SHIPPING FINANCE - Laboratory for Maritime Transport

... Highly cyclical industry Highly leveraged asset Timing critical for investment success Active second hand market for the ...

... Highly cyclical industry Highly leveraged asset Timing critical for investment success Active second hand market for the ...

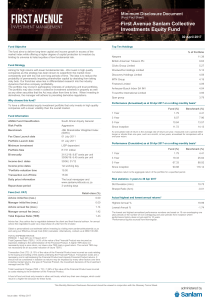

First Avenue Sanlam Collective Investments Equity Fund

... priced in. This is in contrast to investing in companies solely beholden to systematic or cyclical risk. It is a clear choice between arbitraging value rather than betting on the unwinding of macroeconomic risks. As systematic risk cannot be diversified away completely, we will benefit somewhat if m ...

... priced in. This is in contrast to investing in companies solely beholden to systematic or cyclical risk. It is a clear choice between arbitraging value rather than betting on the unwinding of macroeconomic risks. As systematic risk cannot be diversified away completely, we will benefit somewhat if m ...

Document

... internal control, thus leading to greater accountability and better profit margins. • Good CG practices can pave the way for possible future growth, diversification, or a sale, including the ability to attract equity investors – nationally and from abroad – as well as reduce the cost of loans/credit ...

... internal control, thus leading to greater accountability and better profit margins. • Good CG practices can pave the way for possible future growth, diversification, or a sale, including the ability to attract equity investors – nationally and from abroad – as well as reduce the cost of loans/credit ...

PDF - 50 South Capital

... The information contained herein is for informational and educational purposes only. It is neither an offer to sell, nor a solicitation of an offer to buy an interest in any investment fund managed by 50 South Capital Advisors, LLC. The information is obtained from sources believed to be reliable, a ...

... The information contained herein is for informational and educational purposes only. It is neither an offer to sell, nor a solicitation of an offer to buy an interest in any investment fund managed by 50 South Capital Advisors, LLC. The information is obtained from sources believed to be reliable, a ...

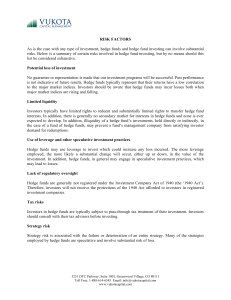

RISK FACTORS As is the case with any type of investment, hedge

... interests. In addition, there is generally no secondary market for interests in hedge funds and none is ever expected to develop. In addition, illiquidity of a hedge fund’s investments, held directly or indirectly, in the case of a fund of hedge funds, may prevent a fund’s management company from sa ...

... interests. In addition, there is generally no secondary market for interests in hedge funds and none is ever expected to develop. In addition, illiquidity of a hedge fund’s investments, held directly or indirectly, in the case of a fund of hedge funds, may prevent a fund’s management company from sa ...

Shipping Industry Profile and Competitive Landscape

... flows, liquid assets, and debt) when funding capital expenditures. They found that oil companies obtained more than half of their funding from internally generated cash flows. Myers and Majluf (1984) observed that managers know more about their firms than outside investors do. They are reluctant to ...

... flows, liquid assets, and debt) when funding capital expenditures. They found that oil companies obtained more than half of their funding from internally generated cash flows. Myers and Majluf (1984) observed that managers know more about their firms than outside investors do. They are reluctant to ...

1 climate assets fund quarterly update - q1 2017

... Exceptionally buoyant sentiment measures are probably overstating the upturn so estimates of 2.8% and 3.2% global real GDP growth in 2017 and 2018 are unchanged. Headline inflation has surprised on the upside but – excluding energy – core inflation and wage growth remain low and relatively stable. Ano ...

... Exceptionally buoyant sentiment measures are probably overstating the upturn so estimates of 2.8% and 3.2% global real GDP growth in 2017 and 2018 are unchanged. Headline inflation has surprised on the upside but – excluding energy – core inflation and wage growth remain low and relatively stable. Ano ...

Standard Life North American Equity Fund

... 30 June 2017 The fund aims to provide long term growth and is designed for investors who are looking for exposure to the North American equity markets. The fund invests predominantly in the shares of companies listed on the US stock markets and is actively managed by our investment team, who will se ...

