Document

... to evaluate the effectiveness of the items, choosing three that are effective and three that are not. Use the economic ripple effect to evaluate it: Does the item create a farreaching, effective economic ripple effect, or is it a waste of money? ...

... to evaluate the effectiveness of the items, choosing three that are effective and three that are not. Use the economic ripple effect to evaluate it: Does the item create a farreaching, effective economic ripple effect, or is it a waste of money? ...

The Commercial Banking Industry

... II. Monetary Policy Instruments A. General Control Instruments ...

... II. Monetary Policy Instruments A. General Control Instruments ...

Practice Midterm 2

... 10. costs that are born even when nothing is produced (example: rent) 11. when increasing all factor of production lowers cost per unit 12. when a group of producers restricts output to raise price—acting like a monopoly. ...

... 10. costs that are born even when nothing is produced (example: rent) 11. when increasing all factor of production lowers cost per unit 12. when a group of producers restricts output to raise price—acting like a monopoly. ...

Why Has Good Economic News Hurt Financial Markets?

... And yet financial assets have been volatile recently. The benchmark 10-year Treasury yield has reached a level not seen since August 2011,* and since rising bond yields are typically accompanied by falling prices, bond markets have been hit across the board lately. The tidal wave of money that has g ...

... And yet financial assets have been volatile recently. The benchmark 10-year Treasury yield has reached a level not seen since August 2011,* and since rising bond yields are typically accompanied by falling prices, bond markets have been hit across the board lately. The tidal wave of money that has g ...

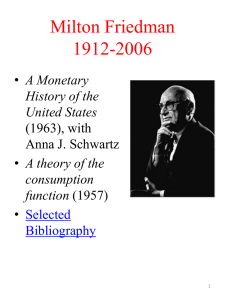

Ch 18 Milton Friedman

... Great Depression was probably caused by a sharp reduction in money supply by the US central bank, the Fed. • In the long run, however, the quantity of money affects the price level alone ...

... Great Depression was probably caused by a sharp reduction in money supply by the US central bank, the Fed. • In the long run, however, the quantity of money affects the price level alone ...

Eco 200 – Principles of Macroeconomics

... Chair of Board – 4-year term – does not coincide with President’s term – “second most powerful person in the U.S.” 12 District Banks – 9 person board (6 elected by members banks in the district, 3 appointed by Board of Governors) Federal Open Market Committee – 12 members (Board of Governors + 5 Dis ...

... Chair of Board – 4-year term – does not coincide with President’s term – “second most powerful person in the U.S.” 12 District Banks – 9 person board (6 elected by members banks in the district, 3 appointed by Board of Governors) Federal Open Market Committee – 12 members (Board of Governors + 5 Dis ...

Monetary Policy Practice EOCT Questions

... A taxing and spending decisions of the United States Government. B buying and selling of currency in foreign exchange markets. C interaction of buyers and sellers in the market place. D decisions of the Federal Reserve System that determine the money supply. ...

... A taxing and spending decisions of the United States Government. B buying and selling of currency in foreign exchange markets. C interaction of buyers and sellers in the market place. D decisions of the Federal Reserve System that determine the money supply. ...

Econ 100Practice Exam 2

... 1. It increases by $400 [multiply $100 times the multiplier, which is 4]. 2. Marginal propensity to consume [MPC]. 3. It increases. 4. When the Fed buys and sells bonds to private bank to increase or decrease the money supply. 5. downward 6. both increase 7. Monetary policy is controlled by the Fed ...

... 1. It increases by $400 [multiply $100 times the multiplier, which is 4]. 2. Marginal propensity to consume [MPC]. 3. It increases. 4. When the Fed buys and sells bonds to private bank to increase or decrease the money supply. 5. downward 6. both increase 7. Monetary policy is controlled by the Fed ...

Was quantitative easing best way to boost US economy?

... reaches zero, it becomes harder to make credit any easier when activity is sluggish. In the years since the financial crisis, this “zero bound” has been a real problem for central banks in most advanced economies. This is not to say that central banks have “run out of bullets.” Most important transa ...

... reaches zero, it becomes harder to make credit any easier when activity is sluggish. In the years since the financial crisis, this “zero bound” has been a real problem for central banks in most advanced economies. This is not to say that central banks have “run out of bullets.” Most important transa ...

It Takes a Woman to Do a Man`s Job - Asia

... captain of the world’s leading central bank. As former President of the San Francisco Fed, she understands not only the issues of an open, innovative West Coast economy, but also the dynamic Pacific Rim countries that account for 55 per cent of world GDP and 44 per cent of world trade. ...

... captain of the world’s leading central bank. As former President of the San Francisco Fed, she understands not only the issues of an open, innovative West Coast economy, but also the dynamic Pacific Rim countries that account for 55 per cent of world GDP and 44 per cent of world trade. ...

Fed/ECB/BOJ Monetary Policy In Shambles. How To Play It?

... bank would raise interest rates from their 0.5 per cent floor as early as November. Markets, naturally, rose on Friday on such pronouncements ... and as Fed funds futures indicated that a first Fed rate hike would not come in June of 2015 as the FOMC had led markets to believe prior to its September ...

... bank would raise interest rates from their 0.5 per cent floor as early as November. Markets, naturally, rose on Friday on such pronouncements ... and as Fed funds futures indicated that a first Fed rate hike would not come in June of 2015 as the FOMC had led markets to believe prior to its September ...

