Big Boom for Stocks

... economy-wide corporate profits and the 10-year Treasury yield to value stocks, consistently said US equities were undervalued. This was even true when we used a higher discount rate. These days we use a 3.5% 10-year Treasury yield (higher than the current 2.3%) and the model still says stocks are un ...

... economy-wide corporate profits and the 10-year Treasury yield to value stocks, consistently said US equities were undervalued. This was even true when we used a higher discount rate. These days we use a 3.5% 10-year Treasury yield (higher than the current 2.3%) and the model still says stocks are un ...

Modern macroeconomics: monetary policy

... Operation Twist - the Fed announced it would purchase $400 billion in long-term Treasury securities while it would sell an equal amount of shorter-term Treasury securities. (Sept 2011) Both tried to reduce interest rates on long-term Treasury securities, which typically move closely with those on ho ...

... Operation Twist - the Fed announced it would purchase $400 billion in long-term Treasury securities while it would sell an equal amount of shorter-term Treasury securities. (Sept 2011) Both tried to reduce interest rates on long-term Treasury securities, which typically move closely with those on ho ...

The Latest from Japan and Hope for a Fiscal Solution

... Fiscal Policy Now in Focus Monetary policy is one aspect of Prime Minister Shinzo Abe’s plan to recharge Japan’s economy, but fiscal policy is arguably more important. One of the reasons that easy monetary policy has not been more successful in rejuvenating Japan’s economy is because fiscal policy h ...

... Fiscal Policy Now in Focus Monetary policy is one aspect of Prime Minister Shinzo Abe’s plan to recharge Japan’s economy, but fiscal policy is arguably more important. One of the reasons that easy monetary policy has not been more successful in rejuvenating Japan’s economy is because fiscal policy h ...

Tom Allen, Head of Economics, Eton College

... combined losses of £50bn since 2008. • C In 2009 the Bank of England commenced quantitative easing, QE, which involves the purchasing of assets – mainly government bonds – from commercial banks, insurance companies and pension funds. • C In selling bonds to the Bank, these institutions now had more ...

... combined losses of £50bn since 2008. • C In 2009 the Bank of England commenced quantitative easing, QE, which involves the purchasing of assets – mainly government bonds – from commercial banks, insurance companies and pension funds. • C In selling bonds to the Bank, these institutions now had more ...

module 31 review

... 2. Now assume that the Fed is following a policy of targeting the federal funds rate. What will the Fed do in the situation described in question 1 to keep the federal funds rate unchanged? Illustrate with a diagram. ...

... 2. Now assume that the Fed is following a policy of targeting the federal funds rate. What will the Fed do in the situation described in question 1 to keep the federal funds rate unchanged? Illustrate with a diagram. ...

Hanuman Morning Report

... European stocks ended slightly lower on Friday as worries over the outcome of the G20 meeting prompted investors to book some profits, after key indexes hit six-month highs in the previous session. The FTSEurofirst 300 .FTEU3 index of top European shares closed 0.4 percent lower at 1,089.45 points, ...

... European stocks ended slightly lower on Friday as worries over the outcome of the G20 meeting prompted investors to book some profits, after key indexes hit six-month highs in the previous session. The FTSEurofirst 300 .FTEU3 index of top European shares closed 0.4 percent lower at 1,089.45 points, ...

Macroeconomics

... deficit of $10,000. You would need to borrow that $10,000 from someone, maybe with a credit card or a home equity loan. If you reduce your spending the following year, to $55,000, you have “halved the deficit”, but you’re still spending $5,000 more than you’re earning, and going further and further ...

... deficit of $10,000. You would need to borrow that $10,000 from someone, maybe with a credit card or a home equity loan. If you reduce your spending the following year, to $55,000, you have “halved the deficit”, but you’re still spending $5,000 more than you’re earning, and going further and further ...

Review Guide 2

... The citizens of a country hold $1000 in currency. The bank has $500 in reserves, and the reserve-deposit ratio is 5%. The Federal Reserve conducts open-market operations to stimulate the economy, and purchases bonds for $100. Assume the $100 from the Federal Reserve is deposited completely into the ...