... 30 June 2017 The fund aims to provide long term growth and is designed for investors who are looking for exposure to the North American equity markets. The fund invests predominantly in the shares of companies listed on the US stock markets and is actively managed by our investment team, who will se ...

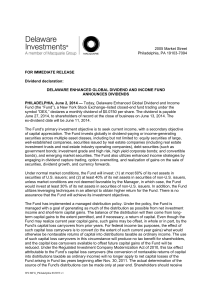

2005 Market Street Philadelphia, PA 19103-7094

... June 27, 2014, to shareholders of record at the close of business on June 13, 2014. The ex-dividend date will be June 11, 2014. The Fund's primary investment objective is to seek current income, with a secondary objective of capital appreciation. The Fund invests globally in dividend-paying or incom ...

... June 27, 2014, to shareholders of record at the close of business on June 13, 2014. The ex-dividend date will be June 11, 2014. The Fund's primary investment objective is to seek current income, with a secondary objective of capital appreciation. The Fund invests globally in dividend-paying or incom ...

growth and the p/e ratio

... • This 20% rate is the sustainable growth rate. It is the rate of growth that is manageable without resort to additional equity financing. Debt and current liabilities have increased “spontaneously.” ...

... • This 20% rate is the sustainable growth rate. It is the rate of growth that is manageable without resort to additional equity financing. Debt and current liabilities have increased “spontaneously.” ...

SECOND ANNUAL WOMEN`S ALTERNATIVE INVESTMENT

... Lexington, Mass., July 21, 2010 -- Falk Marques Group today announced the 2nd Annual Women’s Alternative Investment Summit will be held on November 4 & 5, 2010 at The Pierre in midtown Manhattan. At last year’s inaugural Summit, close to 250 senior women executives in private equity, venture capital ...

... Lexington, Mass., July 21, 2010 -- Falk Marques Group today announced the 2nd Annual Women’s Alternative Investment Summit will be held on November 4 & 5, 2010 at The Pierre in midtown Manhattan. At last year’s inaugural Summit, close to 250 senior women executives in private equity, venture capital ...

WALLACE E. KING EDUCATION

... Collaborated with team to manage cash flow by liaising with customers and creditors to maximize receivables collection and trade credit, leading to significantly improved DSO ratios and a shorter cash conversion cycle. Developed financial model to enable the firm to track depreciation expense an ...

... Collaborated with team to manage cash flow by liaising with customers and creditors to maximize receivables collection and trade credit, leading to significantly improved DSO ratios and a shorter cash conversion cycle. Developed financial model to enable the firm to track depreciation expense an ...

MidCap Financial Launches Commercial Finance Company with

... of all types. Through investment in the healthcare industry, we support both maintenance and improved quality of life. On the investment side, significant opportunities exist for a business with proven management, deep industry contacts and no legacy portfolio." Jean-Pierre Conte, Chairman and Manag ...

... of all types. Through investment in the healthcare industry, we support both maintenance and improved quality of life. On the investment side, significant opportunities exist for a business with proven management, deep industry contacts and no legacy portfolio." Jean-Pierre Conte, Chairman and Manag ...

Every investor, whether conservative or aggressive, wants to see

... Every investor, whether conservative or aggressive, wants to see wealth to grow. A conservative investor would probably stick to bank fixed deposits, postal small savings, insurance policies, public provident fund (PPF), bonds etc. In contrast, an aggressive one would probably look at equity, real e ...

... Every investor, whether conservative or aggressive, wants to see wealth to grow. A conservative investor would probably stick to bank fixed deposits, postal small savings, insurance policies, public provident fund (PPF), bonds etc. In contrast, an aggressive one would probably look at equity, real e ...

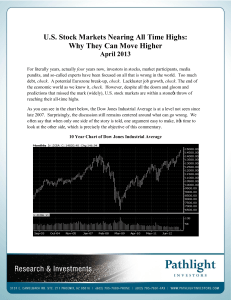

U.S. Stock Markets Nearing All Time Highs: Why They Can Move

... buy stocks and real estate. The rebound in these two investment classes has helped the wealth effect and each respective market. Clearly, the benefit is most captured by the upper income individuals and has not yet trickled down and helped accelerate job growth. It has, however, increased confidence ...

