* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Fund factsheet - BT Investment Management

Survey

Document related concepts

Private equity wikipedia , lookup

Syndicated loan wikipedia , lookup

Systemic risk wikipedia , lookup

Financialization wikipedia , lookup

Business valuation wikipedia , lookup

Lattice model (finance) wikipedia , lookup

Beta (finance) wikipedia , lookup

Stock valuation wikipedia , lookup

Financial economics wikipedia , lookup

Private equity secondary market wikipedia , lookup

Fund governance wikipedia , lookup

Hedge (finance) wikipedia , lookup

Stock trader wikipedia , lookup

Transcript

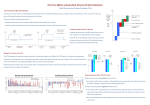

Fact sheet Equity Strategies December 2016 BT Balanced Equity Income Fund ARSN: 159 947 270 Fund objective The Fund aims to provide: consistent monthly income plus franking credits; a total return (including franking credits and after fees, costs and taxes) that exceeds the benchmark (40% S&P/ASX 200 Accumulation Index grossed up for franking credits and 60% Bloomberg AusBond Bank Bill Index) over rolling 5-year periods; and reduced exposure to the S&P/ASX 200 Index. Investment process The Fund’s portfolio is constructed using the following four key steps: 1. Investing in a selection of shares in the S&P/ASX 200 to generate income from dividends. The portfolio will generally include 20-60 companies, with a bias towards high dividend yielding stocks with franking credits and a liquid options market based on our positive, fundamental company research views. BTIM’s fundamental company research focuses on four key factors: valuation, financial risk, franchise and management quality; 2. 3. 4. Selling call options over the shares in the portfolio to generate additional income from option premiums. The call options sold will be fully backed by holding the shares in the portfolio and will significantly reduce the Fund’s exposure to gains on its share portfolio; Buying put options over the S&P/ASX 200 index with the aim of significantly reducing the Fund’s downside market exposure; and Applying a hedging strategy to reduce the adverse impact of extreme market movements caused by significant global events that are expected to occur infrequently. The strategy uses derivatives over international share indices and volatility indices that generate profit when share markets experience large negative movements. This is based on our fundamental view that movements in share markets globally are closely correlated when significant global events occur. Fund details # Income target (excludes franking credits) 4.28% Target average exposure to the ASX 2003 40% Fund size (as at 31 December 2016) $156 million Minimum investment $25,000 Distribution frequency Monthly Liquidity Daily Buy-sell spread4 0.50% (0.25%/0.25%) APIR code BTA0428AU Inception Date October 2012 Announced distributions (after-fees) - January, February, March 2017 0.300 cents per unit - April, May, June 2017 0.300 cents per unit Next distribution announcement date: - March 2017 (for July, August and September 2017) Management cost5 Issuer fee6 Expense recoveries # 1.39% p.a. 0.15% p.a. Monthly distribution (as a percentage of NAV) CPU-NAV Ratio (%) 1.0 Actual* Declared** 0.8 0.6 0.4 0.2 0.0 Oct- Nov- Dec- Jan- Feb- Mar- Apr- May- Jun- Jul-16 Aug- Sep- Oct- Nov- Dec- Jan- Feb- Mar- Apr- May- Jun15 15 15 16 16 16 16 16 16 16 16 16 16 16 17 17 17 17 17 17 * Calculated as CPU divided by month-end NAV price ** Calculated using the announced CPU divided by a $1 unit price Performance (after-fees) Since 1 mth 3 mths 6 mths 1 Year 2 Years 3 Years inception (%) (%) (%) (% pa) (% pa) (% pa) (% pa) Performance before franking credits Total return 1.72 2.82 4.12 1.69 0.11 2.71 Estimated performance grossed up for franking credits Total return1 1.73 3.18 4.86 3.05 1.45 1.54 6.70 5.04 4.89 Bmk return2 1.83 2.47 5.05 4.16 6.45 0.04 Distribution – Growth Split -5.94 Growth return 1.36 1.72 1.53 -3.65 Distribution return (before franking credits) 5.33 5.98 0.36 1.10 2.59 Distribution return (grossed up for franking credits) 6.70 7.39 0.36 1.47 3.33 -6.31 -4.08 6.42 6.79 7.85 8.24 1 Performance (grossed up for franking credits) will tend to be understated relative to benchmark returns. This is because the impact of franking credits are added to the benchmark on the dividend ex-date whereas franking credits are included in the Fund’s performance only after the relevant holding period rules are deemed to have been satisfied. This may be up to 45 days after the dividend ex-date. Performance figures may, therefore, be subject to future upward revision once the holding period has expired. 