GD Causes

... strategy and decided to cut money supply by nearly a third. This harsh reaction may have occurred in order to refuse help to careless banks and to encourage banks to be more responsible. The Federal Reserve’s strategy only made matters worse as with the lack of funds, it was almost impossible fo ...

... strategy and decided to cut money supply by nearly a third. This harsh reaction may have occurred in order to refuse help to careless banks and to encourage banks to be more responsible. The Federal Reserve’s strategy only made matters worse as with the lack of funds, it was almost impossible fo ...

MONETARY POLICY MEASURES

... directives. Direct action includes derecognition of a commercial bank as a member of the country’s banking system. ...

... directives. Direct action includes derecognition of a commercial bank as a member of the country’s banking system. ...

14.02 Principles of Macroeconomics

... Part II. Supply and Demand For Money Assume an economy in which: L(i) = (.5-i) $Y=P*Y=$10 trillion Ms=$3.5 trillion 1. Graph Ms and Md for this economy. 2. What is the equilibrium rate of interest? 3. Label the equilibrium of the money market at point A on the graph from number 1. 4. Now, the centra ...

... Part II. Supply and Demand For Money Assume an economy in which: L(i) = (.5-i) $Y=P*Y=$10 trillion Ms=$3.5 trillion 1. Graph Ms and Md for this economy. 2. What is the equilibrium rate of interest? 3. Label the equilibrium of the money market at point A on the graph from number 1. 4. Now, the centra ...

Business Cycle (Ups and Downs of the Economy)

... circulation. Accomplished through raising or decreasing interest rates. The Federal Reserve (FED) is in control of monetary policy. o Loose Money Policy: Can lead to inflation. 1. Easy to borrow 2. Consumers buy more 3. Business expansion 4. Employment increases 5. Spending increases o Tight Money P ...

... circulation. Accomplished through raising or decreasing interest rates. The Federal Reserve (FED) is in control of monetary policy. o Loose Money Policy: Can lead to inflation. 1. Easy to borrow 2. Consumers buy more 3. Business expansion 4. Employment increases 5. Spending increases o Tight Money P ...

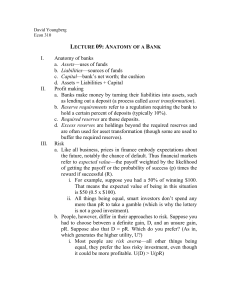

2/27 - David Youngberg

... a. Assets—uses of funds b. Liabilities—sources of funds c. Capital—bank’s net worth; the cushion d. Assets = Liabilities + Capital Profit making a. Banks make money by turning their liabilities into assets, such as lending out a deposit (a process called asset transformation). b. Reserve requirement ...

... a. Assets—uses of funds b. Liabilities—sources of funds c. Capital—bank’s net worth; the cushion d. Assets = Liabilities + Capital Profit making a. Banks make money by turning their liabilities into assets, such as lending out a deposit (a process called asset transformation). b. Reserve requirement ...

Q How Does the Federal Reserve`s Lowering Interest

... formation and implementation of the nation’s monetary policy in pursuit of macroeconomic goals of full employment and price stability2. Monetary policy is implemented by the 12 voting members of the Open Market Committee: seven members of the Board of Governors; the president of the Federal Reserve ...

... formation and implementation of the nation’s monetary policy in pursuit of macroeconomic goals of full employment and price stability2. Monetary policy is implemented by the 12 voting members of the Open Market Committee: seven members of the Board of Governors; the president of the Federal Reserve ...

What Is a Bank, and How Do We Go About

... • Effect on broader economy when reserve source of credit and liquidity taken away • Lose transmission source for monetary policy ...

... • Effect on broader economy when reserve source of credit and liquidity taken away • Lose transmission source for monetary policy ...

The Federal Reserve

... • When the Fed sells bonds, it takes $ out of the citizen’s pocket and replaces it with a piece of paper. ...

... • When the Fed sells bonds, it takes $ out of the citizen’s pocket and replaces it with a piece of paper. ...

LatinAmerica

... - Permitted countries to pay interests only! • Debt-Equity Swap - Transfer of loan to another bank or 3rd party ...

... - Permitted countries to pay interests only! • Debt-Equity Swap - Transfer of loan to another bank or 3rd party ...

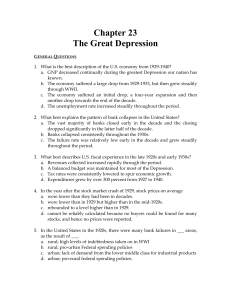

Chapter 23 - Weber State University

... lender of last resort during the early years of the Great Depression, was its power struggle with a. U.S. Treasury. b. foreign central banks. c. the Federal Reserve Bank of New York. d. President Roosevelt. 7. The Stock Market Crash of 1929 probably contributed ____ to the Great Depression because _ ...

... lender of last resort during the early years of the Great Depression, was its power struggle with a. U.S. Treasury. b. foreign central banks. c. the Federal Reserve Bank of New York. d. President Roosevelt. 7. The Stock Market Crash of 1929 probably contributed ____ to the Great Depression because _ ...

File

... 2. What happens when interest rates are low? 3. What happens when interest rates are high? 4. What happens if the Fed increases the money supply? 5. What does the central bank do it they want to speed up the economy? 6. What will that lead to? 7. What is it called? 8. What does the Central Bank do i ...

