DESJARDINS CANADIAN EQUITY VALUE FUND

... The Desjardins Funds are not guaranteed, their value fluctuates frequently and their past performance is not indicative of their future returns. The indicated rates of return are the historical annual compounded total returns as indicated the date of the present document including changes in securit ...

... The Desjardins Funds are not guaranteed, their value fluctuates frequently and their past performance is not indicative of their future returns. The indicated rates of return are the historical annual compounded total returns as indicated the date of the present document including changes in securit ...

Bloomberg 101

... GO Activates all commands MENU Return to previous menu PAGE UP/PAGE DOWN Navigate between pages HELP From whatever screen you are on Type: GRAB E-mail your graph or chart

Type: LAST Your command history

...

... GO Activates all commands MENU Return to previous menu PAGE UP/PAGE DOWN Navigate between pages HELP From whatever screen you are on Type: GRAB

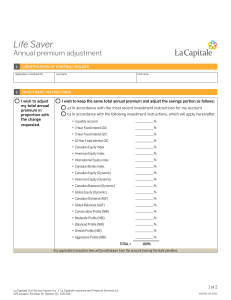

IND001E Life Saver - Annual Premium Adjustment

... generated by these accounts are tied to the performance of a market index or underlying fund, less any applicable management fees. The value of the market index or underlying fund fluctuates depending on the market value of the securities that make up the index or fund. The value of these accounts m ...

... generated by these accounts are tied to the performance of a market index or underlying fund, less any applicable management fees. The value of the market index or underlying fund fluctuates depending on the market value of the securities that make up the index or fund. The value of these accounts m ...

Form of Press Releases to be issued via the primary

... ($0.03) per share for reduction to NII for certain trust preferred securities ...

... ($0.03) per share for reduction to NII for certain trust preferred securities ...

Press release - PAI Partners

... countries, representing c. €41 billion in transaction value. PAI is characterized by its industrial approach to ownership combined with its sector-based organization. They provide the companies they own with the financial and strategic support required to pursue their development and enhance strateg ...

... countries, representing c. €41 billion in transaction value. PAI is characterized by its industrial approach to ownership combined with its sector-based organization. They provide the companies they own with the financial and strategic support required to pursue their development and enhance strateg ...

download

... economy seems headed for a double-dip recession, and the world is on edge over Iraq. Contrarian money managers say it's a great time to buy, but their opinions are suspect. Investment superhero Warren Buffett wrote in his annual letter to Berkshire Hathaway shareholders at the end of February that d ...

... economy seems headed for a double-dip recession, and the world is on edge over Iraq. Contrarian money managers say it's a great time to buy, but their opinions are suspect. Investment superhero Warren Buffett wrote in his annual letter to Berkshire Hathaway shareholders at the end of February that d ...

Factors which influence spot and forward rates

... Conglomerates - A financial services company such as a universal bank that is active in more than one sector of the financial services market e.g. life insurance, general insurance, health insurance, asset management, retail banking, wholesale banking, investment banking, etc. A key rationale for th ...

... Conglomerates - A financial services company such as a universal bank that is active in more than one sector of the financial services market e.g. life insurance, general insurance, health insurance, asset management, retail banking, wholesale banking, investment banking, etc. A key rationale for th ...

3rd Qtr. Investment Letter - Family Fiduciary Services, Inc.

... As most of you know, we have taken several steps over the last three months, which goes against the very core of our investment philosophy, which is to not attempt to time market direction. In the face of a once-in-a-lifetime event, we felt that sticking to this plan just didn’t make sense, as fear ...

... As most of you know, we have taken several steps over the last three months, which goes against the very core of our investment philosophy, which is to not attempt to time market direction. In the face of a once-in-a-lifetime event, we felt that sticking to this plan just didn’t make sense, as fear ...

Listed market could be the out for PE hotel investors Article

... assets. Within three to five years, or perhaps less, these companies will be looking to sell. But where is the exit? Time for some listed hotel companies? That was the question posed during a private equity panel at the Hotel Investment Conference Europe in London on Sept. 29. For panelist Ryan Prin ...