2 Benchmark is 40% ASX 200 Accumulation Index grossed up for franking credits / 60% Bloomberg AusBond Bank Bill Index. This is the Fund’s benchmark as disclosed in the PDS. Note that the primary objectives of the fund are the income and total return objectives. Due to the nature of the investment strategies applied within the fund, the performance of the strategy relative to the benchmark should only be considered over the longer term (3 to 5 years). Over shorter time frames, the performance is likely to differ significantly from that of the benchmark. Growth of $10,000 since inception (distributions reinvested) 12,000 Total Capital Value ($) About the Fund The BT Balanced Equity Income Fund (Fund) gives investors the opportunity to earn a consistent monthly income while reducing their exposure to movements in the Australian share market. The Fund combines expert stock selection with an enhanced income strategy to deliver a known (up to 6 months in advance), consistent monthly income whilst significantly reducing the impact of share market movements. 11,600 11,200 10,800 10,400 10,000 9,600 01-Nov-12 01-Jul-13 01-Mar-14 01-Nov-14 01-Jul-15 01-Mar-16 01-Nov-16 Top 10 stock exposure (as at 31 December 2016) Commonwealth Bank of Australia Ltd Westpac Banking Corporation Telstra Corporation Limited National Australia Bank Limited CSL Limited ANZ Banking Group Limited Wesfarmers Limited BHP Billiton Limited Amcor Limited Westfield Corporation AE Risk statistics (Since inception) Volatility Maximum drawdown Beta 5.6% p.a. -10.1% 37% The annualised rate of income is based on pre-announced distributions for the six months to 30 June 2017 and an application unit price of $0.8418 as at 14 December 2016. The annualised rate of income based only on the pre-announced distributions of 0.300 cents per unit for the June 2017 quarter and the application unit price as at 14 December 2016 is 4.28% pa. As the rate of income depends on the unit price at the time of investment and the unit price will vary daily, this is not a guarantee and there is a risk that there may be lower income after 30 June 2017. Similarly, performance may vary and the value of your investment will go up and down over time. Investment team The Fund combines the experience and skills of our successful Australian equities fundamental research team with experienced equity volatility and risk management experience gained in hedge funds in Asia and the US. The equity income team consists of two portfolio managers Jason Petras and Darron Mitchell. Jason and Darron have combined experience of 30 years in the investment management industry with skills in equity derivative and quantitative hedge funds gained in both Asia and the US. The Fund sits within the Equities Boutique which is run by Crispin Murray. The joint Portfolio Managers for the Fund utilise the support and infrastructure of the Equities Boutique with 10 Equity research analysts and other large cap Portfolio Managers. In particular the equity income team use the expertise of the Equities Boutique to assist with stock analysis. Risks An investment in the Fund involves risk, including: Market risk: The risk of fluctuation in the market price of the Fund’s investments Security specific risk: The risk associated with losses by the Fund from an individual investment Derivative and options risk: The risk that the Fund makes substantial losses or has volatile returns through the use of derivatives. Please read the Fund’s Product Disclosure Statement (PDS) for more information on these risks. Market review & performance drivers Continued momentum from prospective Trump ‘reflation’ policies helped propel the S&P/ASX 200 Accumulation Index higher by a solid 4.3% in December. This was alongside the second Fed rate hike in as many years and the unveiling of a plan from the ECB to extend its QE programme. There were fears coming into the month that a ‘No’ vote in the Italian Referendum could sow the seeds for investor fears about the stability of the Eurozone as a whole, however the markets surpassed this hurdle with ease. These factors all combined to create a Santa-rally finish in the last month of the year. In the US, as widely-expected the Fed ratcheted rates higher by 0.25%. The “gradual” hike trajectory verbiage was retained. However, a shift higher in the Committee’s highly-scrutinised dot plot suggested three hikes were now anticipated in 2017, versus the previous two. Additionally, the growth outlook for the same period was lifted from 2.0% to 2.1%. Data-wise, annualised third quarter GDP growth was again revised higher to 3.5%. Leading indicators were also solid; Manufacturing PMI ticked up by 0.1 to 54.2 – its highest since March 2015, while the University of Michigan’s Consumer Confidence reading hit 98.2 (a level last reached in 2004). In Europe, fears over a fallout from the rejection of the highlypublicised Italian referendum seemingly evaporated. Meanwhile, the