... buy stocks and real estate. The rebound in these two investment classes has helped the wealth effect and each respective market. Clearly, the benefit is most captured by the upper income individuals and has not yet trickled down and helped accelerate job growth. It has, however, increased confidence ...

New Venture Creation

... between venture and team member used to guard against the event that some portion of the stock has been earned and some portion will remain unearned, as when a team member quits or dies; the venture places the stock purchased by team members in escrow to be released over a two- or three-year period. ...

... between venture and team member used to guard against the event that some portion of the stock has been earned and some portion will remain unearned, as when a team member quits or dies; the venture places the stock purchased by team members in escrow to be released over a two- or three-year period. ...

Vintage Capital Announces EScreen, Inc. Merger With Pembrooke

... investment firm founded by successful business executive Mr. Fred Sands in 2000. Mr. Sands, Chairman of Vintage Capital Group and Vintage Real Estate, founded the firm after establishing and successfully building Fred Sands Realtors over three decades into one of the largest real estate and financia ...

... investment firm founded by successful business executive Mr. Fred Sands in 2000. Mr. Sands, Chairman of Vintage Capital Group and Vintage Real Estate, founded the firm after establishing and successfully building Fred Sands Realtors over three decades into one of the largest real estate and financia ...

ppt

... Summarize reasons why people invest, what is required before beginning, how returns are earned, and some ways to obtain funds to invest. Determine your own investment philosophy. Recognize the variety of investments available. Identify the major factors that affect the return on investment. Specify ...

... Summarize reasons why people invest, what is required before beginning, how returns are earned, and some ways to obtain funds to invest. Determine your own investment philosophy. Recognize the variety of investments available. Identify the major factors that affect the return on investment. Specify ...

Infrastructure Investment Trust

... At least one third of the board members have to be independent as the draft Communique seems to accept corporate governance principles as in REIT regulations issued by CMB which are in compliance with OECD principles. The IIT investment capability includes investments to; infrastructure projects or ...

... At least one third of the board members have to be independent as the draft Communique seems to accept corporate governance principles as in REIT regulations issued by CMB which are in compliance with OECD principles. The IIT investment capability includes investments to; infrastructure projects or ...

ITEM

... List of main types of investments in the investment funds hold by the insurance undertaking. In this template the report is made by asset category, according to splits defined by cells A1 to A6 (example: EEA equity in local currency held in Life portfolio, for unit-linked fund) Distinction between l ...

... List of main types of investments in the investment funds hold by the insurance undertaking. In this template the report is made by asset category, according to splits defined by cells A1 to A6 (example: EEA equity in local currency held in Life portfolio, for unit-linked fund) Distinction between l ...

Sales Aid

... –– Investments denominated in a currency other than that of the share-class may not be hedged. The market movements between those currencies will impact the share-class ...

... –– Investments denominated in a currency other than that of the share-class may not be hedged. The market movements between those currencies will impact the share-class ...

Private equity

In finance, private equity is an asset class consisting of equity securities and debt in operating companies that are not publicly traded on a stock exchange.A private equity investment will generally be made by a private equity firm, a venture capital firm or an angel investor. Each of these categories of investor has its own set of goals, preferences and investment strategies; however, all provide working capital to a target company to nurture expansion, new-product development, or restructuring of the company’s operations, management, or ownership.Bloomberg Businessweek has called private equity a rebranding of leveraged-buyout firms after the 1980s. Common investment strategies in private equity include: leveraged buyouts, venture capital, growth capital, distressed investments and mezzanine capital. In a typical leveraged-buyout transaction, a private-equity firm buys majority control of an existing or mature firm. This is distinct from a venture-capital or growth-capital investment, in which the investors (typically venture-capital firms or angel investors) invest in young, growing or emerging companies, and rarely obtain majority control.Private equity is also often grouped into a broader category called private capital, generally used to describe capital supporting any long-term, illiquid investment strategy.