US High Yield Fund

... The Fund seeks both high current income and capital appreciation by investing in a diversified portfolio of high-yield bonds from U.S. corporate issuers. The Philosophy The Fund is managed according to a disciplined philosophy, which emphasizes diversification and extensive proprietary and public cr ...

... The Fund seeks both high current income and capital appreciation by investing in a diversified portfolio of high-yield bonds from U.S. corporate issuers. The Philosophy The Fund is managed according to a disciplined philosophy, which emphasizes diversification and extensive proprietary and public cr ...

PORT MELBOURNE PRIMARY SCHOOL NO 3932

... required to meet budgeted operating expenses (Cash Reserves), are to be invested in short term, interest bearing, cash accounts with a bank regulated by the Australian Federal Government. ...

... required to meet budgeted operating expenses (Cash Reserves), are to be invested in short term, interest bearing, cash accounts with a bank regulated by the Australian Federal Government. ...

Answers to Concepts Review and Critical Thinking Questions

... acting in the interests of the shareholders by fighting the offer. Since current managers often lose their jobs when the corporation is acquired, poorly monitored managers have an incentive to fight corporate takeovers in situations such as this. 13. We would expect agency problems to be less severe ...

... acting in the interests of the shareholders by fighting the offer. Since current managers often lose their jobs when the corporation is acquired, poorly monitored managers have an incentive to fight corporate takeovers in situations such as this. 13. We would expect agency problems to be less severe ...

Media - Profile Financial Services

... It's a hard time to make a buck. You can't make a decent return sitting in cash anymore; bonds are delivering historically low rewards – with government bonds in much of the world generating a negative yield for the first time in living memory – and the outlook for stocks is uncertain. But diversify ...

... It's a hard time to make a buck. You can't make a decent return sitting in cash anymore; bonds are delivering historically low rewards – with government bonds in much of the world generating a negative yield for the first time in living memory – and the outlook for stocks is uncertain. But diversify ...

Why alternative asset classes offer attractive returns

... structure to make private equity an investable asset class for non-institutional investors. “The flexible structure facilitates investment in less liquid and often longer term asset classes. This opens up these asset classes and their attractive historic return profile to investors that may previous ...

... structure to make private equity an investable asset class for non-institutional investors. “The flexible structure facilitates investment in less liquid and often longer term asset classes. This opens up these asset classes and their attractive historic return profile to investors that may previous ...

Year-end accounting balance sheet. Current Assets $500,000

... annum (thereafter into the indefinite future). You do not expect that “other” operating expenses will change. You do not expect cost of goods sold as a fraction of sales to change. With this increase in future sales, will ABC’s EBITDA margin increase or decrease? This change indicates that sales are ...

... annum (thereafter into the indefinite future). You do not expect that “other” operating expenses will change. You do not expect cost of goods sold as a fraction of sales to change. With this increase in future sales, will ABC’s EBITDA margin increase or decrease? This change indicates that sales are ...

Watch for Private Equity Inflows into

... existing owners are more eager, perhaps, to restructure their businesses. Control and buyout transactions, not typical of most emerging market private equity, do happen. The opportunities there are very strong. Similarly, if you’re talking about growth equity [such as] making minority investments in ...

... existing owners are more eager, perhaps, to restructure their businesses. Control and buyout transactions, not typical of most emerging market private equity, do happen. The opportunities there are very strong. Similarly, if you’re talking about growth equity [such as] making minority investments in ...

Venture Capital Market in Poland and Polish government activities

... At the same time (in 2005) total investments made by private equity (PE) including venture capital investments in Poland amounted to EUR 154 million, increased by 20% compared to 2004. The average seize of PE/VC investment grew from EUR 3 million to EUR 4,8 million in 2005. It shows that the number ...

... At the same time (in 2005) total investments made by private equity (PE) including venture capital investments in Poland amounted to EUR 154 million, increased by 20% compared to 2004. The average seize of PE/VC investment grew from EUR 3 million to EUR 4,8 million in 2005. It shows that the number ...

BEF Monthly Report-Master copy_Sep_11.xlsx

... Balanced investment policy that aims at long term capital gains with minimum possible risk to accommodate the fund's nature. Fund's manager may invest in short and mid-term money market/debt instruments until proper investment opportunities arise. ...

... Balanced investment policy that aims at long term capital gains with minimum possible risk to accommodate the fund's nature. Fund's manager may invest in short and mid-term money market/debt instruments until proper investment opportunities arise. ...