ECB finally revealed its intentions for QE; asset purchases will be extended to the end of 2017, but are set to be reduced from 80bn Euros to 60bn Euros from April. At home, the RBA left rates unchanged at 1.50% - as expected. Governor Lowe highlighted a soft patch for economic growth in his Statement. Indeed third quarter GDP disappointed with a 0.5% slide on the previous quarter and 1.8% increase over the previous year – the slowest pace of growth since the GFC. Most major leading indicators of economic growth also faltered, while labour market data was a more of a mixed bag. Outside data prints, the greater than forecast budget deficits in the annual MYEFO caused Australia’s AAA credit rating to come under threat. Sector-wise, all areas posted a positive performance with Financials (+5.5%), REITs (+5.3%) and Energy (+6.1%) at the top of the league tables. The OPEC deal to cut production that was agreed after market on the last day of November meant the effects of the 8.7% WTI rally were felt this month. At the other end of the spectrum Healthcare (+0.9%) and Telcos (+0.5%) underperformed. The former has been one of the few areas in the corporate sphere facing a headwind from “Trumponomics”, which threatens the repeal of supportive US policies for the sector, like Obamacare. Telcos meanwhile have faced more domestically-orientated challenges as the industry grapples with the NBN rollout. The Balanced Fund returned 1.72% post fees for the month of December, taking our total return for the final quarter of 2016 to 2.82%, which was a satisfying end to the year given the ASX returned 5.1% over the same period. We were happy to be able to return more than the targeted 40 delta with the market as this is normally tough for an overwriting fund when the market rallies in such a sustained manner. From the 9th November “Trump” low, the ASX rallied 7.7% into the end of November, and then another 4.3% through December. These strong upwards movements are one of the hardest environments to operate an overwriting fund in, as our exposure to the market falls as the market rallies, meaning it is a constant fight to stay exposed to the rally, whether by buying back short calls at a loss, or buying more stock as the market makes new highs. We had our best return of the year (+1.8%) last month as we had chosen to maintain more upside exposure by not re-writing expiring strikes as low as we normally do, forfeiting call premium but maintaining upside. We managed a 4.07% return in the Equity strategy, which was slightly below the 4.3% return of the ASX200. We had swapped out some of our stock for long index calls in November as we felt the market was not correctly pricing the potential for increased volatility moving into 2017. As such, we felt the low implied volatility made buying calls the most appropriate way to structure our exposure. On continued market strength, long calls are a cost effective way to maintain upside exposure, and given the current overbought nature of the ASX200 if the market had weakened we would have only lost the premium paid for the long calls, instead of the full downside of a stock selloff. This strategy was preferred to us instead of just selling stock as it meant that we still maintained upside with the long calls, but just not as much as being fully invested in stock, which is why we didn’t achieve the full market return in the Equity strategy. In the Overwriting strategy we lost 1.17% due to the strength of the rally. As we mentioned, although we managed to retain a lot of the upside in November, as of the start of December the strikes on our short calls were lower due to the market strength, and this did curtail our ability to fully participate in the upside. In the Hedging component of the book, we lost a combined 1.03% in the structural and tactical hedge, as would be expected in a strong market move. The financial sector added to its strong gains in November, tacking on another 5.5%, which was also the average return for the four major banks. As a result, ANZ (+7.1 %) and WBC (+4.3%) were some of the largest attributors to the fund in December. ANZ was the best performer of the majors, and also our largest stock overweight. The regulatory backdrop for banks domestically has eased significantly over the past few months, with indications that Basel IV and APRA may not be quite as stringent on capital controls as first thought. Alongside the positive movement in the yield curve, and a Trump cabinet tasked with de-regulating the overburdened financial sector, this has caused sentiment in the financial sector to improve drastically. We do note however that the banks are now all trading slightly above their 5 year average P/E relative to the market, and after the extremely strong rally we are