Stocks Are Not The New Bonds

... Past performance is no guarantee of future results. The views expressed are those of the author(s) and are subject to change at any time. These views are for informational purposes only and should not be relied upon as a recommendation to purchase any security or as a solicitation or investment advi ...

... Past performance is no guarantee of future results. The views expressed are those of the author(s) and are subject to change at any time. These views are for informational purposes only and should not be relied upon as a recommendation to purchase any security or as a solicitation or investment advi ...

Hiding in Plain Sight

... strategy or concentrated portfolio that doesn’t fit neatly into an existing slice of a large firm’s asset allocation. Some are as unskilled at marketing as they are skilled at security selection, while others don’t believe in paying the platform fees that are required to gain distribution access wit ...

... strategy or concentrated portfolio that doesn’t fit neatly into an existing slice of a large firm’s asset allocation. Some are as unskilled at marketing as they are skilled at security selection, while others don’t believe in paying the platform fees that are required to gain distribution access wit ...

Gerry Co - JustAnswer

... Gerry Co. has a gross profit of $880,000 and $360,000 in depreciation expense. Selling and administrative expense is $120,000. Given that the tax rate is 40 percent, compute the cash flow for Gerry Co. ...

... Gerry Co. has a gross profit of $880,000 and $360,000 in depreciation expense. Selling and administrative expense is $120,000. Given that the tax rate is 40 percent, compute the cash flow for Gerry Co. ...

FIN4504c3

... Fund is a corporation formed by an investment advisory firm that selects the board of trustees. Trustees hire a management company. ...

... Fund is a corporation formed by an investment advisory firm that selects the board of trustees. Trustees hire a management company. ...

Corporate Finance

... television systems, to evaluate its capital structure. They currently have 70 million shares outstanding trading at $10 per share. In addition, it has 500,000 ten-year convertible bonds, with a coupon rate of 8%, trading at $1000 per bond. JJ Corporation is rated BBB, and the interest rate on BBB st ...

... television systems, to evaluate its capital structure. They currently have 70 million shares outstanding trading at $10 per share. In addition, it has 500,000 ten-year convertible bonds, with a coupon rate of 8%, trading at $1000 per bond. JJ Corporation is rated BBB, and the interest rate on BBB st ...

A Project Report Presentation On *SBI Mutual Fund

... Have higher price fluctuation as compared to money market funds due to interest rate fluctuation. Have a higher risk of default by borrowers as compared to Gilt funds. Debt funds can be categorized further based on their risk profiles. Carry both credit risk and interest rate risks. ...

... Have higher price fluctuation as compared to money market funds due to interest rate fluctuation. Have a higher risk of default by borrowers as compared to Gilt funds. Debt funds can be categorized further based on their risk profiles. Carry both credit risk and interest rate risks. ...

Document

... Lighten up on Treasuries and other government-backed bonds (and by extension, total market bond index funds); they tend to be most vulnerable to changes in interest rates. Also beware of junk bonds: Spreads have narrowed considerably. (Rule of thumb: Buy when spreads are 8 percentage points, sell wh ...

... Lighten up on Treasuries and other government-backed bonds (and by extension, total market bond index funds); they tend to be most vulnerable to changes in interest rates. Also beware of junk bonds: Spreads have narrowed considerably. (Rule of thumb: Buy when spreads are 8 percentage points, sell wh ...

View - Ferguson Wellman Capital Management

... Paulson International Fund seeks to construct a diversified portfolio of merger arbitrage positions. It focuses on high quality, larger-spread deals and gears the portfolio towards transactions with competing higher bid probability as well as focusing on unique deal structures, including stock colla ...

... Paulson International Fund seeks to construct a diversified portfolio of merger arbitrage positions. It focuses on high quality, larger-spread deals and gears the portfolio towards transactions with competing higher bid probability as well as focusing on unique deal structures, including stock colla ...

BsBDH1edchap013WebDisplay

... Qualifying companies can authorize all the shares they expect to sell over a two-year period and sell them when needed. Company can elect to award the underwriting contract through a public auction instead of negotiation. ...

... Qualifying companies can authorize all the shares they expect to sell over a two-year period and sell them when needed. Company can elect to award the underwriting contract through a public auction instead of negotiation. ...

