number of managers beating the

market is equal to the number who would do so purely by

chance. Because past winners may have just been lucky, it

is nearly impossible to pinpoint a manager who will beat

the market in the future. William Bernstein wrote in The

Intelligent Asset Allocator, “There are two kinds of investors,

be they large or small: Those who don’t know where the

{

market is headed, and those who don’t know that they

don’t know. Then again, there is a third type of investor—

the investment professional, who indeed knows that he

or she doesn’t know, but whose livelihood depends upon

appearing to know.” In the end, you only have one option:

to invest with an investment professional who does not

know where the market is headed. So pick a manager

who does not pretend to know where it is going. Passive

managers admit they do not know what the market

will do and, therefore, avoid market predictions. Instead,

their strategy is engineered to capture the returns of the

market, not gamble on investments they hope will do well.

“There are two kinds of investors, be they large or

small: Those who don’t know where the market is

headed, and those who don’t know that they don’t

know. Then again, there is a third type of investor—

the investment professional, who indeed knows

that he or she doesn’t know, but whose livelihood

depends upon appearing to know.”

}

-William Bernstein,The Intelligent Asset Allocator

6

Market Predictions Are Ineffective

The basis of active management is investing in companies

that are predicted to post above-average returns. Much

of what active managers do is attempt to gain insight into

the future performance of a company. They may look for

a company posting significant sales and profits or one that

is touting the launch of a new product. However, while a

manager is gathering this information, there are thousands

of other individuals, analysts, and investment advisors who

are also collecting this information. The information they

are basing their predictions on is already reflected in the

price of the stock because all of the other investors have

this information too and are investing with it in mind.

For example, if Apple announces that it will be launching

the next great device, which will completely alter

electronic communication, the price of the stock will

quickly increase because there are many investors buying

it, hoping that the stock price will continue to rise when

the product is launched. The market instantly digests the

information and reflects it in stock prices. Therefore,

there is no advantage to endlessly seeking information

on individual companies as it is unlikely that there is one

person who will systematically and consistently have more

information than seven billion others.

Market timing, the foundation of active management, may

seem to offer a seductive prospect, with an active manager

boasting of his or her ability to use market predictions to

capture only the best-performing days and avoid the worst.

But Figure 6 tells the other side of that story. Large gains

often come in quick, unpredictable surges. A manager who

incorrectly predicts events may leave the market at the

wrong time, pulling out before a large surge. By missing

only a small fraction of days, especially the best days, a

market timer’s portfolio can be destroyed.

For example, since 1970, if an investor missed any of the

best trading days, his or her annualized compound returns

would be significantly less than those of the S&P 500 Index.

If an active manager incorrectly predicted and missed

those 25 best days, he or she would have 76% less than if

the active manager had stayed in. Attempting to forecast

which days or weeks will yield good or bad returns is a

guessing game that usually proves costly for investors.

Figure 6: Performance of the S&P 500 When Its Best Days Have Been Missed, From January

1970 Through August 2014

Data provided by S&P Dow Jones Indices, LLC

7

Short-Term Investing Can Miss Major Gains

Active managers often try to time the market to get

out before a bear market, a time of decline, strikes. A

bear market is identified in hindsight when the market

experiences a negative daily return followed by a

cumulative loss of at least 20%. The bear market ends at

its low point, the day of the greatest negative cumulative

return, before the reversal.

Since 1926, the bull markets in the S&P 500 Index

have lasted nearly twice as long as bear markets and,

more importantly, have delivered price gains that are

disproportionately greater than the bear-market losses.

Those gains have been nearly three times greater than

the losses. For those passive managers who stayed in the

market the whole time, the losses of the bear markets

were negated by the much greater gains. However, when

an active manager attempts to time the market and gets

out at the wrong time, which happens often, it can be

devastating to the manager’s portfolio because he or she

may miss the monumental gains. When an investor stays in

the market over the long term, he or she is able to endure

the downturns because the upturns have historically offset

them. Moreover, the passive manager reaps all of the gains

of the bull markets, which active managers may be missing.

Secondly, bull markets may have short-term dips, and the

bear markets may have short-term advances. Figure 7

illustrates the lowest point of the stock market during

each calendar year, as shown by the dot, compared to

the market’s return for the full year, as shown by the bar.

History shows that though the market dips each year,

it is clear that the market is capable of recovering from

intra-year drops and finishing the year in positive territory.

However, it is nearly impossible to determine when the

market is in a sustained downturn, hence the difficulty of

accurately predicting and timing market cycles.

As seen in Figure 7, despite average intra-year drops of

14.2%, annual returns were positive in 27 of 35 years. Thus,

it is crucial to maintain a disciplined investment approach

that views market events and trends from a long-term

perspective. Investors who react to short-term market

movements risk making poorly timed decisions that

compromise long-term performance.

