Public Capital: Measurement Issues and Policy Implications Matilde

... They developed a proposal to expand NA boundaries to include a selected group of intangible assets. They develop a new model, including (some) intangibles as investment, instead of following the NA practice of treating them as intermediate consumption goods and services. Following their propos ...

... They developed a proposal to expand NA boundaries to include a selected group of intangible assets. They develop a new model, including (some) intangibles as investment, instead of following the NA practice of treating them as intermediate consumption goods and services. Following their propos ...

Common Errors in DCF Models

... The cost of capital is an estimate of the rate of return an investor demands to hold an asset or, said differently, an investor’s opportunity cost. As such, the cost of capital is the proper rate for discounting future cash flows to a present value. Most companies finance their operations largely th ...

... The cost of capital is an estimate of the rate of return an investor demands to hold an asset or, said differently, an investor’s opportunity cost. As such, the cost of capital is the proper rate for discounting future cash flows to a present value. Most companies finance their operations largely th ...

NBER WORKING PAPER SERIES UNINSURED IDIOSYNCRATIC INVESTMENT RISK AND AGGREGATE SAVING George-Marios Angeletos

... Huggett, 1993, 1997; Krusell and Smith, 1998) by examining the macroeconomic impact of idiosyncratic investment risks. These risks are shown to have very different steady-state and business-cycle implications than labor-income risks. In this respect, the paper complements my work in Angeletos and Cal ...

... Huggett, 1993, 1997; Krusell and Smith, 1998) by examining the macroeconomic impact of idiosyncratic investment risks. These risks are shown to have very different steady-state and business-cycle implications than labor-income risks. In this respect, the paper complements my work in Angeletos and Cal ...

JPMorgan Large Cap Growth Fund

... Source: Compustat, FactSet, Standard & Poor’s, J.P. Morgan Asset Management, (Top right) Federal Reserve, S&P 500 individual company 10k filings, S&P Index Alert; as of 6/30/17. Shown for illustrative purposes only. Past performance is no guarantee of future results. EPS levels are based on operatin ...

... Source: Compustat, FactSet, Standard & Poor’s, J.P. Morgan Asset Management, (Top right) Federal Reserve, S&P 500 individual company 10k filings, S&P Index Alert; as of 6/30/17. Shown for illustrative purposes only. Past performance is no guarantee of future results. EPS levels are based on operatin ...

- Franklin Templeton Investments

... What many investors at the outset of 2017 thought was supposed to be the year of the bear market in bonds has thus far turned out to be just the opposite. The decline in longer-term yields was largely a tailwind for corporate fixed income securities, which ended the period in positive territory desp ...

... What many investors at the outset of 2017 thought was supposed to be the year of the bear market in bonds has thus far turned out to be just the opposite. The decline in longer-term yields was largely a tailwind for corporate fixed income securities, which ended the period in positive territory desp ...

Community Capital Management

... performance. Past performance does not guarantee future results.The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performanc ...

... performance. Past performance does not guarantee future results.The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performanc ...

AS 13 - CAalley.com

... with the value of a category of related current investments and not with each individual investment, and accordingly the investments may be carried at the lower of cost and fair value computed categorywise (i.e. equity shares, preference shares, convertible debentures, etc.). However, the more prude ...

... with the value of a category of related current investments and not with each individual investment, and accordingly the investments may be carried at the lower of cost and fair value computed categorywise (i.e. equity shares, preference shares, convertible debentures, etc.). However, the more prude ...

PDF article file - Krungsri Asset Management

... ETF (master fund) iShares Core S&P 500 ETF (master fund), which focuses to invest in stocks that are included in the S&P 500 Index. The master fund`s objective is to provide investment results that, before expenses, correspond to the price and yield of the S&P 500 Index. KF-HJPINDX allocates at leas ...

... ETF (master fund) iShares Core S&P 500 ETF (master fund), which focuses to invest in stocks that are included in the S&P 500 Index. The master fund`s objective is to provide investment results that, before expenses, correspond to the price and yield of the S&P 500 Index. KF-HJPINDX allocates at leas ...

Samuele Murtinu

... • Difficulty in collecting owed money Fire sales of assets • Firms forced to sell assets quickly to raise cash (i.e., acceptance of a lower price; airlines: -15/40% in the selling price of aircrafts) • Subsidiaries ...

... • Difficulty in collecting owed money Fire sales of assets • Firms forced to sell assets quickly to raise cash (i.e., acceptance of a lower price; airlines: -15/40% in the selling price of aircrafts) • Subsidiaries ...

officers - Maine Estate Planning Council

... investments are expected to account for a quarter of all revenue earned by financial service firms from high-net worth clients. Bartley Parker of MainePERS will define alternative investments, discuss some common types of alternative investments available to all investors, highlight the growth and u ...

