Fiscal Policy:

... • The government spends more money because consumers cannot – keep companies running and workers employed. ...

... • The government spends more money because consumers cannot – keep companies running and workers employed. ...

Ch_ 22_ sec_1 - Pequannock Township High School

... Many Americans practiced speculation & buying on margin ...

... Many Americans practiced speculation & buying on margin ...

Chapter:02

... Other Policy Tools: a) Moral Suasion: The Central bank tries to bring psychological pressure to bear on individuals & institutions to conform the bank’s policies, using telephone calls or letters to bankers, making speeches explaining the Central bank’s policies, & testifying before parliament to ex ...

... Other Policy Tools: a) Moral Suasion: The Central bank tries to bring psychological pressure to bear on individuals & institutions to conform the bank’s policies, using telephone calls or letters to bankers, making speeches explaining the Central bank’s policies, & testifying before parliament to ex ...

Why Won`t Those Banks Lend

... Some observers see high inflation as the result of such an increase in lending. With more money chasing the same amount of goods and services, you have a classic demand inflation scenario. While we see this as a real risk a couple of years out, we do not see it as an immediate risk as: (a) factory ...

... Some observers see high inflation as the result of such an increase in lending. With more money chasing the same amount of goods and services, you have a classic demand inflation scenario. While we see this as a real risk a couple of years out, we do not see it as an immediate risk as: (a) factory ...

PPT ON MONETARY POLICY BY:- SHIVAM SAKHUJA BBA 2nd YEAR

... Limited role in curbing the inflationary pressures. Increased liquidity of commercial banks. Existence of BLACK MONEY. Under developed money market. ...

... Limited role in curbing the inflationary pressures. Increased liquidity of commercial banks. Existence of BLACK MONEY. Under developed money market. ...

fiscal and monetary policy

... bonds, notes, bills, or other government bonds (guaranteed by US gov. and tax exempt) Recommendation by FOMC (Federal Open Market Committee), component of the Fed Foreign ...

... bonds, notes, bills, or other government bonds (guaranteed by US gov. and tax exempt) Recommendation by FOMC (Federal Open Market Committee), component of the Fed Foreign ...

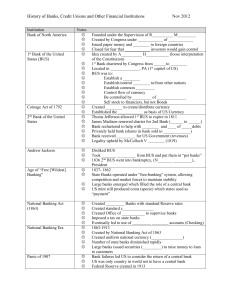

Institution

... US mint still produced coins (specie) which states used as “payment” Created _________ Banks with standard Reserve rates Created standard c_______________ Created Office of ___________ to supervise banks Imposed a tax on state banks Eventually led to use of _________ ________ accounts (Checking) ...

... US mint still produced coins (specie) which states used as “payment” Created _________ Banks with standard Reserve rates Created standard c_______________ Created Office of ___________ to supervise banks Imposed a tax on state banks Eventually led to use of _________ ________ accounts (Checking) ...

Macroeconomics Baseball Review

... Are most goods bought by the government @ the federal or state level? Are taxes classified as leakages or injections? When did the US gov’t start to fight poverty? (Lyndon Johnson) Which country suffered hyper-inflation in the early 1920s? Whom does inflation help? What is currency? Which ethnic gro ...

... Are most goods bought by the government @ the federal or state level? Are taxes classified as leakages or injections? When did the US gov’t start to fight poverty? (Lyndon Johnson) Which country suffered hyper-inflation in the early 1920s? Whom does inflation help? What is currency? Which ethnic gro ...

Fall 2009 - Stonebrooke Asset Management Ltd

... It is becoming clear that inflationary policies are being actively pursued. Money will be borrowed and/or printed for as long as it takes. To head off deflation, the liquidity may just keep flowing until inflation is finally visible! After the 2000-02 financial panic, interest rates were lowered to ...

... It is becoming clear that inflationary policies are being actively pursued. Money will be borrowed and/or printed for as long as it takes. To head off deflation, the liquidity may just keep flowing until inflation is finally visible! After the 2000-02 financial panic, interest rates were lowered to ...

Unorthodox monetary policy - effas-ebc

... – Sept-Oct 2008 • Reserves held at Fed rose by more than 8,000 per cent • Balance sheet nearly tripled to $2,200bn – Holdings of US Treasury debt reduced to $550bn – Loans/deposits from government rose to $380bn ...

... – Sept-Oct 2008 • Reserves held at Fed rose by more than 8,000 per cent • Balance sheet nearly tripled to $2,200bn – Holdings of US Treasury debt reduced to $550bn – Loans/deposits from government rose to $380bn ...

File - Critical Thinking is Required

... How Do Banks Create New Deposits? • Banks receive $1 billion new reserves. • Lend out $6 billion. ▫ By creating new deposits (i.e. loans). ...

... How Do Banks Create New Deposits? • Banks receive $1 billion new reserves. • Lend out $6 billion. ▫ By creating new deposits (i.e. loans). ...

Monetary Policy

... be used by the monetary authorities to further stimulate the economy by purchasing assets of longer maturity than only short-term government bonds, and thereby lowering longer-term interest rates further out on the yield curve. Quantitative easing raises the prices of the financial assets bought, wh ...

... be used by the monetary authorities to further stimulate the economy by purchasing assets of longer maturity than only short-term government bonds, and thereby lowering longer-term interest rates further out on the yield curve. Quantitative easing raises the prices of the financial assets bought, wh ...

