Private Placements and Infrastructure Finance.qxp

... excellent opportunities for pension funds in these asset classes which are uncovered by delving further into the fixed income markets. It is likely that the majority of readers will have never considered assets such as private placements and project and infrastructure finance in any form. These asse ...

... excellent opportunities for pension funds in these asset classes which are uncovered by delving further into the fixed income markets. It is likely that the majority of readers will have never considered assets such as private placements and project and infrastructure finance in any form. These asse ...

read ARTICLE - California Capital Partners

... California Capital Partners normally avoids media coverage and does not release the names of its investments. Part of the reason is to avoid other venture firms snapping up its companies, Nelson said. The firm is one of several debt providers that have cropped up in the past couple of years. Earlier ...

... California Capital Partners normally avoids media coverage and does not release the names of its investments. Part of the reason is to avoid other venture firms snapping up its companies, Nelson said. The firm is one of several debt providers that have cropped up in the past couple of years. Earlier ...

view - Ferguson Wellman

... reform and infrastructure spending are becoming less clear. But more importantly, consumer and business confidence have soared to 16-year highs amidst moves to reduce federal regulation, spurring healthy spending, employment and manufacturing activity. ...

... reform and infrastructure spending are becoming less clear. But more importantly, consumer and business confidence have soared to 16-year highs amidst moves to reduce federal regulation, spurring healthy spending, employment and manufacturing activity. ...

Strong first year for Smartfund 80% Protected

... Smartfund 80% Protected Growth fund. It has done very well in highly volatile markets, protecting value during downturns and yet being able to capture value on upswings. This innovative new product was set out to create an investment strategy for investors looking to grow their capital but seeking a ...

... Smartfund 80% Protected Growth fund. It has done very well in highly volatile markets, protecting value during downturns and yet being able to capture value on upswings. This innovative new product was set out to create an investment strategy for investors looking to grow their capital but seeking a ...

Insulin and Big Data Investing in Brazil

... there was an implicit economic incentive to have a small company and just focus on financial returns as opposed to operating profits. And so with that we put together the first fund. I was one of the LPs, also because Brazil was not an investment destination and investors asked more of our own capit ...

... there was an implicit economic incentive to have a small company and just focus on financial returns as opposed to operating profits. And so with that we put together the first fund. I was one of the LPs, also because Brazil was not an investment destination and investors asked more of our own capit ...

FIN550 final exam

... Assume that the dividend payout ratio will be 55 percent when the rate on long-term government bonds falls to 9 percent. Since investors are becoming more risk averse, the equity risk premium will rise to 8 percent and investors will require a 7 percent return. The return on equity will be 13 percen ...

... Assume that the dividend payout ratio will be 55 percent when the rate on long-term government bonds falls to 9 percent. Since investors are becoming more risk averse, the equity risk premium will rise to 8 percent and investors will require a 7 percent return. The return on equity will be 13 percen ...

Debt - IronHorse LLC

... Small Business Reorganization Committee as well as the Fraud Task Force with the American Institute of Bankruptcy. IronHorse has performed numerous due diligence, valuation, litigation support and restructuring engagements for clients in a variety of industries. Tony has extensive M & A experience o ...

... Small Business Reorganization Committee as well as the Fraud Task Force with the American Institute of Bankruptcy. IronHorse has performed numerous due diligence, valuation, litigation support and restructuring engagements for clients in a variety of industries. Tony has extensive M & A experience o ...

Senior Fund Consultant (m / f) Alternative Investment Funds

... Established 1988, LRI Group is a leading independent investment services company based in Luxembourg. It provides asset managers and investors with nearly three decades of experience in structuring and administration of traditional and alternative investment strategies. In the context of the continu ...

... Established 1988, LRI Group is a leading independent investment services company based in Luxembourg. It provides asset managers and investors with nearly three decades of experience in structuring and administration of traditional and alternative investment strategies. In the context of the continu ...

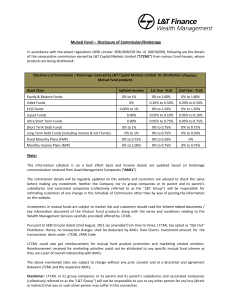

Mutual Fund – Disclosure of Commission/Brokerage Note:

... Reimbursement received for marketing activities could not be attributed to any specific mutual fund scheme as they are a part of overall relationship with AMCs. The above mentioned rates are subject to change without any prior consent and at a discretion and agreement between LTCML and the respectiv ...