Investor `Extra` - Bank of Ireland Private Banking

... Larger monetary bases (money goes into the financial system, in exchange the central bank receives the purchased assets) A second direct impact QE has is in increasing the economy’s monetary base i.e. the total amount of an economy’s currency in public hands and in commercial bank deposits with the ...

... Larger monetary bases (money goes into the financial system, in exchange the central bank receives the purchased assets) A second direct impact QE has is in increasing the economy’s monetary base i.e. the total amount of an economy’s currency in public hands and in commercial bank deposits with the ...

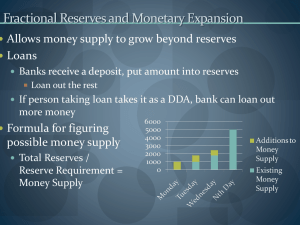

Banking and Money Creation

... the owning of labor and carries with it the care of the laborers, while the European plan, led on by England, is that capital shall control labor by controlling wages. The great debt that the capitalists will see to it is made out of the war, must be used as a means to control the volume of money. T ...

... the owning of labor and carries with it the care of the laborers, while the European plan, led on by England, is that capital shall control labor by controlling wages. The great debt that the capitalists will see to it is made out of the war, must be used as a means to control the volume of money. T ...

The Federal Reserve's Policy Dead End

... the portfolio balance theory predicted. Even if it did account for the entire rise in equity values, the increase in household equity wealth would have only a relatively small effect on consumer spending and GDP growth. There is one further puzzle about the quantitative-easing program. The Fed's pur ...

... the portfolio balance theory predicted. Even if it did account for the entire rise in equity values, the increase in household equity wealth would have only a relatively small effect on consumer spending and GDP growth. There is one further puzzle about the quantitative-easing program. The Fed's pur ...

monetary reform

... What if there’s a great lending opportunity, and bank has already lent 19$? Where do i (interest) and p (profit) come from? More loans or more vertical money required. ECONOMIC GROWTH (physics and ecology) ...

... What if there’s a great lending opportunity, and bank has already lent 19$? Where do i (interest) and p (profit) come from? More loans or more vertical money required. ECONOMIC GROWTH (physics and ecology) ...

Multiple Choice: Circle the answer the best completes each question

... 25. One necessary characteristic of money is that it must be unlimited in supply. 26. Commercial banks like Wells Fargo and Washington Mutual make a profit by loaning money. 27. Money is anything that is accepted for payment for goods and services. 28. Using a contractionary fiscal policy results in ...

... 25. One necessary characteristic of money is that it must be unlimited in supply. 26. Commercial banks like Wells Fargo and Washington Mutual make a profit by loaning money. 27. Money is anything that is accepted for payment for goods and services. 28. Using a contractionary fiscal policy results in ...

POLS 306

... • Quantitative easing is a euphemism for creating money out of thin air. In the vernacular, we call it "printing money," even though it really has nothing to do with the U.S. Bureau of Engraving and Printing. • The way it's supposed to work is that the Fed buys securities in the open market, paying ...

... • Quantitative easing is a euphemism for creating money out of thin air. In the vernacular, we call it "printing money," even though it really has nothing to do with the U.S. Bureau of Engraving and Printing. • The way it's supposed to work is that the Fed buys securities in the open market, paying ...

Money and Banking

... Tools of Monetary Policy Reserve Requirement Fed can change this rate Lower reserve requirement, more money can be loaned Open Market Operations Buying and selling of government securities in financial markets Operations conducted by Federal Open Market Committee Set targets, tell tra ...

... Tools of Monetary Policy Reserve Requirement Fed can change this rate Lower reserve requirement, more money can be loaned Open Market Operations Buying and selling of government securities in financial markets Operations conducted by Federal Open Market Committee Set targets, tell tra ...

Macroeconomics I Final exam: sample questions

... A. excess demand for goods and services B. excess supply of goods and services C. excess demand for money D. excess supply of Money 9. The AD-curve will shift to the right if A. government transfer payments are increased B. real money balances increase due to a decrease in the price level C. autonom ...

... A. excess demand for goods and services B. excess supply of goods and services C. excess demand for money D. excess supply of Money 9. The AD-curve will shift to the right if A. government transfer payments are increased B. real money balances increase due to a decrease in the price level C. autonom ...

Monthly Investment Commentary

... reallocated to life’s necessities. Our concern going forward is that if the Fed is forced to continue abnormally low interest rates in an effort to stimulate the economy, how long will it be before economic gains are offset by rising inflation? It seems like years ago that we were worried about whet ...

... reallocated to life’s necessities. Our concern going forward is that if the Fed is forced to continue abnormally low interest rates in an effort to stimulate the economy, how long will it be before economic gains are offset by rising inflation? It seems like years ago that we were worried about whet ...

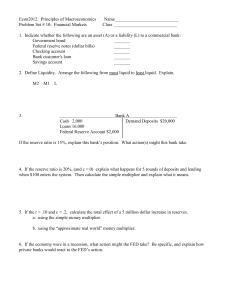

Econ2012: Principles of Macroeconomics

... Name____________________________ Class ____________________________ ...

... Name____________________________ Class ____________________________ ...

Slide 1

... End of 2009 - Summer 2010 (US Consumers drive the ball down the field) US Banks finally provide liquidity to both businesses and consumers US Government stimulus packages have an impact on the economy More mergers and acquisitions; the big get bigger China is still growing at over 7% per yea ...

... End of 2009 - Summer 2010 (US Consumers drive the ball down the field) US Banks finally provide liquidity to both businesses and consumers US Government stimulus packages have an impact on the economy More mergers and acquisitions; the big get bigger China is still growing at over 7% per yea ...