5/7 Warm Up

... monetary policy • To explain how economic stabilization tools affect the money supply, interest rates, & ...

... monetary policy • To explain how economic stabilization tools affect the money supply, interest rates, & ...

here - Lakes Area Tea Party

... economy. Those who receive the new money first are able to purchase real goods and services at preexisting prices. As these recipients spend the new money, they attract resources to themselves by bidding up prices. The second round recipients of the new money then spend the new money according to th ...

... economy. Those who receive the new money first are able to purchase real goods and services at preexisting prices. As these recipients spend the new money, they attract resources to themselves by bidding up prices. The second round recipients of the new money then spend the new money according to th ...

Monetary policy

... and by means of depreciation there will be an improvement in the balance of goods and services. Expansionary monetary policy will reduce unemployment and improve the balance of goods and services in the short period of time; as for the long term effect there is only an increase in inflation. ...

... and by means of depreciation there will be an improvement in the balance of goods and services. Expansionary monetary policy will reduce unemployment and improve the balance of goods and services in the short period of time; as for the long term effect there is only an increase in inflation. ...

Thema

... authorised to buy high-quality assets • Purchase of assets are financed by the Bank creating money • In 5 March, MPC is authorised to use the APF for monetary policy purpose • In crisis: BOE announced £75 Billion Asset Purchase Programe ...

... authorised to buy high-quality assets • Purchase of assets are financed by the Bank creating money • In 5 March, MPC is authorised to use the APF for monetary policy purpose • In crisis: BOE announced £75 Billion Asset Purchase Programe ...

the federal reserve and the money supply

... In an open-market operation the CB prints money to buy more bonds, putting more money into circulation – or sells bonds to withdraw money from circulation. This affects the interest rate – and because the interest rate affects spending, it affects the economy ...

... In an open-market operation the CB prints money to buy more bonds, putting more money into circulation – or sells bonds to withdraw money from circulation. This affects the interest rate – and because the interest rate affects spending, it affects the economy ...

Economic Terms/Notes

... A. Republican measure to tax state banks out of existence B. More involvement IV. Federal Reserve Act (1913) A. response to the perception of a money “trust” Pujo Commission B. more elastic money supply, government can respond to the monetary needs of the economy (monetary policy) C. criticized for ...

... A. Republican measure to tax state banks out of existence B. More involvement IV. Federal Reserve Act (1913) A. response to the perception of a money “trust” Pujo Commission B. more elastic money supply, government can respond to the monetary needs of the economy (monetary policy) C. criticized for ...

open market operations

... When banks need to borrow reserves from other banks they go to the Fed Funds Market. Banks offer their excess funds to other banks for overnight lending to meet their reserve requirements. The Federal Reserve does not decree this interest rate, but they use bonds to add or take from this pool of mon ...

... When banks need to borrow reserves from other banks they go to the Fed Funds Market. Banks offer their excess funds to other banks for overnight lending to meet their reserve requirements. The Federal Reserve does not decree this interest rate, but they use bonds to add or take from this pool of mon ...

The Federal Reserve

... then a banks total reserves increase allowing the bank to loan out more money (Expansionary) • If the “FED” sells government securities from banks then a banks total reserves decrease forcing the bank to loan out less money (Contractionary) ...

... then a banks total reserves increase allowing the bank to loan out more money (Expansionary) • If the “FED” sells government securities from banks then a banks total reserves decrease forcing the bank to loan out less money (Contractionary) ...

SOL 11d

... The Federal Reserve Bank, also known as the _____________________, is our nation’s ___________________________ bank. The Fed’s responsibilities are to maintain the ________________________ of our ____________________________; regulate banks to ensure the soundness of the banking system and the _____ ...

... The Federal Reserve Bank, also known as the _____________________, is our nation’s ___________________________ bank. The Fed’s responsibilities are to maintain the ________________________ of our ____________________________; regulate banks to ensure the soundness of the banking system and the _____ ...

BD104_fme_lnt_006_Ma..

... Tools of Monetary Control • There are 3 tools of monetary control it can use to alter the reserves of commercial banks: (a) Open-market operations. (b) The reserve ratio. (c) The discount rate. ...

... Tools of Monetary Control • There are 3 tools of monetary control it can use to alter the reserves of commercial banks: (a) Open-market operations. (b) The reserve ratio. (c) The discount rate. ...

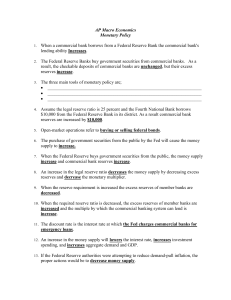

AP Macro Economics Monetary Policy When a commercial bank

... Assume the legal reserve ratio is 25 percent and the Fourth National Bank borrows $10,000 from the Federal Reserve Bank in its district. As a result commercial bank reserves are increased by $10,000. ...