... The citizens of a country hold $1000 in currency. The bank has $500 in reserves, and the reserve-deposit ratio is 5%. The Federal Reserve conducts open-market operations to stimulate the economy, and purchases bonds for $100. Assume the $100 from the Federal Reserve is deposited completely into the ...

499Beaty10Presentation

... • Simon Johnson argues that increase in corporate pay compensation drove financiers to increase profits through risk • Lawrence H. White argues that it was govt. through low interest rates and encouraging unqualified barrowers for loans ...

... • Simon Johnson argues that increase in corporate pay compensation drove financiers to increase profits through risk • Lawrence H. White argues that it was govt. through low interest rates and encouraging unqualified barrowers for loans ...

Occupant Load

... (4) Dramatic reduction of private debt, as money creation no longer requires simultaneous debt creation. We find support for all four of Fisher's claims. Furthermore, output gains approach 10 percent, and steady state inflation can drop to zero without posing problems for the conduct of monetary pol ...

... (4) Dramatic reduction of private debt, as money creation no longer requires simultaneous debt creation. We find support for all four of Fisher's claims. Furthermore, output gains approach 10 percent, and steady state inflation can drop to zero without posing problems for the conduct of monetary pol ...

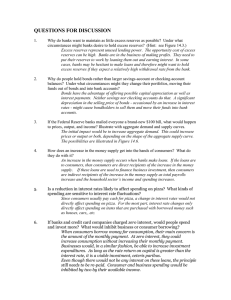

QUESTIONS FOR DISCUSSION

... directly affect spending on items that are purchased with borrowed money such as houses, cars,, etc. ...

... directly affect spending on items that are purchased with borrowed money such as houses, cars,, etc. ...

US Economy in a Snapshot - Federal Reserve Bank of New York

... U.S. Economy in a Snapshot Research & Statistics Group June 2015 The U.S. Economy in a Snapshot compiles observations of staff members of the Federal Reserve Bank of New York’s Research and Statistics Group. The views, model results, and analysis presented are solely those of the individual contribu ...

... U.S. Economy in a Snapshot Research & Statistics Group June 2015 The U.S. Economy in a Snapshot compiles observations of staff members of the Federal Reserve Bank of New York’s Research and Statistics Group. The views, model results, and analysis presented are solely those of the individual contribu ...

Monetary Policy

... 3) Changes in velocity: total expenditures = M times velocity of money (how often spent) 4) Investment Impact: in reality borrowing small source ...

... 3) Changes in velocity: total expenditures = M times velocity of money (how often spent) 4) Investment Impact: in reality borrowing small source ...

2016-2-3 - Guaranteed Losses

... Surely one of the strangest trends on the world investment markets these days is banks paying negative rates to depositors, and bonds issued with negative interest rates. Basically that means that these institutions, and issuers, are guaranteeing a loss when you invest in their bonds or otherwise le ...

... Surely one of the strangest trends on the world investment markets these days is banks paying negative rates to depositors, and bonds issued with negative interest rates. Basically that means that these institutions, and issuers, are guaranteeing a loss when you invest in their bonds or otherwise le ...

Bank Indonesia Eases - TD Securities Research

... This was not a clear cut call and the market had a significant bias to expect a hold (as did we). Bank Indonesia also lowered its reserve ratio by 100bps to 6.50%, a very significant liquidity easing gesture. We had expected that BI would perhaps be likely to stay its hand given recent financial mar ...

... This was not a clear cut call and the market had a significant bias to expect a hold (as did we). Bank Indonesia also lowered its reserve ratio by 100bps to 6.50%, a very significant liquidity easing gesture. We had expected that BI would perhaps be likely to stay its hand given recent financial mar ...

Economics: Module 4 Note Taking Guide

... 1. What is the Gross National Product (GDP)? _____________________________________________________________ __________________________________________________________________________________________________ 2. Write about how each of these five major factors affects the GDP: Population_______________ ...

