Financial Planner`s Approach to Investment Selections for Clients

... given category then meaningfully deviate from its stated investment style. The result could be significantly different risk and return characteristics than originally bargained for. Morningstar scores stock funds on the degree to which they veer off course on the dimensions of value/growth and size. ...

... given category then meaningfully deviate from its stated investment style. The result could be significantly different risk and return characteristics than originally bargained for. Morningstar scores stock funds on the degree to which they veer off course on the dimensions of value/growth and size. ...

Ratio Analysis

... A method of performance measurement that was started by the DuPont Corporation in the 1920s. With this method, assets are measured at their gross book value rather than at net book value in order to produce a higher return on equity (ROE). It is also known as "DuPont identity". DuPont analysis tells ...

... A method of performance measurement that was started by the DuPont Corporation in the 1920s. With this method, assets are measured at their gross book value rather than at net book value in order to produce a higher return on equity (ROE). It is also known as "DuPont identity". DuPont analysis tells ...

IAS INDUSTRY ACCOUNTING STANDARDS

... ▫ Due to the nature of the business, specify which, if any mine development costs incurred prior or subsequent to commercial production commencing, should be capitalized. ...

... ▫ Due to the nature of the business, specify which, if any mine development costs incurred prior or subsequent to commercial production commencing, should be capitalized. ...

The Case for a Concentrated Portfolio

... as “undiversifiable risk,” “volatility,” or “market risk,” systematic risk cannot be diversified away. However, it can be mitigated by diversifying beyond equities into asset classes such as cash, fixed income, and alternative investments. For this reason, a partial allocation to a concentrated equi ...

... as “undiversifiable risk,” “volatility,” or “market risk,” systematic risk cannot be diversified away. However, it can be mitigated by diversifying beyond equities into asset classes such as cash, fixed income, and alternative investments. For this reason, a partial allocation to a concentrated equi ...

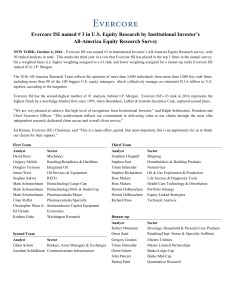

Evercore ISI named # 3 in US Equity Research by

... 30 ranked analysts in total. This marks the third year in a row that Evercore ISI has placed in the top 5 firms in the annual survey. On a weighted basis (i.e. higher weighting assigned to a #1 rank and lower weighting assigned for a runner-up rank) Evercore ISI ranked #2 to J.P. Morgan. The 2016 Al ...

... 30 ranked analysts in total. This marks the third year in a row that Evercore ISI has placed in the top 5 firms in the annual survey. On a weighted basis (i.e. higher weighting assigned to a #1 rank and lower weighting assigned for a runner-up rank) Evercore ISI ranked #2 to J.P. Morgan. The 2016 Al ...

Slaid 1 - Incisive Media Plc

... We believe that… capital markets are not always efficient – especially in underdeveloped CEE region, even more so in Russia and in the CEE mid and small cap arena analyzing stocks by sectors rather than by countries provides better insight in our team we need sub-portfolio managers rather than ...

... We believe that… capital markets are not always efficient – especially in underdeveloped CEE region, even more so in Russia and in the CEE mid and small cap arena analyzing stocks by sectors rather than by countries provides better insight in our team we need sub-portfolio managers rather than ...

Tryg Forsikring A/S

... A number of different factors may cause the actual performance to deviate significantly from the forward-looking statements in the presentations including but not limited to general economic developments, changes in the competitive environment, developments in the financial markets, extraordinary ev ...

... A number of different factors may cause the actual performance to deviate significantly from the forward-looking statements in the presentations including but not limited to general economic developments, changes in the competitive environment, developments in the financial markets, extraordinary ev ...

Why the Mutual Fund Scandal Matters

... professional money management and diversification. An investor with five thousand dollars cannot pay a professional manager a fee large enough to support the direct management of such a small amount. Mutual funds pool the investments of many small holders, allowing money managers to manage them prof ...

... professional money management and diversification. An investor with five thousand dollars cannot pay a professional manager a fee large enough to support the direct management of such a small amount. Mutual funds pool the investments of many small holders, allowing money managers to manage them prof ...

Bombay Stock Exchange Limited

... Provide the SMEs with equity financing opportunities to grow their business – from expansion to acquisition Equity Financing will lower the Debt burden leading to lower financing cost and healthier balance sheet Expand the investors base, which in turn will help in getting secondary equity fin ...

