San Francisco Federal Reserve Meeting

... With the T-Bill rate close to 0% (0.539 as of May 19th), there are diminishing marginal returns. Investors are reluctant to get into long term investments. This problem weakens the Fed’s control of the economy through monetary policy. With interest rates close to zero, the printing of money and buyi ...

... With the T-Bill rate close to 0% (0.539 as of May 19th), there are diminishing marginal returns. Investors are reluctant to get into long term investments. This problem weakens the Fed’s control of the economy through monetary policy. With interest rates close to zero, the printing of money and buyi ...

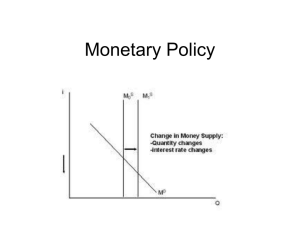

Monetary Policy

... • Stimulates AD (investment and consumption) • Lower interest rates lead to capital outflow, so dollar depreciates, and exports stimulated (higher AD) • Asset prices increase (housing) ...

... • Stimulates AD (investment and consumption) • Lower interest rates lead to capital outflow, so dollar depreciates, and exports stimulated (higher AD) • Asset prices increase (housing) ...

lect16

... • RBA uses changes to cash rate to adjust level of interest rates in economy – overnight loans among intermediaries – shifts base of yield curve ...

... • RBA uses changes to cash rate to adjust level of interest rates in economy – overnight loans among intermediaries – shifts base of yield curve ...

Really Fun Worksheet

... FUN Worksheet “Principles of Macroeconomics” NSCC - Summer 2009 Professor: Moonsu Han Question 1 Consider the following simplified balance sheet for a bank. Assets Reserves Loans ...

... FUN Worksheet “Principles of Macroeconomics” NSCC - Summer 2009 Professor: Moonsu Han Question 1 Consider the following simplified balance sheet for a bank. Assets Reserves Loans ...

The Federal Reserve System Trivia

... When the Federal Reserve System wants to slow the economy it does all of the following EXCEPT A raise income taxes B raise the discount rate C sell government securities D increase reserve rates ...

... When the Federal Reserve System wants to slow the economy it does all of the following EXCEPT A raise income taxes B raise the discount rate C sell government securities D increase reserve rates ...

The Missing Global Recovery C.P. Chandrasekhar & Jayati Ghosh

... the debt-financed boom, which was built on the liquidity infused by the large capital inflows resulting from easy monetary policy in the US, is now proving unsustainable. There is growing evidence of rising defaults and accumulating non-performing assets in bank balance sheets. There too, therefore, ...

... the debt-financed boom, which was built on the liquidity infused by the large capital inflows resulting from easy monetary policy in the US, is now proving unsustainable. There is growing evidence of rising defaults and accumulating non-performing assets in bank balance sheets. There too, therefore, ...

UNIT 15 REVIEW GAME

... Portion of the business cycle when millions are out of work, many businesses fail, and the economy operates at far below capacity. depression ...

... Portion of the business cycle when millions are out of work, many businesses fail, and the economy operates at far below capacity. depression ...

Ch 12: 1.1-4

... rates substantially above the equilibrium rate pose a particularly acute threat of a currency crisis because the country may have insufficient foreign exchange reserves to maintain the pegged exchange rate. Some European countries have been suffering from a sovereign debt crisis because they experie ...

... rates substantially above the equilibrium rate pose a particularly acute threat of a currency crisis because the country may have insufficient foreign exchange reserves to maintain the pegged exchange rate. Some European countries have been suffering from a sovereign debt crisis because they experie ...

fiscal policy - Doral Academy Preparatory

... 1. If the reserve requirement is 25 percent and banks hold no excess reserves, an open market sale of $400,000 of government securities by the Federal Reserve will (A) increase the money supply by up to $1.6 million (B) decrease the money supply by up to $1.6 million (C) increase the money supply b ...

... 1. If the reserve requirement is 25 percent and banks hold no excess reserves, an open market sale of $400,000 of government securities by the Federal Reserve will (A) increase the money supply by up to $1.6 million (B) decrease the money supply by up to $1.6 million (C) increase the money supply b ...

By: Sebastian Spio

... throes of a major category 5 fiscal hurricane. Unless the country’s central bank dramatically changes course at its 23/24 May meetings and agree to a massive inflationary program of quantitative easing and monetization of public (and some corporate) debts, several major local conglomerates and their ...

... throes of a major category 5 fiscal hurricane. Unless the country’s central bank dramatically changes course at its 23/24 May meetings and agree to a massive inflationary program of quantitative easing and monetization of public (and some corporate) debts, several major local conglomerates and their ...

Banking System Notes

... • Open Market Operations • Buying and selling government bonds and securities • This helps control the money supply ...

... • Open Market Operations • Buying and selling government bonds and securities • This helps control the money supply ...

The Business Cycle

... Goal: To expand or contract the amount of money in supply so as to control spending and inflation and manage the business cycle Three Methods Interest rates Open Market Operations Reserve requirement ...

... Goal: To expand or contract the amount of money in supply so as to control spending and inflation and manage the business cycle Three Methods Interest rates Open Market Operations Reserve requirement ...