... 2. What happens when interest rates are low? 3. What happens when interest rates are high? 4. What happens if the Fed increases the money supply? 5. What does the central bank do it they want to speed up the economy? 6. What will that lead to? 7. What is it called? 8. What does the Central Bank do i ...

Econ 204 Practice Qu..

... 1) Which of the following is not a key role of the government: a. Keeping prices low b. Protecting property rights c. Welfare programs d. Maintaining Competition e. Providing public goods 2) Which of the following is not a key role of the government: a. Law and Order b. Income Redistribution c. Supp ...

... 1) Which of the following is not a key role of the government: a. Keeping prices low b. Protecting property rights c. Welfare programs d. Maintaining Competition e. Providing public goods 2) Which of the following is not a key role of the government: a. Law and Order b. Income Redistribution c. Supp ...

Ch. 14 Handout

... During an economic boom, contractionary monetary policy can ____________________________and _____________________. Which means eradicate an __________________________________. ____________________________money supply in order to raise the interest rate: ...

... During an economic boom, contractionary monetary policy can ____________________________and _____________________. Which means eradicate an __________________________________. ____________________________money supply in order to raise the interest rate: ...

- Unique Writers Bay

... Differences between the federal reserve and the Bank of Canada. Bank of Canada is accountable to the minister of finance( governmental policy control) while the federal reserve system is accountable to no one (no governmental policy control) • The federal reserve operates on its own (on private bas ...

... Differences between the federal reserve and the Bank of Canada. Bank of Canada is accountable to the minister of finance( governmental policy control) while the federal reserve system is accountable to no one (no governmental policy control) • The federal reserve operates on its own (on private bas ...

AP Macro reminders

... • Real = nominal adjusted for inflation • Currency appreciates if interest rates rise; depreciates if i falls • Open-market operations – FED buys bonds (expansionary); FED sells bonds (contractionary) • More I means more capital stock; leads to larger shift in PPF and ASLR • Expansionary fiscal poli ...

... • Real = nominal adjusted for inflation • Currency appreciates if interest rates rise; depreciates if i falls • Open-market operations – FED buys bonds (expansionary); FED sells bonds (contractionary) • More I means more capital stock; leads to larger shift in PPF and ASLR • Expansionary fiscal poli ...

China Moves to Tighten the Money Supply

... for banks, the fourth increase in six months, to further tighten the nation’s money supply. The modest move, which takes effect this month, increases the reserve ratio by half a percentage point, to 9.5 percent. Analysts said it was the government’s latest warning that too much money in the financia ...

... for banks, the fourth increase in six months, to further tighten the nation’s money supply. The modest move, which takes effect this month, increases the reserve ratio by half a percentage point, to 9.5 percent. Analysts said it was the government’s latest warning that too much money in the financia ...

Economics Study Guide November 2011 exam

... We ran out of time to review Chapter 11, so the exam will be primarily on Chapters 10, 12, and 16. Chapter 11 will be tested on the final exam in December. Please focus your review these next two nights on 10, 12, and 16. Know the following terms: inside lag monetarism monetary policy outside lag mo ...

... We ran out of time to review Chapter 11, so the exam will be primarily on Chapters 10, 12, and 16. Chapter 11 will be tested on the final exam in December. Please focus your review these next two nights on 10, 12, and 16. Know the following terms: inside lag monetarism monetary policy outside lag mo ...

Spending Money

... • Interest earned on government securities--debt obligation (local or national) backed by the credit and taxing power of a country with very little risk of default (bonds, bills…) • Income from foreign currency held • Interest on loans to depository institutions (banks) ...

... • Interest earned on government securities--debt obligation (local or national) backed by the credit and taxing power of a country with very little risk of default (bonds, bills…) • Income from foreign currency held • Interest on loans to depository institutions (banks) ...

The Evening Standard

... WE must keep a sense of proportion about our present economic position. The shortfall in demand for gilts on Wednesday was a tiny fraction of the Bank of England’s quantitative easing budget, while the UK’s debt to GDP ratio remains manageable and will stay below several comparable EU economies’ pre ...

... WE must keep a sense of proportion about our present economic position. The shortfall in demand for gilts on Wednesday was a tiny fraction of the Bank of England’s quantitative easing budget, while the UK’s debt to GDP ratio remains manageable and will stay below several comparable EU economies’ pre ...

Money and Monetary Policy

... and collecting interest – Assuming few depositors will need money daily – Assuming loans will be repaid on time with interest ...

... and collecting interest – Assuming few depositors will need money daily – Assuming loans will be repaid on time with interest ...

Economic Firefight – An Inside View

... Growth projected to strengthen next year and beyond, led by exports. Net job creation of 20,000 next year, and 45,000 each year thereafter. ...

... Growth projected to strengthen next year and beyond, led by exports. Net job creation of 20,000 next year, and 45,000 each year thereafter. ...

Econ 111 – Monetary Economics

... • To articulate why these markets react so strongly to actions taken by the central bank • To evaluate the effectiveness of monetary policy in dealing with economic shocks and inflation • To analyze the effects of policy on interest rates and how different interest rates affect different actors in t ...

... • To articulate why these markets react so strongly to actions taken by the central bank • To evaluate the effectiveness of monetary policy in dealing with economic shocks and inflation • To analyze the effects of policy on interest rates and how different interest rates affect different actors in t ...