SECTOR REPORT Islamic Asset Management — Asia vs Arabia

... among all applications of asset management — whether for individual or institutional investors — is the ability to sell an asset when needed. In no area of asset management does one commonly find illiquid, long-term investments except as niche products, comprising a small minority of total investmen ...

... among all applications of asset management — whether for individual or institutional investors — is the ability to sell an asset when needed. In no area of asset management does one commonly find illiquid, long-term investments except as niche products, comprising a small minority of total investmen ...

PRIVATE EQUITY PRIMER

... limited partnership interests. Although some firms specialize in buying secondary interests in limited partnerships, such firms generally demand an illiquidity discount that cuts into the returns of the seller. Depending on how skillfully the general partner invests, limited partners begin receiving ...

... limited partnership interests. Although some firms specialize in buying secondary interests in limited partnerships, such firms generally demand an illiquidity discount that cuts into the returns of the seller. Depending on how skillfully the general partner invests, limited partners begin receiving ...

private equity in mining - Berwin Leighton Paisner

... investment was being increased. The average size of the investment where there was an increased stake was $19.7m and again for the deals reported these were often investments in publicly listed companies. The additional percentage by which the funds’ holdings increased ranged from 0% ...

... investment was being increased. The average size of the investment where there was an increased stake was $19.7m and again for the deals reported these were often investments in publicly listed companies. The additional percentage by which the funds’ holdings increased ranged from 0% ...

This publication is intended for general guidance and represents our

... Trusts, who may have favoured buy-out transactions (where they provide an exit to existing shareholders), have been forced to re-focus on growth capital transactions by changes in law that took effect in November 2015. The market for growth capital has been expanded by the creation of the Business G ...

... Trusts, who may have favoured buy-out transactions (where they provide an exit to existing shareholders), have been forced to re-focus on growth capital transactions by changes in law that took effect in November 2015. The market for growth capital has been expanded by the creation of the Business G ...

Firms and Financial Markets

... • Hedge funds are similar to mutual funds but they tend to take more risk and are generally open only to high net worth investors. • Management fees also tend to be higher for hedge funds and most funds include an incentive fee based on the fund’s overall performance, which typically runs at 20% of ...

... • Hedge funds are similar to mutual funds but they tend to take more risk and are generally open only to high net worth investors. • Management fees also tend to be higher for hedge funds and most funds include an incentive fee based on the fund’s overall performance, which typically runs at 20% of ...

The market environment for 2015

... A two-pronged headwind to economic growth is the U.S. government debt. The economy has seen significant growth over the past decade due to lower tax rates. Tax rates will most likely increase in the U.S. as there is a strong need for the government to get its fiscal house in order by reducing the na ...

... A two-pronged headwind to economic growth is the U.S. government debt. The economy has seen significant growth over the past decade due to lower tax rates. Tax rates will most likely increase in the U.S. as there is a strong need for the government to get its fiscal house in order by reducing the na ...

Quarterly Investment Letter

... 54 which is the highest level in over 4 years. Economic growth could be as high as 1.5% in 2014 as the latest consensus predicts and maybe higher next year if this development continues. Researchers from Gavekal further point out that as the Eurozone policy has become less austere and even allows fo ...

... 54 which is the highest level in over 4 years. Economic growth could be as high as 1.5% in 2014 as the latest consensus predicts and maybe higher next year if this development continues. Researchers from Gavekal further point out that as the Eurozone policy has become less austere and even allows fo ...

About Our Private Investment Benchmarks

... investment managers with a way to measure their investment performance against funds in the same asset class and vintage year. In addition to releasing them to the public, Cambridge Associates utilizes the benchmarks when measuring client performance and in evaluating manager performance. 3. What is ...

... investment managers with a way to measure their investment performance against funds in the same asset class and vintage year. In addition to releasing them to the public, Cambridge Associates utilizes the benchmarks when measuring client performance and in evaluating manager performance. 3. What is ...

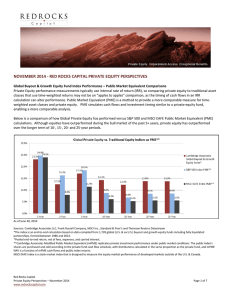

NOVEMBER 2014 - RED ROCKS CAPITAL PRIVATE EQUITY PERSPECTIVES

... minority equity funds specializing in mid-market transactions. The company plays an active role in supporting a company’s development through board representation and participation in key decisions. The management considers flexibility a key to their approach, investing across capital structures fro ...

