Financial crisis

... financial transactions, fueling speculation. "Two rooms" by buying loans with poor mobility of commercial banks and mortgage companies, asset securitization, its conversion into bonds for sale in the market, to attract investment banks and other financial institutions to buy, while investment banks ...

... financial transactions, fueling speculation. "Two rooms" by buying loans with poor mobility of commercial banks and mortgage companies, asset securitization, its conversion into bonds for sale in the market, to attract investment banks and other financial institutions to buy, while investment banks ...

The crisis

... 1. Poor borrowers go bankrupt, so houses are returned to lenders. 2. Central banks help to prevent system collapse. 3. Poor borrowers can no longer repay their loans. 4. Some financial institutions go bust as they cannot sell the property, and some lenders sell loan obligations to investors. 5. Poor ...

... 1. Poor borrowers go bankrupt, so houses are returned to lenders. 2. Central banks help to prevent system collapse. 3. Poor borrowers can no longer repay their loans. 4. Some financial institutions go bust as they cannot sell the property, and some lenders sell loan obligations to investors. 5. Poor ...

SIMSETT Issue 1 on 1st Nov 2014

... After the US sub-prime crisis, the economy slowed down, sales plunged and a recession started setting in. Then the US treasury came up with what it is known as the “bailout bubble”. An infusion of $700 billion was done by the US government - the biggest bailout in the history of the US government kn ...

... After the US sub-prime crisis, the economy slowed down, sales plunged and a recession started setting in. Then the US treasury came up with what it is known as the “bailout bubble”. An infusion of $700 billion was done by the US government - the biggest bailout in the history of the US government kn ...

Economics Semester Review!

... Transfers deposits from one account to another Supervise lending practices ...

... Transfers deposits from one account to another Supervise lending practices ...

Bank One

... 2. How does your answer compare to an economy in which the total amount of the loan is deposited in the banking system and the public doesn’t hold any of the loans in currency? (Hint: Do another table with none of the loan proceeds held in currency.) 3. What does this imply about the relationship b ...

... 2. How does your answer compare to an economy in which the total amount of the loan is deposited in the banking system and the public doesn’t hold any of the loans in currency? (Hint: Do another table with none of the loan proceeds held in currency.) 3. What does this imply about the relationship b ...

Interest Rates - McGraw Hill Higher Education

... • Banks bid for the right to borrow reserves LO2 ...

... • Banks bid for the right to borrow reserves LO2 ...

SUPER NOTES CHs 14-17

... stimulus) and tax cuts. Good for recessions. $ Purpose is to increase output. $ Contractionary policies are policies that encourage slowing down growth. They involve decreasing government spending and raising taxes. ...

... stimulus) and tax cuts. Good for recessions. $ Purpose is to increase output. $ Contractionary policies are policies that encourage slowing down growth. They involve decreasing government spending and raising taxes. ...

It`s all explained in

... from the Bank the bomb would burst and it would be seen that these are dangerous operations.’ Of course, at present, much of quantitative easing has meant the funds pumped into the banks have been deposited back to the Central Banks as special reserves and not lent out. The velocity of circulation i ...

... from the Bank the bomb would burst and it would be seen that these are dangerous operations.’ Of course, at present, much of quantitative easing has meant the funds pumped into the banks have been deposited back to the Central Banks as special reserves and not lent out. The velocity of circulation i ...

Negative real yields on inflation linked bonds

... which will lead to fresh problems down the track. Such problems could either end up being of either an inflationary or a deflationary nature. It is hard to get too excited therefore about US Treasury Inflation Protected Securities (TIPS) as a defensive play in an investment portfolio (although this ...

... which will lead to fresh problems down the track. Such problems could either end up being of either an inflationary or a deflationary nature. It is hard to get too excited therefore about US Treasury Inflation Protected Securities (TIPS) as a defensive play in an investment portfolio (although this ...

Course # and Course Name

... By 1971, dollar had depreciated Concerns about U.S. ability to convert dollars to gold March 1973 ...

... By 1971, dollar had depreciated Concerns about U.S. ability to convert dollars to gold March 1973 ...

Money, Banking & The Federal Reserve: A Brief History

... Securitization of riskier mortgages expanded rapidly, including subprime mortgages made to borrowers with poor credit records. House prices faltered in early 2006 and then started a steep slide, along with home sales and construction. Falling house prices meant that some homeowners owed more on thei ...

... Securitization of riskier mortgages expanded rapidly, including subprime mortgages made to borrowers with poor credit records. House prices faltered in early 2006 and then started a steep slide, along with home sales and construction. Falling house prices meant that some homeowners owed more on thei ...

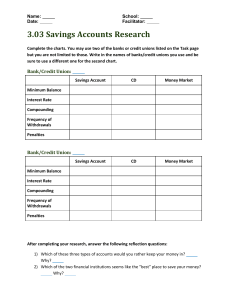

3.03 Savings Account Research

... Complete the charts. You may use two of the banks or credit unions listed on the Task page but you are not limited to those. Write in the names of banks/credit unions you use and be sure to use a different one for the second chart. ...

... Complete the charts. You may use two of the banks or credit unions listed on the Task page but you are not limited to those. Write in the names of banks/credit unions you use and be sure to use a different one for the second chart. ...

Hold the Frankincense and Myrrh

... unprecedented money creation and the Swiss Gold Initiative referendum held on November 30th. The bigger story is the one from Japan. On October 31st, the Bank of Japan announced that it would purchase 80 trillion yen of Japanese Government Bonds in the upcoming year using newly printed money. Two as ...

