* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download “It`s not the return on my money I`m interested in, it`s the return of my

Present value wikipedia , lookup

Financial economics wikipedia , lookup

Credit rationing wikipedia , lookup

Financialization wikipedia , lookup

Lattice model (finance) wikipedia , lookup

Interbank lending market wikipedia , lookup

Interest rate ceiling wikipedia , lookup

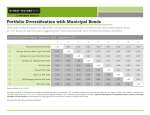

June 30, 2016 “It’s not the return on my money I’m interested in, it’s the return of my money” Mark Twain Dear Shareholder: The month of June was filled with a couple of big surprises for financial markets which brought to mind the above referenced quote attributed to Mark Twain. The first surprise came on June 15th when the Federal Open Market Committee (FOMC) abruptly changed course and decided to hold short-term interest rates steady. In the weeks leading up to its June meeting, Chair Yellen had signaled that she felt the economy was probably healthy enough to nudge short-term rates slightly higher. The decision from the FOMC not to raise rates was unanimous. That was notable as Kansas City Fed President Esther George had previously dissented in March and April in favor of a rate increase. The FOMC statement emphasized the central bank’s uncertainty about the timing and path of future interest rate hikes and cited “persistent headwinds” such as slow productivity growth, softening labor market conditions, and weak business investment. The Fed acknowledged that these structural forces could keep interest rates on hold for longer than anticipated. The new consensus of Fed Governors to “go slow” with future interest rate hikes caused bond markets to rally with yields grinding lower and prices moving higher. The second surprise came at the end of the month with the approval of a referendum by the British to exit the European Union (EU). The Brexit “leave” vote caught financial markets completely off guard and led to a dramatic sell off in equities. The British pound plunged to levels last seen in the mid-1980s, and bond yields dropped (prices up) to near historic lows. The stampede out of stocks and into “safe haven” assets such as U.S. Treasuries and municipal bonds caused an already hot municipal bond market to rally even further. So where do we go from here in a post-Brexit world? Given the unprecedented political and economic uncertainty that currently exists, we believe municipal bonds offer a win/win situation for investors seeking to preserve capital and earn an attractive return in a world of heightened volatility. Slower economic growth, a continued flight to safety trade, and lingering uncertainty should act as a support for municipal bond prices going forward. The Organization for Economic Cooperation and Development (OECD) recently issued a warning that the global economy is slipping into a self-fulfilling “low-growth trap.” The European Central Bank has launched yet another round of quantitative easing to try to stimulate the economies of the EU member countries. On the domestic front, a number of economists and market forecasters have raised the odds of the U.S. entering a recession in the next year. Bill Gross, interviewed shortly after the Brexit vote was announced, suggested that the chances of the U.S. entering a recession in the next year are as high as 30% to 50%. Economists at JP Morgan Chase & Co. think the odds of a recession in the next year are the highest since the current expansion began seven years ago. Gross domestic product increased at a 1.1 percent annual rate in the first quarter. That is well below the trend growth rate which is around 3.25 percent. Inflation has continued to be subdued with the latest reading of the PCE deflator (the Fed’s preferred measure) increasing at a 0.9 percent annual rate. That is well below the Fed’s 2 percent inflation target rate. Municipal bonds typically perform very well in a slow growth/low inflation environment. We think that will be the case during the second half of this year. In the meantime, credit quality in the municipal bond market has continued to hold up well with default rates at or near historic lows. Market technical factors such as supply and demand are also very favorable. The net supply of municipal bonds is limited and demand for high quality bonds by retail and institutional investors has continued to be very robust. Interestingly, the demand for municipal bonds is not only coming from domestic buyers, but also overseas from investors in Europe and Japan that currently have negative yields. The favorable supply/demand backdrop should continue to act as a support for municipal bond prices. We would be remiss if we didn’t at least mention that uncertainty in financial markets and increasing bond prices have a cost associated with them, namely, lower yields. Benchmark 30-year triple-A rated tax-exempt bond yields have dropped to around 2 percent. From a portfolio management standpoint, as older higher interest rate bonds are either called away from us or mature, it becomes impossible for us to replace them with bonds with the same or even a similar yield. The end result is that the income streams generated by each of our funds have gradually declined over time resulting in lower distribution yields to shareholders. Notwithstanding lower yields, we continue to believe that municipal bonds offer an attractive risk/reward ratio for investors--especially when the tax exemption is taken into consideration. As always, we appreciate the trust that you have placed in us. Sincerely, Allen E. Grimes, III Executive Vice President