Venture_Capital_ENG_

... Convert “fixed costs” (incurred whether or not a sale is made) to “variable costs” (incurred only when a sale is made) Outsourcing – reduce capital needs Universities – expertise, pro bono work Suppliers – terms, loans, leads, etc. Factors – advance money, reduce collection risk ...

... Convert “fixed costs” (incurred whether or not a sale is made) to “variable costs” (incurred only when a sale is made) Outsourcing – reduce capital needs Universities – expertise, pro bono work Suppliers – terms, loans, leads, etc. Factors – advance money, reduce collection risk ...

EY widescreen presentation

... market share of the top 10 players amounted to 79.5% in March 2016, while the top 5 players held a 55.6% market share ►Increased retail participation - The industry has been successful in improving the share of retail and high net worth individuals (HNIs) in total AUM from 43% in March 2009 to 51% i ...

... market share of the top 10 players amounted to 79.5% in March 2016, while the top 5 players held a 55.6% market share ►Increased retail participation - The industry has been successful in improving the share of retail and high net worth individuals (HNIs) in total AUM from 43% in March 2009 to 51% i ...

Does PE Create Value.Apr 08

... Public company boards lack the incentives, time, training and information to adequately monitor firm’s derivative exposure Private equity firms help to offset these governance problems by exercising strong control ...

... Public company boards lack the incentives, time, training and information to adequately monitor firm’s derivative exposure Private equity firms help to offset these governance problems by exercising strong control ...

The Capital Stack - Lancaster Pollard

... the capital stack by providing up to 95% of the total cost of a financing. It can either be used on top of mezzanine and senior debt or it can replace the mezzanine debt if the senior lender will not allow a secured second position. Often the structure includes a preferred return to the private equi ...

... the capital stack by providing up to 95% of the total cost of a financing. It can either be used on top of mezzanine and senior debt or it can replace the mezzanine debt if the senior lender will not allow a secured second position. Often the structure includes a preferred return to the private equi ...

Dynamic Global Value Fund Series G

... liquidity needs, portfolio size, income, investment knowledge and attitude toward price fluctuations. Investors should consult their financial advisor before making a decision as to whether this mutual fund is a suitable investment for them. ...

... liquidity needs, portfolio size, income, investment knowledge and attitude toward price fluctuations. Investors should consult their financial advisor before making a decision as to whether this mutual fund is a suitable investment for them. ...

ANZ OA Investment T Rowe Price Global Equity DEF PDF Factsheet

... is made to ensure the accuracy of this data, neither Money Management nor FE can be held liable for any investment decision made based on this data. The price and value of investments and their income fluctuates. Past performance is no guarantee of future performance. ...

... is made to ensure the accuracy of this data, neither Money Management nor FE can be held liable for any investment decision made based on this data. The price and value of investments and their income fluctuates. Past performance is no guarantee of future performance. ...

Amarillo College Book Value Market Value

... advice with respect to our non-endowed local funds. Their address is 300 West 6th Street, Suite 1940, Austin, Texas 78701. They do not have the authority to make investment decisions or initiate transactions. Amarillo College does not use soft dollar arrangements. Amarillo College is associated with ...

... advice with respect to our non-endowed local funds. Their address is 300 West 6th Street, Suite 1940, Austin, Texas 78701. They do not have the authority to make investment decisions or initiate transactions. Amarillo College does not use soft dollar arrangements. Amarillo College is associated with ...

October 2011 - Roof Advisory Group

... current dividend yields on stocks are also compelling when compared to both historic standards and fixed income alternatives. The yield of the S&P 500 index also approximated 2.5% at month end, nearly 25% above its ten year average, with many individual stocks currently offering yields well in exces ...

... current dividend yields on stocks are also compelling when compared to both historic standards and fixed income alternatives. The yield of the S&P 500 index also approximated 2.5% at month end, nearly 25% above its ten year average, with many individual stocks currently offering yields well in exces ...

