THE POWER TO CREATE MONEY: How We the People Lost It …

... Money is created by private banks as a debt at interest. ...

... Money is created by private banks as a debt at interest. ...

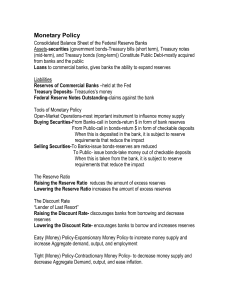

Money, Banking and Monetary Policy

... banks that borrow on a short-term (usually overnight) basis The amount of money banks must keep on reserve at the Fed ...

... banks that borrow on a short-term (usually overnight) basis The amount of money banks must keep on reserve at the Fed ...

Downlaod File

... How are the risks of the capital market securities measured and evaluated? The technical, statistical and behavioral characteristics of the models used by major derivatives intermediaries are, in principle, well-equipped to provide estimates of "risk of loss" or "capital at risk" associated with a g ...

... How are the risks of the capital market securities measured and evaluated? The technical, statistical and behavioral characteristics of the models used by major derivatives intermediaries are, in principle, well-equipped to provide estimates of "risk of loss" or "capital at risk" associated with a g ...

Please read our Full Economic outlook here

... The US economy will continue to expand in the second quarter 2016 in spite of growing fear of a recession. Consumption is positive, jobs continue to increase, the savings rate is rising. Prices in the housing sector are improving, the residential investment should remain buoyant. Short rates will no ...

... The US economy will continue to expand in the second quarter 2016 in spite of growing fear of a recession. Consumption is positive, jobs continue to increase, the savings rate is rising. Prices in the housing sector are improving, the residential investment should remain buoyant. Short rates will no ...

What happens when the Fed buys bonds?

... consumers are more likely to take out loans consumers and businesses borrow money and use it for consumption and investment spending C and I AD RGDP and PL ...

... consumers are more likely to take out loans consumers and businesses borrow money and use it for consumption and investment spending C and I AD RGDP and PL ...

what are the instruments of monetary policy

... inflation rate), full employment, and growth in aggregate income. This is necessary because money is a medium of exchange and changes in its demand relative to supply, necessitate spending adjustments. To conduct monetary policy, some monetary variables which the Central Bank controls are adjusted-a ...

... inflation rate), full employment, and growth in aggregate income. This is necessary because money is a medium of exchange and changes in its demand relative to supply, necessitate spending adjustments. To conduct monetary policy, some monetary variables which the Central Bank controls are adjusted-a ...

Monetary Policy and Financial Markets

... the actual cycle in the fed funds rate was even more pronounced than it would have been had the Fed followed Taylor’s famous rule. This paper begins with the working hypothesis that the Fed can control output and perhaps has stabilized output growth. We then ask what such equilibria imply for the cy ...

... the actual cycle in the fed funds rate was even more pronounced than it would have been had the Fed followed Taylor’s famous rule. This paper begins with the working hypothesis that the Fed can control output and perhaps has stabilized output growth. We then ask what such equilibria imply for the cy ...

xad

... Pass-through effects of higher energy prices have caused upward pressure on core inflation, but falling energy prices are likely to lessen and exert downward leverage on core inflation ...

... Pass-through effects of higher energy prices have caused upward pressure on core inflation, but falling energy prices are likely to lessen and exert downward leverage on core inflation ...

fiscal and monetary policy

... “securities” in the bond market – Treasury bonds, notes, bills, or other government bonds (guaranteed by US gov. and tax exempt) – Recommendation by FOMC (Federal Open Market Committee), component of the Fed Foreign exchange rates, interest rates, and growth of the money supply ...

... “securities” in the bond market – Treasury bonds, notes, bills, or other government bonds (guaranteed by US gov. and tax exempt) – Recommendation by FOMC (Federal Open Market Committee), component of the Fed Foreign exchange rates, interest rates, and growth of the money supply ...

Fiscal and Monetary Policy PowerPoint

... money from the FED Reserve Requirements – Percentage of deposits that banks must hold Open Market Operations – buying and selling of government bonds Federal Funds Rate – interest rate that banks lend to other banks usually overnight ...

... money from the FED Reserve Requirements – Percentage of deposits that banks must hold Open Market Operations – buying and selling of government bonds Federal Funds Rate – interest rate that banks lend to other banks usually overnight ...

