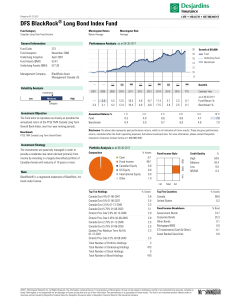

DFS BlackRock® Long Bond Index Fund

... ©2017. Morningstar Research Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Morningstar is not responsible for any damages or losses arising from any use ...

... ©2017. Morningstar Research Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Morningstar is not responsible for any damages or losses arising from any use ...

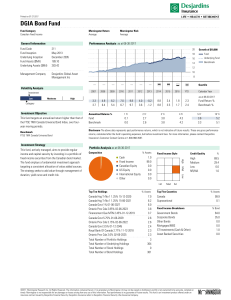

Credit

... The material contained herein has been prepared from sources we believe to be reliable, but is provided without any representation as to accuracy or completeness. This material does not purport to be a complete analysis of the securities, companies or industries involved. This material is published ...

... The material contained herein has been prepared from sources we believe to be reliable, but is provided without any representation as to accuracy or completeness. This material does not purport to be a complete analysis of the securities, companies or industries involved. This material is published ...

Cost of Capital Corporations often use different costs of capital for

... average cost of capital (WACC) were used as the hurdle rate for all divisions, would more conservative or riskier divisions get a greater share of capital? Explain your reasoning. What are two techniques that you could use to develop a rough estimate for each division’s cost of capital? Your initial ...

... average cost of capital (WACC) were used as the hurdle rate for all divisions, would more conservative or riskier divisions get a greater share of capital? Explain your reasoning. What are two techniques that you could use to develop a rough estimate for each division’s cost of capital? Your initial ...

April 2015 Factsheet - Electric and General Investment Fund

... The company has one product in Phase III trials for cat allergies, with results available in the first half of 2016. In addition, two Phase IIB trials are underway for ragweed and house dust mite. Phase III trials are planned for all products by 2017. These products are commercially attractive. In t ...

... The company has one product in Phase III trials for cat allergies, with results available in the first half of 2016. In addition, two Phase IIB trials are underway for ragweed and house dust mite. Phase III trials are planned for all products by 2017. These products are commercially attractive. In t ...

Chapter 17 INVESTMENTS Investment in Debt

... Different motivations for investing: To earn a high rate of return. To secure certain operating or financing arrangements with another company. Companies account for investments based on the type of security (debt or equity) and their intent with respect to the investment. ...

... Different motivations for investing: To earn a high rate of return. To secure certain operating or financing arrangements with another company. Companies account for investments based on the type of security (debt or equity) and their intent with respect to the investment. ...

Waiting can be a winning strategy

... one of the secrets behind his success. Of course, one must have a reason for waiting, and not wait just for the sake of it. Mr Buffett is a long-term value investor. He spots companies whose share prices do not reflect their true value, as they might be unloved by mainstream investors or they could ...

... one of the secrets behind his success. Of course, one must have a reason for waiting, and not wait just for the sake of it. Mr Buffett is a long-term value investor. He spots companies whose share prices do not reflect their true value, as they might be unloved by mainstream investors or they could ...

Private Wealth Adviser United Capital Secures $38 Million in Growth

... adviser and customer base through acquisitions, adviser recruitment, and organic growth initiatives, and it was important that any new equity partner would share our vision.” “We talked to many different potential equity investors, all of which are high-quality firms. What set Sageview apart was the ...

... adviser and customer base through acquisitions, adviser recruitment, and organic growth initiatives, and it was important that any new equity partner would share our vision.” “We talked to many different potential equity investors, all of which are high-quality firms. What set Sageview apart was the ...

Creating a Donor-Advised Fund or Scholarship Fund Contributions

... during the month will typically be "swept" out of our money market funds and invested during the first week of each month and will begin to accrue gain and loss after the first full month that funds have been deposited. Please keep in mind that this is our target timeline only, not a guaranteed one. ...

... during the month will typically be "swept" out of our money market funds and invested during the first week of each month and will begin to accrue gain and loss after the first full month that funds have been deposited. Please keep in mind that this is our target timeline only, not a guaranteed one. ...

Sizing up active small-cap - Charles Schwab Investment Management

... An integrated investment approach may offer the potential for consistent returns. SWSCX’s integrated investment approach is focused on delivering consistent performance through stock selection. This stands in contrast to active strategies that rely upon a top-down approach and take on risks at the ...

... An integrated investment approach may offer the potential for consistent returns. SWSCX’s integrated investment approach is focused on delivering consistent performance through stock selection. This stands in contrast to active strategies that rely upon a top-down approach and take on risks at the ...

Meeting Highlights - Private Company Financial Reporting Committee

... for utilizing the practicability exception rather than the equity method of accounting if the reporting entity does not have significant influence. For investments in which a reporting entity clearly has significant influence, the equity method is appropriate. Common situations often encountered in ...

... for utilizing the practicability exception rather than the equity method of accounting if the reporting entity does not have significant influence. For investments in which a reporting entity clearly has significant influence, the equity method is appropriate. Common situations often encountered in ...

Reverse Takeovers Purchasing a Shell

... GREATER ACCESS TO CAPITAL GREATER VALUATION IN RAISING CAPITAL ...

... GREATER ACCESS TO CAPITAL GREATER VALUATION IN RAISING CAPITAL ...

Investment Proposal - Morgan Stanley Sustainable Investing

... *e2 is a social enterprise based on the GIIRS definition. Specifically it plans to have more than 25% of end beneficiaries from an underserved population and to alleviate poverty through our supply chain. ...