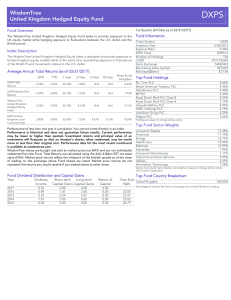

WisdomTree United Kingdom Hedged Equity Fund

... Performance of less than one year is cumulative. You cannot invest directly in an index. Performance is historical and does not guarantee future results. Current performance may be lower or higher than quoted. Investment returns and principal value of an investment will fluctuate so that an investor ...

... Performance of less than one year is cumulative. You cannot invest directly in an index. Performance is historical and does not guarantee future results. Current performance may be lower or higher than quoted. Investment returns and principal value of an investment will fluctuate so that an investor ...

THE CASE AGAINST INTEREST: IS IT COMPELLING?

... management, effective corporate governance, greater transparency ...

... management, effective corporate governance, greater transparency ...

Pengana Capital Funds

... they do not depend on market direction and they are uncorrelated or lowly correlated to market indices, a leading fund manager advises. Pengana Capital’s Damian Crowley says that ‘beta-investment strategies which generate returns mainly due to the market are unlikely to perform as well in the next t ...

... they do not depend on market direction and they are uncorrelated or lowly correlated to market indices, a leading fund manager advises. Pengana Capital’s Damian Crowley says that ‘beta-investment strategies which generate returns mainly due to the market are unlikely to perform as well in the next t ...

risk periods and “extreme” market conditions

... Alternative investors should pay attention to the source of funding in considering investment opportunities • Structured credit opportunities are typically illiquid and subject to supply/demand shocks ; • Roughly they break down into 3 categories: unrated highly illiquid equity, mezzanine tranches, ...

... Alternative investors should pay attention to the source of funding in considering investment opportunities • Structured credit opportunities are typically illiquid and subject to supply/demand shocks ; • Roughly they break down into 3 categories: unrated highly illiquid equity, mezzanine tranches, ...

Manager Bio - Natixis Global Asset Management

... Pavel Vaynshtok is a Managing Director and Senior Portfolio Manager of the U.S. Behavioral Finance Equity group responsible for the Intrepid strategies. Pavel rejoined the firm in 2011. Previously Pavel was a portfolio manager and the head of quantitative research at ING Investment Management where ...

... Pavel Vaynshtok is a Managing Director and Senior Portfolio Manager of the U.S. Behavioral Finance Equity group responsible for the Intrepid strategies. Pavel rejoined the firm in 2011. Previously Pavel was a portfolio manager and the head of quantitative research at ING Investment Management where ...

Downlaod File

... Goals: Accumulate a college and retirement fund within 20 years for his wife and child (also consider the unborn child in the span of the next 3 years), it is necessary to have a well diversified portfolio of high-yield, in a scale of moderate to high risk securities. Investment horizon: 20 years Ri ...

... Goals: Accumulate a college and retirement fund within 20 years for his wife and child (also consider the unborn child in the span of the next 3 years), it is necessary to have a well diversified portfolio of high-yield, in a scale of moderate to high risk securities. Investment horizon: 20 years Ri ...

Corporate Financing

... aspect of M & As Too much focus on the Size (growth) issue of M & As as a result of Globalization and Global Competition - by ”big hands” or “rigging the market” True, but there is another very important, and positive, aspect to it – by “invisible hands” or “market ...

... aspect of M & As Too much focus on the Size (growth) issue of M & As as a result of Globalization and Global Competition - by ”big hands” or “rigging the market” True, but there is another very important, and positive, aspect to it – by “invisible hands” or “market ...

THE CASE AGAINST INTEREST: IS IT COMPELLING?

... management, effective corporate governance, greater transparency ...

... management, effective corporate governance, greater transparency ...

The New Landscape for Business Startups and Their Investors

... Looser reporting/registration requirements for companies Companies with at least $10 million in assets and fewer than 500 "unaccredited" shareholders (not including employees who hold shares) or 2,000 total shareholders generally will no longer be required to register with the Securities and Exchang ...

... Looser reporting/registration requirements for companies Companies with at least $10 million in assets and fewer than 500 "unaccredited" shareholders (not including employees who hold shares) or 2,000 total shareholders generally will no longer be required to register with the Securities and Exchang ...