The share that taps into high yields from North America, at a 13pc

... British dividend pool as a whole is dominated by a small number of very large companies. In fact, just 10 firms account for half of the dividends paid by FTSE 100 constituent companies. If any of these groups is forced to cut or suspend its dividend, the effect will be significant. By contrast, the ...

... British dividend pool as a whole is dominated by a small number of very large companies. In fact, just 10 firms account for half of the dividends paid by FTSE 100 constituent companies. If any of these groups is forced to cut or suspend its dividend, the effect will be significant. By contrast, the ...

Short-term investments - McGraw Hill Higher Education

... Acquired principally for the purpose of selling or repurchasing them in the near term, with a pattern of short-term profit-taking. Such investments are accounted for by the fair value approach, in contrast to the historical cost approach generally used for other assets like land, buildings, and ...

... Acquired principally for the purpose of selling or repurchasing them in the near term, with a pattern of short-term profit-taking. Such investments are accounted for by the fair value approach, in contrast to the historical cost approach generally used for other assets like land, buildings, and ...

Concept 6 Kaufman

... rates. Can be sold to any party interested in owning bonds. o 2. Traditional Private Offerings – debt offered by a limited universe of lenders (banks, leasing companies, insurance companies, etc.) Can be taxable or tax exempt and can carry fixed or variable interest rates. o 3. Nontraditional Vehicl ...

... rates. Can be sold to any party interested in owning bonds. o 2. Traditional Private Offerings – debt offered by a limited universe of lenders (banks, leasing companies, insurance companies, etc.) Can be taxable or tax exempt and can carry fixed or variable interest rates. o 3. Nontraditional Vehicl ...

total alternative debt holdings at 31 december 2016

... TOTAL ALTERNATIVE DEBT HOLDINGS AT 31 DECEMBER 2016 The table below lists the Alternative Debt Funds that Cbus invests in, and their % of the total Alternative Debt asset class. Alternative debt investments are a type of fixed interest investment. Cbus’ alternative debt investments are generally mad ...

... TOTAL ALTERNATIVE DEBT HOLDINGS AT 31 DECEMBER 2016 The table below lists the Alternative Debt Funds that Cbus invests in, and their % of the total Alternative Debt asset class. Alternative debt investments are a type of fixed interest investment. Cbus’ alternative debt investments are generally mad ...

Background Note on leveraging private investment and the role of public sector climate finance

... countries with strong regulatory systems and institutions, and where certain policies are already in place or under development. Foreign exchange liquidity facility. Some projects will need to repay loans on borrowed debt in foreign currency, but will receive project revenues in a local currency. In ...

... countries with strong regulatory systems and institutions, and where certain policies are already in place or under development. Foreign exchange liquidity facility. Some projects will need to repay loans on borrowed debt in foreign currency, but will receive project revenues in a local currency. In ...

Question: Marks: 10

... Solution: a) Dupont Equation Dupont equation is used to judge the impact of operational efficiency and effectiveness on the return on equity and assets or we can say on the overall performance of the company. The Dupont equation can be obtained by decomposing the ROE. It can be achieved through foll ...

... Solution: a) Dupont Equation Dupont equation is used to judge the impact of operational efficiency and effectiveness on the return on equity and assets or we can say on the overall performance of the company. The Dupont equation can be obtained by decomposing the ROE. It can be achieved through foll ...

Premier Multi-Asset Distribution Fund

... portfolio of Big Box logistics assets (modern distribution units typically >500,000 sq. ft.) in prime UK locations. Big Box logistics assets will be let to institutional grade tenants on long-dated leases providing stable and growing revenue with the potential for capital appreciation, to achieve a ...

... portfolio of Big Box logistics assets (modern distribution units typically >500,000 sq. ft.) in prime UK locations. Big Box logistics assets will be let to institutional grade tenants on long-dated leases providing stable and growing revenue with the potential for capital appreciation, to achieve a ...

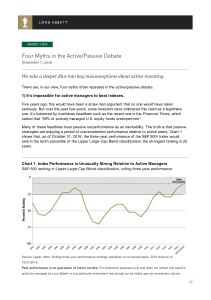

Four Myths in the Active/Passive Debate

... expansion. Growth stocks may also perf orm well during an expansion, but they may also be out of f avor during market downturns, when investors pay more attention to price ratios. While growth stocks are subject to the daily ups and downs of the stock market, their long-term potential as well as t ...