beginning to feel a lot of the optimism could be priced in in the near term. Our strongest attributor for the month was IPL (+14.3%). The stock has been under pressure for the past few months as the result of low Urea and Ammonium pricing tarnishing the profitability potential of their new Louisiana fertiliser plant. Early signs however have suggested the DAP fertilizer price could be finding a bottom, and with the potential for new pro-coal policies in the US, the market has factored in the potential for improved earnings in their explosives business. In the past few months we positioned our portfolio to maintain upside exposure to the mining sector, which has the ability for substantial moves in both directions. We did this by having a smaller stock position, but leaving it not overwritten, using index short calls as a proxy instead. This has previously served us well as the resources sector in Australia has continued to rally over the past six months, as the Chinese government moved to rationalise oversupply in some of its primary industries. This strength continued in December, with Iron ore posting a 9.4% gain for the month. BHP (+2.7%) is an obvious beneficiary of these moves. However because the stock only gained 2.7%, if we had written calls on the stock we would have gained both the premium on the call, and the full stock upside. Writing index calls instead of single stock calls provides lower premium, and lower overall returns in situations where the stock gains are small and positive, which was the case here. As a result BHP was our largest underperformer for the month versus the model. We still feel we have pursued the right strategy with the miners over the past year by using proxy index calls for a portion of the miners as this has allowed us to participate in the strong upside months we have seen this year. BHP’s four largest positive moves in 2016 were +23%, +11%, +10.6%, +5.8%. Selling calls on BHP in those months would have removed the majority of the upside, which we managed to capture by not having the stock overwritten. We are confident that these cases more than make up for the months where the stock move was small and we missed out on the premium. default forecast for investors currently is that Trump will have no issues pushing through fiscal reform, and cutting the tax rate. Whilst these possibilities are certainly achievable, we are wary of the potential for downside surprise if the outcomes don’t become apparent immediately. Negative sentiment could also develop with regards to the delicate Sino-American relationship, something that will have ramifications for the Australian market, and arguably dominate the movements in the local resource sector throughout 2017. Any signs of combative, protectionist rhetoric from the Trump administration could be bad for Chinese growth prospects, having a follow-through impact on the rest of the developing world, and with it their demand for the base resources. A step up in the dispute around the South-China Sea could also cause a risk-off environment to ensue in the Asia-Pac region. We note the structural cheapness of volatility at this stage, and will continue to use long calls where possible to maintain upside to the market whilst limiting downside. We have also positioned ourselves with a larger portion of our portfolio hedged to downside movement than would normally be the case. This will allow us to benefit from any sustained rally should the global economy continue to improve, but also protect us if some of the potential pitfalls eventuate along the way. In summary, 2016 has been a tricky year to navigate, typified by strong sell-offs followed by even stronger reversals. Despite this we are happy with the way we have finished the year, with the 3.2% return in the final quarter. We hope to be able to continue this good run into the New Year. Our second largest underperformer for the month was Newcrest (+3.6%). The stock exhibited very high volatility during the month, at one point down 16%. We had entered the month with a small overweight exposure in the stock, and alongside a strong fall in the gold price the move was greater than our risk limits would allow, causing us to sell the stock at a loss. Unfortunately we were therefore unable to participate in the strong rally at the end of the month. Short dated implied volatility at the index level trended down to the lowest level of the year in December, with one month volatility at one point as low as 9.2% annualised. This was partly a seasonallyinduced effect (markets tend to have supressed volatility over the Christmas period) but also due to the euphoria around Trumps election driving markets higher, reducing investors desire to buy insurance in the options market. We used this seasonal lull in implied