BGF European Value Fund

... Investment involves risk. Past performance is not necessarily a guide to future performance. The value of investments and the income from them can fluctuate and is not guaranteed. Rates of exchange may cause the value of investments to go up or down. Investors may not get back the amount they invest ...

... Investment involves risk. Past performance is not necessarily a guide to future performance. The value of investments and the income from them can fluctuate and is not guaranteed. Rates of exchange may cause the value of investments to go up or down. Investors may not get back the amount they invest ...

Ted Bernhard - Stoel Rives

... • Complex and confusing investment structures • Failure to provide incentives that matter to investors • Failure to communicate the opportunity effectively • Qualification: some of this is due to factors outside of any one individual’s control ...

... • Complex and confusing investment structures • Failure to provide incentives that matter to investors • Failure to communicate the opportunity effectively • Qualification: some of this is due to factors outside of any one individual’s control ...

Call: June 19, 2015 AFFIDAVIT SAMPLE Contact Person

... of the entities that make the commitment, as well as their relationship with both the management team and the Management Company. 11. - In addition, funds in which Fond-ICO Global will invest should meet the following requirements: 1) Funds shall be incorporated and denominated in euros and Fond-ICO ...

... of the entities that make the commitment, as well as their relationship with both the management team and the Management Company. 11. - In addition, funds in which Fond-ICO Global will invest should meet the following requirements: 1) Funds shall be incorporated and denominated in euros and Fond-ICO ...

Artificial Intelligence (AI) Equity Portfolio Fact Sheet

... performance results are provided for informational purposes only and have certain limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not been executed, the results may have under or over compensated for the impact, if any, ...

... performance results are provided for informational purposes only and have certain limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not been executed, the results may have under or over compensated for the impact, if any, ...

competition tribunal

... This activity comprises providing private enterprises with equity capital. They are classified as captive or as independent funds. Captive funds make investments exclusively on behalf of a parent company and funds are drawn from a pool available within the group. Independent funds comprise funds mad ...

... This activity comprises providing private enterprises with equity capital. They are classified as captive or as independent funds. Captive funds make investments exclusively on behalf of a parent company and funds are drawn from a pool available within the group. Independent funds comprise funds mad ...

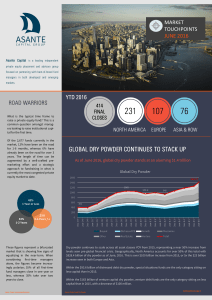

global dry powder continues to stack up

... alone, the figures become increasingly polarize; 35% of all first-time fund managers close in one year or less, whereas 35% take over two years to close. ...

... alone, the figures become increasingly polarize; 35% of all first-time fund managers close in one year or less, whereas 35% take over two years to close. ...

Deconstructing the time in the market mantra

... significantly. The hapless Australian investor who missed the top 100 days either side of the best day in the market is now 144% ahead of the index (and that is not even allowing for a cash return on their money while out of the market) and the US investor 73% ahead. Is this just data-mining or is t ...

... significantly. The hapless Australian investor who missed the top 100 days either side of the best day in the market is now 144% ahead of the index (and that is not even allowing for a cash return on their money while out of the market) and the US investor 73% ahead. Is this just data-mining or is t ...

Private equity

In finance, private equity is an asset class consisting of equity securities and debt in operating companies that are not publicly traded on a stock exchange.A private equity investment will generally be made by a private equity firm, a venture capital firm or an angel investor. Each of these categories of investor has its own set of goals, preferences and investment strategies; however, all provide working capital to a target company to nurture expansion, new-product development, or restructuring of the company’s operations, management, or ownership.Bloomberg Businessweek has called private equity a rebranding of leveraged-buyout firms after the 1980s. Common investment strategies in private equity include: leveraged buyouts, venture capital, growth capital, distressed investments and mezzanine capital. In a typical leveraged-buyout transaction, a private-equity firm buys majority control of an existing or mature firm. This is distinct from a venture-capital or growth-capital investment, in which the investors (typically venture-capital firms or angel investors) invest in young, growing or emerging companies, and rarely obtain majority control.Private equity is also often grouped into a broader category called private capital, generally used to describe capital supporting any long-term, illiquid investment strategy.