Quick Market Update. Six Possible Surprises for 2014

... Information and opinions have been obtained or derived from sources we consider reliable, but we cannot guarantee their accuracy or completeness. Opinions represent Wells Fargo Wealth Management’s opinion as of the date of this report and are for general information purposes only. Wells Fargo Wealth ...

... Information and opinions have been obtained or derived from sources we consider reliable, but we cannot guarantee their accuracy or completeness. Opinions represent Wells Fargo Wealth Management’s opinion as of the date of this report and are for general information purposes only. Wells Fargo Wealth ...

Finance & Accounting

... • Hedge fund – investment fund active in all types of securities markets; noted for short-term, aggressive strategies. • Private equity funds – investment fund managed on behalf of wealthy investors; fund managers invest in companies, usually with short-term gains in mind. • The leveraged buyout (LB ...

... • Hedge fund – investment fund active in all types of securities markets; noted for short-term, aggressive strategies. • Private equity funds – investment fund managed on behalf of wealthy investors; fund managers invest in companies, usually with short-term gains in mind. • The leveraged buyout (LB ...

information

... commercial banking, especially in rural areas in Africa. The project aims to make ...

... commercial banking, especially in rural areas in Africa. The project aims to make ...

Ch 11: 1.1

... a. Traditional pension plans are defined benefit plans under which retirement payouts are fixed by a formula that is typically based on the worker’s years on the job and final salary. 401(k) plans are defined contribution plans under which payouts depend on the return earned by the plan’s investment ...

... a. Traditional pension plans are defined benefit plans under which retirement payouts are fixed by a formula that is typically based on the worker’s years on the job and final salary. 401(k) plans are defined contribution plans under which payouts depend on the return earned by the plan’s investment ...

global equity fund

... applicable sector allocations of investment funds not managed by IA Clarington Investments Inc. 3 Excludes Cash and Other Net Assets and applicable investment funds not managed by IA Clarington Investments Inc. Commissions, trailing commissions, management fees and expenses all may be associated wit ...

... applicable sector allocations of investment funds not managed by IA Clarington Investments Inc. 3 Excludes Cash and Other Net Assets and applicable investment funds not managed by IA Clarington Investments Inc. Commissions, trailing commissions, management fees and expenses all may be associated wit ...

September 30, 2013 Dear Friends, Large cap companies generated

... those who favor low interest rates to stimulate further economic growth was resolved in favor of the low interest rate advocates. The Federal Reserve announced that it would continue to buy $85 billion a month of government securities and mortgages. The net effect of this policy decision is benefici ...

... those who favor low interest rates to stimulate further economic growth was resolved in favor of the low interest rate advocates. The Federal Reserve announced that it would continue to buy $85 billion a month of government securities and mortgages. The net effect of this policy decision is benefici ...

IFC MAKES FIRST INVESTMENT IN SA`s

... 2 636 companies in 140 developing countries. IFC's committed portfolio at the end of the 2001 financial year was $14,3-billion. The IFC's investment follows hard on the heels of the Industrial Development ...

... 2 636 companies in 140 developing countries. IFC's committed portfolio at the end of the 2001 financial year was $14,3-billion. The IFC's investment follows hard on the heels of the Industrial Development ...

Looking to gain from small-cap inefficiencies with active management

... For more information please contact your local Aberdeen representative, or visit our website at aberdeen-asset.com The Fund is a Luxembourg-domiciled UCITS fund, incorporated as a Société Anonyme and organised as a Société d’investissement à Capital Variable (a “SICAV”). The information contained in ...

... For more information please contact your local Aberdeen representative, or visit our website at aberdeen-asset.com The Fund is a Luxembourg-domiciled UCITS fund, incorporated as a Société Anonyme and organised as a Société d’investissement à Capital Variable (a “SICAV”). The information contained in ...

3 8 The economic impact of Private Equity and

... root of the total percentage growth rate, where “n” is the number of years in the ...

... root of the total percentage growth rate, where “n” is the number of years in the ...

Mark A. Bonenfant

... representing OP Bancorp and Open Bank before the Federal Reserve, the FDIC, the California Department of Business Oversight, state securities authorities and FINRA Heritage Commerce Corp (NASDAQ) acquisition of Diablo Valley Bank Bank of Lakewood merger with Gateway Bancorp Family Savings Bank merge ...