How far we`ve come, how little we`ve changed

... institutions. In order to pull the economy out of the steepest slump since World War II, the Federal Reserve injected hundreds of billions of dollars into the system while the government guaranteed some of the biggest companies and the largest banks. Although the cause of the economic decline is typ ...

... institutions. In order to pull the economy out of the steepest slump since World War II, the Federal Reserve injected hundreds of billions of dollars into the system while the government guaranteed some of the biggest companies and the largest banks. Although the cause of the economic decline is typ ...

ARE YOU PREPARED TO RETIRE

... Jones Industrial Average was down 89% from pre-crash levels). The Depression also saw widespread bank failures – roughly 9,000 U.S. thrifts failed during the 1930s, and all U.S. banks were closed for four days in 1933 by presidential order. When the Depression struck, there was no FDIC, no SEC and n ...

... Jones Industrial Average was down 89% from pre-crash levels). The Depression also saw widespread bank failures – roughly 9,000 U.S. thrifts failed during the 1930s, and all U.S. banks were closed for four days in 1933 by presidential order. When the Depression struck, there was no FDIC, no SEC and n ...

The Final Countdown!

... Undaunted by the Federal Open Market Committee (FOMC) meeting in September, investors are buying long-term US Treasuries in droves as the probability of a rate hike falls sharply below 30%. Considering the significant improvements in the world’s largest economy over the last few years, what is drivi ...

... Undaunted by the Federal Open Market Committee (FOMC) meeting in September, investors are buying long-term US Treasuries in droves as the probability of a rate hike falls sharply below 30%. Considering the significant improvements in the world’s largest economy over the last few years, what is drivi ...

“It`s not the return on my money I`m interested in, it`s the return of my

... The month of June was filled with a couple of big surprises for financial markets which brought to mind the above referenced quote attributed to Mark Twain. The first surprise came on June 15th when the Federal Open Market Committee (FOMC) abruptly changed course and decided to hold short-term inter ...

... The month of June was filled with a couple of big surprises for financial markets which brought to mind the above referenced quote attributed to Mark Twain. The first surprise came on June 15th when the Federal Open Market Committee (FOMC) abruptly changed course and decided to hold short-term inter ...

How is money made? - The Central Bank of Samoa

... at different maturities, including the interest rates that banks charge borrowers for loans and offer savers for deposits. This then influences how much money is created. However once short-term interest rates reach their effective lower bound, it is not possible for the central bank to provide furt ...

... at different maturities, including the interest rates that banks charge borrowers for loans and offer savers for deposits. This then influences how much money is created. However once short-term interest rates reach their effective lower bound, it is not possible for the central bank to provide furt ...

JICMI 2014 - Hizbut Tahrir

... • Too big to fail banks provide most senior government financial officers – executive and legal • Quantitative easing programme placing $85 billion monthly into markets including $40 billion of mortgage securities • Major banks 30 and 35 times leveraged and new Dodd Frank laws not applied • March 20 ...

... • Too big to fail banks provide most senior government financial officers – executive and legal • Quantitative easing programme placing $85 billion monthly into markets including $40 billion of mortgage securities • Major banks 30 and 35 times leveraged and new Dodd Frank laws not applied • March 20 ...

HW 5.1 AP Macro – Modules 31 and 32 Directions: After reading

... passes a law requiring the central bank to use monetary policy to lower the unemployment rate to 3% and keep it there. How could the central bank achieve this goal in the short run? What would happen in the long run? Illustrate with a diagram 11. The effectiveness of monetary policy depends on how e ...

... passes a law requiring the central bank to use monetary policy to lower the unemployment rate to 3% and keep it there. How could the central bank achieve this goal in the short run? What would happen in the long run? Illustrate with a diagram 11. The effectiveness of monetary policy depends on how e ...

The crisis

... market forces /reduced income and investment (K) 3. counteract the business cycle/ managing the demand/ governments/ (K) 4. excess savings / interest rates / cause / in the long run / investment / fall / increase (M) 5. dead / in the long run (K) 6. neutral / money supply / constant / non-inflationa ...

... market forces /reduced income and investment (K) 3. counteract the business cycle/ managing the demand/ governments/ (K) 4. excess savings / interest rates / cause / in the long run / investment / fall / increase (M) 5. dead / in the long run (K) 6. neutral / money supply / constant / non-inflationa ...

Type Programme Name or Title Here

... • Government has increased its presence – now government bonds are about 20% of total wealth plus it has a large role in the banking sector and in guarantees for corporate debt ...

... • Government has increased its presence – now government bonds are about 20% of total wealth plus it has a large role in the banking sector and in guarantees for corporate debt ...

Notes for Chapter 14 - FIU Faculty Websites

... Discount rate is the rate of interest charged by the Federal Reserve Banks for lending reserves to private banks. Banks can ensure continual compliance with reserve requirements by maintaining large amounts of excess reserves. But this is unprofitable. By keeping the minimum reserves the bank will p ...

... Discount rate is the rate of interest charged by the Federal Reserve Banks for lending reserves to private banks. Banks can ensure continual compliance with reserve requirements by maintaining large amounts of excess reserves. But this is unprofitable. By keeping the minimum reserves the bank will p ...