Developing a Financial Planning Model

... Required External Financing Required New Investment Spontaneous Financing Internal Equity Financing • See Logic for Debt as Secondary Plug Excel file ...

... Required External Financing Required New Investment Spontaneous Financing Internal Equity Financing • See Logic for Debt as Secondary Plug Excel file ...

Diapositive 1 - Goldman Sachs

... Complement funds can vary in risk level and those terms are not meant to indicate the risk level of the funds. For regionally focussed investment portfolios we understand that the categorisation may be different from the perspective of different investors. Consult your financial adviser before inves ...

... Complement funds can vary in risk level and those terms are not meant to indicate the risk level of the funds. For regionally focussed investment portfolios we understand that the categorisation may be different from the perspective of different investors. Consult your financial adviser before inves ...

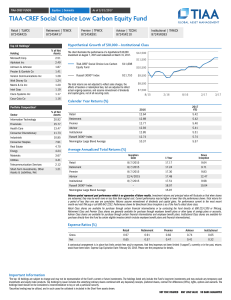

TIAA-CREF Social Choice Low Carbon Equity Fund

... Social Governance (ESG) guidelines. As a result, the universe of investments available to the Fund will be more limited than other funds that do not apply such guidelines. ESG criteria risk is the risk that because the Fund’s ESG criteria exclude securities of certain issuers for nonfinancial reason ...

... Social Governance (ESG) guidelines. As a result, the universe of investments available to the Fund will be more limited than other funds that do not apply such guidelines. ESG criteria risk is the risk that because the Fund’s ESG criteria exclude securities of certain issuers for nonfinancial reason ...

Can an old bull learn new tricks? (March 2017)

... Market index price levels represent the combined value of the future profit generating ability of the intellectual property, human and physical assets of the corporations that comprise them. Thankfully, equity markets have been making new all-time highs for centuries. ...

... Market index price levels represent the combined value of the future profit generating ability of the intellectual property, human and physical assets of the corporations that comprise them. Thankfully, equity markets have been making new all-time highs for centuries. ...

RRF 320.2: Equity Securities Held Instruction Guide

... The Equity Securities Held form is to be completed by all registered financial corporations that have total assets equal to or greater than $500 million, after consolidating all registered financial corporations of the same category in a group of related bodies corporate (e.g. two or more money mark ...

... The Equity Securities Held form is to be completed by all registered financial corporations that have total assets equal to or greater than $500 million, after consolidating all registered financial corporations of the same category in a group of related bodies corporate (e.g. two or more money mark ...

Download pdf | 172 KB |

... The biggest risk to the debt markets at present is the specter of a significant uptick in default rates Forecasters such as Moody’s expect the global default rate to almost triple over the next year The proliferation of highly leveraged deals “priced to perfection” over the past few years sugg ...

... The biggest risk to the debt markets at present is the specter of a significant uptick in default rates Forecasters such as Moody’s expect the global default rate to almost triple over the next year The proliferation of highly leveraged deals “priced to perfection” over the past few years sugg ...

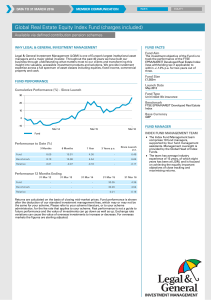

Global Real Estate Equity Index Fund

... Legal & General Investment Management (LGIM) is one of Europe’s largest institutional asset managers and a major global investor. Throughout the past 40 years we have built our business through understanding what matters most to our clients and transforming this insight into valuable, accessible inv ...

... Legal & General Investment Management (LGIM) is one of Europe’s largest institutional asset managers and a major global investor. Throughout the past 40 years we have built our business through understanding what matters most to our clients and transforming this insight into valuable, accessible inv ...

Paradox of Wealth - Helm Investment Management

... opportunities, given adequate fortitude and cash, to purchase securities at near historically low prices, but it seems likely that these windows will be more fleeting than in the past,” Bernstein writes. There is another way: Find investments to make in parts of the world that aren’t quite as cozy a ...

... opportunities, given adequate fortitude and cash, to purchase securities at near historically low prices, but it seems likely that these windows will be more fleeting than in the past,” Bernstein writes. There is another way: Find investments to make in parts of the world that aren’t quite as cozy a ...

designing the portfolio that meets your goals

... Helping you achieve long-term portfolio returns while minimizing risk to your assets is key to designing a recommended investment portfolio. This requires a strategy rooted in diversification by geography, sectors, and asset classes, and one that aligns with your profile. Asset allocation through an ...

