Equity Management

... Partial Redemption or discounting Members get paid discounted value of future equity redemption, but have difficulty on choosing discount rate. Income tax consequences are not well established. ...

... Partial Redemption or discounting Members get paid discounted value of future equity redemption, but have difficulty on choosing discount rate. Income tax consequences are not well established. ...

Assessment of the Non-Observed Economy in Albania

... largely completed - On the supply side from Venture Capital industry Informal investors and Governmental sources - On the demand side from SME surveys conducted ...

... largely completed - On the supply side from Venture Capital industry Informal investors and Governmental sources - On the demand side from SME surveys conducted ...

Presentation (PowerPoint Only)

... corporate resources come mainly from suppliers and commercial banks credit. Credit to the Private Sector (% of GDP) ...

... corporate resources come mainly from suppliers and commercial banks credit. Credit to the Private Sector (% of GDP) ...

DEBT - Association for Financial Professionals of Arizona

... *Securities offered through UMB Financial Services, Inc. member FINRA, SIPC, or the Investment Banking Division of UMB Bank, n.a. Insurance products offered through UMB Insurance, Inc. You may not have an account with all of these entities. Contact your UMB representative if ...

... *Securities offered through UMB Financial Services, Inc. member FINRA, SIPC, or the Investment Banking Division of UMB Bank, n.a. Insurance products offered through UMB Insurance, Inc. You may not have an account with all of these entities. Contact your UMB representative if ...

The Creation of an E-Zone for Europe`s Innovators, Entrepreneurs

... All of the money in the world will not help if Europe does not change this situation and does not do so immediately. The private sector and private investors will not invest if the conditions for success are not at hand and if they cannot be certain that the companies they invest in have the best ch ...

... All of the money in the world will not help if Europe does not change this situation and does not do so immediately. The private sector and private investors will not invest if the conditions for success are not at hand and if they cannot be certain that the companies they invest in have the best ch ...

From shareholder value to private equity – the changing

... of governance of firms, which gained momentum in the US and the UK in the 1990s and became the predominant model for reform promoted by international organisations such as the OECD and the World Bank. The shareholder value model – by opposition to the stakeholder approach – encourages financialisati ...

... of governance of firms, which gained momentum in the US and the UK in the 1990s and became the predominant model for reform promoted by international organisations such as the OECD and the World Bank. The shareholder value model – by opposition to the stakeholder approach – encourages financialisati ...

Chapter 22 File

... Investment of funds: predominantly loans and fixedincome securities Active in securitized loan and asset markets Not active in equity except in trust function ...

... Investment of funds: predominantly loans and fixedincome securities Active in securitized loan and asset markets Not active in equity except in trust function ...

Long-Term Capital Management

... – Companies can enter into interest rate swaps at lower cost than borrowings from government – Implied government had higher likelihood of default on bonds than Italian companies with high credit ratings of similar duration – Trade: traded Libor payments for Treasury (long treasuries), then received ...

... – Companies can enter into interest rate swaps at lower cost than borrowings from government – Implied government had higher likelihood of default on bonds than Italian companies with high credit ratings of similar duration – Trade: traded Libor payments for Treasury (long treasuries), then received ...

CHALLENGES IN PRIVATE STRUCTURE INFRASTRUCTURE

... Pune had high levels of unaccounted water, intermittent supply, low pressure, limited sewage treatment, rising river pollution and need to extend services to include an additional 0.8 million inhabitants. A water supply and sanitation project with private investment was to remedy deficiencies and m ...

... Pune had high levels of unaccounted water, intermittent supply, low pressure, limited sewage treatment, rising river pollution and need to extend services to include an additional 0.8 million inhabitants. A water supply and sanitation project with private investment was to remedy deficiencies and m ...

Did you notice - T3 Equity Labs LLC

... over the next two years. •Institutions are hoarding cash, Bond dealers are setting higher rates on variable bonds, the pool of banks is shrinking! •UBS AG, the second biggest originator in the market for a decade, said in May it was quitting the business. •Lehman Brothers Holdings Inc., the 7th larg ...