... Reimbursement received for marketing activities could not be attributed to any specific mutual fund scheme as they are a part of overall relationship with AMCs. The above mentioned rates are subject to change without any prior consent and at a discretion and agreement between LTCML and the respectiv ...

4Q16 Firm Overview.ind.indd

... Wells Fargo Asset Management (WFAM) is a trade name used by the asset management businesses of Wells Fargo & Company. WFAM includes but is not limited to Analytic Investors, LLC; ECM Asset Management Ltd.; First International Advisors, LLC; Galliard Capital Management, Inc.; Golden Capital Managemen ...

... Wells Fargo Asset Management (WFAM) is a trade name used by the asset management businesses of Wells Fargo & Company. WFAM includes but is not limited to Analytic Investors, LLC; ECM Asset Management Ltd.; First International Advisors, LLC; Galliard Capital Management, Inc.; Golden Capital Managemen ...

Equity Research Analyst - JHM Professional Development and

... own portfolio and track the companies daily. Join one or more relevant associations and start networking, conducting informational interviews and build your understanding of the career. ...

... own portfolio and track the companies daily. Join one or more relevant associations and start networking, conducting informational interviews and build your understanding of the career. ...

Main Message

... Large part of economy still owned or controlled or greatly influenced by the State Service-mainly economy; large importer of goods Small entrepreneurial appetite for risk Complex tax and legal environment limiting activity and sectors (i.e. ...

... Large part of economy still owned or controlled or greatly influenced by the State Service-mainly economy; large importer of goods Small entrepreneurial appetite for risk Complex tax and legal environment limiting activity and sectors (i.e. ...

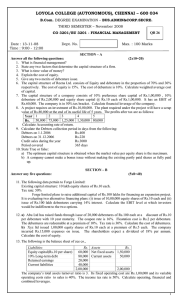

LOYOLA COLLEGE (AUTONOMOUS), CHENNAI – 600 034

... 1. What is financial management? 2. State any two factors that determine the capital structure of a firm. 3. What is time value of money? 4. Explain the cost of equity. 5. Give any two merits of debenture issue. 6. The capital structure of Reena Ltd. consists of Equity and debenture in the proportio ...

... 1. What is financial management? 2. State any two factors that determine the capital structure of a firm. 3. What is time value of money? 4. Explain the cost of equity. 5. Give any two merits of debenture issue. 6. The capital structure of Reena Ltd. consists of Equity and debenture in the proportio ...

Finance - Leeds Beckett University

... the trade debts due to a business, as they arise. Usually cash payments of up to 80% of each new sales invoice are made, with the balance, less charges, being paid when the invoice is settled. Purpose Provides short-term finance to resolve cash flow problems arising from: Funds being tied up in ...

... the trade debts due to a business, as they arise. Usually cash payments of up to 80% of each new sales invoice are made, with the balance, less charges, being paid when the invoice is settled. Purpose Provides short-term finance to resolve cash flow problems arising from: Funds being tied up in ...

June 2008 Performance Review – Listed Hybrid Sector

... (which is lower than the coupon rate they are paying on the hybrid). So they buy their stock back at a discount and book a profit and lower funding costs. This phenomenon shouldn’t last for long, as supply of hybrids will reduce to meet demand and prices will rise. Brookfield Asset Management, Mul ...

... (which is lower than the coupon rate they are paying on the hybrid). So they buy their stock back at a discount and book a profit and lower funding costs. This phenomenon shouldn’t last for long, as supply of hybrids will reduce to meet demand and prices will rise. Brookfield Asset Management, Mul ...

financial engineer / front office quantitative researcher

... Raiffeisen Bank International Group, we focus on equity trading and sales, structured products and company research – working closely together for the benefit of our clients. That makes us one of the leading investment banks in Austria and CEE. We are looking for a motivated Front Office Qua ...

... Raiffeisen Bank International Group, we focus on equity trading and sales, structured products and company research – working closely together for the benefit of our clients. That makes us one of the leading investment banks in Austria and CEE. We are looking for a motivated Front Office Qua ...

Q1 2017 Quarterly Letter - Carmel Capital Partners

... $500,000 in capital improvements for both interior and exterior renovations. Once completed, rental rates should increase materially and we are modeling for a total net return to investors of approximately 12.5%. We currently have additional transactions in the pipeline with other partners at variou ...

... $500,000 in capital improvements for both interior and exterior renovations. Once completed, rental rates should increase materially and we are modeling for a total net return to investors of approximately 12.5%. We currently have additional transactions in the pipeline with other partners at variou ...