Figure 7: S&P 500 Intra-Year Declines versus Calendar-Year Returns,

from 1980 through July 2015

40%

30%

20%

10%

0%

-10%

-20%

-30%

-40%

-50%

-60%

1980

1985

1990

1995

2000

2005

2010

2015

Data provided by J.P. Morgan Asset Management

8

Active Management Is Costly

Active managers regularly buy and sell securities in their

clients’ portfolios, attempting to select the investments

they believe will perform best. With each buy or sell

transaction, there is a cost. Comparisons of the cost

of active and passive management indicate that active

management is the most expensive investment approach.

Active managers typically have higher management fees

to cover the cost of research and higher transaction

costs because of the high turnover of securities from

attempting to beat the market. As well, active investment

management’s higher security turnover can also increase

an investor’s tax burden if the investment turnover results

in short-term capital gains, instead of long-term capital

gains, which are taxed at lower rates.

Additionally, Figures 8 and 9 display the expense ratio

for domestic and international mutual funds. This study

was conducted using mutual fund expense ratios as of

August 21, 2012 and asset weighting based on net assets

as of July 31, 2012. The average expense ratios for active

funds were more than 50% greater than passive funds.

When the weighted average was calculated, the actively

managed domestic funds were more than five times more

expensive than the passive funds, and the actively managed

international funds were more than three times more

expensive than the passive funds.

Figure 8: Domestic Mutual Fund Expense

Ratios

The cost of an actively managed portfolio varies greatly

and is often masked to clients. Because the total cost is a

combination of management fees, transaction fees, the cost

of cash, the market impact cost, and taxes, clients of active

investment managers often do not know how much they

are truly paying.

In fact, most actively managed mutual funds actually hold

many of the same securities as those held by their passive

benchmark. It is those securities that have been found

to earn the majority of the mutual funds’ return. But

that is only half the story. Measuring the True Cost of Active

Management by Mutual Funds by Ross M. Miller goes on

to show that the majority of the costs of mutual funds is

generated by the securities that are actively managed and

are not commonly held by the benchmark index. Miller

found that, at the end of 2004, the average expense ratio

for the actively managed portion of actively managed

large-cap equity mutual funds tracked by Morningstar was

7%, more than six times their published expense ratio of

1.15%. This means that 7% of any gains obtained through

active management would automatically be offset to cover

expenses. In other words, any enhanced portfolio returns

earned as a result of active management must overcome a

7% hurdle before any actual investment gains are realized.

So the bulk of the earnings were made by the same

securities as those held by the passive benchmark index,

and the remaining actively managed funds generated the

high costs.

Figure 9: International Mutual Fund

Expense Ratios

Data provided by Morningstar

9

{

“After costs, the return on the average actively

managed dollar will be less than the return on the

average passively managed dollar for any time

period.”

- William F. Sharpe, 1990 Nobel Laureate

More cost does not equal greater returns, however.

Research shows that managers who charge extraordinarily

high fees and have extremely high turnover are more likely

to persistently underperform the market, net of fees and

expenses. Are those odds you would like to play?

On the other hand, passive managers recognize and

avoid the excessive cost and poor performance of active

investment management. Knowing the impact of trading

costs on returns and the low probability for success with

stock picking and market timing, passive managers offer

a less costly alternative. Primarily because of their lowcost structure, passively managed investments typically

outperform actively managed funds over the long term.

}

Active Management Is a Losing Game

Active management, while it may sound alluring, is riddled

with flaws. As the data show, active managers consistently

fail to outperform the very benchmark they are attempting

to beat because it is very difficult to regularly predict the

market correctly. Active management is also expensive, at

times costing clients more than five times what a passively

managed fund would. Identifying a manager who will

perform well in the future is nearly impossible because

past performance does not dictate future performance,

and beating the market appears to be based on luck more

than skill. The data strongly suggest that active management

fails to deliver its promise of superior

returns time and again.

As a columnist for The Wall Street Journal, Jonathan

Clements penned this warning, “Ignore market timers,

Wall Street strategists, technical analysts, and bozo

journalists who make market predictions ... Admit to

your therapist that you can’t beat the market. Investors

would also benefit by remembering this simple phrase:

Trading is hazardous to your wealth.”

10

Playing It Safe With Passive Management — The Evidence

Fortunately for investors, active management is not the

only option. Instead of playing the game, the passive

investor decides it is better to avoid the game and the

endless options. Many successful wealth management firms,

investment writers, and, of course, the wealthy employ

a passively engineered investment strategy. Let’s look at

what makes passive management the prudent choice when

selecting a long-term investment strategy.