... investments are expected to account for a quarter of all revenue earned by financial service firms from high-net worth clients. Bartley Parker of MainePERS will define alternative investments, discuss some common types of alternative investments available to all investors, highlight the growth and u ...

High Yield Bond Fund

... Bond values fluctuate in response to the financial condition of individual issuers, general market and economic conditions, and changes in interest rates. Changes in market conditions and government policies may lead to periods of heightened volatility in the bond market and reduced liquidity for ce ...

... Bond values fluctuate in response to the financial condition of individual issuers, general market and economic conditions, and changes in interest rates. Changes in market conditions and government policies may lead to periods of heightened volatility in the bond market and reduced liquidity for ce ...

Investment Strategies and Alternative Investments in Insurance and

... WHO IS AIMCO? • A high performing investment manager that finds the best opportunities from around the world, and delivers results. One of Canada’s largest and most diversified institutional investment managers with more than $84 billion of assets under management • A crown corporation responsible ...

... WHO IS AIMCO? • A high performing investment manager that finds the best opportunities from around the world, and delivers results. One of Canada’s largest and most diversified institutional investment managers with more than $84 billion of assets under management • A crown corporation responsible ...

Chapter 11

... Novo’s proactive strategy to internationalize their own cost of capital. What are the preconditions that would be necessary to succeed in such a proactive strategy? The Novo experience has been described in hopes that it can be a model for other firms wishing to escape from segmented and illiquid ho ...

... Novo’s proactive strategy to internationalize their own cost of capital. What are the preconditions that would be necessary to succeed in such a proactive strategy? The Novo experience has been described in hopes that it can be a model for other firms wishing to escape from segmented and illiquid ho ...

North Americans go bargain hunting in UK listed sector

... In the FTSE 250, which is more dominated by domestic investors, North Americans have also been buyers of property companies. In 2016, there were only two months when the top 20 North American investors were net sellers. Recently, in October and November, they have become particularly active investo ...

... In the FTSE 250, which is more dominated by domestic investors, North Americans have also been buyers of property companies. In 2016, there were only two months when the top 20 North American investors were net sellers. Recently, in October and November, they have become particularly active investo ...

Large Cap Growth Factsheet

... in the second half of the year, the Federal Reserve will end the zero interest rate policy (the ZIRP) that has been in effect since the end of 2007. The increase will be of a large magnitude (moving up from zero will look dramatic on a percentage basis) but will probably only go to .5%. At that poin ...

... in the second half of the year, the Federal Reserve will end the zero interest rate policy (the ZIRP) that has been in effect since the end of 2007. The increase will be of a large magnitude (moving up from zero will look dramatic on a percentage basis) but will probably only go to .5%. At that poin ...

Accessing Finance: A Guide for Food and Drink Companies

... sales invoice. For example, a company may be lent 70% of all of its sales invoices and therefore it will be entitled to draw down under that arrangement £70 every time it raises a sales invoice for £100. The benefit of Invoice Finance is that the company is able to obtain a chunk of its sales values ...

... sales invoice. For example, a company may be lent 70% of all of its sales invoices and therefore it will be entitled to draw down under that arrangement £70 every time it raises a sales invoice for £100. The benefit of Invoice Finance is that the company is able to obtain a chunk of its sales values ...

Asset Management Fees and the Growth of Finance

... one. Modern technology has fully automated such tasks as dividend collection, tax reporting, and client statements. To be sure, an active investment manager of a small company (so-called “small-cap”) fund may find that somewhat more effort will be required than for the management of large-cap funds. ...

... one. Modern technology has fully automated such tasks as dividend collection, tax reporting, and client statements. To be sure, an active investment manager of a small company (so-called “small-cap”) fund may find that somewhat more effort will be required than for the management of large-cap funds. ...

Aberdeen UK Blue Chip Fund

... Important information The CPF Board currently pays a legislated minimum annual interest rate of 2.5% on the Ordinary Account and a guaranteed minimum annual rate of 4.0% on the Special Account. The CPF interest rate is based on the 12-month fixed deposit and month-end savings rates of the major local ...

... Important information The CPF Board currently pays a legislated minimum annual interest rate of 2.5% on the Ordinary Account and a guaranteed minimum annual rate of 4.0% on the Special Account. The CPF interest rate is based on the 12-month fixed deposit and month-end savings rates of the major local ...

