New Sustainability Sales Deck

... security types, geographies and markets. RiskMetrics is well known for its Value at Risk methodologies, as well as being a leading provider of credit and counterparty risk systems. ...

... security types, geographies and markets. RiskMetrics is well known for its Value at Risk methodologies, as well as being a leading provider of credit and counterparty risk systems. ...

Investment Strategy for Pensions Actuaries A Multi Asset Class

... Past performance is not a guide to future returns. The value of investments can fall as well as rise as a result of market movements. Investments in smaller companies may be less liquid than in larger companies and price swings may therefore be greater than in larger company funds. Exchange rate cha ...

... Past performance is not a guide to future returns. The value of investments can fall as well as rise as a result of market movements. Investments in smaller companies may be less liquid than in larger companies and price swings may therefore be greater than in larger company funds. Exchange rate cha ...

the stability of large external imbalances

... U.S. securities yielded higher returns than foreign securities. Given that the negative return effect almost exactly offsets the positive composition effect, the researchers say that it is surprising that they find any return differential at all. Their explanation for this is that investors in forei ...

... U.S. securities yielded higher returns than foreign securities. Given that the negative return effect almost exactly offsets the positive composition effect, the researchers say that it is surprising that they find any return differential at all. Their explanation for this is that investors in forei ...

Taiwanese Delegation to Nigeria - Nigeria Investment Promotion

... finance and develop industries in small scale sectors. It intends to route its various forms of assistance through the state-level institutions viz the banking system in Nigeria As part of its on-going exercise to fill the gaps in the existing schemes of assistance, the VCS will operate a Ventur ...

... finance and develop industries in small scale sectors. It intends to route its various forms of assistance through the state-level institutions viz the banking system in Nigeria As part of its on-going exercise to fill the gaps in the existing schemes of assistance, the VCS will operate a Ventur ...

The Missing Link: Financing the Industry

... older generation. Therefore, the result would be one of two things: either the government’s funding and budgets will decline or not grow, or there will be much greater productivity needed in service and product delivery within the private sector. Therefore, instead of new technologies essentially cr ...

... older generation. Therefore, the result would be one of two things: either the government’s funding and budgets will decline or not grow, or there will be much greater productivity needed in service and product delivery within the private sector. Therefore, instead of new technologies essentially cr ...

Morgan Stanley Dean Witter

... Morgan Stanley is a preeminent global financial services firm that maintains market positions in each of its businesses — Securities, Asset Management, and Credit Services. The company combines leadership in investment banking (including underwriting public offerings of securities and mergers and ac ...

... Morgan Stanley is a preeminent global financial services firm that maintains market positions in each of its businesses — Securities, Asset Management, and Credit Services. The company combines leadership in investment banking (including underwriting public offerings of securities and mergers and ac ...

Beyond EBITDA: 5 Other Factors That Affect

... vision for business growth drives a premium valuation. The investor can handicap the future opportunity when a team is in place and able to provide a large amount of upfront information to chart the company’s course. That said, not every seller has developed a complete team or can recruit the talent ...

... vision for business growth drives a premium valuation. The investor can handicap the future opportunity when a team is in place and able to provide a large amount of upfront information to chart the company’s course. That said, not every seller has developed a complete team or can recruit the talent ...

CURRICULUM VITAE

... I am a pro-active and hardworking team member with the ability to work on my own initiative or as part of a team to solve problems effectively. I am open minded, always looking for exciting new challenges and methods of working and posses the capability to learn fast. I am an individual with an upda ...

... I am a pro-active and hardworking team member with the ability to work on my own initiative or as part of a team to solve problems effectively. I am open minded, always looking for exciting new challenges and methods of working and posses the capability to learn fast. I am an individual with an upda ...

Private Equity Investment in High Growth Companies: Selection

... VCs focus on technology companies, acquire a minority stake (less than 50%) in early-stage (sometimes pre-revenue) companies and use only equity in their investments. They typically ...

... VCs focus on technology companies, acquire a minority stake (less than 50%) in early-stage (sometimes pre-revenue) companies and use only equity in their investments. They typically ...

