* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Monetary-Policy

Non-monetary economy wikipedia , lookup

Full employment wikipedia , lookup

Fiscal multiplier wikipedia , lookup

Modern Monetary Theory wikipedia , lookup

Business cycle wikipedia , lookup

Exchange rate wikipedia , lookup

Money supply wikipedia , lookup

Austrian business cycle theory wikipedia , lookup

Phillips curve wikipedia , lookup

Post–World War II economic expansion wikipedia , lookup

Fear of floating wikipedia , lookup

Quantitative easing wikipedia , lookup

Monetary policy wikipedia , lookup

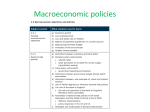

Monetary Policy • A demand-side policy – shifts AD (secondarily affects AS) 1. Changes in short-term interest rates to influence the level of AD & inflation 2. Quantitative Easing (QE) Economic Effects of Interest Rate Changes Exchange Rate Housing Market Credit Demand Interest rate changes will impact: Investment Saving Monetary Policy Committee • MPC has 9 members – Governor plus 4 from the Bank of England (including 2 Deputy Governors) – 4 external members appointed by the Chancellor • The MPC set interest rates every month in order to meet their mandate from the chancellor of the exchequer: “inflation must be at 2%” (if inflation is below 1% or above 3%, the MPC must explain why in an open letter to the Chancellor) • Economic data is considered to assess the potential of each indicator to impact inflation What do the MPC look at when deciding if inflation might become too high / too low… Exchange Rate Rate of GDP Growth Wage Inflation Housing Market Credit Demand Economic data for consideration Unemployment Investment Manufacturing Output Retail Sales MPC must consider all these things in the economy to assess the inflationary pressure that is likely – decide whether they need to change interest rates to achieve 2% inflation target. Economic indicator How it will affect inflationary expectations… Investment If it is rising, then this will increase AD in the short run, causing Demand-Pull inflation. (In the longer term, it might lower production costs through greater efficiency reducing inflation again if AS shifts out) If it is falling then… Unemployment If it is rising, then… If it is falling then… Housing Market If it is rising, then… If it is falling then… Rate of GDP Growth If it is high, then… Exchange Rate If it is rising, then… If it is low then… If it is falling then… Wage Inflation If it is high, then… If it is low then… Credit Demand If it is rising, then… If it is falling then… Manufacturing Output If it is rising, then… Retail Sales If it is rising, then… If it is falling then… If it is falling then… Advantages of Lower Interest Rates • Cheaper for businesses to finance capital investment long-run economic growth • Households enjoy cheaper loans for homes, cars, etc – boost to C • Easier to start new businesses – source of long-run growth • Reduced interest burden on the national debt for the Government - reallocate spending • Currency may fall Disadvantages of Lower Interest Rates • Disincentive to save – (savings needed to finance investment, education, etc) • Retirees may see incomes fall • Credit boom may fuel rising inflation • Currency may fall Quantitative Easing • Used when interest rates are already low and AD still needs stimulating • Bank of England creates new money electronically • B of E buys bonds from financial institutions (eg. pension funds, commercial banks) • Commercial banks have more cash to lend out to customers • ↑ money available for lending → ↓ interest rates → ↑C & I → ↑AD Criticisms of Monetary Policy • Difficult to assess state of the economy based on monthly data • Time lags – takes up to two years for effects to be fully realised in the economy • Effects on currency may be undesirable • One size fits all – needs of one sector may be opposite to those of another – can’t be targeted at problem areas • May not be effective if already anticipated