- Rainer Maurer

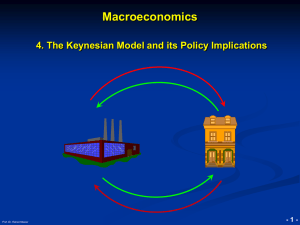

... GDP Y depends on consumption C(Y) and consumption C(Y) depends on GDP Y and so on… ...

... GDP Y depends on consumption C(Y) and consumption C(Y) depends on GDP Y and so on… ...

Capitalist Revolutionary: John Maynard Keynes

... to fi ne-tune the economy. However, behind this Keynes lies the economist, much more visible to other economists, who created a new way of analyzing capitalist economies. His great book, The General Theory of Employment, Interest and Money, published in 1936, may have served to inspire the policies o ...

... to fi ne-tune the economy. However, behind this Keynes lies the economist, much more visible to other economists, who created a new way of analyzing capitalist economies. His great book, The General Theory of Employment, Interest and Money, published in 1936, may have served to inspire the policies o ...

Capitalist Revolutionary: John Maynard Keynes

... to fi ne-tune the economy. However, behind this Keynes lies the economist, much more visible to other economists, who created a new way of analyzing capitalist economies. His great book, The General Theory of Employment, Interest and Money, published in 1936, may have served to inspire the policies o ...

... to fi ne-tune the economy. However, behind this Keynes lies the economist, much more visible to other economists, who created a new way of analyzing capitalist economies. His great book, The General Theory of Employment, Interest and Money, published in 1936, may have served to inspire the policies o ...

N - Piazza

... the random walk in GDP and on real business cycles in Chapter 21. • A Business School Course In addition to the core chapters for the overview course, a business school course should emphasize Chapters 16 and 18, which deal with the Federal Reserve and financial markets. And Chapters 3 and 4 on grow ...

... the random walk in GDP and on real business cycles in Chapter 21. • A Business School Course In addition to the core chapters for the overview course, a business school course should emphasize Chapters 16 and 18, which deal with the Federal Reserve and financial markets. And Chapters 3 and 4 on grow ...

Haberler, the League of Nations, and the Quest for

... conflicting theories that proliferated at the time. The importance of such a project is aptly made clear by Schumpeter's remark that the debate on business cycles in the early 1930s gave the impression of being "nothing but disagreement and antagonism that went so far as to be discreditable to the s ...

... conflicting theories that proliferated at the time. The importance of such a project is aptly made clear by Schumpeter's remark that the debate on business cycles in the early 1930s gave the impression of being "nothing but disagreement and antagonism that went so far as to be discreditable to the s ...

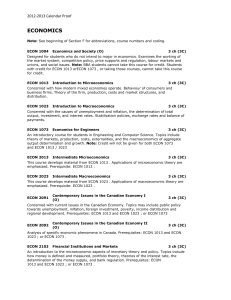

Economics

... Designed for students who do not intend to major in economics. Examines the working of the market system, competition policy, price supports and regulation, labour markets and unions, and social issues. Note: BBA students cannot take this course for credit. Students with credit for ECON 1013 orECON ...

... Designed for students who do not intend to major in economics. Examines the working of the market system, competition policy, price supports and regulation, labour markets and unions, and social issues. Note: BBA students cannot take this course for credit. Students with credit for ECON 1013 orECON ...

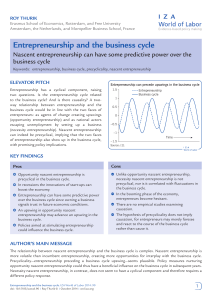

Entrepreneurship and the business cycle

... Data come from the Global Entrepreneurship Monitor surveys, which show yearly estimates on nascent entrepreneurship and its subcategories such as nascent innovative, imitative, opportunity, and necessity entrepreneurship. The survey asks entrepreneurs about their motives (opportunity or necessity), ...

... Data come from the Global Entrepreneurship Monitor surveys, which show yearly estimates on nascent entrepreneurship and its subcategories such as nascent innovative, imitative, opportunity, and necessity entrepreneurship. The survey asks entrepreneurs about their motives (opportunity or necessity), ...

SAVING IS THE ACCOUNTING RECORD OF INVESTMENT

... But both the mainstream and its critics agree that saving and investment are independent behavioral relationships ex ante. But this chapter demonstrates that since total saving is the accounting record of investment, it cannot be the product of individual saving units total saving. Saving is identic ...

... But both the mainstream and its critics agree that saving and investment are independent behavioral relationships ex ante. But this chapter demonstrates that since total saving is the accounting record of investment, it cannot be the product of individual saving units total saving. Saving is identic ...