DFS GIF – Growth - Desjardins Life Insurance

... ©2017. Morningstar Research Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are ...

... ©2017. Morningstar Research Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are ...

Chapter Seven

... Small Business Investment Companies (SBIC): Private firms licensed by SBA to make venture investment in small companies. SBIC make equity type investment with SB, by owning part of the firm’s equity security. Venture capitalist: Wealthy individuals who provide equity investment in small businesses. ...

... Small Business Investment Companies (SBIC): Private firms licensed by SBA to make venture investment in small companies. SBIC make equity type investment with SB, by owning part of the firm’s equity security. Venture capitalist: Wealthy individuals who provide equity investment in small businesses. ...

Investment Strategy Net Monthly Returns (1)

... representative of the segment of the hedge fund universe representing equity market neutral investment strategies seeking to generate consistent returns in both up and down markets. These strategies typically maintain net equity market exposure no greater than 10% long or short. (3) The MSCI World I ...

... representative of the segment of the hedge fund universe representing equity market neutral investment strategies seeking to generate consistent returns in both up and down markets. These strategies typically maintain net equity market exposure no greater than 10% long or short. (3) The MSCI World I ...

Class Outline - Villanova University

... commitment of dollars for a period of time in order to derive future payments that will compensate the investor for: • 1. The time value of money • 2. The expected rate of inflation • 3. The risk associated with the investment ...

... commitment of dollars for a period of time in order to derive future payments that will compensate the investor for: • 1. The time value of money • 2. The expected rate of inflation • 3. The risk associated with the investment ...

The Role of Debt and Equity Financing over the Business Cycle

... (reduction in default probability and the value of this transfer is smaller during a boom) • Covas and Denhaan (pro-cylical) • Standard debt contract with default Desire to expand leads to tightening of bank break-even condition pro-cyclical equity issuance • Counter-cyclical risk premium and eq ...

... (reduction in default probability and the value of this transfer is smaller during a boom) • Covas and Denhaan (pro-cylical) • Standard debt contract with default Desire to expand leads to tightening of bank break-even condition pro-cyclical equity issuance • Counter-cyclical risk premium and eq ...

Liquidity vs Profitability - Futuregrowth Asset Management

... equity arrangements. One example is ‘passive’ equity money. ‘Passive’ equity investors would invest in the land and lease it back to the farming business. This would also remove the largest liability for the farmer, being the land purchase. ‘Passive’ equity money would thus receive no or little retu ...

... equity arrangements. One example is ‘passive’ equity money. ‘Passive’ equity investors would invest in the land and lease it back to the farming business. This would also remove the largest liability for the farmer, being the land purchase. ‘Passive’ equity money would thus receive no or little retu ...

Colbar Completes $7.25 Million Series D Financing Round

... Colbar Completes $7.25 million Round Led by Vitalife Vitalife joins existing investors Pitango, Evergreen, Genesis, and Biomedical Investments in current round Tel Aviv, Israel – 7th September, 2004: Colbar, the Israeli manufacturer of reconstructive medicine and tissue engineering products, today a ...

... Colbar Completes $7.25 million Round Led by Vitalife Vitalife joins existing investors Pitango, Evergreen, Genesis, and Biomedical Investments in current round Tel Aviv, Israel – 7th September, 2004: Colbar, the Israeli manufacturer of reconstructive medicine and tissue engineering products, today a ...

Q1: What is your reading of the state of Indian economy

... much better in 2008. As we progress into 2008 investors will get a much better handle on these issues. Overall, these sectors will be keenly watched by investors. Q7 ...

... much better in 2008. As we progress into 2008 investors will get a much better handle on these issues. Overall, these sectors will be keenly watched by investors. Q7 ...

Risk-Spreading via Financial Intermediation: Life Insurance

... capital market to raise the funds, it is doubtful if such an organization could occur without substantially higher premiums. Suppose one (wealthy) individual provided all the capital ($60 million): (at the derived rates with R = 1) the expected rate of return is zero and there is a .16 probability o ...

