* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Ted Bernhard - Stoel Rives

International investment agreement wikipedia , lookup

Investor-state dispute settlement wikipedia , lookup

Land banking wikipedia , lookup

Investment management wikipedia , lookup

Private equity secondary market wikipedia , lookup

Syndicated loan wikipedia , lookup

Corporate venture capital wikipedia , lookup

Private equity wikipedia , lookup

Private equity in the 2000s wikipedia , lookup

Private equity in the 1980s wikipedia , lookup

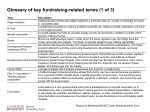

Equity Investment in Community Wind: What’s the problem? Oregon Wind Working Group Klamath Falls, Oregon Ted Bernhard April 8, 2005 Ted Bernhard • Stoel Rives corporate and securities attorney in the firm’s technology venture and wind energy groups • Practice focused on equity finance issues representing: – Private Equity Investors – Startup Technology Companies – Sub-utility scale (community) renewable energy projects • Prior life: Venture capital investor focused on energy technology investing • Specific involvement in this area with Paul Woodin, DOE on China Hollow Community Wind 2 Stoel Rives, LLP www.stoel.com • A 100-year old leading law firm in the Western United States based in Portland, Oregon • More than 370 lawyers practicing across the full spectrum of corporate law, energy law and business litigation • Offices in five western states (Oregon, Washington, Idaho, Utah, and California) • One of the largest and most respected dedicated renewable energy legal teams in the nation 3 Raising Private Equity for Wind Projects • Level of Investor Interest • Problems for attracting equity investors – Define six general issues – Clarify the specific roadblocks in each category • Potential Solutions – Near term – Longer term 4 Investors (large and small) truly ARE interested in wind! • • • • • • • 5 Financial Institutions Private Equity Funds Angel Investors Non-profit groups States Commercial Banks Individuals The U.S. Wind Industry has made it very difficult for them to ACTUALLY INVEST • Complex and confusing investment structures • Failure to provide incentives that matter to investors • Failure to communicate the opportunity effectively • Qualification: some of this is due to factors outside of any one individual’s control 6 – Amazingly complex regulatory patchwork – The economics of wind projects are what they are (power is cheap in the NW and transactions costs are high) Bickering #1: Fighting about ways to carve up the non-existent pie • Landowners and communities: – Should not get nothing – Should not get everything • Economic theory: in the long term, compensation received is based on value created for which a third party will pay. • Control vs. money is not unique to wind, entrepreneurs in start-up mode face it all the time • Whenever you take significant outside investment dollars, the project is no longer yours (but the entire pie is larger) 7 Bickering # 2: Playing the Blame game -- Utilities and Large Wind Developers are not the enemy • Utilities: – Distributed generation is clearly the future (with or without the utilities) – Near term – Standardized PURPA contracts will help make the transition less painful for them – Still need to remember, the projects must be valuable and profitable for all stakeholders, including those who buy and transmit the energy • Large Developers: 8 – primarily irrelevant to community wind – Could actually partner with them in a way that is mutually beneficial (share common costs and issues) The Pot of Gold #1: “Tax-Hungry Corporate Investors” • There simply aren’t very many of them • Here’s why they are few and far between: – Corporation, not a pass through entity – Enough taxable income to utilize PTC credits and depreciation – Unless they are an owner of virtually all of the project for a period of time, their income also has to be passive – Understand wind power project structures – Comfortable with the risk/reward profile offered to them • However, bring them in as much as you can – cheapest and least dilutionary money short of a grant that you will find 9 The Pot of Gold #2 - Venture Capital • Venture capitalists will not invest in renewable energy projects! • Venture Capitalists’ goals: – – – – – New Technologies On going, rapid growth businesses Highest risk/reward profile Expected IRR of 45-55% Exit strategy of IPO or acquisition • Exception: they will invest if there is a new technology that happens to also be a project 10 Finding a “clever” way out of this mess • The whole investment structure is already too complex • Many funds won’t invest in anything other than stock • Even those that are comfortable with passthru entities may not be comfortable with complex, customized allocation provisions • The solution is not more complex, convoluted structures, it is simplicity • Bottom Line: complexity scares away all but 11 the most die hard investors Securities Laws • Serious consideration, but probably not as big of an issue as you think • No formal prospectus required if you sell solely to Accredited Investors • No limit on number of Accredited Investors you can sell to • If you accept non-accredited investors money, you will need to: – Write a Prospectus – Limit the number of non-accredited investors to 35 12 Back on the bright side… • Projects can make money • Relatively low risk once the project financing comes together (almost no technology risk) • Energy prices are rising = higher potential revenues • Very broad based federal and state support for these program that make the economics far superior to other low-risk investments 13 First Steps for those Considering Community Wind Projects • Understand the financial landscape – Types of players – Motivations of the various parties (separate tax driven investors from others) – Speak their language (see next slide) • Strive for “Balance” – Its not all or nothing: think in terms of compromise – Don’t get too greedy -- get the deal done rather than remaining defensive – Seek ways for all interested parties win • Simplicity. Keep investment structure as simple as possible and make it easy to invest. • Comply with Securities Laws, but don’t get hung up on them 14 – Work with a professional – Know the law Speaking the language of Equity Investors • Stop talking about: – government subsidies – tax credits – Wind regulatory policy – Social benefits of investing • Start talking about ROI, IRR, Investment Multiples, and EBITDA • Even simpler, start talking Profits and Revenues and cash flow • Make presentations the way investors are used to seeing investment pitches 15 Longer Term steps towards a solution • Create a viable long term investment pool of recurring investors – Educate them about how wind projects work – Find ways for them to pool their capital for long term investing – Provide access to multiple projects for diversification purposes – Get real projects up and running and make them successful • Work with lawyers and other service providers to streamline and standardize 16 agreements and minimize the costs Since all of these things take time… • Make the Federal PTC PERMANENT and freely MARKETABLE – Create confidence among long term investors – Open up the pool of investment • Oregon is outstanding in its leadership in this area – BETCs, DOE loans/grants – take advantage of it. 17