volatility as an opportunity to roll up our structural hedge earlier than normal, in order to benefit from the relatively lower cost of protection. We are increasingly feeling that markets are pricing in the most positive outcome possible for the next six months. We note that economic indicators are showing improvement, but it seems the 3 The target average exposure over a full market cycle. Actual market exposure at any point in time may vary substantially from this depending on market circumstances. The buy-sell spread represents transaction costs incurred whenever you invest or withdraw funds, and may vary from time to time without notice. You should refer to the latest Product Disclosure Statement for full details of fees and other costs you may be charged. 6 This is the fee for managing the assets of the Fund and overseeing the operations of the Fund. The Issuer fee is paid from the assets of the Fund and is reflected in the unit price of your investment. 4 5 This fact sheet has been prepared by BT Investment Management (Fund Services) Limited (BTIM) ABN 13 161 249 332, AFSL No 431426 and the information contained within is current as at the date of this fact sheet. It is not to be published, or otherwise made available to any person other than the party to whom it is provided. BTIM is the responsible entity and issuer of units in the BT Balanced Equity Income Fund (Fund) ARSN: 159 947 270. A product disclosure statement (PDS) is available for the Fund and can be obtained by calling 1800 813 886 or visiting www.btim.com.au. You should obtain and consider the PDS before deciding whether to acquire, continue to hold or dispose of units in the Fund. An investment in the Fund is subject to investment risk, including possible delays in repayment of withdrawal proceeds and loss of income and principal invested. This fact sheet is for general information purposes only, should not be considered as a comprehensive statement on any matter and should not be relied upon as such. It has been prepared without taking into account any recipient’s personal objectives, financial situation or needs. Because of this, recipients should, before acting on this information, consider its appropriateness having regard to their individual objectives, financial situation and needs. This information is not to be regarded as a securities recommendation. The information in this fact sheet may contain material provided by third parties, is given in good faith and has been derived from sources believed to be accurate as at its issue date. While such material is published with necessary permission, and while all reasonable care has been taken to ensure that the information in this fact sheet is complete and correct, to the maximum extent permitted by law neither BTIM nor any company in the BTIM group accepts any responsibility or liability for the accuracy or completeness of this information. Performance figures (before franking credits) are calculated in accordance with the Financial Services Council (FSC) standards. Total returns are calculated: to the last day of each month using exit prices; taking into account management costs of the fund; assuming reinvestment of distributions (which may include net realised capital gains from the sale of assets of the fund). No reduction is made to the unit price (or performance) to allow for tax you may pay as an investor, other than withholding tax on foreign income (if any). Performance figures (grossed up for franking credits) are estimates and calculated by adding the impact of franking credits to fund returns before franking credits. Franking credit impacts are included in performance only after the relevant holding period rules are deemed to have been satisfied, which may be up to 45 days after the dividend ex-date. Performance figures (grossed up for franking credits) shown may therefore be subject to future upward revision once the holding period has expired. If market movements, cash flows or changes in the nature of an investment (e.g. a change in credit rating) cause the Fund to exceed any of the investment ranges or limits specified, this will be rectified by BTIM as soon as reasonably practicable after becoming aware of it. If BTIM does so, it will have no other obligations in relation to these circumstances. The procedures, investment ranges, benchmarks and limits specified are accurate as at the date of this fact sheet and BTIM reserves the right to vary these from time to time. Bloomberg Finance L.P. and its affiliates (collectively, “Bloomberg”) do not approve or endorse this material and disclaim all liability for any loss or damage of any kind arising out of the use of all or any part of this material. BT® is a registered trade mark of BT Financial Group Pty Ltd and is used under licence.