This PDF is a selection from an out-of-print volume from... of Economic Research

... major influence on the economy. Movements in military spending reveal the slopes of the consumption schedule and other spending schedules. My basic strategy is the following. Fluctuations in military spending reveal the slope of the consumption/GNP schedule. GNP rises with military spending-quite st ...

... major influence on the economy. Movements in military spending reveal the slopes of the consumption schedule and other spending schedules. My basic strategy is the following. Fluctuations in military spending reveal the slope of the consumption/GNP schedule. GNP rises with military spending-quite st ...

John Maynard Keynes

... — Attributed to John Maynard Keynes The purpose of this book is to convince the reader, whether an intelligent layperson, a student of economics, or even a professional economist, that what passes as the conventional economic wisdom espoused by the talking heads on television or written about in the ...

... — Attributed to John Maynard Keynes The purpose of this book is to convince the reader, whether an intelligent layperson, a student of economics, or even a professional economist, that what passes as the conventional economic wisdom espoused by the talking heads on television or written about in the ...

John Maynard Keynes

... — Attributed to John Maynard Keynes The purpose of this book is to convince the reader, whether an intelligent layperson, a student of economics, or even a professional economist, that what passes as the conventional economic wisdom espoused by the talking heads on television or written about in the ...

... — Attributed to John Maynard Keynes The purpose of this book is to convince the reader, whether an intelligent layperson, a student of economics, or even a professional economist, that what passes as the conventional economic wisdom espoused by the talking heads on television or written about in the ...

The business cycle effects of Christmas

... explain 50% of the business cycle in aggregate output. Such findings provide a novel and powerful explanation for the observed strong correlation between seasonal fluctuations and business cycles. The implication is that in addition to trying to determine whether it is monetary, technology, or other t ...

... explain 50% of the business cycle in aggregate output. Such findings provide a novel and powerful explanation for the observed strong correlation between seasonal fluctuations and business cycles. The implication is that in addition to trying to determine whether it is monetary, technology, or other t ...

** Complementary Credit Networks and Macro-Economic Stability * * uses data from a Swiss barter network to argue that large scale internet barter helps to stabilize the business cycle. My paper was recently invited for a 2nd presentation to the Central Bank of Brazil, and is in the

... If units are chosen so that competitive equilibrium prices are unity, Pa = Pb = Pc = 1, then the direction of mutually improving trade is shown by the arrows in the picture: A gives a unit of c to C, C a unit of b to B and, and B a unit of a to A. If these are the only goods of interest for each fir ...

... If units are chosen so that competitive equilibrium prices are unity, Pa = Pb = Pc = 1, then the direction of mutually improving trade is shown by the arrows in the picture: A gives a unit of c to C, C a unit of b to B and, and B a unit of a to A. If these are the only goods of interest for each fir ...

The Current Account and the Interest Rate Differential in Canada

... study this version of the interest differential because it is widely used in the literature (see, for example, Letendre (2004), Nason and Rogers (2003), and Schmitt-Grohé and Uribe 2003). In this version, the interest differential worsens with a deterioration in the net foreign asset position. A ris ...

... study this version of the interest differential because it is widely used in the literature (see, for example, Letendre (2004), Nason and Rogers (2003), and Schmitt-Grohé and Uribe 2003). In this version, the interest differential worsens with a deterioration in the net foreign asset position. A ris ...

Fiscal and Monetary Policies The Nominal Anchor

... the long-run equilibrium values of real variables (e.g., employment, output, real interest rates) don’t depend on monetary conditions The Quantity Theory of Money (MV = PY ) was typically the link between the money supply and the price level But some classical (neoclassical) economists discussed pri ...

... the long-run equilibrium values of real variables (e.g., employment, output, real interest rates) don’t depend on monetary conditions The Quantity Theory of Money (MV = PY ) was typically the link between the money supply and the price level But some classical (neoclassical) economists discussed pri ...

Money, Central Banking in India and International Financial Institutions - I

... had planted and harvested more corn that what he would need.. Goods used in barter are generally in their natural state, in line with the environment conditions and activities developed by the group, corresponding to elementary needs of the group's members. This exchange, however, is not free from d ...

... had planted and harvested more corn that what he would need.. Goods used in barter are generally in their natural state, in line with the environment conditions and activities developed by the group, corresponding to elementary needs of the group's members. This exchange, however, is not free from d ...