Our Beliefs About Investing

... Diversification is analogous simply to the age-old adage, “Don’t put all your eggs in one basket.” Naïve investors often practice diversification by selecting more than one financial advisor, and naïve financial advisors often practice diversification through product proliferation. At its core, dive ...

... Diversification is analogous simply to the age-old adage, “Don’t put all your eggs in one basket.” Naïve investors often practice diversification by selecting more than one financial advisor, and naïve financial advisors often practice diversification through product proliferation. At its core, dive ...

Cash Flow Capital Preservation Moderate Growth Wealth Building

... Through a balancing process of the potential risk return trade-off, the portfolio objectives can be achieved. All investment strategies used to achieve the objectives must focus on these two important portfolio elements. “Risk & Return.” ...

... Through a balancing process of the potential risk return trade-off, the portfolio objectives can be achieved. All investment strategies used to achieve the objectives must focus on these two important portfolio elements. “Risk & Return.” ...

Lower Middle Market Direct Lending

... $12 per year, has already been paid to the lender. Additional upside can deliver up to earning 1.8x its initial investment when receiving various upside features or participating in the equity returns. Direct lenders benefit from equity investors and the private equity industry putting multiples of ...

... $12 per year, has already been paid to the lender. Additional upside can deliver up to earning 1.8x its initial investment when receiving various upside features or participating in the equity returns. Direct lenders benefit from equity investors and the private equity industry putting multiples of ...

Tom Gores - Palace of Auburn Hills

... are reflected in the success of Platinum Equity, the investment firm he founded in 1995. Under his strategic direction, Platinum Equity has grown into a multibillion-dollar investment firm with a diverse, global portfolio of operating companies in a wide range of industries including automotive, tec ...

... are reflected in the success of Platinum Equity, the investment firm he founded in 1995. Under his strategic direction, Platinum Equity has grown into a multibillion-dollar investment firm with a diverse, global portfolio of operating companies in a wide range of industries including automotive, tec ...

chapter 11 part 2 savings class notes

... When you start saving for retirement you first need to decide the type of retirement account you want to use for your savings. Once the money is in an account you may purchase investments with that money. Common types of retirement accounts are Roth IRA’s, Traditional IRA’s, and 401k’s. These aren’t ...

... When you start saving for retirement you first need to decide the type of retirement account you want to use for your savings. Once the money is in an account you may purchase investments with that money. Common types of retirement accounts are Roth IRA’s, Traditional IRA’s, and 401k’s. These aren’t ...

Capital Markets Review

... “We usually think of ‘technology’ as just gadgets and gizmos, but it’s simply the continuous progression of doing things better. Fire was technology. The wheel was technology. The steam engine and the assembly line were definitely technology. This is the next stage of that evolution, which is why it ...

... “We usually think of ‘technology’ as just gadgets and gizmos, but it’s simply the continuous progression of doing things better. Fire was technology. The wheel was technology. The steam engine and the assembly line were definitely technology. This is the next stage of that evolution, which is why it ...

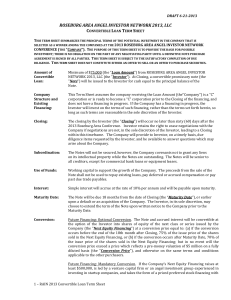

RAIN-2013-Term

... accrued interest will automatically convert into shares issued in the Next Equity Financing upon its initial closing at the Conversion Price (at discounted price defined above) and otherwise on the same terms and conditions applicable to the other purchasers in such Qualified Equity Financing. Optio ...

... accrued interest will automatically convert into shares issued in the Next Equity Financing upon its initial closing at the Conversion Price (at discounted price defined above) and otherwise on the same terms and conditions applicable to the other purchasers in such Qualified Equity Financing. Optio ...

Private equity

In finance, private equity is an asset class consisting of equity securities and debt in operating companies that are not publicly traded on a stock exchange.A private equity investment will generally be made by a private equity firm, a venture capital firm or an angel investor. Each of these categories of investor has its own set of goals, preferences and investment strategies; however, all provide working capital to a target company to nurture expansion, new-product development, or restructuring of the company’s operations, management, or ownership.Bloomberg Businessweek has called private equity a rebranding of leveraged-buyout firms after the 1980s. Common investment strategies in private equity include: leveraged buyouts, venture capital, growth capital, distressed investments and mezzanine capital. In a typical leveraged-buyout transaction, a private-equity firm buys majority control of an existing or mature firm. This is distinct from a venture-capital or growth-capital investment, in which the investors (typically venture-capital firms or angel investors) invest in young, growing or emerging companies, and rarely obtain majority control.Private equity is also often grouped into a broader category called private capital, generally used to describe capital supporting any long-term, illiquid investment strategy.