Fiscal State of US

... attached), increase of 300,000. • Alternative unemployment figure was 16.1% • Benchmark changes revised total employment down by 483,000 (seasonally adj.) for December • Weekly claims 383,000 (438,000 unadjusted). These are self correcting. ...

... attached), increase of 300,000. • Alternative unemployment figure was 16.1% • Benchmark changes revised total employment down by 483,000 (seasonally adj.) for December • Weekly claims 383,000 (438,000 unadjusted). These are self correcting. ...

Every Breath You Take

... Loose Monetary Policy ! Expansionary – a policy that causes the MS to increase ! Increases inflation ! Lowers unemployment ! Lowers interest rates ! Increase GDP ! Aggregate Demand increases ...

... Loose Monetary Policy ! Expansionary – a policy that causes the MS to increase ! Increases inflation ! Lowers unemployment ! Lowers interest rates ! Increase GDP ! Aggregate Demand increases ...

Chapter 8

... What can cause a shift to the left of the aggregate supply curve? An increase in costs ...

... What can cause a shift to the left of the aggregate supply curve? An increase in costs ...

Debt_PPT-1192wvq

... • Government borrowing in the loanable funds market has resulted in rising real interest rates • European governments have been able to offset this by issuing and buying bonds in the open market, leading to falling nominal interest rates (in the money market). • That encourages more borrowing, and i ...

... • Government borrowing in the loanable funds market has resulted in rising real interest rates • European governments have been able to offset this by issuing and buying bonds in the open market, leading to falling nominal interest rates (in the money market). • That encourages more borrowing, and i ...

Central banking, money and taxation

... (a percentage of deposits) that banks and other depository institutions are required by law to keep on hand, and which may not be used for lending or investing. The interest rate charged to commercial banks and other depository institutions for loans received from a central bank’s discount ...

... (a percentage of deposits) that banks and other depository institutions are required by law to keep on hand, and which may not be used for lending or investing. The interest rate charged to commercial banks and other depository institutions for loans received from a central bank’s discount ...

Slide 1

... promoting economic growth and stability. • Monetary policy is the process by which the government, central bank, or monetary authority of a country controls (i) The supply of money, (ii) Availability of money, (iii) Cost of money or rate of interest to attain a set of objectives oriented towards the ...

... promoting economic growth and stability. • Monetary policy is the process by which the government, central bank, or monetary authority of a country controls (i) The supply of money, (ii) Availability of money, (iii) Cost of money or rate of interest to attain a set of objectives oriented towards the ...

renaissance view - Renaissance Financial

... which currently entails monthly purchases of $85 billion in Treasuries and mortgage-backed securities from financial institutions. The objective of quantitative easing is to inject liquidity into the financial system, which will in turn be put to use as bank credit. For the process to work from a ma ...

... which currently entails monthly purchases of $85 billion in Treasuries and mortgage-backed securities from financial institutions. The objective of quantitative easing is to inject liquidity into the financial system, which will in turn be put to use as bank credit. For the process to work from a ma ...

Effect of Lower interest rates:

... • Aims to stimulate borrowing by banks and consumers... • Stimulate economy with increased economic activity... ...

... • Aims to stimulate borrowing by banks and consumers... • Stimulate economy with increased economic activity... ...

1930: The Federal Reserve during the Great Depression

... Federal Reserve System: The central bank of the United States. It is responsible for controlling the money supply of our nation, and includes serving as a bank for all other banks and a bank for the U.S. Government. Central Bank: A bank that regulates the money supply for a nation and oversees the o ...

... Federal Reserve System: The central bank of the United States. It is responsible for controlling the money supply of our nation, and includes serving as a bank for all other banks and a bank for the U.S. Government. Central Bank: A bank that regulates the money supply for a nation and oversees the o ...

Aim: How does the Federal Reserve regulate the money supply?

... in this photo? What qualifications do you think this employee needs to do her job? ...

... in this photo? What qualifications do you think this employee needs to do her job? ...

Monetary Policy

... not forced to make loans when excess reserves rise. This may mean that moving the economy out of recession and low employment may be more difficult than “cooling off” the economy. Changes in velocity: An easy money policy will increase velocity (turnovers) since the cost of holding money is lower. A ...

... not forced to make loans when excess reserves rise. This may mean that moving the economy out of recession and low employment may be more difficult than “cooling off” the economy. Changes in velocity: An easy money policy will increase velocity (turnovers) since the cost of holding money is lower. A ...