THE MIT DICTIONARY OF MODERN ECONOMICS

... j S MILL extended the notion of abstinence to include a reward for foregoing consumption of capital itself. Since capital goods take time to produce commodities for consumption the individual must wait for some period before benefiting from an investment. Abstention in this sense of 'waiting' is sca ...

... j S MILL extended the notion of abstinence to include a reward for foregoing consumption of capital itself. Since capital goods take time to produce commodities for consumption the individual must wait for some period before benefiting from an investment. Abstention in this sense of 'waiting' is sca ...

CEEC – Transition and Enlargement

... – Capital stock adjustment – Wage rigidities and unemployment – Empirical evidence ...

... – Capital stock adjustment – Wage rigidities and unemployment – Empirical evidence ...

Credit contractions and unemployment

... The peak effect occurs, on average, two years after the beginning of the decline in credit, and it does not quite vanish after four years. A credit contraction in a typical OECD country increases total unemployment rates by nearly 1% at the peak. The impact on young workers is even more pronounced, i ...

... The peak effect occurs, on average, two years after the beginning of the decline in credit, and it does not quite vanish after four years. A credit contraction in a typical OECD country increases total unemployment rates by nearly 1% at the peak. The impact on young workers is even more pronounced, i ...

NBER WORKING PAPER SERIES CREDIT SPREADS AND MONETARY POLICY Vasco Cúrdia Michael Woodford

... to the conduct of monetary policy continue to provide reasonable guidelines under such circumstances? For example, the Federal Reserve aggressively reduced its operating target for the federal funds rate in late 2007 and January 2008, though official statistics did not yet indicate that real GDP was ...

... to the conduct of monetary policy continue to provide reasonable guidelines under such circumstances? For example, the Federal Reserve aggressively reduced its operating target for the federal funds rate in late 2007 and January 2008, though official statistics did not yet indicate that real GDP was ...

kalecki`s long-run theory of effective demand

... analysis of investment to situation in which 1) long term expectations are not exogenous but endogenous and related to the current situation and 2) returns on capital equipment are not decreasing but constant. Regarding point 1), Kalecki suggested capturing the sensitivity of long term expectations ...

... analysis of investment to situation in which 1) long term expectations are not exogenous but endogenous and related to the current situation and 2) returns on capital equipment are not decreasing but constant. Regarding point 1), Kalecki suggested capturing the sensitivity of long term expectations ...

How Friedman and Schwartz became monetarists

... what he referred to as “two pillars to the [inflation] problem”. The first was “the large volume of money and money substitutes in the hands of the public” and the second, “the great volume of unused lending power in the hands of the banks”. (Friedman, Hart and Jacoby, 1946). In further contrast to ...

... what he referred to as “two pillars to the [inflation] problem”. The first was “the large volume of money and money substitutes in the hands of the public” and the second, “the great volume of unused lending power in the hands of the banks”. (Friedman, Hart and Jacoby, 1946). In further contrast to ...

Money and the Transmission Mechanism in the Optimizing IS

... assumption of fully rigid nominal wages, while even some modern textbook treatments (e.g. Auerbach and Kotlikoff, 1995, p. 314) give the impression that the derivation of IS and LM relations requires the assumption of a rigid price level. But analysis of the flexible-price (and wage) equilibrium was ...

... assumption of fully rigid nominal wages, while even some modern textbook treatments (e.g. Auerbach and Kotlikoff, 1995, p. 314) give the impression that the derivation of IS and LM relations requires the assumption of a rigid price level. But analysis of the flexible-price (and wage) equilibrium was ...

PDF Download

... arithmetic average. The two climate components reflect the current situation (the business situation is good/ satisfactory/ poor) and the outlook (the business situation is likely to be more favourable/ about the same/ somewhat more unfavourable) of the surveyed businesses. The questions have been c ...

... arithmetic average. The two climate components reflect the current situation (the business situation is good/ satisfactory/ poor) and the outlook (the business situation is likely to be more favourable/ about the same/ somewhat more unfavourable) of the surveyed businesses. The questions have been c ...

UNIVERSITY OF CALICUT SCHOOL OF DISTANCE EDUCATION II SEMESTER BA ECONOMICS

... either by specifying some set of causal factors or by specifying some range of phenomena. But since so many different causal factors are relevant to the study of production or consumption, from the laws of thermodynamics and metallurgy to the laws governing digestion, economics cannot be distinguish ...

... either by specifying some set of causal factors or by specifying some range of phenomena. But since so many different causal factors are relevant to the study of production or consumption, from the laws of thermodynamics and metallurgy to the laws governing digestion, economics cannot be distinguish ...