5. Approaches to policy and macroeconomic context

... Keynes shifted macroeconomic thought from a focus on AS to AD. Keynesian economists emphasise the use of demand-side policies, fiscal and monetary, to close gaps between actual and potential output. The 2008 financial crisis caused an increase in popularity of Keynesian beliefs. Keynesians believe t ...

... Keynes shifted macroeconomic thought from a focus on AS to AD. Keynesian economists emphasise the use of demand-side policies, fiscal and monetary, to close gaps between actual and potential output. The 2008 financial crisis caused an increase in popularity of Keynesian beliefs. Keynesians believe t ...

Bank of England * Outright Purchases

... The BoE buys assets and pays them outright (on the spot) with new created money. This newelectronically created money is deposited in the commercial bank of the former owner of the asset. This money can now be transformed in consumption of goods, investment, or it can stay “idle” in the bank, helpin ...

... The BoE buys assets and pays them outright (on the spot) with new created money. This newelectronically created money is deposited in the commercial bank of the former owner of the asset. This money can now be transformed in consumption of goods, investment, or it can stay “idle” in the bank, helpin ...

Monetary Policy

... purchases or sells securities (government bonds) to banks and the public, which changes the amount of money available from the public and banks for loans. The Fed would purchase securities to pump in money to increase economic growth. The Fed would sell securities to soak up money from the econo ...

... purchases or sells securities (government bonds) to banks and the public, which changes the amount of money available from the public and banks for loans. The Fed would purchase securities to pump in money to increase economic growth. The Fed would sell securities to soak up money from the econo ...

The Impact of the End of Quantitative Easing

... As the economy contracted after the financial crisis, the Fed maintained very low Fed funds rates (essentially zero) and then employed QE to purchase bonds to increase the amount of money in circulation. The goal was to stimulate economic activity which would in turn reduce the unemployment rate and ...

... As the economy contracted after the financial crisis, the Fed maintained very low Fed funds rates (essentially zero) and then employed QE to purchase bonds to increase the amount of money in circulation. The goal was to stimulate economic activity which would in turn reduce the unemployment rate and ...

WSJ: Hitting the Limits of Monetary Policy

... Loose monetary policy also depends on the credit channel. If businesses and households are reluctant to borrow more, the impact of monetary policy will be muted. The additional liquidity created by QE will remain in the banking system instead of flowing into the real economy. Subdued credit growth i ...

... Loose monetary policy also depends on the credit channel. If businesses and households are reluctant to borrow more, the impact of monetary policy will be muted. The additional liquidity created by QE will remain in the banking system instead of flowing into the real economy. Subdued credit growth i ...

Abstract

... The Central Bank is the highest authority employed by the government for formulation of monetary policy to guide the economy in a certain country. Monetary policy is defined as the regulation of the money supply and interest rates by a central bank. Monetary policy also refers to how the central ban ...

... The Central Bank is the highest authority employed by the government for formulation of monetary policy to guide the economy in a certain country. Monetary policy is defined as the regulation of the money supply and interest rates by a central bank. Monetary policy also refers to how the central ban ...

REAL ESTATE ECONOMICS - Chapter Quizzes

... 1. A demand deposit that must be paid by the depositor’s bank to the payee upon presentation is known as: a. cash. b. check. c. money order. d. all of the above. 2. California is in which district of the Federal Reserve System? a. 16th b. 13th c. 12th d. 11th 3. The rate of interest at which member ...

... 1. A demand deposit that must be paid by the depositor’s bank to the payee upon presentation is known as: a. cash. b. check. c. money order. d. all of the above. 2. California is in which district of the Federal Reserve System? a. 16th b. 13th c. 12th d. 11th 3. The rate of interest at which member ...

Key Terms Work Sheet

... 2. A(n) ______ is a savings alternative in which money is left on deposit for a state period of time to earn a specific rate of return. 3. The _______ is the amount of interest that your deposit would earn, after compounding, for one year. 4. ____ is the process in which interest is earned on both t ...

... 2. A(n) ______ is a savings alternative in which money is left on deposit for a state period of time to earn a specific rate of return. 3. The _______ is the amount of interest that your deposit would earn, after compounding, for one year. 4. ____ is the process in which interest is earned on both t ...

Understanding the Bond Market

... Bonds are a well-established asset class holding trillions of dollars globally. Even though they pass for “boring” in the general public and with some novice investors, debt instruments are anything but. When you understand them in more depth, you will gain new insights into many news stories from r ...

... Bonds are a well-established asset class holding trillions of dollars globally. Even though they pass for “boring” in the general public and with some novice investors, debt instruments are anything but. When you understand them in more depth, you will gain new insights into many news stories from r ...

Objective of MP - qazieconometrics

... the exchange rate. The exchange rate is the relative price of domestic and foreign money, so it depends on both domestic and foreign monetary conditions. ► However, other things being equal, an unexpected rise in the official rate will probably lead to an immediate appreciation of the domestic curre ...

... the exchange rate. The exchange rate is the relative price of domestic and foreign money, so it depends on both domestic and foreign monetary conditions. ► However, other things being equal, an unexpected rise in the official rate will probably lead to an immediate appreciation of the domestic curre ...

Bonds Payable * A corporate debt

... If market rate > stated rate, issue at a discount If market rate < stated rate, issue at a premium ...

... If market rate > stated rate, issue at a discount If market rate < stated rate, issue at a premium ...