Passive Management Is Not Inactive

While passive management may sound sedentary, it is

only passive with respect to actions that research

suggests do not add value, such as market timing. In

reality, passive management is actually quite active and

does so to the benefit of its clients. Passive managers

systematically construct portfolios to balance risk and

returns while executing these strategies patiently and

efficiently. This disciplined asset-class approach inherently

involves no forecasting, stock picking, or market timing.

Passively engineered investment management is based on

prudent guidelines, and its benefits can be reaped by those

who choose to work with a passive investment manager

who implements it.

The foundations of passively engineered investment

management are asset-class investing and remaining

invested through the inevitable ups and downs of market

cycles. Asset-class investing can be accomplished by using

index funds to represent an asset class or by selecting

institutional asset-class funds, which invest in virtually every

security that comprises an asset class. Using historical

data, passive managers can form reasonable estimates

of the overall volatility for a given asset class and can

approximate how closely its performance correlates

with the performance of other asset classes. Through

combinations of asset classes, asset allocations are created.

Each allocation has unique estimated risk and expected

return characteristics. Each client can find an overall

allocation that best matches his or her risk and return

tolerances. Finally, the asset allocation can be implemented

precisely by investing in those asset classes. The resulting

portfolio is easy to explain and understand, verifiable, and

highly defendable.

Passive Management Is Not a Buy-and-Hold

Approach

It is a common misconception that passive management

is a buy-and-hold strategy, which believes that in the long

term, markets produce a good rate of return despite

periods of volatility or decline. While passive managers

do believe in the futility of attempting to outperform the

markets, systematic rebalancing of portfolios without

market predictions is crucial to proper implementation of

the passive approach.

Over time, some assets will appreciate in value while

others decline. This causes a portfolio’s allocation to skew,

changing the level of risk and return. Eventually, it will

drift far enough away from the original allocation that the

original objectives are no longer being met. Because the

original portfolio was aligned with the investment goals

and risk tolerance, its integrity should be preserved. The

solution is rebalancing, reducing assets that have risen in

value and purchasing assets that have dropped in value.

While selling assets that are performing well and buying

those that are underperforming may be counterintuitive,

one must remember that positive past performance may

not continue, and there is no reliable way to predict

future returns.

Through rebalancing, the portfolio will return to its

original target allocation, putting the portfolio back on

track to pursue long-term goals. It is prudent to return to

the original asset allocation, as it reflects the desired risk

and return preferences. It also enables an investor to buy

low and sell high without making any market predictions.

By using structure, not recent performance, to make

investment decisions, rebalancing realigns the portfolio

to these priorities. Furthermore, a properly structured

portfolio provides a basis for making adjustments when

one’s overall financial situation or goals change. Without a

quantifiable plan, adjustments are a guessing game.

11

Figure 10: Annualized Long-Term Returns of

Equities and Active Managers, Since 1984

S&P 500 Outperforms Active Managers

The Quantitative Analysis of Investor Behavior compiles

yearly data comparing the performance of the S&P 500

to that of the average investor, who typically employs an

active investment strategy. The S&P 500 column in Figure

10 represents a passively managed portfolio. Over the last

thirteen years, the average investor has underperformed

the S&P 500 by an average of more than 7.5%. While

investors often base investment decisions on their market

predictions and gut feelings, they do this under the guise

of sound judgment and analytical reasoning. But in the end,

they fail to outperform a passive investment strategy, as

seen in Figure 11.

Year

S&P 500

Average

Equity Fund

Investor

Difference

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

17.90%

18.01%

16.29%

14.51%

12.22%

12.98%

13.20%

11.90%

11.80%

11.81%

8.35%

8.20%

9.14%

7.81%

8.21%

4.22%

9.85%

7.25%

7.23%

5.32%

4.17%

2.57%

3.51%

3.75%

3.90%

4.30%

4.48%

1.87%

3.17%

3.83%

3.49%

4.25%

5.02%

5.19%

-10.65%

-10.78%

-10.97%

-10.34%

-9.65%

-9.47%

-9.50%

-8%

-7.50%

-7.33%

-6.48%

-5.03%

-5.31%

-4.32%

-3.96%

-4.20%

4.66%

Data provided by Dalbar, Inc.

Figure 11: S&P 500 Versus Average Equity Fund Investor Returns

20%

18%

16%

14%

12%

10%

8%

6%

4%

2%

0%

1998

1999

2000 2001 2002 2003 2004 2005 2006 2007 2008

S&P 500

2009 2010 2011 2012 2013 2014

Average Equity Fund Investor

Data provided by Dalbar, Inc.

12

Concentrated Portfolios Are Hazardous

Some active managers encourage concentrating a portfolio

to hold a small number of different securities that they

believe will fare well. For example, a concentrated portfolio

might be one that holds a limited number of stocks,

one where an individual stock comprises a meaningful

percentage of the total portfolio, one that invests heavily

in only a few economic regions, or one that has most of its

holdings in one or a few asset classes. Regardless of which

type of concentration is used, a concentrated portfolio can

be hazardous to an investor’s wealth.