... representing OP Bancorp and Open Bank before the Federal Reserve, the FDIC, the California Department of Business Oversight, state securities authorities and FINRA Heritage Commerce Corp (NASDAQ) acquisition of Diablo Valley Bank Bank of Lakewood merger with Gateway Bancorp Family Savings Bank merge ...

Russell Continental European Equity Fund

... FTSE World Europe ex-UK Index, building over time into significant value-added. In Continental Europe, Russell’s analysts have found that two of the key drivers are stock selection and sector selection allocation relative to the benchmark. In order to focus on these two areas, other factors such as ...

... FTSE World Europe ex-UK Index, building over time into significant value-added. In Continental Europe, Russell’s analysts have found that two of the key drivers are stock selection and sector selection allocation relative to the benchmark. In order to focus on these two areas, other factors such as ...

Bonds Are Different

... bond strategies are impacted by changes in interest rates. Bonds and bond strategies with longer durations tend to be more sensitive and volatile than those with shorter durations; bond prices generally fall as interest rates rise, and the current low interest rate environment increases this risk. C ...

... bond strategies are impacted by changes in interest rates. Bonds and bond strategies with longer durations tend to be more sensitive and volatile than those with shorter durations; bond prices generally fall as interest rates rise, and the current low interest rate environment increases this risk. C ...

Media release - Insync Funds Management

... Australian-based international equities fund generated a positive return in January while broad MSCI index was down -3.3% in January Insync Global Titans Fund deploys downside protection in the form of buying out-of- the-money index puts (with 60% net asset value covered using index puts for Jan.) T ...

... Australian-based international equities fund generated a positive return in January while broad MSCI index was down -3.3% in January Insync Global Titans Fund deploys downside protection in the form of buying out-of- the-money index puts (with 60% net asset value covered using index puts for Jan.) T ...

Main Market – key eligibility criteria

... The Main Market is the London Stock Exchange’s flagship market for large, established companies and our regulated market for listed securities. Issuers of securities admitted to trading on the Main Market are also admitted to the UK Listing Authority’s Official List. There are two listing segments – ...

... The Main Market is the London Stock Exchange’s flagship market for large, established companies and our regulated market for listed securities. Issuers of securities admitted to trading on the Main Market are also admitted to the UK Listing Authority’s Official List. There are two listing segments – ...

Infrastructure drive raises price concerns 4th November

... Global infrastructure assets under management through unlisted funds are currently at their highest point, standing at $282bn as of March this year, a near threefold increase since 2007, according to the data provider Prequin. Institutional investors’ appetite for infrastructure investment continues ...

... Global infrastructure assets under management through unlisted funds are currently at their highest point, standing at $282bn as of March this year, a near threefold increase since 2007, according to the data provider Prequin. Institutional investors’ appetite for infrastructure investment continues ...

Growth Equity in the Lower Middle Market

... in some cases, either flattened out or even started to decline. To generate returns in businesses with these characteristics, LBO investors use “financial engineering,” meaning they put debt on the business and then try to pay that debt off as fast as possible using the cash flow from the business. ...

... in some cases, either flattened out or even started to decline. To generate returns in businesses with these characteristics, LBO investors use “financial engineering,” meaning they put debt on the business and then try to pay that debt off as fast as possible using the cash flow from the business. ...

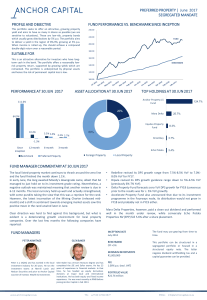

fund performance vs. benchmark since inception

... yield and aims to have as many A shares as possible (we are sensitive to valuations). These are low-risk, property bonds which usually grow distributions by 5% p.a. The portfolio aims to deliver a yield in the region of 8%-9%, growing at 5% p.a. When income is rolled up, this should achieve a compou ...

... yield and aims to have as many A shares as possible (we are sensitive to valuations). These are low-risk, property bonds which usually grow distributions by 5% p.a. The portfolio aims to deliver a yield in the region of 8%-9%, growing at 5% p.a. When income is rolled up, this should achieve a compou ...