... minority equity funds specializing in mid-market transactions. The company plays an active role in supporting a company’s development through board representation and participation in key decisions. The management considers flexibility a key to their approach, investing across capital structures fro ...

What can be learned from the banking crisis

... The loans given to homeowners in the US – and that ended up as mortgaged-backed securities and collateralised debt obligations – are lemon products. In America higher rates of indebtedness are more common than in Germany. But the banks do not have the same claims to the private assets or income of h ...

... The loans given to homeowners in the US – and that ended up as mortgaged-backed securities and collateralised debt obligations – are lemon products. In America higher rates of indebtedness are more common than in Germany. But the banks do not have the same claims to the private assets or income of h ...

October 2, 2012 Global equity markets generally performed well in

... Canadian and US equity markets have generated positive annual, compound total returns of 5.5% and 13.2% respectively. Our view is that equity investors have generally been discounting (expecting) very little economic growth and possibly even a mild recession? As a result, even tepid GDP and corporat ...

... Canadian and US equity markets have generated positive annual, compound total returns of 5.5% and 13.2% respectively. Our view is that equity investors have generally been discounting (expecting) very little economic growth and possibly even a mild recession? As a result, even tepid GDP and corporat ...

Federated Mid-Cap Index Fund

... The investment seeks to provide investment results generally corresponding to the aggregate price and dividend performance of the publicly traded common stocks that comprise the mid-level stock capitalization sector of the United States equity market. The fund normally invests its assets primarily i ...

... The investment seeks to provide investment results generally corresponding to the aggregate price and dividend performance of the publicly traded common stocks that comprise the mid-level stock capitalization sector of the United States equity market. The fund normally invests its assets primarily i ...

Epoch Global Equity Shareholder Yield Fund Institutional Class

... position in the financials sector, which lost some of its post-election steam, also contributed. We continue to expect a slow-growth environment over the coming years due to challenging demographics and excessive debt burdens. The rise of capital-light business models, which should be positive for p ...

... position in the financials sector, which lost some of its post-election steam, also contributed. We continue to expect a slow-growth environment over the coming years due to challenging demographics and excessive debt burdens. The rise of capital-light business models, which should be positive for p ...

local investment fund eligibility

... development, to stimulate entrepreneurship, to create and retain jobs in Laval, through funding for startup or expanding companies. ...

... development, to stimulate entrepreneurship, to create and retain jobs in Laval, through funding for startup or expanding companies. ...

Meet Shirley Watson EPC, FCSI - Shirley Watson Financial Solutions

... solicitation is not authorized or to any person to whom it is unlawful to make such offer or solicitation. It is for general information only and is not intended to provide specific personalized advice including, without limitation, investment, financial, legal, accounting or tax advice. Investors s ...

... solicitation is not authorized or to any person to whom it is unlawful to make such offer or solicitation. It is for general information only and is not intended to provide specific personalized advice including, without limitation, investment, financial, legal, accounting or tax advice. Investors s ...

Financing Non-P3 Infrastructure Projects

... The abiliy to execute P3 projects in the north is challenged by lack of project size, large of a large user base and a lack of a credit rating for Nunavut Territory ...

... The abiliy to execute P3 projects in the north is challenged by lack of project size, large of a large user base and a lack of a credit rating for Nunavut Territory ...

Private equity

In finance, private equity is an asset class consisting of equity securities and debt in operating companies that are not publicly traded on a stock exchange.A private equity investment will generally be made by a private equity firm, a venture capital firm or an angel investor. Each of these categories of investor has its own set of goals, preferences and investment strategies; however, all provide working capital to a target company to nurture expansion, new-product development, or restructuring of the company’s operations, management, or ownership.Bloomberg Businessweek has called private equity a rebranding of leveraged-buyout firms after the 1980s. Common investment strategies in private equity include: leveraged buyouts, venture capital, growth capital, distressed investments and mezzanine capital. In a typical leveraged-buyout transaction, a private-equity firm buys majority control of an existing or mature firm. This is distinct from a venture-capital or growth-capital investment, in which the investors (typically venture-capital firms or angel investors) invest in young, growing or emerging companies, and rarely obtain majority control.Private equity is also often grouped into a broader category called private capital, generally used to describe capital supporting any long-term, illiquid investment strategy.