A concentrated portfolio is like a giant redwood tree

towering high above a forest of saplings. When a storm

rolls in, which tree is most likely to be struck by lightning?

As portfolios become more and more concentrated in a

small number of investments, asset classes, or economic

regions, they increase their risk of devastation if they

are struck.

But not only are storms inevitable, they are frequent. Many

investors are shocked by the frequency at which lightning

strikes occur. A study was conducted in 2011 regarding

the percentage of individual companies in the S&P 1500

that underperformed the market. Over the thirteen years

in the study, 39% of the 1500 companies underperformed

the index by more than 15%, as shown in Figure 12. That

is nearly a two-in-five chance that an individual investment

gets struck. When the strike occurs on an investment that

makes up a significant portion of your portfolio, the results

can be catastrophic. Not only can a strike occur on an

individual investment, it can also occur on an asset class or

on an economic region.

While lightning strikes are also likely to occur in a passive

broadly diversified portfolio, this type of portfolio is

constructed to withstand the hit. Diversification can help

eliminate unsystematic risk in a portfolio. In essence, with

a diversified portfolio, you are likely to lose only a few

small saplings, not the giant redwood, when lightning

strikes. Broad diversification can provide investors peace

of mind when weathering a financial storm and can help

them overcome the impulse to run for shelter at exactly

the wrong time.

Figure 12: Percentage of S&P 1500

Companies Underperforming

by 15% or More

Time Period

Percentage

2010

18%

2009

31%

2008

30%

2007

58%

2006

34%

2005

42%

2004

33%

2003

34%

2002

31%

2001

32%

2000

45%

1999

45%

1998

71%

Average

39%

Data provided by Dimensional Fund Advisors

13

Passive Management Outperforms Active Management

Investors are presented with a fundamental choice

when choosing with whom and how to invest their life

savings. But research suggests that passive management

yields better returns, as passive managers consistently

outperform active managers over the long term. Passive

managers construct portfolios that capture the returns of

the market, while active managers attempt to predict the

future using market timing to beat the market. But in the

end, most active managers fail, with more than 80% of all

actively managed funds failing to outperform the market

over a fifteen-year period. And over the last thirteen years,

active investors have underperformed their benchmark

by an average of more than 7.5%. Not only are active

managers failing, they are failing greatly. Moreover, because

future performance is independent of past performance,

it is nearly impossible to identify in advance a manager

who is likely to perform well. Though active managers may

boast, their chances at succeeding over the long term are

small.

The foundation of active management, market timing, is

overcome with drawbacks. Market timing often proves

ineffective as active managers can miss the best trading

days when they incorrectly predict where the market is

headed. If a manager missed only 25 of the market’s best

days, the manager’s returns would have decreased by

75%.Yet, missing even only one day can be hazardous to

a portfolio’s return. Instead, passive managers choose to

remain invested through market cycles to reap the gains

of the best days to effectively weather the downturns.

Market timing and active management also cost their

clients more. From increased management fees to cover

endless research to mounting transaction costs for trading

securities, actively managed domestic funds are more than

five times more expensive than passive funds.

Passive management fundamentally involves no forecasting,

stock picking, or market timing. Instead, passive managers

seek to capture the returns of the market. This can be

accomplished either by using index funds to represent

an asset class or institutional asset-class funds to hold

essentially all of the securities that comprise an asset class.

By investing in a combination of asset classes, a passive

manager can estimate the risk and expected return of the

total portfolio and can find an overall allocation that best

matches the preferences of the client. Passive managers

use structure, not recent performance, to make investment

decisions. By developing an intelligent plan with a longrange strategy and rebalancing the portfolio to align with

the original target allocation, passive managers strive to

keep the portfolio on track to pursue long-term goals.

Jentner Wealth Management is a nationally

recognized wealth-management firm based

in Akron, Ohio. By providing fee-only

comprehensive financial planning, globally

diversified investing, and fiduciary advice,

Jentner seeks to preserve the financial

legacy of clients in Northeast Ohio and

across the United States. Founded in 1984,

Jentner Wealth Management provides

both financial planning and investment

management to individuals, families

and trusts. Jentner Global Management

is a specialized division that provides

institutions with investment portfolio

management services, including portfolios

customized specifically for endowments

and foundations. Jentner’s proven, lowcost passively-engineered investment

strategy invests broadly in more than

14,000 companies on six continents, seeking

to provide steadiness in good times and

challenging times to earn meaningful

returns over the long term. For more

information, please visit www.jentner.com

or call 1-866-JENTNER.

© 2015 Jentner Wealth Management

14