Fact Sheet: The Morningstar Equity Style Box™

... The Morningstar Equity Style BoxTM was introduced in 1992 to help investors and advisors determine the investment style of a fund. The Style Box is a nine-square grid that classifies equities by size along the vertical axis and by value and growth characteristics along the horizontal axis. Different ...

... The Morningstar Equity Style BoxTM was introduced in 1992 to help investors and advisors determine the investment style of a fund. The Style Box is a nine-square grid that classifies equities by size along the vertical axis and by value and growth characteristics along the horizontal axis. Different ...

Financial Accounting and Accounting Standards

... LO 2 Journal entries for Parent using complete equity method. ...

... LO 2 Journal entries for Parent using complete equity method. ...

Table of Contents - Maryland Public Service Commission

... that makes the net present value of an investment zero ...

... that makes the net present value of an investment zero ...

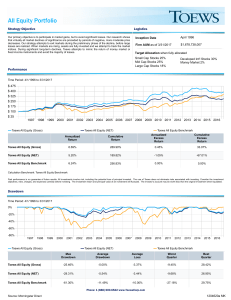

All Equity Portfolio

... Past performance is no guarantee of future results. All investments involve risk, including the potential loss of principal invested. The use of Toews does not eliminate risks associated with investing. Consider the investment objectives, risks, charges, and expenses carefully before investing. The ...

... Past performance is no guarantee of future results. All investments involve risk, including the potential loss of principal invested. The use of Toews does not eliminate risks associated with investing. Consider the investment objectives, risks, charges, and expenses carefully before investing. The ...

How to foster investments in long-term assets such as

... requirement to match their liabilities to long term assets. For instance, pension funds start collecting contributions when individuals enter the workforce and pay benefits with the assets accumulated thirty to forty years later. Life insurers also clearly belong to this category of natural long-ter ...

... requirement to match their liabilities to long term assets. For instance, pension funds start collecting contributions when individuals enter the workforce and pay benefits with the assets accumulated thirty to forty years later. Life insurers also clearly belong to this category of natural long-ter ...

PSF Conservative Balanced Portfolio

... "AA-", but greater or equal to "BBB-"; and high are those with a weighted-average credit quality of "AA-" or higher. When classifying a bond portfolio, Morningstar first maps the NRSRO credit ratings of the underlying holdings to their respective default rates (as determined by Morningstar's analysi ...

... "AA-", but greater or equal to "BBB-"; and high are those with a weighted-average credit quality of "AA-" or higher. When classifying a bond portfolio, Morningstar first maps the NRSRO credit ratings of the underlying holdings to their respective default rates (as determined by Morningstar's analysi ...

Balance Sheet Ratios and Analysis for Cooperatives

... It is also called the WORKING CAPITAL RATIO. Higher ratios indicate a greater ability to pay debts. However, too high a ratio may indicate poor asset management. Formula: Total Current Assets / Total Current Liabilities Quick Ratio: Popularly called the ACID TEST RATIO, indicates the extent to which ...

... It is also called the WORKING CAPITAL RATIO. Higher ratios indicate a greater ability to pay debts. However, too high a ratio may indicate poor asset management. Formula: Total Current Assets / Total Current Liabilities Quick Ratio: Popularly called the ACID TEST RATIO, indicates the extent to which ...

Determinant of Return on Assets and Return on Equity and Its

... comparative advantage in financial term and every individual either sole proprietor or Financial Manager of a Giant Corporation want to know precise actions that can be taken that will lead to higher profitability and return? They also contributed that one can get valuable insights to return even wi ...

... comparative advantage in financial term and every individual either sole proprietor or Financial Manager of a Giant Corporation want to know precise actions that can be taken that will lead to higher profitability and return? They also contributed that one can get valuable insights to return even wi ...

Guaranteed Capital Fund

... Linked Pension or if the regular cash withdrawals amounts are larger than the declared bonus. However, if you invest your Stratus Investment Linked Pension in the Guaranteed Capital Fund, your net investment will be increased by the declared bonuses and decreased by your pension payments. Therefore ...

... Linked Pension or if the regular cash withdrawals amounts are larger than the declared bonus. However, if you invest your Stratus Investment Linked Pension in the Guaranteed Capital Fund, your net investment will be increased by the declared bonuses and decreased by your pension payments. Therefore ...