... assets. Within three to five years, or perhaps less, these companies will be looking to sell. But where is the exit? Time for some listed hotel companies? That was the question posed during a private equity panel at the Hotel Investment Conference Europe in London on Sept. 29. For panelist Ryan Prin ...

What effect has quantitative easing had on your share

... and related increases in rates may still be associ- ...

... and related increases in rates may still be associ- ...

Advanced Practicum in Investment Management (FBE453a and

... portfolio theory and practice, as well as behavioral finance. You will get to learn the analytical framework for the valuation of stocks and bonds, risk management, portfolio optimization, and performance attribution. You will be a real money manager and produce industry reports, company research re ...

... portfolio theory and practice, as well as behavioral finance. You will get to learn the analytical framework for the valuation of stocks and bonds, risk management, portfolio optimization, and performance attribution. You will be a real money manager and produce industry reports, company research re ...

MESSAGE TO INVESTORS Year 2003 in Review The year 2003

... spending continued at a robust pace, driven primarily by a low interest rate environment. In Canada, the Bank of Canada’s overnight rate remained in a fairly tight band, rising to as high as 3.25%, only to end the year where it started at 2.75%. In the United States, the federal funds rate was reduc ...

... spending continued at a robust pace, driven primarily by a low interest rate environment. In Canada, the Bank of Canada’s overnight rate remained in a fairly tight band, rising to as high as 3.25%, only to end the year where it started at 2.75%. In the United States, the federal funds rate was reduc ...

fin 394 14-venture captl fellows prog -nolen

... provided with an opportunity to apply these concepts in actual investment decisions and management of businesses. The course provides the student with an opportunity to integrate and apply the concepts from the major functional areas in business. Because the content varies each semester (later stage ...

... provided with an opportunity to apply these concepts in actual investment decisions and management of businesses. The course provides the student with an opportunity to integrate and apply the concepts from the major functional areas in business. Because the content varies each semester (later stage ...

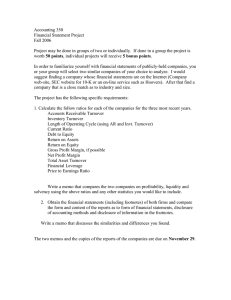

Accounting 350 Financial Statement Project Fall 2006

... Project may be done in groups of two or individually. If done in a group the project is worth 50 points, individual projects will receive 5 bonus points. In order to familiarize yourself with financial statements of publicly-held companies, you or your group will select two similar companies of your ...

... Project may be done in groups of two or individually. If done in a group the project is worth 50 points, individual projects will receive 5 bonus points. In order to familiarize yourself with financial statements of publicly-held companies, you or your group will select two similar companies of your ...

Overview • Equities enjoy strong returns as investors turn to risk

... holders must wait longer for a repayment of capital. The 10-year benchmark gilt index currently yields 2.27%, while the longest-dated conventional bond, which matures in 2060, yields 3.22%. But despite a higher headline rate, Andrew Humphries, Head of Investment Marketing at St. James’s Place, sugge ...

... holders must wait longer for a repayment of capital. The 10-year benchmark gilt index currently yields 2.27%, while the longest-dated conventional bond, which matures in 2060, yields 3.22%. But despite a higher headline rate, Andrew Humphries, Head of Investment Marketing at St. James’s Place, sugge ...

2001 Midterm (with answers)

... intermediate-stage firms with requirements for equipment that can be readily valued and redeployed if returned. The biotech, communciations, and computer industies are typical prospects for VL investors satisfying these requirements. Firms using VL financing gain relatively inexpensive access to cre ...

... intermediate-stage firms with requirements for equipment that can be readily valued and redeployed if returned. The biotech, communciations, and computer industies are typical prospects for VL investors satisfying these requirements. Firms using VL financing gain relatively inexpensive access to cre ...