... Assume the legal reserve ratio is 25 percent and the Fourth National Bank borrows $10,000 from the Federal Reserve Bank in its district. As a result commercial bank reserves are increased by $10,000. ...

Unconventional Monetary policy

... • The Bank of England has overwhelmingly bought UK government bonds from the non-bank private sector through its QE operations; • the Fed has bought US Treasuries but also large quantities of agency debt and agency-backed mortgage backed securities. The differences between the assets bought by the F ...

... • The Bank of England has overwhelmingly bought UK government bonds from the non-bank private sector through its QE operations; • the Fed has bought US Treasuries but also large quantities of agency debt and agency-backed mortgage backed securities. The differences between the assets bought by the F ...

Monetary Policy Practice

... If the Fed believes there is too much money in the economy, they can try to reduce lending activity by banks. In order to do this, they should _________________ the discount rate. This would cause banks to _______________ their interest rates. As interest rates increase, money becomes ______________ ...

... If the Fed believes there is too much money in the economy, they can try to reduce lending activity by banks. In order to do this, they should _________________ the discount rate. This would cause banks to _______________ their interest rates. As interest rates increase, money becomes ______________ ...

Of Money and Economics: The Effects of Quantitative Easing

... It seems to be a world-wide phenomenon, with the US sitting this one out since the Federal Reserve (the FED) has already accumulated $4.5 trillion in assets through its three rounds of easing that concluded in October 2014. The European Central Bank (ECB) announced plans to buy €1.1 trillion ($1.3 t ...

... It seems to be a world-wide phenomenon, with the US sitting this one out since the Federal Reserve (the FED) has already accumulated $4.5 trillion in assets through its three rounds of easing that concluded in October 2014. The European Central Bank (ECB) announced plans to buy €1.1 trillion ($1.3 t ...

Federal Reserve System

... money supply that exceeds increases in its output of goods and services. (demand >supply) • Changes in the money supply can influence overall levels of spending, employment, and prices in the economy by inducing changes in interest rates charged for credit and by affecting the levels of personal and ...

... money supply that exceeds increases in its output of goods and services. (demand >supply) • Changes in the money supply can influence overall levels of spending, employment, and prices in the economy by inducing changes in interest rates charged for credit and by affecting the levels of personal and ...

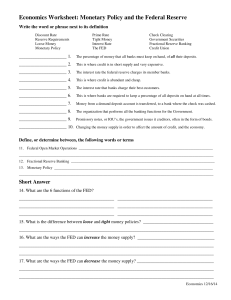

Economics Worksheet: Monetary Policy and the Federal Reserve

... The interest rate the federal reserve charges its member banks. ...

... The interest rate the federal reserve charges its member banks. ...

Quiz 9

... (2) 1. Which of the following is true according to The Economist? a. The US federal government can end the financial crisis in the US by adding layers of new regulations on financial institutions b. An expected increase in state and local government spending will help keep the US economy our of rece ...

... (2) 1. Which of the following is true according to The Economist? a. The US federal government can end the financial crisis in the US by adding layers of new regulations on financial institutions b. An expected increase in state and local government spending will help keep the US economy our of rece ...

MULTIPLE CHOICE: Please select the best answer for the following

... How do budget deficits contribute to the national debt? The national debt is increased by double each budget deficit. The national debt is increased by each budget deficit. The national debt is reduced by each budget deficit. The national debt is not affected. ...

... How do budget deficits contribute to the national debt? The national debt is increased by double each budget deficit. The national debt is increased by each budget deficit. The national debt is reduced by each budget deficit. The national debt is not affected. ...

Impacts of QE Policy, Fiscal Cliff, and Euro Zone Crisis

... Reduce or increase Discount Rate Reduce or increase bank reserve requirement ...

... Reduce or increase Discount Rate Reduce or increase bank reserve requirement ...

**** 1 - E-SGH

... Terra Securities (Norway) – 28.11.2007 American Freedom Mortgage Inc. (USA) – 30.1.2007 ...

... Terra Securities (Norway) – 28.11.2007 American Freedom Mortgage Inc. (USA) – 30.1.2007 ...

CENTRAL BANKING

... QE is an unconventional monetary policy in which a central bank purchases government securities or other securities from the market in order to lower interest rates and increase the money supply. Quantitative easing increases the money supply by flooding financial institutions with capital in an eff ...

... QE is an unconventional monetary policy in which a central bank purchases government securities or other securities from the market in order to lower interest rates and increase the money supply. Quantitative easing increases the money supply by flooding financial institutions with capital in an eff ...