... Provide the SMEs with equity financing opportunities to grow their business – from expansion to acquisition Equity Financing will lower the Debt burden leading to lower financing cost and healthier balance sheet Expand the investors base, which in turn will help in getting secondary equity fin ...

Producing Liquidity

... institutions (issuers of liquidity instruments) and implicitly purchased by the counterparty sectors of those institutions (holders) • 1947 – Richard Stone’s Appendix to Measurement of National Income and the Construction of Social Accounts; Report of the Sub-Committee on National Income Statistics ...

... institutions (issuers of liquidity instruments) and implicitly purchased by the counterparty sectors of those institutions (holders) • 1947 – Richard Stone’s Appendix to Measurement of National Income and the Construction of Social Accounts; Report of the Sub-Committee on National Income Statistics ...

Finance_Notes_2009 Size: 342.5kb Last modified

... Interest tax shields are less valuable to loss or tax exempt firms. ...

... Interest tax shields are less valuable to loss or tax exempt firms. ...

Are the GMO Predictions of Asset Style Returns Accurate

... Exhibit 2 is the same graph except the 8 asset classes are obtained by sorting the stock and bond funds together. Here the correlation falls to 0.677. In 5 cases the predictions are too pessimistic and in 3 they are two optimistic. It is not surprising that when all the assets are lumped together th ...

... Exhibit 2 is the same graph except the 8 asset classes are obtained by sorting the stock and bond funds together. Here the correlation falls to 0.677. In 5 cases the predictions are too pessimistic and in 3 they are two optimistic. It is not surprising that when all the assets are lumped together th ...

Returns, Absolute Returns and Risk

... identify the opportunity, buy the company at a good price, make it a better company, and sell it at higher valuation parameters than it was bought for. Certainly all of the elements included in “b” are highly dependent on the manager’s skill and have little or nothing to do with the fact that the in ...

... identify the opportunity, buy the company at a good price, make it a better company, and sell it at higher valuation parameters than it was bought for. Certainly all of the elements included in “b” are highly dependent on the manager’s skill and have little or nothing to do with the fact that the in ...

Emerging Market Equity Fund Investor: SEMNX SEMNX | Advisor: SEMVX SEMVX

... each fund with at least a 3-year history, Morningstar calculates a Morningstar RatingTM based on a Morningstar Risk-Adjusted return measure that accounts for variation in a fund's monthly performance (including the effects of sales charges, loads and redemption fees), placing more emphasis on downwa ...

... each fund with at least a 3-year history, Morningstar calculates a Morningstar RatingTM based on a Morningstar Risk-Adjusted return measure that accounts for variation in a fund's monthly performance (including the effects of sales charges, loads and redemption fees), placing more emphasis on downwa ...

New York 2008

... want to manage those functions themselves. In essence, also our fund of funds division becomes the client of that company but then that company can grow by serving other institutions as well. I joined the firm ten years ago as a Junior Analyst, and I wear a few different hats. In addition to being t ...

... want to manage those functions themselves. In essence, also our fund of funds division becomes the client of that company but then that company can grow by serving other institutions as well. I joined the firm ten years ago as a Junior Analyst, and I wear a few different hats. In addition to being t ...

Corporate debt overhang

... Excessive debt becomes self-perpetuating • firms are unable to deleverage due to falling revenues in the wake of recession, • while recessions is protracted due to debt overhang • Solutions are needed ...

... Excessive debt becomes self-perpetuating • firms are unable to deleverage due to falling revenues in the wake of recession, • while recessions is protracted due to debt overhang • Solutions are needed ...

Why listed infrastructure is at the core

... But there are other ways to think about that risk because there’s a risk to being locked into an investment for a long holding period in a direct investment or a fund vehicle, when regulation, political agendas, technology, interest rates and other factors can change and impact the risk and return p ...

... But there are other ways to think about that risk because there’s a risk to being locked into an investment for a long holding period in a direct investment or a fund vehicle, when regulation, political agendas, technology, interest rates and other factors can change and impact the risk and return p ...

Euronav NV (Form: 6-K, Received: 01/27/2017 16:07:39)

... Euronav's return to shareholders' policy is to distribute 80% of net income over the full financial year. Under Belgian corporate law the final full year dividend must be approved by the Annual General Meeting of Shareholders (AGM) on the basis of the fully audited results of the financial year. The ...