... 1. What is the Gross National Product (GDP)? _____________________________________________________________ __________________________________________________________________________________________________ 2. Write about how each of these five major factors affects the GDP: Population_______________ ...

Read this essay here.

... Essentially, if the central bank has bought up lots of assets, it can start selling them, destroying the money it receives from sales. The central bank can also raise interest rates, which will encourage people to switch away from holding money, reducing inflationary pressure. Sadly however, the sol ...

... Essentially, if the central bank has bought up lots of assets, it can start selling them, destroying the money it receives from sales. The central bank can also raise interest rates, which will encourage people to switch away from holding money, reducing inflationary pressure. Sadly however, the sol ...

Great Depression Terms Puzzle - Federal Reserve Bank of St. Louis

... revenues. (2 words) [BUDGETDEFICIT] 6. The quantity of money available in an economy. The basic money supply in the United States consists of currency, coins and checking account (i.e., demand) deposits. (2 words) [MONEYSUPPLY] ...

... revenues. (2 words) [BUDGETDEFICIT] 6. The quantity of money available in an economy. The basic money supply in the United States consists of currency, coins and checking account (i.e., demand) deposits. (2 words) [MONEYSUPPLY] ...

Chapter 19

... – Reserve requirement—% of its deposits a bank must retain, either in its own vault or on deposit with its Federal Reserve District Bank – More required reserves = less money in circulation ...

... – Reserve requirement—% of its deposits a bank must retain, either in its own vault or on deposit with its Federal Reserve District Bank – More required reserves = less money in circulation ...

Traditional Interest Rate Channels

... with fall or rise in nominal interest rates. 2. Other asset prices besides short-term debt have information about stance of monetary policy. 3. Monetary policy effective in reviving economy even if short-term interest rates near zero. 4. Avoiding unanticipated fluctuations in price level important: ...

... with fall or rise in nominal interest rates. 2. Other asset prices besides short-term debt have information about stance of monetary policy. 3. Monetary policy effective in reviving economy even if short-term interest rates near zero. 4. Avoiding unanticipated fluctuations in price level important: ...

Bank of England governor Mervyn King faced a flurry of questions

... the result of inflation being high, inflation is the symptom. The causes of that squeeze on living standards are real causes. They are a change in real prices of energy, and utility prices of gas, electricity at home. They are the consequences of higher value added tax, higher food prices and conseq ...

... the result of inflation being high, inflation is the symptom. The causes of that squeeze on living standards are real causes. They are a change in real prices of energy, and utility prices of gas, electricity at home. They are the consequences of higher value added tax, higher food prices and conseq ...

Macroeconomic environment of business activities

... inflation so low and stable over time that is does not materially enter into the decisions of firms and households. ...

... inflation so low and stable over time that is does not materially enter into the decisions of firms and households. ...

OFFICIAL CASH RATE HOW DOES IT WORK?

... • The Official Cash Rate (OCR) is an interest rate set by the Reserve Bank to implement monetary policy, so as to maintain price stability. • The OCR review is done 8 times in a year. • By setting the OCR, the Reserve Bank is able to substantially influence short-term interest rates, such as the 90- ...

... • The Official Cash Rate (OCR) is an interest rate set by the Reserve Bank to implement monetary policy, so as to maintain price stability. • The OCR review is done 8 times in a year. • By setting the OCR, the Reserve Bank is able to substantially influence short-term interest rates, such as the 90- ...

Monetary-Policy

... • Effects on currency may be undesirable • One size fits all – needs of one sector may be opposite to those of another – can’t be targeted at problem areas • May not be effective if already anticipated ...

... • Effects on currency may be undesirable • One size fits all – needs of one sector may be opposite to those of another – can’t be targeted at problem areas • May not be effective if already anticipated ...

And the second half begins

... • Fed Gov’t ability to influence economy by controlling taxes & spending • CIGX • Spending = G • Taxes = C ...

... • Fed Gov’t ability to influence economy by controlling taxes & spending • CIGX • Spending = G • Taxes = C ...