Overview of Craft3 Powerpoint with information on

... A Learned and Shared Practice The skilled work of many hands over time triples positive impacts on local economies, the environment, and opportunity for the excluded. ...

... A Learned and Shared Practice The skilled work of many hands over time triples positive impacts on local economies, the environment, and opportunity for the excluded. ...

TEMPLETON GLOBAL SMALLER COMPANIES FUND

... base currency, include reinvested dividends and are net of management fees. Sales charges and other commissions, taxes and other relevant costs to be paid by an investor are not included in the calculations. Past performance is no guarantee of future performance. When investing in a fund denominated ...

... base currency, include reinvested dividends and are net of management fees. Sales charges and other commissions, taxes and other relevant costs to be paid by an investor are not included in the calculations. Past performance is no guarantee of future performance. When investing in a fund denominated ...

Gradually Regaining Ground 2011 Wharton Private Equity Review:

... Delaney noted. Moreover, “There are a lot of questions in the limited-partner community about whether the mega-model [for funds] is viable,” he pointed out. “We will need to see how investments made in the late 2000s play out.” Middle-market investors have greater flexibility when it comes to cashin ...

... Delaney noted. Moreover, “There are a lot of questions in the limited-partner community about whether the mega-model [for funds] is viable,” he pointed out. “We will need to see how investments made in the late 2000s play out.” Middle-market investors have greater flexibility when it comes to cashin ...

AC ALTERNATIVES® Equity Market Neutral

... The opinions expressed are those of the portfolio investment team and are no guarantee of the future performance of any American Century Investments portfolio. Statements regarding specific holdings represent personal views and compensation has not been received in connection with such views. This i ...

... The opinions expressed are those of the portfolio investment team and are no guarantee of the future performance of any American Century Investments portfolio. Statements regarding specific holdings represent personal views and compensation has not been received in connection with such views. This i ...

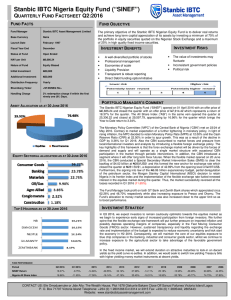

adviceworx old mutual inflation plus 3

... With effect from 1 January 2016, a new methodology in respect of the calculation of total expense ratios (TERs) was implemented by the unit trust industry. The key change in the methodology is that TERs used to be calculated on a rolling one-year basis, which has now moved to a rolling three-year ba ...

... With effect from 1 January 2016, a new methodology in respect of the calculation of total expense ratios (TERs) was implemented by the unit trust industry. The key change in the methodology is that TERs used to be calculated on a rolling one-year basis, which has now moved to a rolling three-year ba ...

5vcforum - Attica Ventures

... correlation between profits and return on investments on Stock Exchanges and investments in non-listed companies (investments made by VC funds). Small investments in PE Funds compared to overall cash available and spread across many Funds further reduce risk. ...

... correlation between profits and return on investments on Stock Exchanges and investments in non-listed companies (investments made by VC funds). Small investments in PE Funds compared to overall cash available and spread across many Funds further reduce risk. ...

Private equity

In finance, private equity is an asset class consisting of equity securities and debt in operating companies that are not publicly traded on a stock exchange.A private equity investment will generally be made by a private equity firm, a venture capital firm or an angel investor. Each of these categories of investor has its own set of goals, preferences and investment strategies; however, all provide working capital to a target company to nurture expansion, new-product development, or restructuring of the company’s operations, management, or ownership.Bloomberg Businessweek has called private equity a rebranding of leveraged-buyout firms after the 1980s. Common investment strategies in private equity include: leveraged buyouts, venture capital, growth capital, distressed investments and mezzanine capital. In a typical leveraged-buyout transaction, a private-equity firm buys majority control of an existing or mature firm. This is distinct from a venture-capital or growth-capital investment, in which the investors (typically venture-capital firms or angel investors) invest in young, growing or emerging companies, and rarely obtain majority control.Private equity is also often grouped into a broader category called private capital, generally used to describe capital supporting any long-term, illiquid investment strategy.