PRIVATE EQUITY FOR THE COMMON MAN

... event.3 Wiley (2013) shows that the most common form of liquidity event is acquisition by another UL-REIT (typically from the same Sponsor). Other options include exchange-listing, individual asset sales in the private real estate market and bankruptcy. Marketing of equity interests occurs as follow ...

... event.3 Wiley (2013) shows that the most common form of liquidity event is acquisition by another UL-REIT (typically from the same Sponsor). Other options include exchange-listing, individual asset sales in the private real estate market and bankruptcy. Marketing of equity interests occurs as follow ...

Session 3-Project Development under PPP

... PPP: What is it? • It is about creating, nurturing and sustaining an effective relationship between the Government and the private sector • Achieving improved value for money by utilising the innovative capabilities and skills to deliver performance improvements and efficiency savings. ...

... PPP: What is it? • It is about creating, nurturing and sustaining an effective relationship between the Government and the private sector • Achieving improved value for money by utilising the innovative capabilities and skills to deliver performance improvements and efficiency savings. ...

Slide 1

... • Indian demand for metals expected to remain robust on the back of strong demand drivers such as infrastructure and autos • Non ferrous metal prices have seen a revival as restocking of inventory in anticipation of demand pick up • Pressure on steel prices appears to have eased due to rise of steel ...

... • Indian demand for metals expected to remain robust on the back of strong demand drivers such as infrastructure and autos • Non ferrous metal prices have seen a revival as restocking of inventory in anticipation of demand pick up • Pressure on steel prices appears to have eased due to rise of steel ...

Capital Structure of Private Pharmaceutical Companies in Russia

... Hypotheses on capital structure of private pharmaceutical companies in Russia are based on the review of recent studies. Hypotheses are as follows: H1 : The larger the size of the firm the higher the total debt/ total assets ratio. Generally, large firms are more financially stable and have better ...

... Hypotheses on capital structure of private pharmaceutical companies in Russia are based on the review of recent studies. Hypotheses are as follows: H1 : The larger the size of the firm the higher the total debt/ total assets ratio. Generally, large firms are more financially stable and have better ...

cost of capital

... Based upon NPV, we would accept Project C. But if Project C were riskfree, then by accepting it, we would reduce the risk of the company overall. If the risk of the company is reduced, then the company’s cost of capital should fall. Thus, while it looks like we would be losing money by accepting Pro ...

... Based upon NPV, we would accept Project C. But if Project C were riskfree, then by accepting it, we would reduce the risk of the company overall. If the risk of the company is reduced, then the company’s cost of capital should fall. Thus, while it looks like we would be losing money by accepting Pro ...

Investment Strategy 2005.06

... appropriate in determining its counterparty limits. Investments with institutions that do not have a credit rating e.g. many smaller building societies or investments for periods over one year would be classed as non specified investments. However it is important to stress that both the specified an ...

... appropriate in determining its counterparty limits. Investments with institutions that do not have a credit rating e.g. many smaller building societies or investments for periods over one year would be classed as non specified investments. However it is important to stress that both the specified an ...

OLD MUTUAL FIXED INTEREST TRACKER LIFE FUND

... Old Mutual is a Licensed Financial Services Provider. The information and opinions contained in this guide are made in good faith and are based on sources believed to be reliable, but no representation or warranty, express or implied, is made as to their accuracy, completeness or correctness. The op ...

... Old Mutual is a Licensed Financial Services Provider. The information and opinions contained in this guide are made in good faith and are based on sources believed to be reliable, but no representation or warranty, express or implied, is made as to their accuracy, completeness or correctness. The op ...

IFM7 Chapter 27

... What impact does the inability to issue common stock have on a not-for-profit business’s capital structure and capital budgeting decisions? The lack of access to equity capital effectively imposes capital rationing, so the firm may not be able to undertake all projects deemed worthwhile. In order ...

... What impact does the inability to issue common stock have on a not-for-profit business’s capital structure and capital budgeting decisions? The lack of access to equity capital effectively imposes capital rationing, so the firm may not be able to undertake all projects deemed worthwhile. In order ...