... unprecedented money creation and the Swiss Gold Initiative referendum held on November 30th. The bigger story is the one from Japan. On October 31st, the Bank of Japan announced that it would purchase 80 trillion yen of Japanese Government Bonds in the upcoming year using newly printed money. Two as ...

1. In what transaction would the Federal Reserve Bank engage, if it

... a) How large is the money supply (M1)? b) How large are required reserves? c) How large are excess reserves? d) By how much could the banks increase their lending activity? 5. In the problem above, suppose the Fed wanted to stop further lending activity by changing the reserve requirement. What rese ...

... a) How large is the money supply (M1)? b) How large are required reserves? c) How large are excess reserves? d) By how much could the banks increase their lending activity? 5. In the problem above, suppose the Fed wanted to stop further lending activity by changing the reserve requirement. What rese ...

Units 4 Breakdown: Money Market, Banking and Multiple Deposit

... Open Market Operations Excess Reserves Discount Rate Federal Funds Rate Key Information to Know (answer): 1. List and explain the 3 tools of monetary 3. How does the government target interest policy. rates of banks? 2. If there is a recession, what monetary policy 4. What changes the demand for mon ...

... Open Market Operations Excess Reserves Discount Rate Federal Funds Rate Key Information to Know (answer): 1. List and explain the 3 tools of monetary 3. How does the government target interest policy. rates of banks? 2. If there is a recession, what monetary policy 4. What changes the demand for mon ...

Money supply, the Fed and Monetary Policy

... • In the United States, the Federal Reserve System is the sole issuer of currency. – This means the Fed has monopoly control over the money supply. ...

... • In the United States, the Federal Reserve System is the sole issuer of currency. – This means the Fed has monopoly control over the money supply. ...

Slide 1

... Activity indicators for Q2, especially the PMI surveys, suggested that the rate of contraction in the global and UK economies had slowed, and there were signs of improving business confidence. There had also been signs that the second-quarter decline in consumption would be smaller than the Committe ...

... Activity indicators for Q2, especially the PMI surveys, suggested that the rate of contraction in the global and UK economies had slowed, and there were signs of improving business confidence. There had also been signs that the second-quarter decline in consumption would be smaller than the Committe ...

solution

... Changes in parities reflected both initial misalignments and balance of payments crises. Attempts to return to the parities of the prewar period after the war ignored the changes in underlying economic fundamentals that the war caused. This made some exchange rates less than fully credible and encou ...

... Changes in parities reflected both initial misalignments and balance of payments crises. Attempts to return to the parities of the prewar period after the war ignored the changes in underlying economic fundamentals that the war caused. This made some exchange rates less than fully credible and encou ...

Gold In A `Sweet Spot` As Central Banks Pursue Aggressive Easing

... Although the Fed is on the sidelines for now, Stoeferle said that there is a paradigm shift in Europe after the European Central Bank (ECB) President Mario Draghi “over-delivered” at the January monetary policy meeting and introduced a €60 billion monthly asset-purchase program. Unlike the Fed, the ...

... Although the Fed is on the sidelines for now, Stoeferle said that there is a paradigm shift in Europe after the European Central Bank (ECB) President Mario Draghi “over-delivered” at the January monetary policy meeting and introduced a €60 billion monthly asset-purchase program. Unlike the Fed, the ...

What Is Monetary Policy?

... Most economists would agree that in the long run output is fixed, so any changes in the money supply only cause prices to change. But in the short run, because prices and wages usually do not adjust immediately, changes in the money supply can affect the actual production of goods and services. This ...

... Most economists would agree that in the long run output is fixed, so any changes in the money supply only cause prices to change. But in the short run, because prices and wages usually do not adjust immediately, changes in the money supply can affect the actual production of goods and services. This ...

Chapter 14

... some of its deposits on reserve at the central bank; they do not receive interest on these deposits. If this reserve requirement is raised, then banks have less money to lend out and interest rates will rise. ...

... some of its deposits on reserve at the central bank; they do not receive interest on these deposits. If this reserve requirement is raised, then banks have less money to lend out and interest rates will rise. ...

Bernanke Cites a Rise in Risk Aversion

... Federal Reserve Chairman Ben Bernanke said long-term interest rates have started to rise in part because global investment is picking up and partly because lenders have become more risk averse. That aversion could be a factor favoring a cut in the Fed's target for short-term interest rates when its ...

... Federal Reserve Chairman Ben Bernanke said long-term interest rates have started to rise in part because global investment is picking up and partly because lenders have become more risk averse. That aversion could be a factor favoring a cut in the Fed's target for short-term interest rates when its ...

Brazil`s 1998-1999 BOP Crisis

... against the dollar. It was set up in the way that it could depreciate at controlled rate against the dollar. High interest rates were created and were intended to fight the high inflation by reducing an incentive to hold money. ...

... against the dollar. It was set up in the way that it could depreciate at controlled rate against the dollar. High interest rates were created and were intended to fight the high inflation by reducing an incentive to hold money. ...

Deflation: Economic Significance, Current Risk, and Policy Responses

... balance sheet, by increasing its monetary liabilities through buying securities to increase the supply of reserves in the banking system Fed undertook a huge increase of its balance sheet from about 900 billion in late 2007 to about 2.3 trillion in mid2010 ...

... balance sheet, by increasing its monetary liabilities through buying securities to increase the supply of reserves in the banking system Fed undertook a huge increase of its balance sheet from about 900 billion in late 2007 to about 2.3 trillion in mid2010 ...