... Helping you achieve long-term portfolio returns while minimizing risk to your assets is key to designing a recommended investment portfolio. This requires a strategy rooted in diversification by geography, sectors, and asset classes, and one that aligns with your profile. Asset allocation through an ...

Industry Comparison by GDP and Percentage of the

... Sustainable Capital Formation The innovation is here, but the risk capital required to sustain R&D in the long-run is lacking. Canada’s biotechnology industry requires $1 billion annually to sustain itself. This is capital from all sources: ...

... Sustainable Capital Formation The innovation is here, but the risk capital required to sustain R&D in the long-run is lacking. Canada’s biotechnology industry requires $1 billion annually to sustain itself. This is capital from all sources: ...

bastion worldwide flexible fund of funds bastion

... commissions is available on request from company/scheme. Commission and incentives may be paid and if so, are included in the overall cost. This fund may be closed to new investors. A fund of funds collective investments may invest in other collective investments, which levy their own charges, which ...

... commissions is available on request from company/scheme. Commission and incentives may be paid and if so, are included in the overall cost. This fund may be closed to new investors. A fund of funds collective investments may invest in other collective investments, which levy their own charges, which ...

www.FirstRate.com | Evaluating Performance of Alternative

... a private placement rather than a public offering. Investments are made through private equity funds which are pooled investment vehicles that are relatively illiquid. These investments include the venture capital financing of private companies as well as the buyout of public companies. There is a d ...

... a private placement rather than a public offering. Investments are made through private equity funds which are pooled investment vehicles that are relatively illiquid. These investments include the venture capital financing of private companies as well as the buyout of public companies. There is a d ...

presentation

... • Asia is now large enough to drive its own growth led by consumer driven countries such as China, India, Indonesia, Korea and other Asian nations. • Real consumption throughout Asia is sustained by per capita income and population growth. • Asian consumption has grown 25% year on year compared to a ...

... • Asia is now large enough to drive its own growth led by consumer driven countries such as China, India, Indonesia, Korea and other Asian nations. • Real consumption throughout Asia is sustained by per capita income and population growth. • Asian consumption has grown 25% year on year compared to a ...

theory of capital structure

... As we previously uncovered when we looked at financial leverage, this is not a surprising result. As a firm increases its use of debt, the risk to the stockholder increases and, as a consequence, the stockholder’s required rate of return will increase. Modigliani and Miller simply defined how the st ...

... As we previously uncovered when we looked at financial leverage, this is not a surprising result. As a firm increases its use of debt, the risk to the stockholder increases and, as a consequence, the stockholder’s required rate of return will increase. Modigliani and Miller simply defined how the st ...

Private Company Financial Reporting Initiative Achieves

... issued, it also applies to many of the approximately 28.5 million private companies. The result is that too much of what’s included in private company financial statements is not useful to anyone who uses them. Users of private company financial statements need straightforward, understandable inform ...

... issued, it also applies to many of the approximately 28.5 million private companies. The result is that too much of what’s included in private company financial statements is not useful to anyone who uses them. Users of private company financial statements need straightforward, understandable inform ...

Income taxes

... = Income after tax and before extraordinary items + Extraordinary items = Net income - Preferred dividends = Net income available to common shareholders ...

... = Income after tax and before extraordinary items + Extraordinary items = Net income - Preferred dividends = Net income available to common shareholders ...

PRIVATE EQUITY IN REAL ESTATE

... The term private equity refers to equity investment in growth oriented businesses, majority of which are unlisted. The capital is provided for medium to long term to enable such businesses to grow and expand. Private equity investors assume the role of active investors and work closely with their po ...

... The term private equity refers to equity investment in growth oriented businesses, majority of which are unlisted. The capital is provided for medium to long term to enable such businesses to grow and expand. Private equity investors assume the role of active investors and work closely with their po ...

CPD Quiz - Association of Corporate Treasurers

... The right answer is (c) improving profitability by reducing the weighted average cost of capital Of course all of the areas of responsibility are important, the real question is one of priorities. Reducing the cost of debt can increase profitability but, in practice, the value gains are relatively m ...

... The right answer is (c) improving profitability by reducing the weighted average cost of capital Of course all of the areas of responsibility are important, the real question is one of priorities. Reducing the cost of debt can increase profitability but, in practice, the value gains are relatively m ...