Early stage investment in companies with high growth potential

... A total of $40 Million is available for investment through this Fund. As of October 2013 approximately $140 Million has been invested. The Fund co-invests alongside accredited investment partners. Seed-stage and start-up investments are eligible for the Fund. Investment occurs alongside selected pri ...

... A total of $40 Million is available for investment through this Fund. As of October 2013 approximately $140 Million has been invested. The Fund co-invests alongside accredited investment partners. Seed-stage and start-up investments are eligible for the Fund. Investment occurs alongside selected pri ...

Updates to the HealthEquity investment lineup

... mutual funds. You can still keep any current investments you have in these funds, but HealthEquity will no longer monitor their performance. Investment fees in the new lineup are typically lower than before. However, in some cases the newer funds may cost more and provide additional revenue to Healt ...

... mutual funds. You can still keep any current investments you have in these funds, but HealthEquity will no longer monitor their performance. Investment fees in the new lineup are typically lower than before. However, in some cases the newer funds may cost more and provide additional revenue to Healt ...

BMO Asset Management Global Equity Fund

... The team builds focused portfolios of high quality companies which are held regardless of their popularity or size. The key risk to be avoided is that of losing money for our clients, not that of appearing different from a benchmark. The stock selection process includes two separate strands. The fir ...

... The team builds focused portfolios of high quality companies which are held regardless of their popularity or size. The key risk to be avoided is that of losing money for our clients, not that of appearing different from a benchmark. The stock selection process includes two separate strands. The fir ...

axis dynamic equity fund

... Rebalancing happens every ~2 months (40 trading days) At all times, min gross equity is maintained at 65% Please refer to SID for detailed asset allocation and investment strategies. Subject to provisions of SID, portfolio Allocation/Positioning will be based on the prevailing market conditions and ...

... Rebalancing happens every ~2 months (40 trading days) At all times, min gross equity is maintained at 65% Please refer to SID for detailed asset allocation and investment strategies. Subject to provisions of SID, portfolio Allocation/Positioning will be based on the prevailing market conditions and ...

Ingen bildrubrik

... • Scouting the Private Equity Landscape in Russia • Investment Opportunities in Russian and Eastern European Private Equity ...

... • Scouting the Private Equity Landscape in Russia • Investment Opportunities in Russian and Eastern European Private Equity ...

Origination Execution

... measured by share of client activity, market rank and profitability Manage a diversified portfolio of business and asset classes, making prudent use of Firm capital Out-perform through market cycles Be the most relevant advisor to its target client base ...

... measured by share of client activity, market rank and profitability Manage a diversified portfolio of business and asset classes, making prudent use of Firm capital Out-perform through market cycles Be the most relevant advisor to its target client base ...

Constructing the Appropriate Private Equity Investment

... The return data presented herein is based on historical portfolio company data of ASP funds of funds’ underlying private equity fund investments and represents simulated partnership funds; these returns are hypothetical and are intended to be used for illustrative purposes only. This return data doe ...

... The return data presented herein is based on historical portfolio company data of ASP funds of funds’ underlying private equity fund investments and represents simulated partnership funds; these returns are hypothetical and are intended to be used for illustrative purposes only. This return data doe ...

principles of finance

... Below is a list of reference publications that were either used as a reference to create the exam, or were used as textbooks in college courses of the same or similar title at the time the test was developed. You may reference either the current edition of these titles or textbooks currently used at ...

... Below is a list of reference publications that were either used as a reference to create the exam, or were used as textbooks in college courses of the same or similar title at the time the test was developed. You may reference either the current edition of these titles or textbooks currently used at ...

Private equity

In finance, private equity is an asset class consisting of equity securities and debt in operating companies that are not publicly traded on a stock exchange.A private equity investment will generally be made by a private equity firm, a venture capital firm or an angel investor. Each of these categories of investor has its own set of goals, preferences and investment strategies; however, all provide working capital to a target company to nurture expansion, new-product development, or restructuring of the company’s operations, management, or ownership.Bloomberg Businessweek has called private equity a rebranding of leveraged-buyout firms after the 1980s. Common investment strategies in private equity include: leveraged buyouts, venture capital, growth capital, distressed investments and mezzanine capital. In a typical leveraged-buyout transaction, a private-equity firm buys majority control of an existing or mature firm. This is distinct from a venture-capital or growth-capital investment, in which the investors (typically venture-capital firms or angel investors) invest in young, growing or emerging companies, and rarely obtain majority control.Private equity is also often grouped into a broader category called private capital, generally used to describe capital supporting any long-term, illiquid investment strategy.