... over the next two years. •Institutions are hoarding cash, Bond dealers are setting higher rates on variable bonds, the pool of banks is shrinking! •UBS AG, the second biggest originator in the market for a decade, said in May it was quitting the business. •Lehman Brothers Holdings Inc., the 7th larg ...

Birla Sun Life Focused Equity Fund - Series 4.cdr

... 3. Over next 5 years, stable political regime with key policy initiatives by the central government would aid revival in GDP growth. Therefore we believe there is a strong potential upside from current levels on a 3 year basis. We believe the GDP growth can average 6.5% p.a. over that period and wit ...

... 3. Over next 5 years, stable political regime with key policy initiatives by the central government would aid revival in GDP growth. Therefore we believe there is a strong potential upside from current levels on a 3 year basis. We believe the GDP growth can average 6.5% p.a. over that period and wit ...

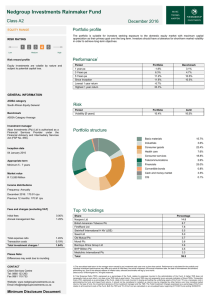

Fact sheets - Nedgroup Investments

... The JSE All Share Index recorded a gain of 1.0% in December and 2.6% for the 2016 calendar year. For the month of December, Financials gained 3.5% and Industrials +1.8%. Resources lagged in December (-3.6%) but still ended the year well ahead of the other major sectors in performance terms. Our hold ...

... The JSE All Share Index recorded a gain of 1.0% in December and 2.6% for the 2016 calendar year. For the month of December, Financials gained 3.5% and Industrials +1.8%. Resources lagged in December (-3.6%) but still ended the year well ahead of the other major sectors in performance terms. Our hold ...

The Benefits of High-Quality in an Uncertain Environment

... The U.S. presidential election that commanded so much attention across the globe over the last year has now concluded. The election of Donald Trump came as a surprise to many, just as had been the case leading up to the Brexit referendum. Both votes have come to be seen as expressions of populist di ...

... The U.S. presidential election that commanded so much attention across the globe over the last year has now concluded. The election of Donald Trump came as a surprise to many, just as had been the case leading up to the Brexit referendum. Both votes have come to be seen as expressions of populist di ...

The balance sheet: Telling a balanced story

... By using debt, companies can leverage their profits. The higher the debt level, the riskier the profit stream. If operating profits rise or fall 15%, a company completely financed by equity will tend to see per-share profits rise or fall 15%. But what if a company borrows to buy back some of its sha ...

... By using debt, companies can leverage their profits. The higher the debt level, the riskier the profit stream. If operating profits rise or fall 15%, a company completely financed by equity will tend to see per-share profits rise or fall 15%. But what if a company borrows to buy back some of its sha ...

UNIVERSITY of OKLAHOMA Retirement Plans Management

... First discussion point by Weigthman and Kuwitzky would be to determine which two of the active companies could move on. Taylor noted JP Morgan has a 15bps revenue share and committee had expressed interest in the past on moving away from that type of structure. On measuring performance and basis poi ...

... First discussion point by Weigthman and Kuwitzky would be to determine which two of the active companies could move on. Taylor noted JP Morgan has a 15bps revenue share and committee had expressed interest in the past on moving away from that type of structure. On measuring performance and basis poi ...

2 January 2008

... Partners, LLC. About HarbourVest Partners, LLC: HarbourVest is an independent global private equity investment firm and an SEC registered investment advisor, providing vehicles for institutional investors to invest in the venture capital and buyout markets in the U.S., Europe, and elsewhere through ...

... Partners, LLC. About HarbourVest Partners, LLC: HarbourVest is an independent global private equity investment firm and an SEC registered investment advisor, providing vehicles for institutional investors to invest in the venture capital and buyout markets in the U.S., Europe, and elsewhere through ...

Product Brochure - Pramerica Mutual Fund

... Mandated three year lock-in ensures that you do not react to market swings and continue to remain invested. Tax free dividend No tax on long-term capital gains ...

... Mandated three year lock-in ensures that you do not react to market swings and continue to remain invested. Tax free dividend No tax on long-term capital gains ...