Exploiting Inefficiencies Across Asset Classes, Globally

... Global Tactical Asset Allocation (GTAA) via CEFs offers investors three levels of market inefficiency to exploit. First, at the underlying fund level there is the inefficiencies within the underlying asset class in which the CEF invests. The extent of these inefficiencies will vary via asset class. ...

... Global Tactical Asset Allocation (GTAA) via CEFs offers investors three levels of market inefficiency to exploit. First, at the underlying fund level there is the inefficiencies within the underlying asset class in which the CEF invests. The extent of these inefficiencies will vary via asset class. ...

Discussion of "The Leverage Cycle" by John Geanakoplos

... leveraged investors. These alternative approaches (as well as my example above) have two possible advantages over Geanakoplos’s more explicitly micro-founded approach. First, the active investors with warped incentives are very reminiscent of the banks and financial intermediaries who operate with r ...

... leveraged investors. These alternative approaches (as well as my example above) have two possible advantages over Geanakoplos’s more explicitly micro-founded approach. First, the active investors with warped incentives are very reminiscent of the banks and financial intermediaries who operate with r ...

JPMorgan Market Overview

... Opinions and estimates offered constitute our judgement and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable but do not warrant its accuracy or completeness. This mat ...

... Opinions and estimates offered constitute our judgement and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable but do not warrant its accuracy or completeness. This mat ...

all cap equity - Eagle Asset Management

... the global economy will maintain its forward momentum. Nearly 80 percent of individual countries’ manufacturing surveys around the world indicate that their economies ended the quarter in “expansion” territory: the best reading in two years. In the United States, regional economic indicators have be ...

... the global economy will maintain its forward momentum. Nearly 80 percent of individual countries’ manufacturing surveys around the world indicate that their economies ended the quarter in “expansion” territory: the best reading in two years. In the United States, regional economic indicators have be ...

FrontInvest Alternatives

... Improve Fund Management and Investor Relations FrontInvest manages any type of real estate structure and can capture master-feeder fund structures and complex organizational management, such as management companies and special purpose vehicles, as well as securitized and unitized funds. FrontInvest ...

... Improve Fund Management and Investor Relations FrontInvest manages any type of real estate structure and can capture master-feeder fund structures and complex organizational management, such as management companies and special purpose vehicles, as well as securitized and unitized funds. FrontInvest ...

top of the line thinking - Northern Funds

... in the right asset class in the right amount at the right time is important for growing and preserving wealth. Which is where Northern Trust’s allocation process comes into play. The Fund’s objective of capital appreciation and current income reflects IPC’s model portfolio, with a structure based ...

... in the right asset class in the right amount at the right time is important for growing and preserving wealth. Which is where Northern Trust’s allocation process comes into play. The Fund’s objective of capital appreciation and current income reflects IPC’s model portfolio, with a structure based ...

Seed Equity uses LinkedIn targeting, Spotlight Ads and Sponsored

... sign up for the company’s social community. “Because Spotlight Ads pull in a LinkedIn member’s profile image, they draw attention – more than you’d receive from the typical display ad,” says Crosland. “They allow you to call out LinkedIn members personally, and offer a call to action that will be me ...

... sign up for the company’s social community. “Because Spotlight Ads pull in a LinkedIn member’s profile image, they draw attention – more than you’d receive from the typical display ad,” says Crosland. “They allow you to call out LinkedIn members personally, and offer a call to action that will be me ...

Private equity

In finance, private equity is an asset class consisting of equity securities and debt in operating companies that are not publicly traded on a stock exchange.A private equity investment will generally be made by a private equity firm, a venture capital firm or an angel investor. Each of these categories of investor has its own set of goals, preferences and investment strategies; however, all provide working capital to a target company to nurture expansion, new-product development, or restructuring of the company’s operations, management, or ownership.Bloomberg Businessweek has called private equity a rebranding of leveraged-buyout firms after the 1980s. Common investment strategies in private equity include: leveraged buyouts, venture capital, growth capital, distressed investments and mezzanine capital. In a typical leveraged-buyout transaction, a private-equity firm buys majority control of an existing or mature firm. This is distinct from a venture-capital or growth-capital investment, in which the investors (typically venture-capital firms or angel investors) invest in young, growing or emerging companies, and rarely obtain majority control.Private equity is also often grouped into a broader category called private capital, generally used to describe capital supporting any long-term, illiquid investment strategy.