... expansion. Growth stocks may also perf orm well during an expansion, but they may also be out of f avor during market downturns, when investors pay more attention to price ratios. While growth stocks are subject to the daily ups and downs of the stock market, their long-term potential as well as t ...

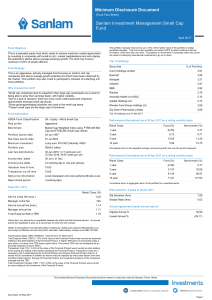

Sanlam Investment Management Small Cap Fund

... therefore carries a long-term investment horizon (5 years and upwards). The portfolio will be diversified across all major asset classes with significant exposure to equities, and may include offshore equities. There may be some capital volatility in the short term, although higher returns may be ex ...

... therefore carries a long-term investment horizon (5 years and upwards). The portfolio will be diversified across all major asset classes with significant exposure to equities, and may include offshore equities. There may be some capital volatility in the short term, although higher returns may be ex ...

Infrastructure Bonds in Chile

... payment of 100% all future interest and capital on the financing All parties involved: Sponsors, market regulators, monoline insurance companies and local long term investors worked a solution to transfering risks inherent to this financings to the best able to manage it Main benefits of the structu ...

... payment of 100% all future interest and capital on the financing All parties involved: Sponsors, market regulators, monoline insurance companies and local long term investors worked a solution to transfering risks inherent to this financings to the best able to manage it Main benefits of the structu ...

Turmoil and Opportunities in Brazil Infographic

... Source: BofA Merrill Lynch Global Research as of 9/30/2015. Risk-Love is a sentiment indicator used to measure the mood of consensus. Factors such as turnover to market cap, volatility, put call ratio, CDS spreads, IPO issuance as proportion of market cap are used to construct this metric. Each fact ...

... Source: BofA Merrill Lynch Global Research as of 9/30/2015. Risk-Love is a sentiment indicator used to measure the mood of consensus. Factors such as turnover to market cap, volatility, put call ratio, CDS spreads, IPO issuance as proportion of market cap are used to construct this metric. Each fact ...

chapter 17

... asset’s value for an 8 percent promised return unless other assets are put up as collateral. Sometimes firms find it convenient to borrow all the cash required for a particular investment. Such investments do not support all of the additional debt; lenders are protected by the firm’s other assets to ...

... asset’s value for an 8 percent promised return unless other assets are put up as collateral. Sometimes firms find it convenient to borrow all the cash required for a particular investment. Such investments do not support all of the additional debt; lenders are protected by the firm’s other assets to ...

closed-end fund “at the market” equity shelf offerings

... In an ATM Offering, these funds may, subject to market conditions, raise additional equity capital by issuing new common shares from time to time in varying amounts at a net price at or above the fund’s net asset value (“NAV”) per common share. Because the fund is selling newly-issued shares at the ...

... In an ATM Offering, these funds may, subject to market conditions, raise additional equity capital by issuing new common shares from time to time in varying amounts at a net price at or above the fund’s net asset value (“NAV”) per common share. Because the fund is selling newly-issued shares at the ...

Weighted Average Cost of Capital

... investment for many investors, this company does not meet the basic needs of our client. Do not purchase ...

... investment for many investors, this company does not meet the basic needs of our client. Do not purchase ...

Private equity

In finance, private equity is an asset class consisting of equity securities and debt in operating companies that are not publicly traded on a stock exchange.A private equity investment will generally be made by a private equity firm, a venture capital firm or an angel investor. Each of these categories of investor has its own set of goals, preferences and investment strategies; however, all provide working capital to a target company to nurture expansion, new-product development, or restructuring of the company’s operations, management, or ownership.Bloomberg Businessweek has called private equity a rebranding of leveraged-buyout firms after the 1980s. Common investment strategies in private equity include: leveraged buyouts, venture capital, growth capital, distressed investments and mezzanine capital. In a typical leveraged-buyout transaction, a private-equity firm buys majority control of an existing or mature firm. This is distinct from a venture-capital or growth-capital investment, in which the investors (typically venture-capital firms or angel investors) invest in young, growing or emerging companies, and rarely obtain majority control.Private equity is also often grouped into a broader category called private capital, generally used to describe capital supporting any long-term, illiquid investment strategy.

![[Ke E/(E+D)] + [Kd D/(E+D)]](http://s1.studyres.com/store/data/020124919_1-d1a577e860ab264b71a0e8a1a0742507-300x300.png)