Bankruptcy and Firm Value

... Keep in mind that the firm is an operation that attracts resources from investors, uses them and returns profits to investors according to certain rules. Bankruptcy is simply a recognition that the promised payments to debt-holders are greater than the value of all the assets. Since equity-holders a ...

... Keep in mind that the firm is an operation that attracts resources from investors, uses them and returns profits to investors according to certain rules. Bankruptcy is simply a recognition that the promised payments to debt-holders are greater than the value of all the assets. Since equity-holders a ...

Fund factsheet - BT Investment Management

... of the league tables. The OPEC deal to cut production that was agreed after market on the last day of November meant the effects of the 8.7% WTI rally were felt this month. At the other end of the spectrum Healthcare (+0.9%) and Telcos (+0.5%) underperformed. The former has been one of the few areas ...

... of the league tables. The OPEC deal to cut production that was agreed after market on the last day of November meant the effects of the 8.7% WTI rally were felt this month. At the other end of the spectrum Healthcare (+0.9%) and Telcos (+0.5%) underperformed. The former has been one of the few areas ...

Implications of Proposed Bank Capital Regulations for Investors in

... Over time, we expect that banks will replace most outstanding TruPS with DRD-eligible preferred stock. However, the substitution of preferred stock for TruPS will be neither dollar-fordollar nor simultaneous. Initially, we expect that many banks will redeem TruPS at par between now and early 2013 by ...

... Over time, we expect that banks will replace most outstanding TruPS with DRD-eligible preferred stock. However, the substitution of preferred stock for TruPS will be neither dollar-fordollar nor simultaneous. Initially, we expect that many banks will redeem TruPS at par between now and early 2013 by ...

THE DREYFUS CORPORATION August 11, 2016 Mr. Dale

... permit insurance companies to report shares of money market funds with stable NAV as bonds instead of as shares of common stock….”(emphasis in the original). While we believe a stable NAV provides several benefits, we do not believe that making shares of a money market fund more ‘bond-like’ is one o ...

... permit insurance companies to report shares of money market funds with stable NAV as bonds instead of as shares of common stock….”(emphasis in the original). While we believe a stable NAV provides several benefits, we do not believe that making shares of a money market fund more ‘bond-like’ is one o ...

What Income-Seeking Investors Should Know

... Salient Select Income Fund seeks high current income and potential for modest long-term growth of capital. RISKS There are risks involved with investing, including loss of principal. Past performance does not guarantee future results, share prices will fluctuate and you may have a gain or loss when ...

... Salient Select Income Fund seeks high current income and potential for modest long-term growth of capital. RISKS There are risks involved with investing, including loss of principal. Past performance does not guarantee future results, share prices will fluctuate and you may have a gain or loss when ...

ALLAN GRAY BALANCED FUND

... Investor sentiment towards emerging markets remains weak. This has left emerging markets at a valuation discount to developed markets. The MSCI Emerging Market Index trades at a discount of over 30% to the MSCI World Index – an index dominated by the US and other developed markets – on a price to ea ...

... Investor sentiment towards emerging markets remains weak. This has left emerging markets at a valuation discount to developed markets. The MSCI Emerging Market Index trades at a discount of over 30% to the MSCI World Index – an index dominated by the US and other developed markets – on a price to ea ...

Private equity

In finance, private equity is an asset class consisting of equity securities and debt in operating companies that are not publicly traded on a stock exchange.A private equity investment will generally be made by a private equity firm, a venture capital firm or an angel investor. Each of these categories of investor has its own set of goals, preferences and investment strategies; however, all provide working capital to a target company to nurture expansion, new-product development, or restructuring of the company’s operations, management, or ownership.Bloomberg Businessweek has called private equity a rebranding of leveraged-buyout firms after the 1980s. Common investment strategies in private equity include: leveraged buyouts, venture capital, growth capital, distressed investments and mezzanine capital. In a typical leveraged-buyout transaction, a private-equity firm buys majority control of an existing or mature firm. This is distinct from a venture-capital or growth-capital investment, in which the investors (typically venture-capital firms or angel investors) invest in young, growing or emerging companies, and rarely obtain majority control.Private equity is also often grouped into a broader category called private capital, generally used to describe capital supporting any long-term, illiquid investment strategy.