* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download lect16

Foreign-exchange reserves wikipedia , lookup

Non-monetary economy wikipedia , lookup

Monetary policy wikipedia , lookup

Real bills doctrine wikipedia , lookup

Quantitative easing wikipedia , lookup

Modern Monetary Theory wikipedia , lookup

Fractional-reserve banking wikipedia , lookup

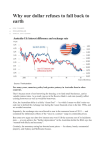

Money and Banking Professor Chris Adam Australian Graduate School of Management University of Sydney and University of New South Wales 1 INTRODUCTION • What is money? • What are the forms of money? • How does banking work? • How does the government influence money? 2 MEANING OF MONEY • Money is set of assets used in economy to buy goods and services from people • Three functions of money: 1. Medium of exchange • Universally accepted for exchange • Can be used to pay taxes 3 MEANING OF MONEY • Three functions of money: 2. Unit of account • Yardstick of measuring value 3. Store of value • Transfer purchasing power from present to future • Concept of liquidity: ease of converting asset into medium of exchange 4 KINDS OF MONEY • Commodity money has intrinsic value – Gold standard – Cigarettes • Fiat money has value established by decree • Economic conditions can induce people to substitute first for second 5 MONEY IN ECONOMY • Money supply as circulating volume of purchasing power • Basic type as currency: notes and coins in hands of public – Includes EFTPOS (“debit” cards) – Also called money base or high powered money 6 MONEY IN ECONOMY • Broader definitions (M1, M2, etc.,) include – cheque accounts – savings accounts – time deposits (Certificates of Deposit) – deposits in non-bank financial intermediaries • Credit cards are means of deferring payment: not part of current money supply 7 AUSTRALIAN MONETARY AGGREGATES CHANGES 8 AUSTRALIAN MONEY AND CREDIT CHANGES 9 RESERVE BANK OF AUSTRALIA • RBA is Australian central bank – Created in 1959 from Commonwealth Bank – Established to manage financial system stability for good of economy – Policy maker for banking system and money supply functions – RBA Board as guide to RBA Governor 10 RESERVE BANK OF AUSTRALIA • RBA functions: 1. Originally to monitor bank financial conditions and recommend actions to keep solvent – prudential supervision • Now with APRA 2. Guarantor of banking system stability but not lender of last resort • Operates cheque clearance process 11 RESERVE BANK OF AUSTRALIA • RBA functions: 3. Monetary policy design and implementation, to influence growth rate of economy and inflation • Through open-market operations 12 BANKS AND MONEY SUPPLY • Bank balance sheet model to demonstrate credit creation with 100% reserves – no credit creation! • Bank balance sheet model to demonstrate credit creation with frational reserves – Allows creation of credit – Money multiplier 13 AUSTRALIAN BANK INTEREST SPREADS 14 AUSTRALIAN BANK FEE INCOME 15 AUSTRALIAN BANK EQUITY RETURNS 16 AUSTRALIAN MONETARY POLICY • RBA uses changes to cash rate to adjust level of interest rates in economy – overnight loans among intermediaries – shifts base of yield curve • Open-market operations to adjust to excess supply or demand of overnight funds – buying and selling government securities from own portfolio 17 AUSTRALIAN CASH RATE 18 AUSTRALIAN INTEREST RATES 19 AUSTRALIAN MONETARY POLICY • RBA also oversees reserve requirements for banks – Basel Agreement: Tier 1 and Tier 2 reserves held against assets with appropriate risk classes • Problems for RBA in monetary policy: – Household deposits at banks are discretionary – Bank lending as decisions of banks – Confidence in banks: role of bank runs 20 AUSTRALIAN CREDIT AND GDP CHANGES 21