Performance as of 10/31/2014

... NAV. Some performance results reflect expense subsidies and waivers in effect during certain periods. Absent these waivers, results would have been less favorable. Risks: There is no guarantee that the funds will reach their objective. An investment in the Funds is subject to risk including the poss ...

... NAV. Some performance results reflect expense subsidies and waivers in effect during certain periods. Absent these waivers, results would have been less favorable. Risks: There is no guarantee that the funds will reach their objective. An investment in the Funds is subject to risk including the poss ...

Pensions Investment Sub 080512 Appendix A to Previous Part 1

... considered given exposure within the above mandates. Adding complexity to the investment strategy as noted above leads us to believe that, whilst the introduction of property to the investment strategy is not unreasonable, there are other demands on the governance budget that should take precedence ...

... considered given exposure within the above mandates. Adding complexity to the investment strategy as noted above leads us to believe that, whilst the introduction of property to the investment strategy is not unreasonable, there are other demands on the governance budget that should take precedence ...

The benefits of private equity investment

... model is that we would expect to see much faster revenue growth in smaller companies in the funds portfolio than in larger companies. While there may be a general expectation that successful smaller companies can enjoy higher growth rates than larger ones, as they are expanding off a low base, in th ...

... model is that we would expect to see much faster revenue growth in smaller companies in the funds portfolio than in larger companies. While there may be a general expectation that successful smaller companies can enjoy higher growth rates than larger ones, as they are expanding off a low base, in th ...

Download attachment

... Tech stocks have taken a beating the past several weeks, so many Islamic equity funds might not do so well in the second quarter. But there are plenty of Muslim-targeted investment alternatives -- funds based on commodities, hedge funds, guaranteed-return funds and Islamic leasing funds, for example ...

... Tech stocks have taken a beating the past several weeks, so many Islamic equity funds might not do so well in the second quarter. But there are plenty of Muslim-targeted investment alternatives -- funds based on commodities, hedge funds, guaranteed-return funds and Islamic leasing funds, for example ...

Impact of market changes on business

... Impact of market changes on business Panel Discussion "How do things look in the year 2001? I think it's going to be slow, but good. You can't transform yourself very quickly if you want to do it right. But the demise of the dot-coms is certainly going to help traditional value companies. "We're st ...

... Impact of market changes on business Panel Discussion "How do things look in the year 2001? I think it's going to be slow, but good. You can't transform yourself very quickly if you want to do it right. But the demise of the dot-coms is certainly going to help traditional value companies. "We're st ...

Multinational Financial Management 896N1

... should be forward looking since it is being used to calculate expected returns ...

... should be forward looking since it is being used to calculate expected returns ...

Blue Chip Fund Changes Name to Focus Growth Fund

... The prospectus can be found at www.calamos.com/FundInvestor/FundLit/. The principal risks of investing in the Calamos Focus Growth Fund include: equity securities risk, growth stock risk, value stock risk, foreign securities risk and portfolio selection risk. As a result of political or economic ins ...

... The prospectus can be found at www.calamos.com/FundInvestor/FundLit/. The principal risks of investing in the Calamos Focus Growth Fund include: equity securities risk, growth stock risk, value stock risk, foreign securities risk and portfolio selection risk. As a result of political or economic ins ...

Private equity

In finance, private equity is an asset class consisting of equity securities and debt in operating companies that are not publicly traded on a stock exchange.A private equity investment will generally be made by a private equity firm, a venture capital firm or an angel investor. Each of these categories of investor has its own set of goals, preferences and investment strategies; however, all provide working capital to a target company to nurture expansion, new-product development, or restructuring of the company’s operations, management, or ownership.Bloomberg Businessweek has called private equity a rebranding of leveraged-buyout firms after the 1980s. Common investment strategies in private equity include: leveraged buyouts, venture capital, growth capital, distressed investments and mezzanine capital. In a typical leveraged-buyout transaction, a private-equity firm buys majority control of an existing or mature firm. This is distinct from a venture-capital or growth-capital investment, in which the investors (typically venture-capital firms or angel investors) invest in young, growing or emerging companies, and rarely obtain majority control.Private equity is also often grouped into a broader category called private capital, generally used to describe capital supporting any long-term, illiquid investment strategy.