... capital market to raise the funds, it is doubtful if such an organization could occur without substantially higher premiums. Suppose one (wealthy) individual provided all the capital ($60 million): (at the derived rates with R = 1) the expected rate of return is zero and there is a .16 probability o ...

Limited Liability Partnership

... Income is taxed once. Set up with ease Few government regulations Unlimited liability for each partner. A limited life of partnership. Limited access to additional funds. ...

... Income is taxed once. Set up with ease Few government regulations Unlimited liability for each partner. A limited life of partnership. Limited access to additional funds. ...

China: All Eyes on Another Five Years of Economic Reform

... the FYP now serves as a guideline rather than a set plan, but it still carries critical importance in understanding the overall direction of China’s economic reform. ...

... the FYP now serves as a guideline rather than a set plan, but it still carries critical importance in understanding the overall direction of China’s economic reform. ...

Equity Share Class Fact Sheet

... To achieve the stated objectives, the Investment Committee (IRC) may invest the Class in large-to-mid-capitalization common shares and equities with both low systematic risk and higher expected returns through capital appreciation, dividend income, or a combination of both. The IRC may also invest t ...

... To achieve the stated objectives, the Investment Committee (IRC) may invest the Class in large-to-mid-capitalization common shares and equities with both low systematic risk and higher expected returns through capital appreciation, dividend income, or a combination of both. The IRC may also invest t ...

Financing a Small Business 4.00 Explain the fundamentals of

... F. Factors to consider when choosing a financial plan 1. Risk a. There is a greater risk of loss with debt funds since the entrepreneur must repay the loan in accordance with the terms or risk losing the business, collateral, or even personal possessions. b. There is less risk for the entrepreneur ...

... F. Factors to consider when choosing a financial plan 1. Risk a. There is a greater risk of loss with debt funds since the entrepreneur must repay the loan in accordance with the terms or risk losing the business, collateral, or even personal possessions. b. There is less risk for the entrepreneur ...

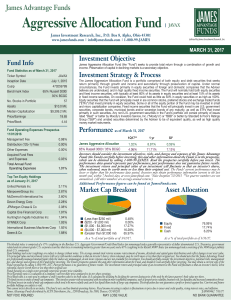

Aggressive Allocation Fund | JAVAX

... The blended index is comprised of a 35% weighting in the Barclays U.S. Aggregate Government/Credit Bond Index (an unmanaged index generally representative of dollar denominated U.S. Treasuries, government related and investment grade U.S. corporate securities that have a remaining maturity greater t ...

... The blended index is comprised of a 35% weighting in the Barclays U.S. Aggregate Government/Credit Bond Index (an unmanaged index generally representative of dollar denominated U.S. Treasuries, government related and investment grade U.S. corporate securities that have a remaining maturity greater t ...

Houston Paper - First International

... If the assets were marked to market today most public companies would show a negative net value. There is no IPO market today and shipping is unlikely to attract new equity for some considerable time except for the venture capital funds that are seeking to buy distressed assets cheaply. The Private ...

... If the assets were marked to market today most public companies would show a negative net value. There is no IPO market today and shipping is unlikely to attract new equity for some considerable time except for the venture capital funds that are seeking to buy distressed assets cheaply. The Private ...

Private equity

In finance, private equity is an asset class consisting of equity securities and debt in operating companies that are not publicly traded on a stock exchange.A private equity investment will generally be made by a private equity firm, a venture capital firm or an angel investor. Each of these categories of investor has its own set of goals, preferences and investment strategies; however, all provide working capital to a target company to nurture expansion, new-product development, or restructuring of the company’s operations, management, or ownership.Bloomberg Businessweek has called private equity a rebranding of leveraged-buyout firms after the 1980s. Common investment strategies in private equity include: leveraged buyouts, venture capital, growth capital, distressed investments and mezzanine capital. In a typical leveraged-buyout transaction, a private-equity firm buys majority control of an existing or mature firm. This is distinct from a venture-capital or growth-capital investment, in which the investors (typically venture-capital firms or angel investors) invest in young, growing or emerging companies, and rarely obtain majority control.Private equity is also often grouped into a broader category called private capital, generally used to describe capital supporting any long-term, illiquid investment strategy.