... Euronav's return to shareholders' policy is to distribute 80% of net income over the full financial year. Under Belgian corporate law the final full year dividend must be approved by the Annual General Meeting of Shareholders (AGM) on the basis of the fully audited results of the financial year. The ...

Active Managers are Doing the Unexpected

... Investment consultants Cambridge Associates found that institutional managers running US small cap, US large cap and non-US equity strategies with high active share beat both closet indexers as well as their benchmarks after fees over the period reviewed. The active vs passive approach has become a ...

... Investment consultants Cambridge Associates found that institutional managers running US small cap, US large cap and non-US equity strategies with high active share beat both closet indexers as well as their benchmarks after fees over the period reviewed. The active vs passive approach has become a ...

Social Investor Meeting on Responsible Inclusive Finance 2017

... lot of “competitors” talk about “impact” and claim “impact measurement” without explaining methodology of measurement, even when they are not measuring outcomes at the client-level. It is hard for fund managers to continue to be rigorous in explaining methodology of measuring social performance w ...

... lot of “competitors” talk about “impact” and claim “impact measurement” without explaining methodology of measurement, even when they are not measuring outcomes at the client-level. It is hard for fund managers to continue to be rigorous in explaining methodology of measuring social performance w ...

2-4 Financial Analysis-

... After completing the CUBIC accounting module, describe your opinion regarding knowledge of financial statements: A. I am very comfortable with them B. I have a general understanding but lack details C. I saw much, but retained little ...

... After completing the CUBIC accounting module, describe your opinion regarding knowledge of financial statements: A. I am very comfortable with them B. I have a general understanding but lack details C. I saw much, but retained little ...

A team approach to Multi Asset investing

... way to implement a view on policy intervention in Japan? The team has the freedom to roam freely across asset types and geographies to seek investment ideas which are appropriate for its two- to three-year investment horizon. ...

... way to implement a view on policy intervention in Japan? The team has the freedom to roam freely across asset types and geographies to seek investment ideas which are appropriate for its two- to three-year investment horizon. ...

Investment Fund Overview

... When you participate in the Electrical Workers’ HRA, you can choose to invest your account among the investment options listed below. You can work with your financial advisor to invest your account, and the following investment fund overview might help you choose. Please remember that potential stoc ...

... When you participate in the Electrical Workers’ HRA, you can choose to invest your account among the investment options listed below. You can work with your financial advisor to invest your account, and the following investment fund overview might help you choose. Please remember that potential stoc ...

OUR INVESTMENT PROCESS - RBC Wealth Management

... comprised of senior investment professionals, forecasts key macroeconomic variables, such as expected interest rate moves, economic growth, earnings growth, and prevailing valuations of equity markets. Through this analysis, the committee develops recommended over-weights and underweights for each o ...

... comprised of senior investment professionals, forecasts key macroeconomic variables, such as expected interest rate moves, economic growth, earnings growth, and prevailing valuations of equity markets. Through this analysis, the committee develops recommended over-weights and underweights for each o ...

Flyer re x - AMP Capital

... which a prospective investor would consider material, and has been prepared without taking account of any particular person’s objectives, financial situation or needs. Accordingly, the information in this document should not form the basis of any investment decision. A person should, before making a ...

... which a prospective investor would consider material, and has been prepared without taking account of any particular person’s objectives, financial situation or needs. Accordingly, the information in this document should not form the basis of any investment decision. A person should, before making a ...

Private equity

In finance, private equity is an asset class consisting of equity securities and debt in operating companies that are not publicly traded on a stock exchange.A private equity investment will generally be made by a private equity firm, a venture capital firm or an angel investor. Each of these categories of investor has its own set of goals, preferences and investment strategies; however, all provide working capital to a target company to nurture expansion, new-product development, or restructuring of the company’s operations, management, or ownership.Bloomberg Businessweek has called private equity a rebranding of leveraged-buyout firms after the 1980s. Common investment strategies in private equity include: leveraged buyouts, venture capital, growth capital, distressed investments and mezzanine capital. In a typical leveraged-buyout transaction, a private-equity firm buys majority control of an existing or mature firm. This is distinct from a venture-capital or growth-capital investment, in which the investors (typically venture-capital firms or angel investors) invest in young, growing or emerging companies, and rarely obtain majority control.Private equity is also often grouped into a broader category called private capital, generally used to describe capital supporting any long-term, illiquid investment strategy.