... *e2 is a social enterprise based on the GIIRS definition. Specifically it plans to have more than 25% of end beneficiaries from an underserved population and to alleviate poverty through our supply chain. ...

San Francisco Capital Projects $750K to $5M Facility Investment

... Capital Projects $750K to $5M Facility Investment Needs Fiscal Year: Multi Project Description • Includes smaller projects, under $5 million each, that may not yet be defined. • Provides minor improvements to building infrastructures. Project Scope Summary ASF Summary of Budget by Fund Type External ...

... Capital Projects $750K to $5M Facility Investment Needs Fiscal Year: Multi Project Description • Includes smaller projects, under $5 million each, that may not yet be defined. • Provides minor improvements to building infrastructures. Project Scope Summary ASF Summary of Budget by Fund Type External ...

MFIN5600 Practice questions Chapter 1 1. Characterize each of the

... 1. Characterize each of the investment objectives given below as one of the following: an absolute risk objective, a relative risk objective, an absolute return objective, or a relative return objective. a) Achieve a rate of return of 8% a year. b) Limit the standard deviation of portfolio returns t ...

... 1. Characterize each of the investment objectives given below as one of the following: an absolute risk objective, a relative risk objective, an absolute return objective, or a relative return objective. a) Achieve a rate of return of 8% a year. b) Limit the standard deviation of portfolio returns t ...

Document

... The firms' financing and operating decisions are independent. In particular, no agency costs (managers maximize firm value) Individuals can undertake the same financial transactions as the firms and at the same prices (e.g. borrow at the same interest rate) ...

... The firms' financing and operating decisions are independent. In particular, no agency costs (managers maximize firm value) Individuals can undertake the same financial transactions as the firms and at the same prices (e.g. borrow at the same interest rate) ...

Introduction to Financial Management

... for another two years. It has no book and market values. The maintenance cost for this old machine is $20,000 every year. Now a new packaging machine is available at the price of $ 300,000, which is depreciated in three years. If the new packaging machine is used, the maintenance cost is $10,000 eve ...

... for another two years. It has no book and market values. The maintenance cost for this old machine is $20,000 every year. Now a new packaging machine is available at the price of $ 300,000, which is depreciated in three years. If the new packaging machine is used, the maintenance cost is $10,000 eve ...

BALANCE SHEET RESTRUCTURING AND INVESTMENT 1

... between 1989/90 and 1991/92. Initially, the corporate sector’s demand for both new debt and equity was reduced. The increase in debt of the listed corporate sector in 1989/90 was half that of the previous year. It was negligible the following year, and firms actually reduced debt outstanding in 1991 ...

... between 1989/90 and 1991/92. Initially, the corporate sector’s demand for both new debt and equity was reduced. The increase in debt of the listed corporate sector in 1989/90 was half that of the previous year. It was negligible the following year, and firms actually reduced debt outstanding in 1991 ...

1 The Equity Home Bias: Why do Investors Prefer Domestic

... transaction costs and maximize benefits. A compelling explanation for the equity home bias has been the idea of information asymmetry. The data and French and Poterba examined in 1991 to make their claim about the existence of the home bias were collected before the widespread use of the Internet be ...

... transaction costs and maximize benefits. A compelling explanation for the equity home bias has been the idea of information asymmetry. The data and French and Poterba examined in 1991 to make their claim about the existence of the home bias were collected before the widespread use of the Internet be ...

Fourth Week Study Guide

... 1. Distinguish between Accounting and Finance Functions. Accounting records and reports firm’s financial transactions. Finance manages firm’s capital structure. 2. Accounting function: Responsible for (a) compliance with tax and other financial laws and regulations and (b) providing consistent finan ...

... 1. Distinguish between Accounting and Finance Functions. Accounting records and reports firm’s financial transactions. Finance manages firm’s capital structure. 2. Accounting function: Responsible for (a) compliance with tax and other financial laws and regulations and (b) providing consistent finan ...

Sample Powerpoint Slides

... – Tax Equity: Typically will take a major stake in the project for the first 5 years (to maximize depreciation and tax benefits) and then become a background player for remaining ~10 or so years – Main equity investors at this point are: Banks and insurance companies (and Google) ...

... – Tax Equity: Typically will take a major stake in the project for the first 5 years (to maximize depreciation and tax benefits) and then become a background player for remaining ~10 or so years – Main equity investors at this point are: Banks and insurance companies (and Google) ...

Private equity

In finance, private equity is an asset class consisting of equity securities and debt in operating companies that are not publicly traded on a stock exchange.A private equity investment will generally be made by a private equity firm, a venture capital firm or an angel investor. Each of these categories of investor has its own set of goals, preferences and investment strategies; however, all provide working capital to a target company to nurture expansion, new-product development, or restructuring of the company’s operations, management, or ownership.Bloomberg Businessweek has called private equity a rebranding of leveraged-buyout firms after the 1980s. Common investment strategies in private equity include: leveraged buyouts, venture capital, growth capital, distressed investments and mezzanine capital. In a typical leveraged-buyout transaction, a private-equity firm buys majority control of an existing or mature firm. This is distinct from a venture-capital or growth-capital investment, in which the investors (typically venture-capital firms or angel investors) invest in young, growing or emerging companies, and rarely obtain majority control.Private equity is also often grouped into a broader category called private capital, generally used to describe capital supporting any long-term, illiquid investment strategy.