Investing During a Non-Normal Market Environment

... the long term. Investing in the stock market has now become less about being patient and employing a rational approach to allocating capital, and more about outsmarting others as a means to make fast money. Rigorously analyzed, the environment has changed in such a fundamental way that adopting the ...

... the long term. Investing in the stock market has now become less about being patient and employing a rational approach to allocating capital, and more about outsmarting others as a means to make fast money. Rigorously analyzed, the environment has changed in such a fundamental way that adopting the ...

What annual returns do investors expect?

... of those primarily investing in stocks in the future, over two thirds (69%) plan to invest in Canadian stocks ...

... of those primarily investing in stocks in the future, over two thirds (69%) plan to invest in Canadian stocks ...

1 - The North West Fund

... 3) Business Loan Fund, £35m, administered by FW Capital Ltd. Business Loan Fund is aimed at those businesses that can demonstrate a strong case for investment; which includes business plans to show growth and ability to service a loan. Loans can typically be repaid over 3.5 to 5 years. Security, suc ...

... 3) Business Loan Fund, £35m, administered by FW Capital Ltd. Business Loan Fund is aimed at those businesses that can demonstrate a strong case for investment; which includes business plans to show growth and ability to service a loan. Loans can typically be repaid over 3.5 to 5 years. Security, suc ...

MODEL ANSWERS TO FINANCIAL ECONOMICS (IOBM

... Sinking fund This is an annuity invested in order to meet a known commitment at some future date. Common uses f sinking fund include repayment of debt or provision of funds to purchase a new asset when the existing one is fully depreciated (ii) Hedge This is a financial strategy that offsets the ris ...

... Sinking fund This is an annuity invested in order to meet a known commitment at some future date. Common uses f sinking fund include repayment of debt or provision of funds to purchase a new asset when the existing one is fully depreciated (ii) Hedge This is a financial strategy that offsets the ris ...

Innovative Financial Instruments and EU Blending

... public investment projects. However, they also provide the means to catalyse private investments – particularly by using more innovative financial instruments such as risk capital and guarantees. • Risk capital can help address the lack of equity capital in some countries, particularly for new secto ...

... public investment projects. However, they also provide the means to catalyse private investments – particularly by using more innovative financial instruments such as risk capital and guarantees. • Risk capital can help address the lack of equity capital in some countries, particularly for new secto ...

Keeping Up with the (Paul Tudor) Joneses: a Hedge

... FIRST OF (W)ALL (OF TEXT) Hedge funds are private partnerships in which the manager or general partner (GP) has a significant personal stake in the fund and is free to operate in a variety of markets and to utilize investments and strategies with variable long/short exposures and degrees of leverag ...

... FIRST OF (W)ALL (OF TEXT) Hedge funds are private partnerships in which the manager or general partner (GP) has a significant personal stake in the fund and is free to operate in a variety of markets and to utilize investments and strategies with variable long/short exposures and degrees of leverag ...

Private equity

In finance, private equity is an asset class consisting of equity securities and debt in operating companies that are not publicly traded on a stock exchange.A private equity investment will generally be made by a private equity firm, a venture capital firm or an angel investor. Each of these categories of investor has its own set of goals, preferences and investment strategies; however, all provide working capital to a target company to nurture expansion, new-product development, or restructuring of the company’s operations, management, or ownership.Bloomberg Businessweek has called private equity a rebranding of leveraged-buyout firms after the 1980s. Common investment strategies in private equity include: leveraged buyouts, venture capital, growth capital, distressed investments and mezzanine capital. In a typical leveraged-buyout transaction, a private-equity firm buys majority control of an existing or mature firm. This is distinct from a venture-capital or growth-capital investment, in which the investors (typically venture-capital firms or angel investors) invest in young, growing or emerging companies, and rarely obtain majority control.Private equity is also often grouped into a broader category called private capital, generally used to describe capital supporting any long-term, illiquid investment strategy.

![History Sheet Information entered by [ ]](http://s1.studyres.com/store/data/008202941_1-745098000e8c3b4ca6ac471bb8585e75-300x300.png)